In last decade, index funds have gained lot of popularity. What makes index funds attractive is their low cost.

Compared to actively managed funds, index funds has lower expense ratio. ‘HDFC Index Fund – Sensex’ is one of the better index funds. It has an expense ratio of 0.3% (Regular Plan), and 0.1% (Direct Plan).

‘Invesco India Multicap Fund’ is one of the better performing multicap funds. It has an expense ratio of 2.46% (Regular Plan), and 0.95% (Direct Plan).

So if we compare the expense ratio of multicap funds and index funds, the latter is a clear winner. Multi cap funds are very expensive compared to index funds.

So which is better – index funds or actively managed funds like multicap funds? A common man like me and you should pick which type of mutual fund?

Data Collection…

To answer the above question, I decided to collect some data related to mutual funds.

What was the objective?

The objective was to compare index funds vs actively managed funds with respect to the following parameters, and arrive at a conclusion:

- Last 10 Years Average Returns.

- Last 5 Years Average Returns.

- Last 3 Years Average Returns.

- Price Volatility (Last 3 Years).

In addition to the index funds, which are the actively managed funds I am considering for comparison? Following type of active funds:

- Large Cap Funds.

- Mid Cap Funds.

- Small Cap Funds.

- Multi Cap Funds.

- Value Funds.

What is the source of data? I have collected the data from morningstar. I have screened those mutual funds which had at least 10 years past data available for analysis.

Number of mutual funds I have considered for my analysis is as listed below (total: 271 Nos).

- Large Cap Funds – 64 Nos.

- Mid Cap Funds – 57 Nos.

- Small Cap Funds – 23 Nos.

- Multi Cap Funds – 73 Nos.

- Value Funds – 28 Nos.

- Index Funds – 26 Nos.

The range of values that I got out of the above 271 Nos mutual funds has been summarised in the below table:

| SL | Mutual Fund | 10Y Return | 5Y Return | 3Y Return | Volatility |

| 1 | Large Cap | 16.6% | 14.0% | 13.0% | 13.47 |

| 2 | Mid Cap | 22.3% | 19.0% | 13.6% | 15.86 |

| 3 | Small Cap | 20.4% | 17.8% | 12.0% | 16.60 |

| 4 | Multi Cap | 18.3% | 15.0% | 13.4% | 14.40 |

| 5 | Vlaue | 20.2% | 16.9% | 14.8% | 14.90 |

| 6 | Index | 15.0% | 12.0% | 14.7% | 14.10 |

Analysing the collected data

Before analysing the data, let me highlight a number in the above table which plays a part in the decider between index funds vs actively managed funds.

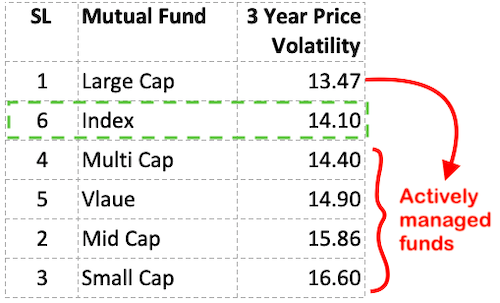

#A. Three (3) Year Price Volatility Index

In the period of last 3 years, which type of mutual fund was least volatile?

From these values it is clear that index funds (and large cap funds) are least volatile funds. Small cap fund is the most volatile mutual fund.

Hence one distinction between index funds vs actively managed funds is already clear.

Except for the large cap fund, 3 year price volatility of index funds is least compared to other actively managed mutual funds.

Read more about Performance of mutual funds and Total Return Index (TRI)…

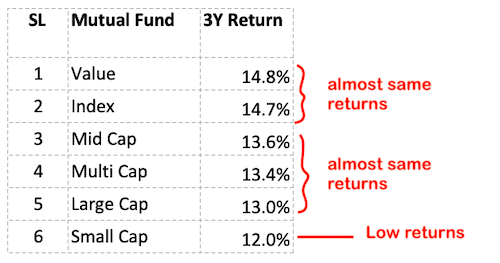

#1. Time Horizon of 3 Years

I personally consider the time horizon of 3 years as “small” for equity investors. With my personal experience, I can say that 3 year period is rather a small holding time.

Let’s see, in this holding period which mutual fund has performed best:

What is evident from the numbers in the above table is an important point.

This point will make more impact when we will discuss returns of longer time horizons (like 5 & 10 years).

What is the point? For equity investors who are not investing for a longer terms, index fund is giving good returns.

Important note related to index funds…

When experts claim that index funds are better for common men, they take the following points in consideration:

- Holding Time: People will generally buy mutual funds and hold it for only next 3 years or less.

- Price Volatility: Within a shorter time horizons like 3 years, price fluctuations of index funds will be lower than actively managed funds.

- Returns: When holding time is as short as 3 years, index funds tend to give better returns than actively managed funds.

- Expense Ratio: Expense ratio of index funds are anyways low. If people can pick a direct plan, return of index funds (in a 3 year period) will be even better.

Example of an index fund:

| Name of Fund | 3Y Return (Regular Plan) | 3Y Return (Direct Plan) |

| HDFC Index Fund – Sensex | 16.42% | 16.58% |

Read more about direct plans of mutual funds…

#2. Time Horizon of 5 Years

Before we proceed further, I would like to first emphasise on a point. Ask yourself this question:

How many mutual funds are there in my portfolio which I’m holding since last 5 years?

If I’m not mistaken, 80% people will give ‘Nil’ as an answer.

The point is, we common people do not stay invested in equity for this long.

Either we stop contributing to the fund and switch, or we simply sell the units and use the money somewhere else.

This is a very strong consideration when expert suggest index funds as a better investment option for we common people. They know that we will not stay invested for more than 3 years at a stretch in a mutual fund.

Now suppose, you are not in the general 80% category. You are the one who will stay invested for 5 years.

Let’s see, in this holding period (5 years), which type of mutual fund has performed the best:

What is clear from the above numbers is that, low volatile/low-risk funds like index and large cap mutual funds are giving low returns.

The top 2 funds in terms of returns are those funds which were considered most volatile (when investment time horizon was 3 years or less).

But now (in 5 years periods), these funds are giving the best returns.

- Mid Cap (19.0% p.a.)

- Small Cap (17.8% p.a.)

Important Note: If only we decide that no matter what may come we will stay invested for at least 5 years, following will change in our investment patterns:

- Fund Selection: We will start picking mid cap funds instead of safer index funds.

- Difference in Returns: We may start earning higher returns. There is a difference of 7% between returns generated by index funds compared to actively managed funds (19% – 12%).

Read more about small cap, mid cap and large cap mutual funds…

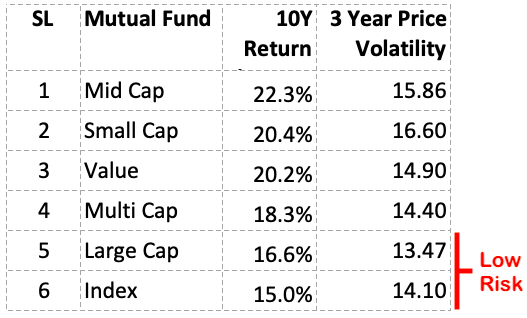

#3. Time Horizon of 10 Years+

There are hardly any people who stay invested in equity for a period as long as 10+ years.

My personal guess is, out of 1,000 people investing in mutual funds, only one or two will hold on to their units for this long.

Yes, this holding time is so rare.

But people who follow such holding periods also gets compensated accordingly.

Consider this, we common people who hardly stay invested for more than 3 years, what best returns we can earn? 14.7% from index funds.

But people who will stay glued to their actively managed mutual fund for 10 years or more, can earn a return as high as 20%+.

Let’s see, when holding period is as long as 10 years, which mutual fund has performed best in the past:

What is clear from the above numbers is this, low risk funds like large cap and index funds are giving minimum returns.

The high risk funds like mid cap and small cap funds are giving returns in tune of 20-22% per annum.

The difference in returns between an index fund and a mid cap fund is close to 7.3% p.a.

Conclusion

Index funds can give a returns like 15% p.a. in 10 years. An actively managed fund (like mid cap fund) can give a returns of 22.3% in 10 years.

What is the difference between 15% and 22.3%? Suppose you are investing Rs.25,000 per month in a mid cap fund for next 10 years (@22.3% p.a.). You will build a corpus of Rs.1.1 Crore.

Investing Rs.25,000 per month in an index fund for next 10 years (@15% p.a.) – will build a corpus of Rs.70 Lakhs.

Because of the 7% difference in returns, the difference in corpus built will be Rs.40 Lakhs (1.1 Crore minus 70 lakhs).

Expert and skilful ‘mutual fund manager’ can beat the index. But in order to do so, we must give ‘ample time’ to our fund manager.

What I mean by ‘ample time’? We must stay invested and hold the mutual fund units for periods like 5-10 years.

In our debate between index funds vs actively managed funds, the clear winner is actively managed funds.

Actively managed funds can give higher returns than index funds, but for that one must stay invested for long term.

But we people do not stay invested for so long. Generally speaking, our holding time is three years or less. For such smaller time horizons, index fund is a better investment vehicle.

Handpicked articles:

You did not consider expense ratio and post tax amount in hand on redemption at various timelines and check between index and other funds

The expense ratio is built-in the NAV.

Considering we are talking about equity, the tax treatment will be the same for both index and actively managed funds.

but you need to factor in costs as well. A mutual fund has ‘n’ of costs per year, say 2 % a year Over a long term period, they will preform worse than an index fund.

NAV posted by all mutual funds is net of costs.

Very impressive analytics. It is very helpful. Thank you so much.

Dear Sir/Madam

Is it meant to educate a common man, customer or his agent. You please mention whether the mutual fund investments, rules and regulations are company and agent centric or customer centric. What are the inherent charges to be borne by the customer. If the common man is interested to know what is the sum invested and assured after 5 yrs, do you have an answer. You should really distinguish this aspect and highlight for the sake of customer right in the beginning. Terms and Conditions are mentioned in such a way common man understands without having an agent or lawyer. Does a common understand what is equity. Actually, agents keep cheating the customers.for their commission, if any. I think you should write an article explaining to a prospective investor in the beginning what factors should he consider and how he could be cheated in by agents, the amount money one forgoes towards charges for investing in mutual funds for the sum invested and the agents commission. Thank you

In this category we do not aggressive hybrid and balanced advantage fund

You compared a nifty index fund . What about junior nifty index or midcap index funds?

thanks for differentiating the difference between index funds and actively managed funds for a naiive investors like me.