The purpose of this blog is to highlight the importance of timing the sale of stocks sitting in an investment portfolio. When to sell a stock? We often do not give too much weight to this question. There are some stocks that must be sold before it’s too late to exit. This article will show us how to identify such stocks and when to sell them. For quick answers, please read the FAQs

Introduction

People must buy stocks with the objective of wealth building and not money making. I know this theory might sound counterintuitive in the beginning, but that’s the way it is. We must buy stocks to build wealth over time. How is it done? By accumulating good stocks at the right price and holding them for a very long time.

Buying stocks is a more difficult decision as no stocks shall be purchased without proper analysis. The correct procedure to do it is through fundamental analysis. Its implementation also takes some learning. But an online tool like my Stock Engine can make the analysis relatively easy.

The decision to sell stocks is relatively easy. But it must be timed in a way that post-selling there is no regret. The idea is to sell a particular stock at a right time. What is the right time? Ideally, it must be before the stock price goes for a nose dive.

To protect oneself from losses, a stock portfolio must release potentially loss-making stocks.

When to sell a stock?

The ideal time to sell stocks is when the stock market is at its peak, period.

The majority of stocks at this moment will be trading at their peaks as well. This is especially true for stocks included in the index like Nifty50, Sensex, Nifty Next 50, S&P BSE 100, etc. When these indices and large-cap stocks move up, they generally drive other stocks as well.

So, the right time to sell stocks is when there is euphoria in the market. At other times, do your analysis and sit tight, do not sell. Wait for the indices to start climbing. When that time comes, sell the stocks you want out of your portfolio.

Video

Which stocks to sell?

The rule is to sell only those stocks about which you are not feeling good. How to build a feel about the stocks in our portfolio?

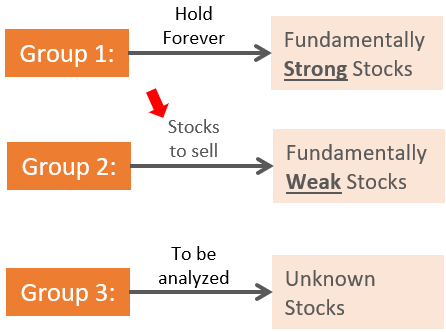

The first step is to categorize all stocks in the portfolio into three groups.

Grouping

- Group 1: In this group keep stocks about which you are very confident. These are fundamentally strong stocks having an overall score rating of 75% plus. When these stocks are bought at a price below their intrinsic values, they become eligible for a very (very) long holding time. I will try to hold these stocks for at least 20-Years. Why? A stock like RIL has given a return of 21% per annum in the last 20 years. What does 21% per annum mean? It will convert Rs.5.0 lakhs into Rs.2.25 Crore in 20 years.

- Group 2: In this group keep those stocks about which your confidence is low. Keep the reasons for the low confidence limited to weak fundamentals. Do not listen to the views of too many experts. Do your own fundamental analysis of the company. Stocks whose overall score rating is too low and is very overvalued shall be on this list. A stock whose fundamentals are weak but its stock is performing well, makes it an ideal contender for selling. We must not get greedy for higher returns from weak stocks.

- Group 3: Here there will be such stocks about which you don’t know much. Read the financial statements of these stocks. If you do not want to do so much research, just note their intrinsic value and overall score. Stocks with high intrinsic value and high overall scores will go into group #1. The others will go into group #2.

Ideally, all portfolio stocks must fall into group #1 only. How to ensure that? By doing a thorough analysis before buying any stocks. But even in this case, some companies can eventually slide into group #2.

The fundamentals of companies change with time. A strong airline company like Jet Airways has been in the doldrums for the last 6-7 years. This is the reason why re-analyzing all portfolio stocks at least once a year is mandatory.

What to specifically look for in these companies?

I will look at the following trends to decide if a stock is worth selling or holding.

Parameters to Check

Please note that here we are doing more of a trend analysis than a number crunching. Hence, we must at least look at 5 to 10 years of data together. One year of standalone data will not help. Idea is to establish the fact that, in the past years the fundamentals of the company is showing improving or deteriorating trends.

Financial Reports

- #1. Net worth & Reserves: The first document one must open is the company’s balance sheet. Check the reserves numbers. In the last 5 to 10 years, if the company is showing falling reserves, it is a hint that the company is either not profitable or it is paying dividends that it cannot afford. Such companies are potentially moving towards bankruptcy in times to come. Better sell their stocks today than tomorrow.

- #2. Revenue and Profit: In the time span of 5 years, the company revenue must grow at least at the rate of inflation. In India, we can assume 5-year inflation between 6 to 7% per annum. To analyze profits, we must look at three numbers, operating profit, net profit, and EPS. All these numbers must at least show a rising trend. A company showing falling revenue and profits is giving an indication of weak fundamentals.

- #3. Cash Flow from operations: Open the company’s cash flow report and check the net cash it is generating from its operations. The minimum requirement is a positive net cash flow. If the company is consistently negative on this cash flow, it will be surely free cash flow negative. Such companies find it difficult to grow in the future.

Financial Ratios

- #4. Margins: Companies that are showing falling operating margins are ones with low pricing power. These are such companies that might crumble when competition intensifies. A low but consistent operating margin is better than falling margins. Stocks will falling margins can be sold.

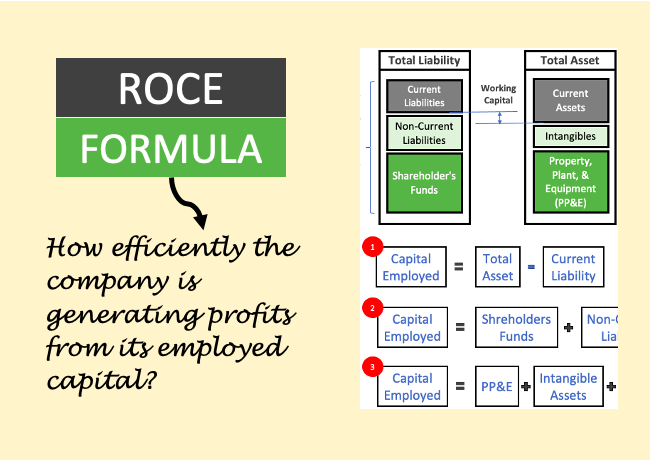

- #5. Leverage: Companies with high ROCE trading at low PE multiples are ideal for investors. But high ROCE will only happen if the company in consideration is keeping its debt under control. How to know if the debt is within acceptable limits or not? Check the Interest Coverage Ratio (ICR) and Debt to Equity Ratio (D/E). If the ICR is remaining consistently below one, and D/E is above 3, it makes the company risky. I’ll not hold such stocks in my portfolio.

Probably there will be no companies that will show a negative trend for all the above five parameters at tandem. Even if three parameters are showing a downward trend, stocks can be considered worth selling.

Conclusion

In an investment portfolio, there could be a number of stocks. Out of all stocks, some are eligible for sale. As an investor, one must not hold on to weaker companies. When to sell a stock? As soon as one realizes the weak fundamentals one must exit. In case the current losses are too high, one may wait for a stock market rally to get a better price.

FAQs

The stock with weaker fundamentals (like a low overall score) needs to be sold. There is no point holding on to such stocks expecting a revival. Why? Because in many cases the revival wait time could be too long. In some cases, a company (like Kingfisher, etc) might not revive at all. So the logic should be to exit a weak stock, even if at a loss, and invest the money elsewhere. The alternative investment could be an index ETF or blue chip stocks.

If one has already identified a stock as weak, waiting and selling it during a rally would be a good decision. But there is no point holding on to toxic stocks. They must be sold immediately without any delay. Such stocks may never see their past glory.

Set your goal and sell it as soon as the goal is reached. But this is the way traders operate in the stock market. Investors buy stock to take advantage of the power of compounding. Buy good stocks and hold on to them till their fundamentals are strong. For stocks like RIL, TCS, Tata Steel, JSW Steel, HUL, Britannia, etc, their fundamentals are intact for the last few decades. So, if the idea is wealth-building, focus on time in the market instead of timing the market.

No. I’ll explain it with an example. Reliance Industry was trading at Rs.57 levels 20 years back. Between the year Nov’2002 and Nov’2022, it has yielded a return of 20.94% per annum. It means Rs.1.0 lakhs invested in 2002 has become Rs.45 lakhs in 2022. Had one sold the stock when it was only 20% up, the gain would have only been Rs.20 thousand.

Long-term investors may continue to hold on to a stock even if it shows losses of 30% or higher. Why? Because of the expectation that the fundamentals of the stock will improve in times to come. Stock traders may put a stop-loss and sell stocks if they fall by 10%. But the investor’s mindset is different. They do not think in terms of stop losses.

![Understanding Block Deals: A Guide for Retail Investors [Also Fact Check]](https://ourwealthinsights.com/wp-content/uploads/2024/11/Block-Deals-Fact-Check-Thumbnail3.png)