Companies need cash to run their day-to-day operations. Working capital management focuses on factors that generate and consumes cash. A company must be capable of generating more cash than it consumes.

Cash parked in the company’s bank account is not working capital. We will dig deeper to get a better understanding of the concept of working capital.

What Is Working Capital?

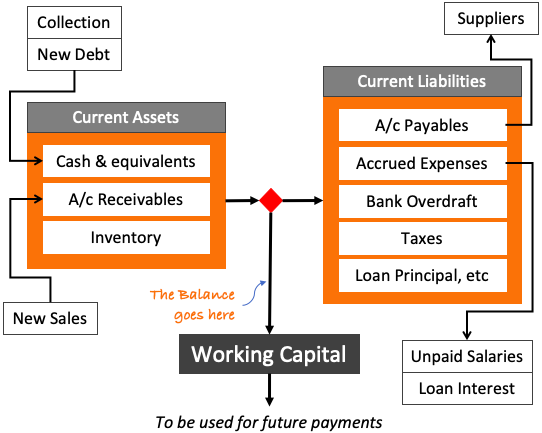

In layman’s terms, we can understand it like this. Using the capital parked in current assets to pay the current liabilities is a priority. After payment of all current liabilities, what remains balance becomes the working capital. The company will use it to pay for the upcoming day-to-day operating activities of the company.

Working Capital = Current Assets – Current Liabilities

After operations and sales, I think working capital management is perhaps the most crucial activity. Because of its immediate nature, it is even more important than the company’s profits and profitability.

Working Capital Management Is Tough, Why?

If we can understand the flow of cash, we will know why working capital management is challenging. The working capital formula (WC = current assets – current liabilities) is not enough to understand this difficulty. Allow me to explain it using infographics and an example.

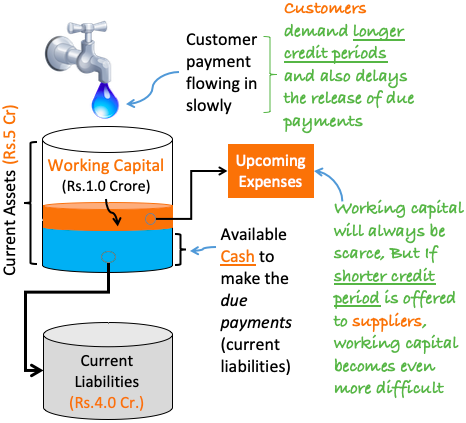

Suppose a company has Rs.5.0 crores in current assets and Rs.4.0 crores in current liabilities. It might look like the company has Rs.1.0 crore spare as working capital. But in reality, the situation may be different. Why? Because of the following three reasons:

- All Current Asset is not Cash: Only a portion of the current asset is cash. A majority portion of it is account receivables. Till it gets collected from the customer, the account receivables are just a number on paper. It is not cash. Hence cannot be used to make payments to employees, vendors, etc.

- Delayed A/c Receivables: For many companies, especially in the construction industry, customers can demand extended credit periods. Sometimes it can be as long as 90 days. If such customers further delay the payment release for any reason, the cash inflow problem further intensifies. It means hard current assets not getting converted into cash on time. Hence, onward payments to employees, vendors get delayed creating a negative cash flow.

- Early Supplier Payment: A company with a shallow reputation may not get suppliers to agree for long credit periods. In this case, the company may be obliged to pay its vendors sooner than they want. It can create a negative cash flow.

What is the inference?

These are the three reasons why working capital management is a challenge. Current asset substantially higher than its current liability means less. It is just a number on the paper. It may not ensure enough working capital. The company must do three things to remain liquid:

- Remember that the current asset is not cash.

- Quickly collect the due payments from its customers.

- Build its credibility so that the suppliers will agree to a better credit period.

Very High Working Capital is also Not Good

Creating a balance between current assets and current liability is crucial. Till now, what we have seen are the disadvantages of low working capital. But too high a working capital is also not good.

Companies must strike a balance in working capital. It must neither be too high or low.

Every company/industry has its optimum level of working capital. First, the company must identify that level. Then it can try to maintain it most of the time. It may sound easy, but practically, it is not.

But why an excessively high working capital level is not acceptable?

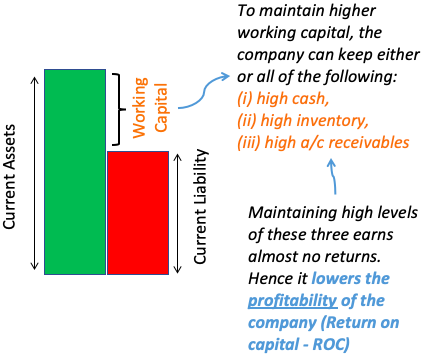

To understand this, we must also know that, along with liquidity, profitability is another priority for a company. But unfortunately, too much liquidity lowers the profitability.

Maintaining enough liquidity is a priority for any company. This priority takes precedence over profitability. But it is also true that a company cannot focus only on liquidity and start ignoring profitability completely. Why?

Why do companies do business? Doing business is all about generating profits. So we can say liquidity is critical to stay alive. But profit numbers are also crucial (for the owners). If there will be insufficient profit, the owners may eventually decide to wind up the business.

How High Working Capital Lowers The Profitability?

High working capital means the company keeping a high level of current assets compared to its current liabilities. If the current assets level is too high, it can be due to the following reasons:

- (i) High cash reserves.

- (ii) High inventory levels.

- (iii) High account receivables.

Generally, the cash of companies remains parked in current accounts in banks. It earns no interest. Even the cash-equivalent options yield only a dismal return of 5-6% per annum. This level of return will not be acceptable for owners and shareholders.

High inventory levels, both WIP and finished goods earn near-zero returns. Hence the company must convert them into sales and account receivables.

The company has less control over collections from account receivables. Here, complete dependency is on the customer and the contractual obligations. What best the company can do is to deliver the product/services as per agreement. Generally speaking, if the deliverable is as per contract, customers do not delay the payment release.

The point is, account receivables anyways earn no interest for the company. Now, if the customers further complicate the situation by delaying the payment release, it hurts even more. How does it hurt? Reduced return on capital.

Operating Cash Cycle

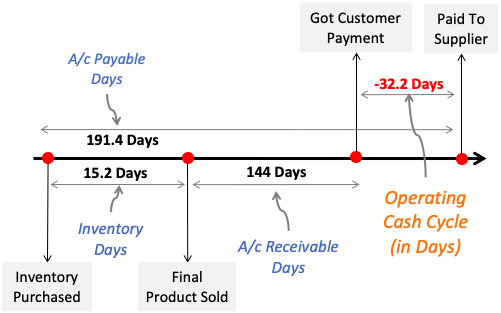

The operating cash cycle is the gap (in days) between the payments made (to suppliers) and the payments received (from customers). The cash cycle is pictorially depicted above for better understanding. In terms of formula, it looks like this:

Op. Cash Cycle = (Inventory Days + A/c Receivable Days) – A/c Payable Days

Let’s calculate the operating cash cycle for an example company (Larsen & Toubro). Below is the number table and calculation method.

The calculation gives us the following values:

- Inventory Days: 15.2 Days

- A/c Receivable Days: 144 Days

- A/c Payable Days: 191.4 Days

- Operating Cash Cycle = (15.2+144)-191.4 = -32.1 Days

The same can be shown diagramatically as below:

Our example company is from the construction sector. Hence, its account receivable days are very long, 144 days (almost five months). It is a problem. How the company managed this issue? In two ways:

- Low Inventory Days: The company somehow has kept the inventory days as low as 15.2 days. For a company in this sector, this is exceptional.

- Long Credit Period for Suppliers: Managing 191.4 days long (6 months) credit period for suppliers is another exceptions feat. The procurement department deserves a big pat on the back.

Low inventory days and long suppliers credit period has its benefits. For our example company, the operating cash cycle is in the negative (-32.2 days). What does it mean? The company is paying its suppliers after it receives payments from its customers. It’s an ideal scenario.

Suggested Reading: Use of operating cash cycle in the calculation of the self-financiable growth rate of a company.

Conclusion

The balance between current assets, current liabilities, and cash flow control is critical for working capital management. To get a deeper understanding and control of working capital, the company must know its operating cash cycle. Awareness of this cycle highlights the importance of the credit period offered to suppliers and the credit period received from customers.

One of the best article ever readed! Keep it up. Check this out if you want to opening a new bank account online.

hi Manish,

I regularly follow your blogs,even non finance person can easily understand your blogs.

I strongly recommend guys first learn how to understand and interpret financial reports rather than asking stock recommendations.

thus one can make better decision in choosing companies to invest right and hold for long.

Recommend to come up with series of blogs to connect the dots of this individual blogs.

Thanks for the tip

this article offers a good and easy explanation about working capital. I liked the timeline explanation for the operating cash cycle.

Thanks