Warren Buffett is an investor that we can emulate. Warren Buffett’s letter to shareholders provides valuable insights and understandngs. These letters are full of hints about the investment philosophy practiced by him. The letter becomes even more endearing because every year, since year 1977, Buffett’s letter accompany’s the Berkshire Hathaway’s annual report.

For sure, we retail investors can only dream of investing like Buffett. But we can certainly gain more wisdom by reading letters written by the legendary investor himself.

In this blog, I’ll share some insights I could get from the letter issued by Buffett in the year 1977.

Management: Utilization of Equity Capital

Warren Buffett gives importance to quality management to identify good companies. Being the world’s greatest investor, Buffett can afford to do management analysis in a lot more detail. How? He gets access to the insiders and the board itself. He can interview them to make a judgment. But for people like us, we do not have that kind of access. We will have to resort to the numbers in the company’s financial reports.

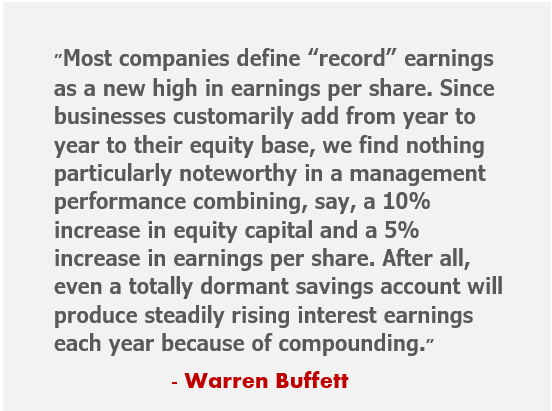

People get impressed seeing a growing EPS year-on-year. But Buffett says that even the money idling in the bank’s savings account will grow due to interest earnings and compounding. For Warren Buffett, a slow-growing EPS, and a fast-growing equity capital (net worth) is not impressive.

For Buffett, utulizationn of equity capital must be done in a way that the company’s earning grows at a rate faster than the growth of retained earnings.

Management: Operating Earnings Vs Equity Capital

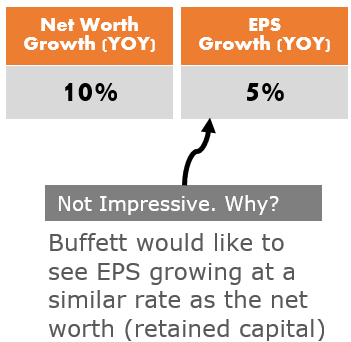

In his letter to the Shareholders’, Buffett further elaborates on his idea of the management’s performance parameter. The key is how the management utilizes retained earnings (equity capital) to generate profits (operating earnings).

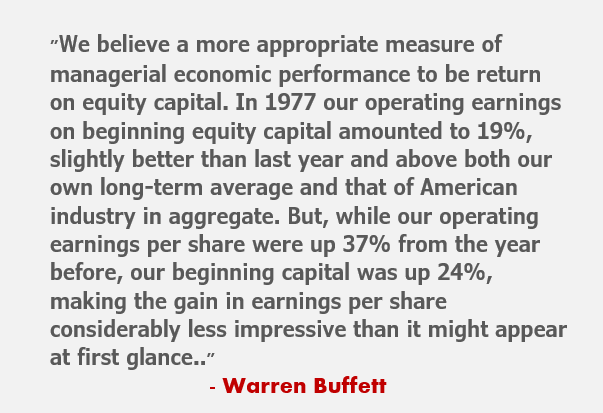

In the above quote from Warren Buffett’s letter to shareholders, the emphasis is on the importance of Return on Equity (ROE) over Earning Per Share (Operating Profit/share).

Buffett gives an example. A faster Earnings Growth is not an accurate indicator of the enhanced shareholders’ value. A company whose earnings grew by 37% and equity capital by 24%, sees only a marginal increase in the ROE.

A standalone 37% earnings growth might look fantastic at the first sight. But a trained investor would also see the ROE enhancement happening during the same period. In our example, though the earning grows at 37%, but the ROE enhancement is not as glorious.

[Note: A company having a lower debt to equity ratio, fast growing EPS, and above average ROE is investment worthy]

Industry: Tailwinds vs Headwinds

The progress is made harder in a business where headwinds prevail. Progress is easier in businesses with tailwinds. Buffett explains that the Textile Business, irrespective of its quality management, is rendering only modest results. It is an example of a business with headwinds (business moving against the windspeed).

In the year 1977, Warren Buffett was trying to turn around the fortunes of Berkshire Hathaway which was primarily a textile company (back then). But the fundamentals of the textile industry itself are weak (headwinds). No matter, even a good management team was delivering only modest results.

Today (2022), the industry that is facing clear headwinds are IT and Infrastructure. Both these industries can boast of quality management teams, but in the last 1-year, their performance is dismal. The IT sector is facing headwinds due to a slowdown in the US market. The infrastructure sector is plagued by cash-flow issues, etc.

Before COVID, till 2020, for almost three to four years, the healthcare and pharma sectors faced similar headwinds.

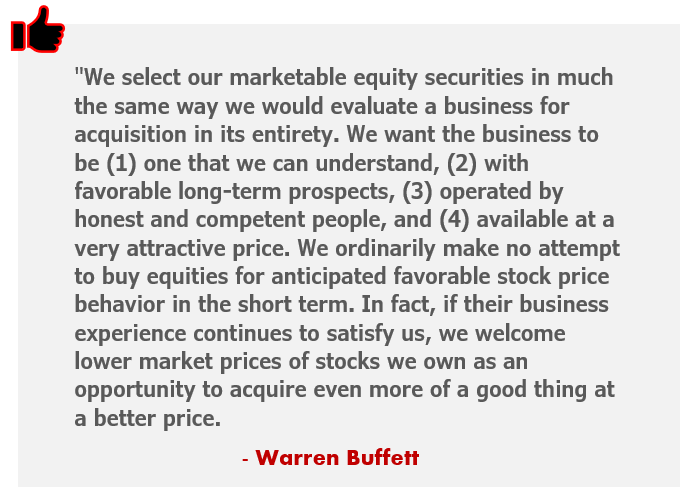

Company: Favourable for Investing

This one paragraph describes the whole concept based on which Warren Buffett picks his stocks. There are four parameters based on which Warren Buffett select his companies:

- Simple and understandable business: If the business of a company cannot be understood after reading the first few pages of its annual report, it’s a problem. Clarity about the company’s products, operations, customers, suppliers, promoters, and board of directors, among others must be clearly explained in the document.

- Long-term prospects: The outlook of the company for the next 10-15 years, at least, should look promising. The sector/industry in which it operates must be thriving. This will provide reasonable growth prospects for the company in consideration.

- Good Management: The top managers who run the company must run it with competence and ethics. The combination of these two traits gives a clear edge to a company in long term.

- Good Price Valuation: Identifying a good company, as discussed in 1, 2, and 3 above, is only a part of the analysis. The company must also be available at a discounted price. Buying a good business at expensive price levels must be avoided.

Warren Buffett’s letter to shareholders further states that they do not buy equity with a short-term focus. If the fundamentals of the company are intact, even if the stock’s price falls, they will not sell it. In fact, they would use these dips to “acquire” more of it.

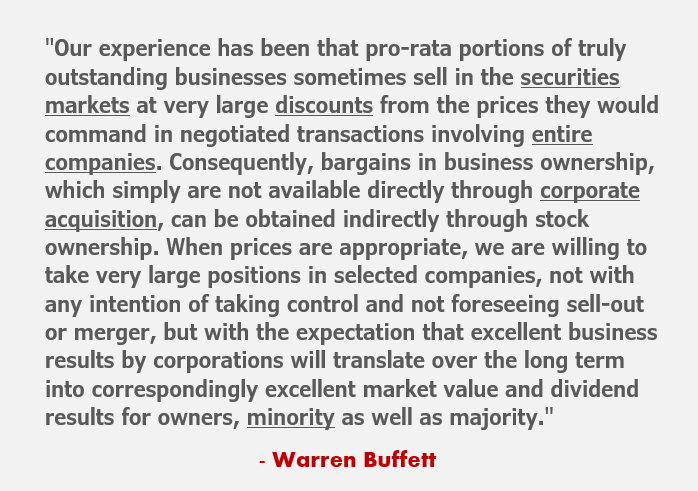

Large Discounts

Warren Buffett is always looking to buy stakes in “outstanding businesses.” Ideally, he will like to buy the ‘entire company’ and take control of it. But often, such quality businesses are not on offer for sale.

But stocks of such companies are available in the stock market. Buffett is okay with the share purchase for even a minority stake in an outstanding company. As the stock market is volatile, the price of stocks of these companies gyrates with time. Sometimes, the stocks sell at “very large discounts” to their intrinsic value. Buffett sees this as an opportune time to buy stocks at bargain prices.

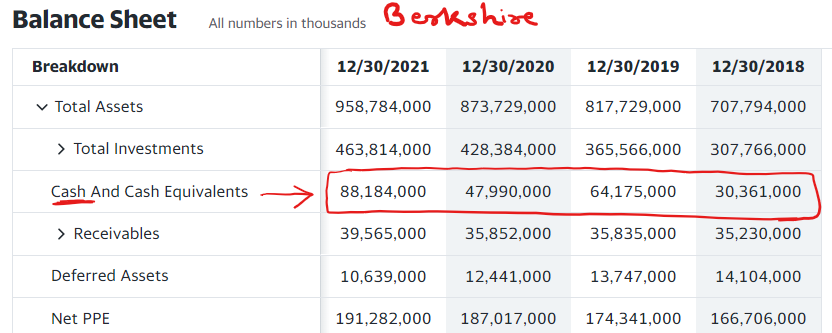

For an investor like Buffett, whose company Berkshire Hathaway keeps over $50 Billion in cash, this investment behavior is extraordinary. Such a cash-rich company can negotiate and buy majority stakes in almost any company. But their preference for ‘large discounts’ makes them flexible for even a minority stake purchases. Check here for the top Berkshire Holding companies & it’s percentage stake in them.

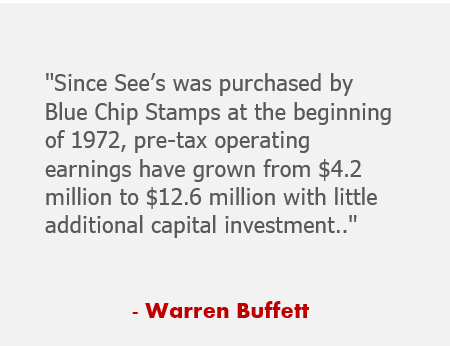

Use of Capital & Earnings Growth

This small statement published in Warren Buffett’s letter to shareholders describes his inclination to achieve earnings growth at a less cost. Upon infusion of capital, any decent company can report earnings growth. In fact, for a company to grow with time, capital expenditure (CAPEX) is required. But the target should be to yield maximum growth with minimum investment.

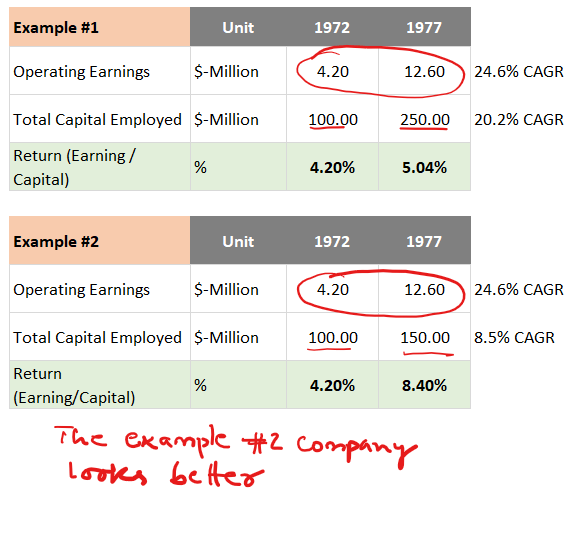

Below is an example of two hypothetical companies. Both the companies has increased its operating earnings from $4.2 million to $12.6 million in 5-Years. The company #1 achieved with much large capital base compared to the company #2. For a value investor, between both the companies, the company #2 is better suited for investing.

Conclusion

The 1977’s Warren Buffett letter to shareholders revealed the mindset of the legendary investor. The first thing that’s clear about Buffett is that, he sees stocks from the eyes of a business man. For Buffett, observing the business behind the stocks gives deeper understanding about the company. For buffett, the priority is to invest only in outstanding businesses. It is the top management of the company that makes even an ordinary company outstanding.

Buffett is also sensitive to earnings growth. But he prefers to look at the earnings through the lens of employed capital. Growing earnings at a much smaller capital infusion is what’s preferred.

Warren Buffett loves to see a strong top management running the business. But he also knows that even good management, sometimes, can yield only average results. This will happen if the company is facing too much headwinds. Hence, Buffett also looks for companies benefitting from tailwwinds (read more here).

Thanks for reading the article through.

Have a happy investing.