Why I’m blogging about this topic? Considering the COVID-led collapse of the market, I was thinking about investing in stocks of Airline Companies. But when I saw their Profit & Loss Accounts for the last five years, I became hesitant. Why? Because even Interglobe Aviation (Indigo) has reported losses since covid. In this article, we will see why most airlines operate at a loss. For quick answers check the FAQs.

Introduction

It is surprising how good airline companies like Air Deccan, Kingfisher, Jet Airways, etc drifted from being a ‘good company’ towards bankruptcy. The first logical reason that comes to mind is probable cutthroat competition.

But if competition is the reason then why these companies reported losses in FY Mar’20? Kingfisher and Jet Airways are out. Only Indigo and SpiceJet are the dominant players. AirAsia and Vistara are there, but their volumes are comparatively small.

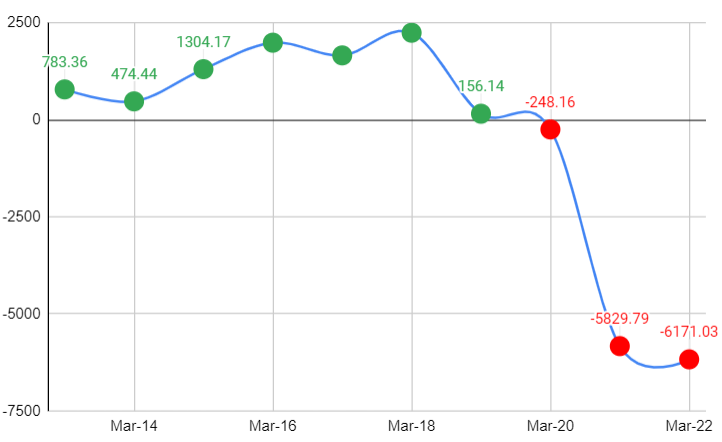

In these conditions (less competition), why SpiceJet has reported losses in FY ending Mar’20 and Mar’19? The airline was also under loss in FY ending Mar’12 to Mar’15. Comparably, Indigo’s reports are better. In the last 10-15 years, it has reported losses only post covid. Check the net profit numbers of Indigo in the last 10 years.

Running an airline is not an easy business to execute. The cost pressures, government intervention, and world factors immediately affect their revenue and margins. Let’s know more about the airline business to judge why do most airlines operate at a loss. We’ll start with their pain point, the cost structure. Suggested Reading: What led to Go First Airlines filing for bankruptcy?

Where Do Airlines Spend Their Income

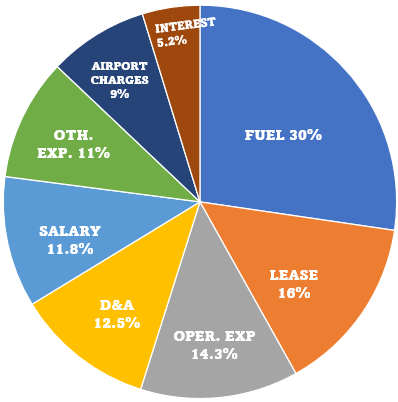

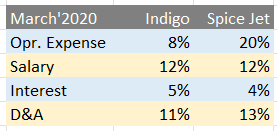

To understand why a company like Indigo is making losses, we need to first understand where these companies spend their money. The below infographics will typically represent the cost structure of most airline companies operating in India.

Expenses over which airlines have little control

- #1. Fuel (ATF): Airlines had to spend nearly 30% of their income to buy Aviation Turbine Fuel (ATF). As of today, 01-Nov’22, ATF’s rate is Rs.123.00/Ltr. In June’22, the cost was at Rs.141.00/Ltr levels. In June’21, the ATF rate was Rs.70/Ltr levels. Since the start of the Ukraine war, the price of ATF has almost doubled.

- #2. Lease & Rent: The majority of assets of the airline companies are on lease. Its major assets are aircraft, engines, spare parts, airport premises, etc. Under the lease agreement, the company pays the lessors a monthly rent. Nearly 16% of their income goes on leases & rents.

- #3. Airport Charges: Under this head, airline companies pay charges to airports for aircraft’s landing, parking, route & terminal navigation, baggage X-ray, etc. Under this head airline companies pay almost 9% of their income. Developed airports of Delhi, Mumbai, Bangalore, Kolkata, Hyderabad, etc charge higher rates. Read – The Business model of airports.

The above three expenses (55% of Income) are like ever-increasing expenses for the company. Moreover, airline companies can do very little to reduce this cost. Why? They have no control over the rates that they pay for fuel. They also can do less about the fuel efficiency of the aircraft’s engine.

The Airline companies do lease agreements with lessors. The lessors are companies that are in the business of leasing aircraft, engines, spares, etc to airline companies. There is only a handful of aircraft lessors around the world. In a way, they have a monopoly.

The two biggest names of this business (lessors) are Avolon and GESAC. Airline companies go into a lease agreement with these giants for a period ranging from 4 to 12 years. It is almost a fixed cost with virtually no negotiating power in hands of the airlines.

Expenses over which airlines have control.

- #4. Salary & Employee Benefits: Typically an airline company spends close to 12% of the income on the salaries etc of their employees. This is where airline companies have opportunities to save costs. Hence, these days airline companies maintain a tight hand on their employee size.

- #5. Other Expenses: Under this head, what mainly comes are the administration expenses. This includes travel and conveyance, accommodation, insurance, etc. Typically an airline company spends close to 11% of its income under this head.

- #6. Interest Payment: As most airline companies operate at a loss, they manage their cash flows by sourcing short-term debts. These loans come at a cost. Approximately, 5% of the income of airline companies gets lost in interest payments. For the airline industry, which operates at such low margins, 5% interest expense is too much.

The above-listed 3 expenses take away another 27% of the airline’s income. Though airlines can do some cost-cutting here, it is not easy. Why? Because for any company, when they start cutting corners on salaries, benefits, administrative expenses, and financing (loans) it only results in discourse, attrition, and unhappy stakeholders.

Income vs Expense Growth Rate for Airlines

We have already seen that nearly 55% of the airline’s income is spent on expenses over which they have virtually no control. The next 28% is on employee benefits (11.8%), administrative expenses (11%), and financing costs (5%).

Being a part of the hospitality sector, it is not easy for airline companies to cut costs here. Why? Because it can lower their brand value. These numbers (55% + 28% = 83%) already pose a huge uphill task for airline companies. But an even bigger problem is the inflation of these costs.

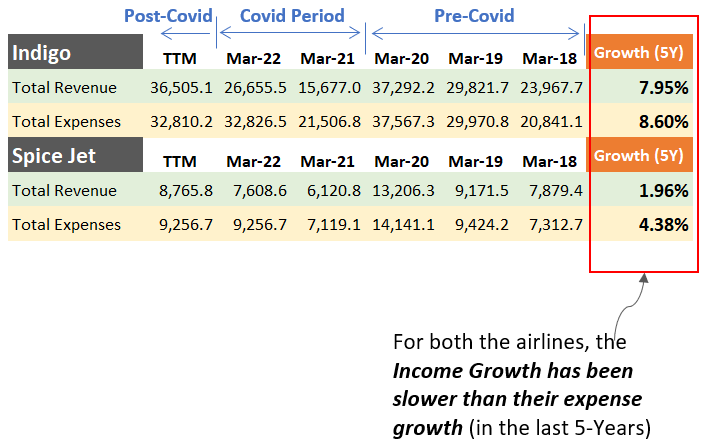

Cost inflation is understandable, but when costs grow at a rate faster than income, it’s a problem. Check the income vs expense growth rates shown above. Between 2018 and 2022, Indigo’s income grew at 7.95% per annum compared to expense growth rate of 8.6% per annum. In the same period Spice Jet’s income grew at 1.6% p.a. while expense grew at 4.38% per annum. As an investor, I would prefer staying away from such companies.

Inspite of the huge margin concerns, these companies, like Spice Jet, are surviving because their cash inflows are very strong. Passengers buy tickets by paying in advance.

Future Growth of Aviation in India

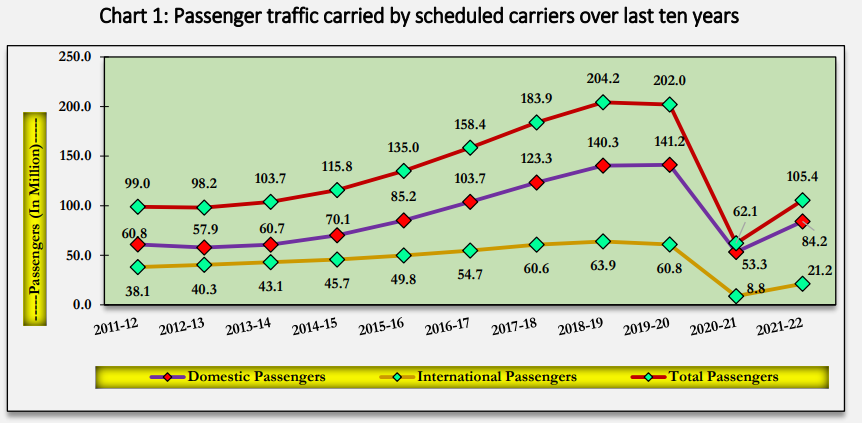

In reports published by DGCA, the total air traffic, international and domestic, as recorded in the last 12 year is shown below. Between 2011 and 2020 (Before Covid), the passenger traffic grew from 99 millions to 202 millions. It is a growth rate of 8.25% per annum. In times to come, the Indian air passenger traffic is expected to grow faster or at least at the same rate (8.25% per annum).

It is a clear indicator for airline companies that the aviation industry is poised to offer at least a 8.25% p.a. growth rate. But the challenge is to stay profitable.

This brings us to the question that how the airline companies can stay profitable? To know this, we must first answer why do airlines operate at a loss?

Why do airlines operate at a loss [2022]

As you can see in the above comparison, for the two airlines, the rate of growth of expenses exceeds the income growth. When it happens, companies report losses. The root cause behind the above-par expense growth for these airlines are listed below:

- Higher Fuel Cost: In the last 12 months, the cost of aviation turbine fuel (ATF) has risen by 75%. Back in June’21, it was at Rs.70/Ltr levels. In June’22 it rose to Rs.140/Ltr levels. Presently the cost of ATF is Rs.123/Ltr. This spurge in ATF was mainly caused by the Ukraine war.

- INR Weakening: In the last 5 years, the INR/USD exchange rate has risen from Rs.65 to Rs.82. Approximately 35% of all airline costs are denominated in USD. Few such prices are lease rentals, aircraft maintenance (engine, and others), etc. When INR becomes weaker, for the same USD, Indian airline companies have to spend more INR to make these payments.

- Low Pricing Power: Till a few years back there was fierce competition between airline companies. The presence of multiple players like Jet Airways, Kingfisher, Indigo, Air India, and Spice Jet accounted for the fierce competition. But slowly, the most debt-ridden companies like Jet and Kingfisher, Air India, eventually became insignificant. During the COVID phase, there were only two operators, Indigo and Spice Jet. But as the traffic was low, and there was also government induced fare-restriction, these operators had little pricing power. On one side the costs were rising, but airlines could not increase their ticket fares.

- Interest Expense: Post covid, most airline companies have huge debt burdens. They have taken these debts to stay alive, pay salaries, rentals, maintenance, airport charges, etc. Hence, their interest expense has increased multi-folds.

These are the four main reasons why most airlines reported losses in the year 2022. In the year 2023, the situation is expected to improve. The caveat is of course the Ukraine war. I personally do not see the INR/USD rate coming back to Rs.60/70 levels in the next decade. But if the war stops and domestic and international travel are already rising, airlines may start reporting profits.

Conclusion

The aviation industry is plagued with high costs all over the world. Any airline not managing its operations intently and efficiently eventually becomes bankrupt.

Here the margins are very low, but the volume is high. Making a high absolute profit number is not so difficult in this sector. One perfect example is Indigo. When it came around 10 years back, there were giants like AirIndia, Indian Airlines, Jet Airways, Kingfisher, etc. doing good business.

But see, even they have to meet a loss. For sure there is a problem with the airline sector itself. The nature of business is such that they have to deal with expenses not in their control. But the airline companies too must share the blame for their losses. As soon as they become successful, they go overboard and mismanagement starts to creep in.

Anyways, if I’ve to invest in this sector, for sure Indigo will be the first choice. But problem is, what’s happening behind those closed doors, nobody knows. Today’s Indigo can be tomorrow’s Jet Airways or Kingfisher.

This is a sector that is not going to close down in the next 50-60 years. Moreover, this industry will grow at least at 8% per annum in years to come. But does this positive outlook give an advantage to the existing airline companies? I’m not sure.

With my limited understanding of this business, I’ll say, there is some inherent problem with their current business model itself. As a long-term investor, I would prefer to park my money in another hospitality industry. Not airlines.

In this post-COVID climate, if ATF rates start to go up further, there are no headroom left for the airline companies. Moreover, Tata is also entering the space with Air India, Vistata, and Air Asia. This will further decrease the competitive moat of companies like Indigo and SpiceJet. I’m sure, if I will ever decide to buy an airline stock, I use my Stock Engine as one of the pointer.

FAQs

An airline is a typical business. Consider a manufacturing unit. Its management is comparatively easy as it is operated from a single-point location. But Airline Company’s operations are vastly spread across all airports in a country. Hence, cost control becomes a big challenge. Moreover, the major costs to run an airline business are fuel (ATF), lease/rent, and airport charges. These are all such costs over which the Airline companies have no control. Together, these three cost heads account for about 55-60% of the total cost for the airlines.

The airline industry suffered a lot during the two worst years of covid (2020 & 2021). To stay alive, even an excellent company like Indigo had to borrow money (take a loan). For example, till Mar’2020 (before covid), the short-term debt of Indigo was zero. But in Mar’21 and Mar’22, it reported a short-term, debt of Rs.2124 cr and Rs.3480 cr respectively. Before covid, the interest expense of Indigo was at Rs.500 crore levels. But after covid, its interest load has increased to Rs.2000 crores. This is the main reason why Indigo is reporting losses. Moreover, other factors like the weakening Rupee, expensive ATF (fuel cost), and increasing airport charges are affecting all airline companies.

There are costs over which airlines have no control (Fuel, Lease, and Airport Charges). But there are other costs that Indigo control to generate profits. Indigo has kept its operating cost, interest expenses, and use of non-cash D&A expenses efficiently. Indigo mostly runs on domestic, high-volume routes. They operate their airlines with minimum frills. Before COVID and Ukrain war, Indigo was almost debt-free (minimum interest expenses). It also utilizes its non-cash expense (D&A) to build a cost-effective fleet that includes fuel-efficient airplanes and trained crew members).

Both Indigo and SpiceJet have reported losses. As of the last quarter June’2022, Interglobe Aviation (Indigo) reported a net profit (loss) of Rs. -1,064.3 crore. In TTM terms, the net profit (loss) for Indigo was Rs.-4051 crore. In the same quarter (June 2022), Spice Jet reported a net profit (loss) of Rs.-788.8 crore. In TTM terms, the net profit (loss) for Spice Jet was Rs.-1766.1 crore

Before COVID, Interglobe Aviation (Indigo) was consistently profitable. To date, it is the most profitable airline in India. In the last 10-Years, its net profit numbers were mostly positive, except post-COVID: Mar’13 (Rs.783 cr), Mar’14 (Rs.474 cr), Mar’15 (Rs.1304 cr), Mar’16 (Rs.1986 cr), Mar’17 (Rs.1659 cr), Mar’18 (Rs.2242 cr), Mar’19 (Rs.157 cr), Mar’20 (Rs.-233 cr), Mar’21 (Rs.-5818 cr), Mar’22 (Rs.-6161 cr), TTM-2022 (Rs.-4051 cr),

What do you think about the aviation sector and airlines in specific? Please put your views in the comment section below.

Have a happy investing.

Your Calculations goes upto 110%, You also did not consider operational expense, which is a major part for an airline

Really very comprehensive analysis .

Thank you .

Regards,

Manjunath

Dear Mani(sh),

Please develop an excel sheet to analyse banks.

If you dig deeper into the financials of Indigo, you will realise a huge part of the loss is due to non-cash item entries, which means there is no cash outflow. Also, the FY20 Balance sheet and P&L of airlines are highly affected due to IndAS 116, wherein the operating lease liability are treated as debt (similar to finance lease).

You are right. I found the explanation in Note 16b of Indigo’s annual report (FY Mar’20). Thanks for pointing.

Very interesting analysis

Thanks