Warren Buffett’s rules of investing are not just rules, they are principles based on which good businesses operate. So it would not be wrong to say that Warren Buffett is not just a great investor, he also has extraordinary business acumen.

So let’s try to first dig into the roots of Warren Buffett and his investment mindset. Warren Buffett learned investment at ‘Columbia Business School’. In that school, the great value investor Benjamin Graham was his teacher.

Benjamin Graham is also the author of the book called “The Intelligent Investor“. This book is considered a bible of value investing.

In the 1950s, Warren Buffett learned investment under Benjamin Graham at Columbia Business School. Buffett was just 21 years old. Buffett was young, and he found a perfect investment in Benjamin Graham, Guru. [Read: Investment basics for beginners]

Video

About Warren Buffett’s Rules of Investing

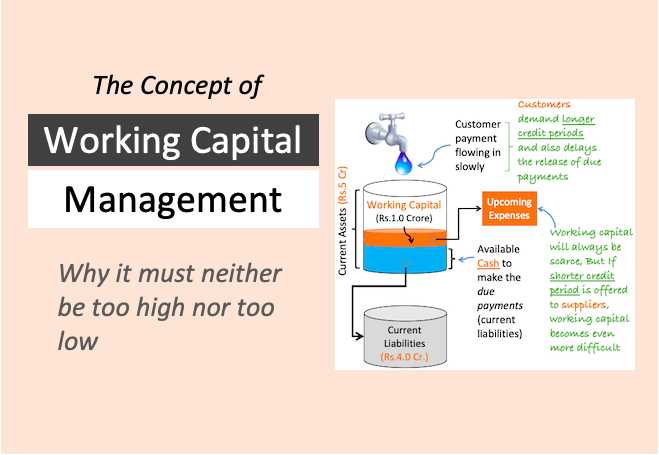

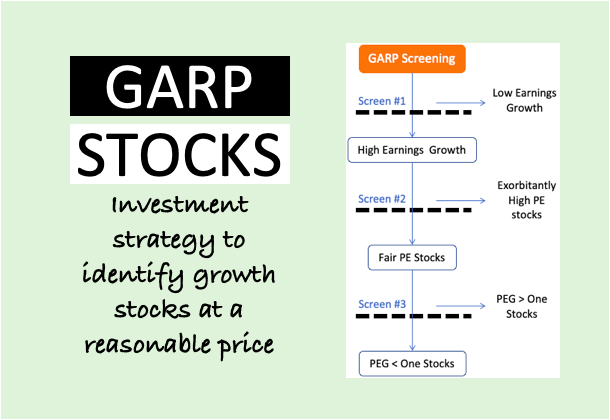

According to Warren Buffett, people must practice value investing while investing in stocks. How to do it? The first principle of value investing is to buy stocks of blue chip companies. These are companies whose business fundamentals are super strong.

But Warren Buffett goes one step ahead in screening his set of blue chip stocks. He does not go only by the numbers, he also verifies the fundamentals based on the current real-life position of companies.

Examples of such Warren Buffett-type Indian stocks are HUL, Castrol, Nestle, etc. Currently [Mar 2020], in this bear market phase, few such stocks are included in my watchlist.

Here are three (3) Warren Buffett’s rules of investing derived from the principle used by Buffett to pick value stocks. Read: About dividend-paying stocks.

1. Practise Value Investing

Warren buffett says, “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

If our investment decisions are driven by sound value investing principles, chances of them turning into loss is minimal. Why? Because it is almost a foolproof investment style.

It is the way how Warren Buffett thinks makes him successful. Generally people consider Buffett as a great stock picker. But if we go slightly deeper, we will know that stock picking happens to him as a by product. It is actually his thinking style which helps him pick profitable stocks.

So for a common man, what should be the thought process while buying stocks? There are 3 basic principles of value investing. I’ll explain them briefly in layman terms:

Principles

- Holding Time: Warren Buffett says “Our favourite holding time is forever”. When traders buy stocks, they do it for intraday or short term trading. When investors buy stocks, they do so with the intention of holding those stocks for years ahead. This is a general mind-set of value investors. They might end-up selling their stocks within months. But before buying stocks, they do it with a strategy of long term holding. Read: How to make money in stocks.

- Blue Chip Stock: Warren Buffett says “If the business does well, the stock eventually follows.” This is the reason why Buffett only buys stocks of fundamentally strong companies. These are companies which are driven by strong managers, sells excellent products, and is loved by their customers. Such companies will continue to do business forever. Read: High-weight stocks in Sensex.

- Undervalued Stock: A combination of a blue chip stock bought with a long term holding strategy should be enough to yield future profits. But the problem with this strategy is that, the yield is average and holding time may be too long. Hence it is important to add a third angle to stock investing. It is called price valuation. Buying a blue chip stock which is also undervalued will make stock investing a quick success.

Warren Buffett says: “Investors making purchases in an overheated market need to recognize that it may often take an extended period for the value of even an outstanding company to catch up with the price they paid.”

2. Estimate Value

Warren Buffett says ” Long ago, Ben Graham taught me that “Price is what you pay; value is what you get.” Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

This one sentence of Buffett has roots deep inside value investing principles. Two phrases immediately catches attention “quality merchandise” and “market down” price.

Here Buffett is saying that he will buy only quality stocks whose market price is currently available at a discounted price levels (undervaluation). But how Buffett will know if the price is discounted or not? Moreover, how Buffett know which is a quality stock?

He analyse following two things of a company:

- Intrinsic Value: When current price is trading at level below the stock’s intrinsic value, it is discounted. Stock’s in which Buffett is interested, he deeply estimates its intrinsic value. This estimation keeps him aware of the overvaluation or undervaluation levels of his stocks. [Note: I use my stock analysis worksheet to estimate a stock’s intrinsic value].

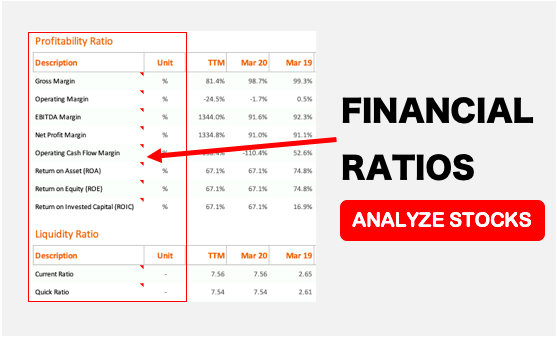

- Quality of Business: Companies whose business fundamentals are strong are “quality stocks”. Warren Buffett never analyzes stocks as a stock picker. He does it as a business analyst. He looks at the company (business) from these angles: nature of business, its management, financial health and price valuation. Analysis like this gives a more holistic picture of a business instead of only price sensitivity. Read more about it here.

2.1 Intrinsic Value

In 1998, Warren Buffett described intrinsic value like this “It is the present value of the stream of cash that’s going to be generated by any financial asset between now and doomsday. And that’s easy to say and impossible to figure.”

All stock investing decisions should be driven by the intrinsic value estimation – period. But the problem is, most people do not know what is intrinsic value and how to estimate it. But if you are not a day trader of stocks, you will need intrinsic value for investing.

- What is intrinsic value: What we see in price charts is the stock’s “market value”. They are not the intrinsic value. Market value of good stocks are often inflated. It only says what we must spend to buy one share of a company. But it does not say if this price is fair or not. What is fair price? It is that market price which is below the stocks estimated intrinsic value. Buying stocks without knowing its intrinsic value is not informed investing.

- Intrinsic Value Formula: There is a blog post on the topic of intrinsic value formula. It also has an inbuilt free intrinsic value (IV) calculator. But you can ask, if intrinsic value calculation is so easy, that a small blogger like me can offer it for free, why people do not calculate it by self? Because IV calculation has two layers. The starting layer is easy to unfold (throws general numbers). But what Buffett does is detailed. Sometimes it can take months for calculation. But we common people are not Buffett. What we can do? We can at least use an MS Excel sheet to do our maths. It is better than investing blindly.

3. Understand The Business Behind Stocks

Warren Buffett says: “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

Why people get attracted towards stocks? Because in stock investing, there is always a possibility of price trend moving upward. In such market times, people can practice buy low and sell high investing.

But the problem with this investment style is that, a common man can rarely guess an up-trend accurately. Hence, if one wants to buy a stock just because he/she thinks its price is going to go up – shall be avoided. Why? Because it is like playing god. No one can forecast price movements.

How Warren Buffett picks his stocks? He will only invest in stocks of those business which offers long term value. Now, this is a challenge for a common man. How to know if a stock offers long term value?

- High RoCE: Companies which has high Return on Capital Employed (RoCE). What is RoCE? It is a measure of how much profit a company is able to generate on its invested capital. A company which displays high RoCE for an extended period of time should immediately qualify for inclusion in ones watchlist. Read more about RoCE.

- Quality of Management: Warren Buffett gives lot of emphasis on the quality of top managers who runs the business. How Buffett judge the top managers of a company? By reading their annual reports. A report which is talking only good things about the company is not what Buffett wants to see. He gives credit to frankness. Buffett also like companies which handles its capital wisely. Read more about how to judge a company’s management.

What Buffett says about Good Management: “When you have able managers of high character running businesses about which they are passionate, you can have a dozen or more reporting to you and still have time for an afternoon nap. Conversely, if you have even one person reporting to you who is deceitful, inept or uninterested, you will find yourself with more than you can handle.”

As an investor, make a habit of writing down at least 10-12 reasons why you want to buy a stock. Among your reasons, make sure to talk about past growth rates, profitability, debt dependency, price valuations etc. You can also use my stock analysis worksheet to make the process of analysis easier.

Explanation

How these rules can help to buy better stocks? It helps in screening best stocks over average ones. Suppose, you bought 1,000 stocks of Apple Inc yesterday. Today for some reason, the stock market closed for next 10 year. Does these 1,000 stock becomes a trash? Even if the market is closed, the business of Apple Inc will continue to operate. Your stock’s price will continue to appreciate in value, and may also pay some dividends.

Story #1

“Risk comes from not knowing what you’re doing.”

“If you don’t feel comfortable making a rough estimate of the asset’s future earnings, just forget it and move on.”

— Warren Buffett

Let’s read a story related to this theory.

Suppose you saw a small tyre repair shop adjacent to your office. Would you like to buy it from its owner? Possibly No. There could be several reasons for the “No”.

But one major reason could be related to your “understanding of this business”. It is easy to understand the nature of a tyre shop business, right?

A tyre repair shop mends the flat tyres of automobiles. People having issues with their tyres approach the shop. Once their problems gets resolved, the pay for the services.

What is known about the business? Following: (a) How this business operates, (b) how the cash flows (income & expenses), and (c) Type of customers. Almost everything is known about how to run a tyre repair shop. So should you go ahead and buy this business? At least you know how it is done.

But the problem with this business is its future growth prospects. Our automobiles are quickly shifting to tubeless and more sophisticated tyres. Compared to our olden days, these days we go to a tyre repair shop less frequently.

A tyre repair shop business is understandable, but it has a weak future growth prospects. So the story ends with a conclusion that you will not buy this business.

What was the idea behind telling this story? Knowledge/awareness of the business is essential before buying its stocks. It is the deep understanding of a business that gives investors an edge over other people.

Warren Buffett is so successful because not only he buys good stocks, but the knowledge of his stocks underlying business makes his purchases even more profitable.

Story #2

“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.”

— Warren Buffett

Warren Buffett believes that a good business acumen in an investor is necessary. It will help him/her beat the other big fishes in the ocean of stock market. Let’s take an example.

Suppose there are two investor’s Mr. X and Mr. Warren Buffett. Mr.X is an IIT and IIMA alumni. He also had special training in companies valuation.

- Mr. X estimates the intrinsic value of Company called “ABZ Corp.” as $10 Million. Hence Mr. X offered $6.7 Million to the owner of ABZ Corp for the takeover. Though Mr.X’s calculation is mathematically correct, but he had little know-how of how ABZ Corp functions.

- Mr. Warren Buffett had this edge. He did his research and exactly knew how ABZ Corp was running its business. Being aware of this fact, Buffett estimated the intrinsic value of ABZ Corp as $12 Million. Hence Buffett offered $7.5 Million to the owner of ABZ Corp for the takeover.

What is your guess, the owner of ABZ Corp will accept whose offer? Of course, the owner will accept Buffett’s offer, as it is on the higher side ($7.5 million over $6.7 million).

Though at this moment, it may look like Buffett has overpaid for the ABZ Corp. But over a period of time this investment will yield great returns for Buffett.

How Buffett is so sure about it? Because his estimates shows present value of all future cash flows of ABC corp as $12 Million. But as Buffett paid only $7.5 million to buy its stocks, future growth is almost assured. Read More: Discounted Cash Flow (DCF): How to use DCF Method for Stock Valuation?

So what is the point? The more an investor knows about how the business is done, more accurate will be his/her intrinsic value estimation. This eventually helps in picking right stocks at right prices.

Conclusion

Warren Buffett will only buy stocks of super strong companies by paying minimum price for it. But why Warren Buffett buy’s stocks? Warren Buffett is a chairman of company called Berkshire Hathaway. Buffett buy’s shares of companies on behalf of the shareholders of Berkshire.

The idea behind share purchases is to put the capital of Berkshire to more effective use, without taking unnecessary risk. Hence the cash of Berkshire is used to buy shares of highly profitable companies which ensures fast future capital appreciation. Read: How companies use retained earnings.

But Warren Buffett do not buy stocks all the time. He waits for the right opportunity to buy stocks of high quality companies. In year 2008 when Subprime mortgage crisis struck the world, Warren Buffett was busy accumulating shares of blue chip stocks.

During such time, stocks of even high quality business is available at hugely discounted price. A similar situation (opportunity) is now available for today’s investor in the present bear market. Stocks of high quality companies are trading at discounted price levels.

Suggested Reading:

I am all the way from Sierra Leone, West Africa. I came from a average family, and I always got this belief and confidence that one day I will make the difference in business to help family and others emerge from poverty.

But my question is this; how can I start with a little capital that is at risk towards family responsibility.

Small capital base is a challenge. There are three series of steps to manage this limitation:

– Invest regularly

– Invest in high-return quality investments,

– Stay invested for long term (give yourself 20+ years to create wealth).

Hello Mani,

I like your work and models. Could you please tell me if the Stockanalyzer spreadsheet model can be amended to work on US (SP500, Russel 2000), Canadian, or European stocks? I see value in using the Stockanalyzer model as a screener, but I invest in the west.

Thank you,

V

Hello Mr Mani,

Tnak you very much for your posts. Really I don’t know how to thank.

I have one question please, if I want to start my first investment with an amount of $5,000, what’s your best advice for me (investing in individual stocks, Pyramidal Networking, Dropshipping (Amazon FBA, Ebay,..). Thank you by advance for your feedback.

I came to know about your blog while googling about direct equity investment and I am really happy to have found you. I am also in pursuit of my financial freedom (though in the first stage becoming debt free) and your articles are really helping me. Thank you!

Thanks for posting your views

Thank you for your advise in the correct timeing

Thanks for commenting