What are stocks all about? Why they are often seen as a complicated investment? Is it really complicated to buy and sell stocks?

For sure, investing in stocks is not as simple as buying a fixed deposit. Why? Because fixed deposits are fixed return investments, and stocks do not give fixed returns.

Stock’s returns could be high, or might even be negative (loss). Why this unpredictability? Because stock’s price is volatile, and many people who trade stocks, do not know how to deal with its volatility.

How to deal with this volatility?

By knowing the “necessary things” about stocks before investing in it. What are the necessary things? Most important: This realisation that stock’s prices are volatile; and it needs to be managed to prevent loss.

This volatility of price makes it risky and hence slightly complicated.

But how price volatility makes stocks risky? Due to price volatility, people might end up purchasing stocks at overvalued price levels. Whenever this happens, there are high chances of loss making.

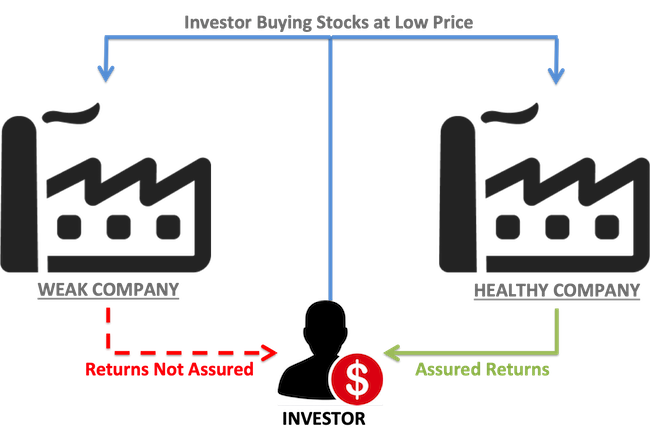

It might also happen that, people might buy stocks of a “bad company” thinking it to be undervalued, as the trade at low price levels (like majority penny stocks). In such a situation, there is again a very high chance of loss making.

So basically there are two things that one must take care while dealing in stocks:

- Price Levels.

- Business Fundamentals of Company.

If one can learn to handle these two parameters, stock investing will no longer be complicated and risky.

Hence here in this series of articles, I target to make the “complications of stocks” understandable. Moreover, I will also emphasise on how to manage the risks involved in stock investing.

How I will do it? By answering the most basic questions related to stocks in a systematic and phased manner.

Moreover, these articles will include zero jargons. I will use simple words and sentences, more understandable by common public.

So lets start with the most ‘asked’ question related to stocks…

How shares can make money for its investors?

Shares are risky, but we also know that it ‘makes money’ for some people. But bigger question is, how? To answer this question, we must first know what are stocks?

Owning a stock means, proportionate ownership in a businesses. How this ownership helps its investors? They become eligible in “profit sharing” of the company.

Profit sharing means what? Example: if the company made Rs.100 Crore as profit, and it has 50 crore number shareholders. Then each shareholder is eligible for a profit sharing of Rs.2 per share (Rs.100 / 50).

How this profit will be paid to the shareholders? In form of dividends. Alternatively, company may not pay full dividends (Rs.2 per share) but decide to reinvest a part of profit it back into the company.

This reinvestment of profit, will further boost the profits of the company in coming years. When profit grows, it will also reflect into the “growth in share price” of the company.

So shares can make money for its investors in two ways:

- Dividends.

- Share price growth (capital appreciation).

So what a potential investor shall do? Simply buy stocks of good companies, and hold it for long term.

Just buying and holding stocks is enough?

Yes and No.

Why Yes? Because good stocks will make money for its investors (in form of dividend and capital appreciation) as seen above.

Why No? Because it is essential to buy “good” stocks to make money. In stock investing there are chances that people may end up buying a “not good stock”. Hence chances of making money goes down.

But why people will buy a “not good stock”? Because of the lack of know-how to identify good stocks.

Intentionally nobody will buy a bad stock. But due to ignorance, people may mistakenly buy a bad stock. What is a bad stock? There are two qualities of a bad stock:

- Overpriced.

- Weak Business Fundamentals.

So if a person has bought a bad stock, even if he/she holds on to it for long term, the possibility of profit making will remain low.

What makes matters more complicated is this:

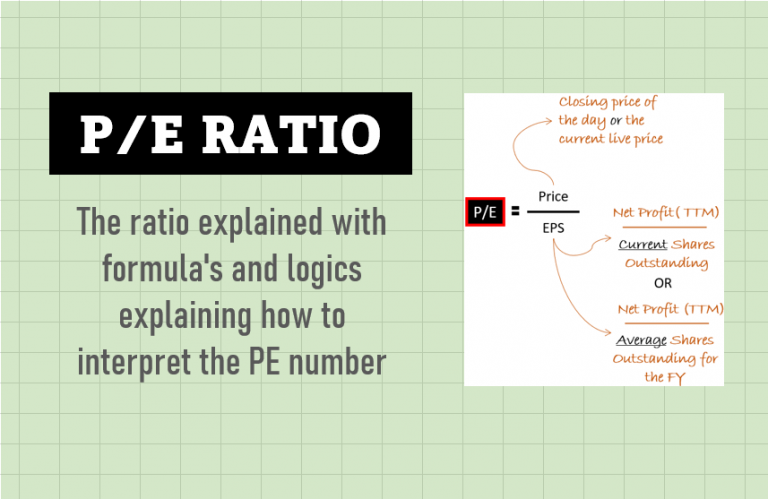

“Fundamentally strong stock’s often trade at overvalued price levels”

How does it make a difference? Buying a strong stock is not the only criteria. It is equally important to buy them at a right price.

No matter how strong is the stock, if it is not bought at the right price, it will not be considered a good buy.

Example: BOSCH India has a strong business fundamentals. But buying it at overvalued price levels will make it bad.

So this is all about stock’s introduction from point of view of the investors.

For a potential investor, it is also useful to understand stock’s utility from point of the issuing company.

So let’s dig deeper into why shares are issued in first place…

Why companies issue shares to public?

Shares issued to public gives shareholders the right to claim profit-sharing.

This looks like foolishness on part of company to issue shares to public, right? Otherwise why companies will share their profits with outsiders?

There is something very important that companies gains by issuing shares to public. What is it? “Access to cheap funds”. By issuing stocks companies can raise funds to do business. This is called equity financing.

Why equity is referred as cheap funding? As per rules, when companies raise funds by equity financing, they are not obliged to payback money to shareholders.

But in case company is raising funds using bank loans (debt financing), they will be obliged to pay interest to the lender (bank).

What does it mean? Companies are not legally obliged to pay either “dividends” or ensure “capital appreciation” to their shareholders.

So it means, equity funding is almost free money for the listed companies. But still company pay handsomely to their shareholders. Why? This is where things becomes very interesting:

Important to note…

Why company pay dividends? For three main reasons.

First, dividend payment is an indication that the company is making profits. This action assures investors to hold on to their stocks longer.

Second, dividend payment also adds to the short term income of the shareholders. Hence, shareholders are tempted not to sell their stocks any time soon.

Third, for long term shareholder dividend is like a double bonanza. They earn dividends in short term, and will eventually also earn capital appreciation in long term.

Hence, long term shareholders gets an added motivation to stay glued to their stock (when they are paid dividends).

Why it is essential for companies to ensure capital appreciation? For two main reasons.

First, to survive. It is essential for listed companies to continue growing and thereby assuring capital appreciation for its shareholders. Why? Because if it is not growing, shareholders will start selling its stocks.

Increased selling means share price will fall dramatically. This may create a vicious price-cycle, which will prove disastrous for the companies market valuation and hence existence.

Second, to keep shareholders happy. Dividend yield is often not enough for shareholders. To keep shareholders happy, good companies ensure long term capital gain for its shareholders.

Why companies would like to keep shareholders happy? Because keeping existing shareholders happy will further boost its shares demand, which means more buying. This way the market value of shares will further go up.

Final Words…

Lets sum-up what we have learnt about stocks till now:

Returns from stocks are not fixed. They are variable.

Stock’s price fluctuates, making it risky.

It is investors responsibility to manage the risk.

Buy strong stocks at undervalued price.

In form of dividends, capital appreciation or both.

Good companies will always ensure that shareholders interest are never compromised.

its really helpful, nice article.

hello sir. Today I have watched your site and I loved it very much. The appearance is beautiful. I am always against the one page display. It is looking very good. Please keep the Contact Form. It will help us to contact you.

good job sir.