The Dosa Economics of Raghuram Rajan explains the negative impact of high inflation on our purchasing power. But we already know that high inflation is bad, right? So why the RBI Governor had to coin the concept of Dosa Economics?

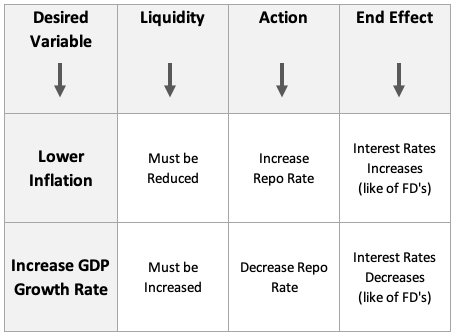

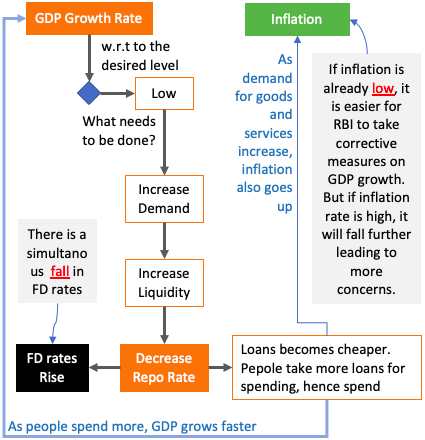

Both, ‘high’ and ‘very-low’ inflation is bad for the overall economy and also for our pockets. Hence Reserve Bank of India (RBI) keeps a control on it. One tool that they use to tame the mood of inflation is called Repo Rate. When inflation is too high, they increase repo rate and vice versa.

Repo rate directly effects the interest rates offered by banks on their term deposits (FD’s). When repo rate goes up FD’s interest rate also goes up and vice versa.

So as far as relation between inflation, repo rate and FD’s interest rate is concerned, it is quite linear and simple. But if we will factor in the GDP growth rate, things start to become complicated. Why? Because inflation and GDP growth rate is like inversely related.

Controlling Inflation & GDP Growth

Inflation and GDP growth rate is inversely related. This is the reason why, even if RBI/Government desires to keep FD rates high, they cannot always do it. Because it is more important to keep a balance between inflation and GDP growth rate.

This is what explains the dilemma and limitation of RBI/Government. But how common men should deal with falling interest rate regime?

This is what has been beautifully explained by our Ex. RBI Governor Raghuram Rajah using his theory called Dosa Economics. We will read more about it in this article.

But before knowing about how Raghuram Rajan explained Dosa Economics, let’s know more about how interest rated on FD and economic health of a nation are interrelated.

Concept of Purchasing Power

Everyone likes when income from risk free investment options (like Bank’s Term Deposits) is high. But it is also important to understand that very high FD rates are not a good sign for the economy.

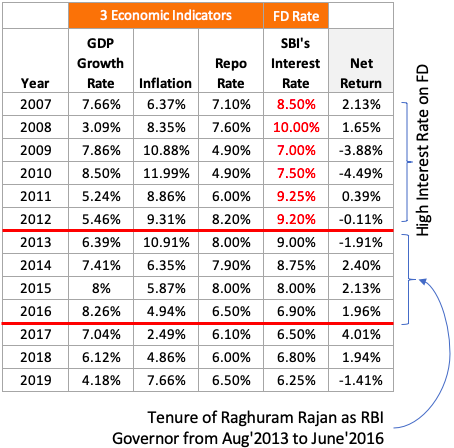

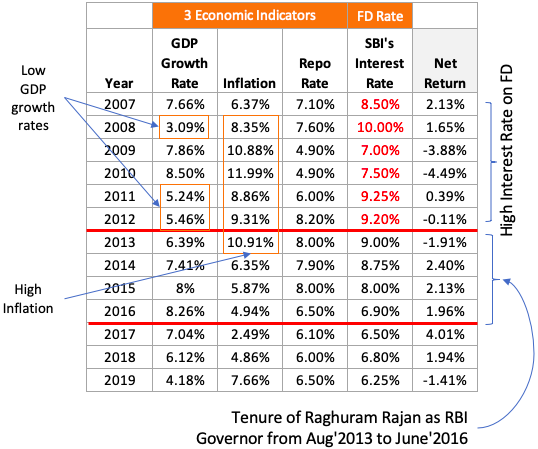

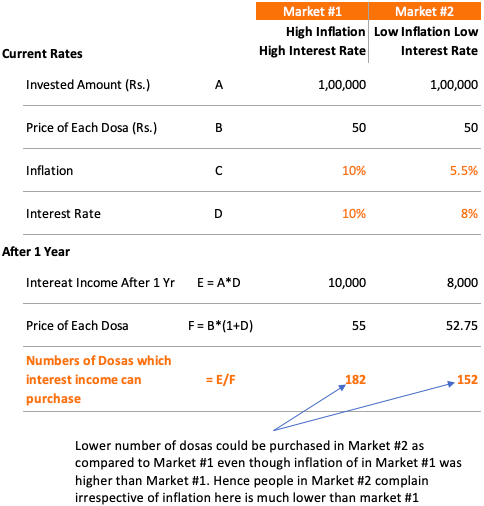

Let me give you a data. Below is the list of three economic indicators: GDP Growth rate, Inflation and Repo rate in last 14 years. I’ve compared these indicators with SBI’s FD rates in those years.

You can see, in the pre Raghuram Rajan’s era, interest rates on FD’s were on the high side. On an average, between 2007 and 2012, FD rates were in 8.5%+ range.

While Raghuram Rajan was in office (Aug’13 to Jun’16), the rates of FD started falling. In 2016 it came down to 6.9%.

If people will see only FD’s rates, in Raghuram Rajan’s era they were at a loss, right? But it is important not to see FD rates in isolation. What we must actually see is “net returns”. What is net returns? FD’s interest rates minus inflation.

It is the net returns which we must be concerned about. Till net returns are showing as positive, an FD investor must feel happy. No matter how high is the FD’s interest rates, if net return is negative, in long term, it is only decreasing our purchasing power.

Remember, why we are investing money? What it does when we earn returns? We are doing it to boost our purchasing power. Suppose, today we have Rs.1000 and we invest in FD @10%, then after 1 years it will become Rs.1,100. It is a boost of our purchasing power.

So no matter how high is the interest rate, if net returns are negative (see pre Raghuram Rajan’s era), our purchasing power is actually going down.

Why High FD Rate is not a good sign?

High FD rates signal towards a thing working in the economy. It signals towards a high prevailing inflation. In this scenario, FD’s rates can go up. High FD rates may look dearer in short term, but it is a bad indicator and it also adversely effects the GDP growth rate.

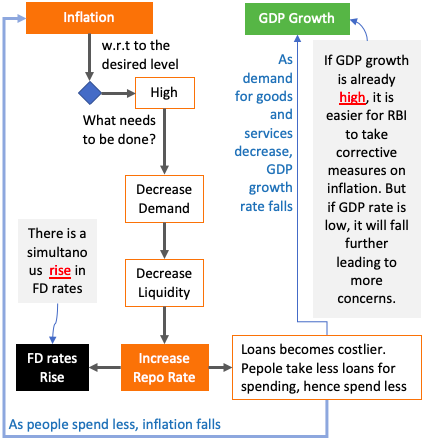

When inflation is high, RBI will try to curtail the consumer demand. It does so by trying to decrease the liquidity in the economy. How it will implement it? By increasing the repo rate.

The increased repo rate on hand will increase the FD rates, but it will also increase the rates on loans. Hence, people will take less loans and overall spending in the economy will go down. This way inflation falls.

But on down side, it can also negatively effect the GDP growth rate. This is a challenge for the government.

How low FD rates is a good sign?

When GDP growth is slow (like in present situation of Corona Virus), RBI will try to boos the demand. How it will do it? By lowering Repo rate and making loans cheaper. This way people will take more loans and spending goes up. This will push the GDP up.

But on down side, lower repo rates will also decrease the interest rates on FD’s. Moreover, lower repo rates also will increase the inflation. This is a challenge for the government.

But we can say that, falling FD rates are a sign that government is trying to boost the GDP growth rate which will eventually help us in long term.

Dosa Economics

Senior citizens think differently. They have already lived their working lives. Their ambitions are mostly taken care of. Their priorities are different. They are also concerned about long term effects of high inflation, but it is subdued. For them, fall in FD rates means fall in their income.

It is for them that Raghuram Rajan has used the analogy of Dosa’s to explain how they must decipher the puzzle of low FD rates.

Before that two terms Raghuram Rajan used in this Dosa Economics. Knowing this will help us better correlated our understanding with his explanation:

- Nominal Interest Rate: What we see as a quote from bank’s in their websites about the prevailing interest rates offered by them on term deposits, is called nominal interest rate. If SBI is offering 5.5% interest on FD’s as on July’20, then 5.5% is the nominal interest rate.

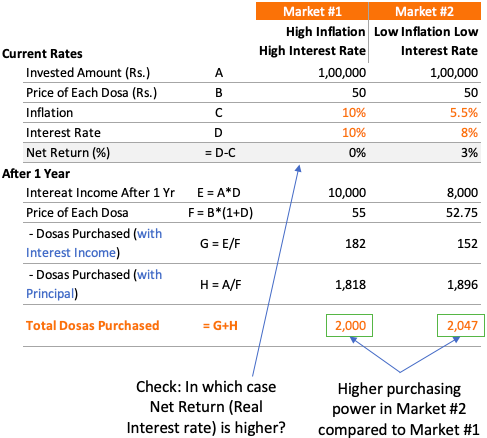

- Real Interest Rate: What we have seen here as Net Return, Raghuram Rajan calls it as ‘real interest rate’. It is FD’s interest rate minus inflation.

– Explanation (First Impression)

Suppose there is a senior citizen who has Rs.1,00,000 as his savings. At that point of time the market rate of dosa’s was Rs.50 per dosa. How many dosa’s the person can buy with Rs.1,00,000? He can buy 2,000 number dosas ( = 100000/50). So in a way we can say that the purchasing power of Rs.1,00,000 at this moment of time was 2,000 number dosas.

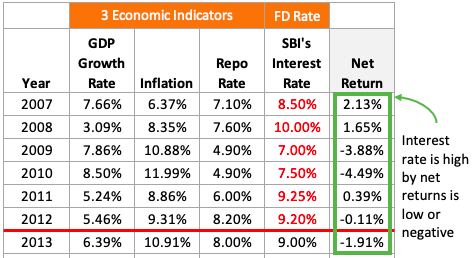

Now suppose, the senior citizen decides to invest this money (Rs.100,000) to generate some regular income. Hypothetically speaking, let’s assume that he has two market available for him for investing.

The first market is “high inflation high interest rate” market. The second market is “low inflation low interest rate” market. Let’s see what happens when he invests in either of them.

- Market #1: In this market current interest rate offered on FD’s is 10% per annum. Hence after the end of year 1, income generated by investment of Rs.100,000 is Rs.10,000. In the same time, as inflation was also playing at 10% per annum, price of each dosa rose from Rs.50 to Rs.55. This means, interest income of Rs.10,000 could buy 182 number dosas ( =10000/55).

- Market #2: In this market current interest rate offered on FD’s is 8% per annum. Hence after the end of year 1, income generated by investment is Rs.8,000. In the same time, as inflation was at 5.5% p.a. levels. Hence, price of each dosa rose from Rs.50 to Rs.52.75. This means, interest income of Rs.8,000 could buy only 152 number dosas (=8,000/52.5).

So you can see, lower number of dosas could be purchased in Market #2 compared to Market #1. Even though inflation was lower in Market #2, still people could buy lesser number of dosas.

So people in market #2 can conclude that Market #1, high interest rate regime, is better. Why? Because in market #1 people could buy more dosas.

So what do you think? Which market is more suitable for our example senior citizen to invest in? I’m sure majority will opt for Market #1. But this will be a mistake.

High interest, high inflation regime is never good for either economy or for its people. Let’s understand more about its inbuilt fallacy.

– The Fallacy of High Interest Regime

On the face of it, high interest regime might look good. But we must not forget that high interest regime is always backed by high inflation.

Whenever inflation begins to rise and soars beyond a level, it becomes uncontrollable. What is that level where we can say that inflation is is crossing its limits? A point at which interest rates on FD becomes lower than inflation rate. At this point, “Net return/Real interest rate” becomes negative. Check ‘net returns’ shown in high interest regime between 2007 and 2013

What happens when net return in zero or negative?

This is a situation where our investment are actually yielding zero or negative returns. But it is not easily visible to normal eye. This has been beautifully explained in the concluding remarks of Raghuram Rajan about Dosa Economics.

You can see in the above infographics, that in Market #2 the net return was positive. Hence, though Market #1 was yielding high interest, but still purchasing power is enhanced (after 1 year) in Market #2.

How we can say that? Because it is only people in market #2 who were able to buy more Dosas after 1 year of staying invested.

Conclusion

People often worry when interest rates on deposits are falling. Of course, earning higher interest rate is better, but the only correction one must make into ones thinking is this…

Focus should be on real returns (real interest rate) and not only on nominal interest rate.

It is only the positive real returns which has potential to enhance our purchasing power. No amount of high interest rate on FD’s will actually benefit us till it is higher than the prevailing inflation rate.

So the key takeaway of Dosa Economics is Real Returns. Focus on this, and your personal economics will begin to fetch real returns.

There are many caveats to the low-interest rate regimes.

- People say that when interest rates on deposit fall, our income falls from today. But the benefit of low inflation will be felt only after a few years/months from now. So the loss is immediate when interest rates fall.

- People may also say that, no matter how low may be the inflation, the price of food items never cools.

These caveats will be there. Probably these are side-effects of a growing buoyant economy like India. There is no other way. We will have to learn to manage this risk. How to manage this risk? Read about it here: How to invest retirement money.

Suggested Reading:

Very good article, simple to understand even for people like me who does not know economics.

Thank you

I am a retired officer, your analysis is correct but you have missed one thing. The inflation data is fugged and the requirements of senior citizens is very limited so they are not much affected by inflation.

Ok, but not every senior citizen has the same experience. Thanks for posting your views.

Hi Manish,

Thanks for the insightful article. Could you please elaborate more on why and how Repo rates and Banks’ FD rates are positively correlated?

Regards

I am yet to see prices going down or cost of living for that matter. So dosa economics is just a catchy term and nothing beyond that. If our savings are limited then reduction in interest will certainly hurt those who live on that income. Most senior citizens do fall under this category. We need some creative solutions for senior citizens and insulate them from the interest rate changes.

I agree. Prices of essential commodities grow at a much faster rate.

Hi Mr. Mani,

Once again thank you very much for your detailed explanations, i loved it.

May i know what do you think about current FD interest rate(5.1%) wrt current inflation rate?

does it give positive returns?

I can understand that you could take a lot of time to collect data from various sources to present the matter in lucid and put to understand the matter. Good article. Wish to give more to the readers.

Thanks

I truly admire your way of explaining.You make complex economy concepts super easy to understand.

Looking forward to your nxt article.

Thanks for the feedback.