We all know what is a fixed deposit, right? Many consider it as an investment option. But I personally prefer to refer to and use it as a convenient savings option.

‘Term deposit’ and ‘bank deposit’ are few other names of fixed deposits. What is ‘fixed’ in a fixed deposit? The tenure of the deposit. This is what makes a fixed deposit different from a savings deposit.

Money parked in a savings account is very liquid. We can withdraw this money using ATM, Debit Card, Cheque, UPI, Net Banking, etc. All these transactions can be made from a remote location. The person need not visit a bank.

But money fixed in a term deposit is not so liquid. To withdraw the amount, the deposit needs to be first redeemed. In our common language, we call it “breaking the FD”. Otherwise, the money parked in FD is locked till maturity.

If fixed deposits are redeemed before the maturity period, a penalty is also applicable on the accrued interest. Hence the term “fixed” is used. It acts as a reminder to the depositors that for a certain period of time the money is illiquid.

FD Calculator

| Fixed Deposit Amount (Rs.) | Enter the amount of money which has been deposited into the fixed deposit scheme | |

| Interest Rate p.a. (%) | Enter the interest offered on the FD | |

| Number of Compounding in a Year (n) | If interest is compounded yearly, then n = 1; if semi-annually, then n = 2; quarterly, then n = 4; monthly, then n = 12. If you do not know, leave it as one (1) | |

| Time (in years) | This is the lock-in period for which the money will remain parked in FD |

| Principal Amount (Rs.) | This is the money which was invested | |

| Interest Earned (Rs.) | This is the extra money which has been generated by the principal on account of being invested in a FD | |

| Maturity Amount (Rs.) | This is a sum of Principal and Interest |

[P.Note: Generally, interest is compounded one every quarter in a bank FD]

Why to value a fixed deposit?

Interesting question, right? We have heard about stock valuation. But “who” values fixed deposits? Well, we will do it in this article. Is it necessary? Not really but it is worth an effort. Why? Because it helps us to get a perspective about the process of “stock analysis in general“.

A beginner, who wants to learn the process of stock valuation can take the first step by learning how to value a fixed deposit. It can frame the basics. Stock valuation is more complicated than the valuation of fixed deposit (FD). But if one knows how to do it for FD, it means the basic principle is in place.

Moreover, we have also heard that while investing for the long term, investing in savings schemes (like fixed deposits, endowment plans, etc) is not advisable. Do you know why? Possibly yes. But what’s the mathematics behind it?

This is actually what we can prove by seeing the mathematics behind the valuation of a fixed deposit.

What is valuation?

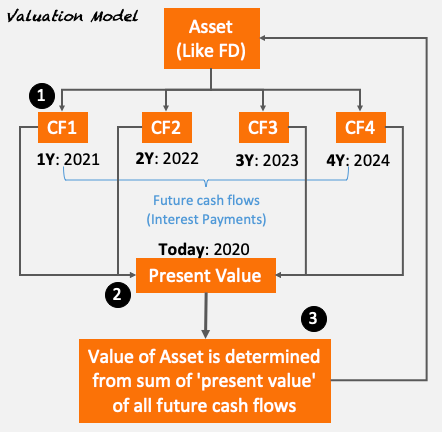

Valuation is a process, using which, we can estimate present value of an “asset” with respect to the potential cash flows it is expected to generate in future.

What are assets? Anything which generates positive cash flows in future can be called an asset. If there are no positive cash flows, it is not an asset.

As an investor, it is important to realise that while investing in an asset, we are dealing with two variables: (a) future cash flows (CFs) & (b) holding time (T). To be an asset, the investment must generate net positive future cash flows (CFs) during the course of its holding time (T).

Once a person is aware of “CFs and T”, the next step is to estimate the “present value” of all CFs. This process of estimating future cash flows (CFs in time T), and calculation of “present value” of CFs is called valuation.

In simple terms we can say that valuation is also a tool which we laymen can use to confirm, whether an item in consideration is an asset or a liability. How? If the present value of all future cash flows is positive, the item is an asset.

Confused? Let’s take an example.

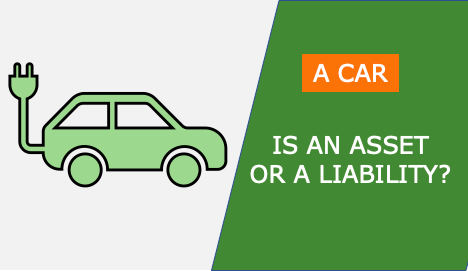

#1 Car is an asset or a liability?

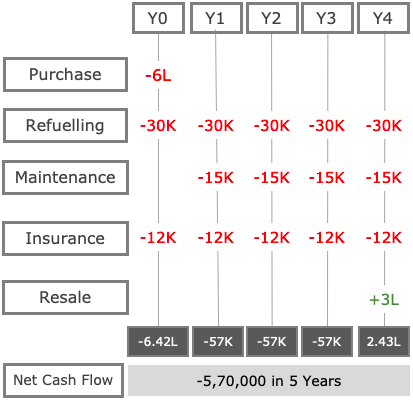

On purchase of a car, say it costs Rs.600,000. Suppose one wants to hold the car for next 5 years only. What will be the future cash flows upon owning a car? These are the following costs:

- Refuelling = Rs.30,000 / year

- Maintenance = Rs.15,000 / year

- Insurance = Rs.12,000 / year

- Resale Value (5th Year) = Rs.3,00,000

Based on these values, this is how the cash flow diagram of the car would look like:

So you can see that the net cash flow is in negative (-Rs.5,70,000) over a period of five years. The longer one holds on to a car, the ‘negative cash flow’ will become bigger bigger.

What is an asset? Anything which generates positive cash flows. But the car has generated net negative cash flows. Hence it is not an asset – it is a liability.

This process of gauging future cash flows of an item, calculation of net cash flows is what is called valuation.

I know the example of car was like a deviation from our topic. But I thought to use this diversion to make a point. What is the point?

Estimation of ‘all’ future cash flows, whether they are negative or positive is essential for correct valuation of an investment. Whether it is stock or a fixed deposit, before one can value it, estimation of its future cash flows is essential.

[P.Note: For fixed deposit, estimation of future cash flows is easy. But future cash flow estimation of stocks is not so easy.]

How to value a fixed deposit?

We will use a mathematical formula to value a fixed deposit. Same procedure can be used to value any asset. But before using this mathematical formula, the user must apply the rule to confirm whether the item in consideration is an asset or not (Check: car is an asset or a liability?).

Once the asset vs liability checking is done, we can go to the next step. Now we are ready to implement the mathematical formula of valuation.

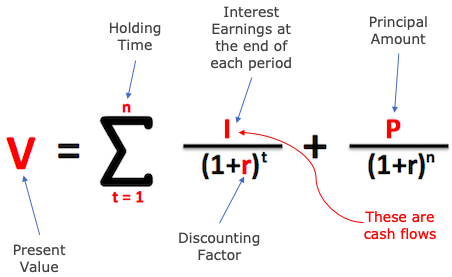

To value a fixed deposit, we must use this mathematical formula:

V = Present Value, n = Holding Time, I = Interest Earned Each Year, P = Principal, r = discounting factor.

Let’s value a fixed deposit using the above formula. The details of the fixed deposit is mentioned below:

- Deposit Value (P): Rs.100,000.

- Interest Rate Offered: 6.00% p.a.

- Period (n): 5 Years.

- Inflation Rate (r): 6.5% p.a.

In addition to these values, we will also need a discounting factor indicated in the above formula. What we shall use as a discounting factor? For debt based investments (like FD), we can use inflation rate. For equity based investments (like stocks or mutual funds) we shall use “expected returns” or “Weighted Average Cost of Capital (WACC)“.

Why Inflation rate for FD’s? When we invest money, our objective is to make our money grow. How much the money grows? It grows at the rate of interest rate offered on the deposit. But during the same time, our money gets devalued at the rate of inflation. Hence the net effective growth rate is actually lower than the offered interest rate.

Let’s start using the mathematical formula to value the FD. We will consider two cases for evaluation:

#Case 1 – Interest payable at end of each year

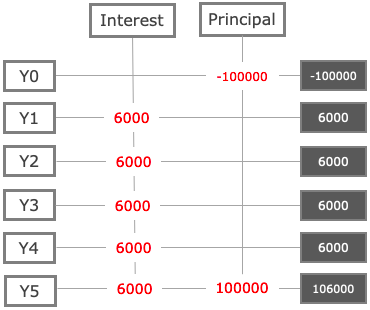

In this example, we are considering r = 6.5%. What will be the future cash flows of the fixed deposit? All Cash Flows in next 5 years is represented below:

The above infographics shows that in year zero, the cash flow is negative (-ve) Rs.1.0 Lakhs. This is the year where the money is being invested to buy the FD. In the subsequent five years, the interest @6% p.a. flows in. In addition to this the principal amount also flows back-in at the end of the fifth year.

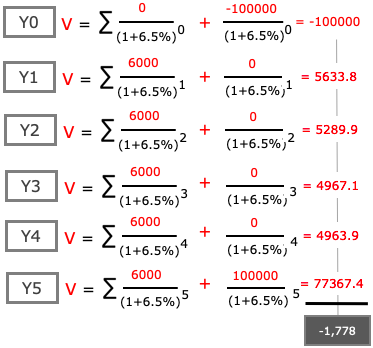

To calculate the Present Value of these cash flows, the mathematical formula will look like this:

[Suggested Reading: Discounted Cash Flow (DCF) method of analysing stocks]

Present value of all cash flows happening between year zero and future five years is Rs.-1,778. As the value is in negative, it means that the investment is not worth spending-in. Why this is happening?

Because of the negative effect of inflation (@6.5% p.a.). Had the inflation rate be lower than “interest rate” offered by FD’s, present value would have been positive.

The negative value also answers this important question:

“How much “net extra cash” the fixed deposit is going to bring-in into our pocket after five years – considering the impact of inflation? The net extra cash flow will be in negative (-1,778).

In other words, our Rs.100,000 will be weaker by Rs.1,778 after five years. Please note that this weakening of money is happening even after it remained invested for all the five years.

What is the solution? For such long durations (like 5 years), the money must be invested in equity or balanced schemes, not in debt plans (like a fixed deposit).

#Case 2 – Interest payable at maturity

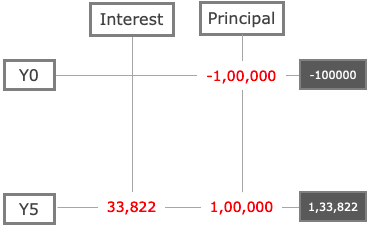

In this example, we are considering r = 6.5%. What will be the future cash flows of the fixed deposit? All Cash Flows in next 5 years is represented below:

[Note: 33,822 = [1,00,000*(1+6%)^5 – 1,00,000]

The above infographics shows that in year zero, the cash flow is negative (-ve) Rs.1.0 Lakhs. This is the year where the money is being invested to buy the FD. The next cash flow happens only after the end of fifth year. This will be interest plus the principal (Rs.1,33,822).

To calculate the ‘present value’ of these cash flows, the mathematical formula will look like this:

“How much “net extra cash” this fixed deposit is going to bring-in into our pockets after five years – considering the impact of inflation? The net extra cash flow will be again in negative (-2,325). In other words, our Rs.100,000 will be weaker by Rs.2,325 after five years.

Conclusion…

This is an example where, though an asset (Fixed Deposit) is generating positive future cash flows, but still net cash added into the pocket is negative.

Hence we can say that, though FD’s offer some respite but they cannot qualify as a good long term investment. Reason? Their offered interest rates do not beat inflation in long term.

Yes, fixed deposits are not worth investing-in when holding period is longer. For me, fixed deposits are not investment option. But they are great savings option.

There are other options available in the market which can generate higher returns than FD (for almost the same risk level). So, what we can finally conclude from this article? Two things:

- Always value your investments before buying.

- Use FD only as a saving option.

- Liquidate savings to buy assets.

- Assets generate higher returns .

Have a happy investing.

Suggested Reading:

Fixed deposits (FDs) are a very good investment option to grow your wealth. It is essential to calculate the returns in order to gain maximum profits. The blog gives a detailed description of the calculator procedure. It explains how finding the value of fixed deposits can be helpful in learning stock valuation also. The valuation of assets is also mentioned in great detail. Those trying to know how to calculate returns from FDs and value them as assets would greatly benefit from the blog.

Hi Mani(sh),

Great article. I being an NRI what other best options I can have besides NRE FDs where it is Tax free like NRE FDs?

Dear Mani, I am planning to invest funds that I will be getting on retirement. The article on investment planning is of great help in understanding the different investment tools. I also have an idea to start something new which can help me to bring back my children working elsewhere and struggling for peace and satisfaction in work. Please suggest from where and how can I get knowledge.

Another great article Mani, I really appreciate your sharing of knowledge and thoughts.

Thanks

I love your articles and I couldn’t stop after reading one. Despite me being a chartered accountant, the application of that knowledge never happened. I am so grateful to have found your blog. It’s very useful. Thank you so much.

Thank you for the awesome feedback

Hello manish, really well explained topic. Really like your detailed content. Since everything is explained technically I would like to correct one technical point. Car is not a liability, its an asset, it is a depreciating asset but it is still an asset. The PV of the car would be an asset, and if there is a loan on it than that loan would appear in liability.

In accounting term it is handled as an asset. But in investing terms it is a liability. The explanation is provided in the article itself. Thanks for your comment.

Dear Manish. Very thank to you that I wanted to start into direct shares investing after geeting guidance from your blogs. Your conclusion statements are really notable and remarkable. Very few people have knowledge and fewest of them shares it. Thanks again. you are our Indian Warren Buffet. Will keep in touch.

Thanks. If I can emulate even 1% of how Mr.Buffett “thinks” – I’ll consider myself successful

Hi Mani,

Thank you so much for detailed article, you mentioned we have other investment option available in the market with risk as FD, can you pls let us know what are those.

Any debt based mutual fund schemes, bonds etc

Very well explained, thank you.

Thanks

Hi Mani,

i have been reading your article since a while and have shared with few others. you have abundant knowledge and sharing its wisdom to general public. I wish to see you on youtube channels and provide some valueable insights on stocks, finance.

Thanks for the feedback. We have a small channel on youtube (https://bit.ly/312bie5)

I love your contents and thought process on investing that is inspired by investors like Warren Buffett. Very few has that kind of knowledge, mindset and stomach to sustain the market cycle. You are doing great job with sharing the contents. I wish more people would read it rather than going though the quick profit fad on youtube and all over the places.

Thanks for the awesome feedback.

I like your articles as they are well explanatory.

Thank you