The formula of working capital (WC) has two components, current assets, and current liabilities. Both are the numbers of the past. Though it is derived from the past numbers, the working capital use is in the future. This is the reason why it is a vital number in both corporate finance and valuation.

Companies report the quantum of their current assets and current liabilities at the end of every financial year (FY).

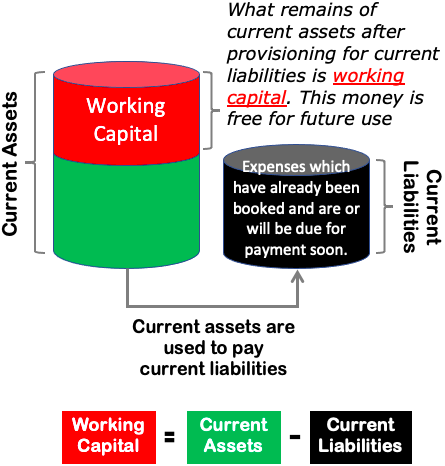

The cash in flow happens from current assets, and the cash flows out to manage current liabilities.

Subtracting current liabilities from current assets gives us the working capital. It is the short-term capital left in the hands of the company after provisioning for all outstanding current liabilities.

The working capital use is in the payment of forthcoming current expenses like salaries, supplier payments, utility bills, loan dues, taxes, etc.

The higher will be the working capital, the easier will be the future expense management. But only the quantum of WC is not important, cash flow planning is also required. It is essential to accurately forecast the future needs of cash to manage working capital (WC).

A good company would like to avoid both the extremes, too hight or a too low WC.

Cash Flow Schedule & Working Capital (WC)

The quantum of WC hints at the immediate financial health of a company. A high working capital number is considered good. Why? Because this money is free from any obligations. It can be used for NEW expenses.

Allow me to explain it more clearly with a simplified example.

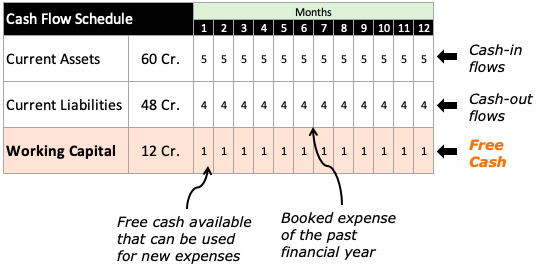

Suppose there is a company whose current asset is Rs.60 crore and current liability is Rs.48 crore. Hence its WC, current assets minus current liability, will be Rs.12 crore.

Now, let’s assume that none of the current assets have been converted into cash yet. It will flow in gradually in the next 12 months. As shown in the cash flow schedule, Rs.5 crore of cash will be collected each month for the next 12 months (12 months x Rs.5 cr = 60 crores).

Similarly, Rs.4 crore of cash will be paid as payments for the next 12 months against the due current liabilities (12 months x Rs.4 cr = 48 crores).

Collection of Rs.5 crore and payment of Rs.4 crore creates a cash surplus of Rs.1 crore each month. This surplus cash is the company’s working capital (free cash). The cumulative free cash for the year will be Rs.12 crore (Rs.1 cr x 12).

This type of cash flow planning is essential to manage WC. Staying cash surplus, always, should be the goal. How it will happen? By planning the cash flow in such a way that the collections are early and payouts are later.

Working Capital Use

The WC is used as a provision for the forthcoming current liabilities. Preferably, its use must be limited to immediate cash needs only.

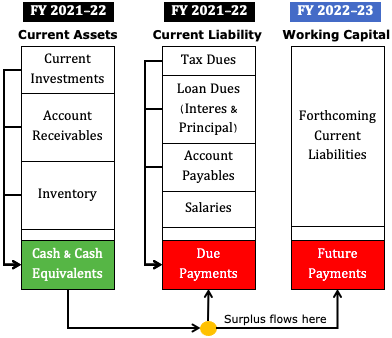

As shown in the above infographics, the company earns cash from the current assets it built in the past year (FY 2021-22). A majority portion of this cash will be used to pay the dues – current liabilities accumulated in the past (FY 2021-22).

The surplus cash will become the company’s WC. It will be used to make future purchases and pay for the forthcoming current liabilities (FY 2022-23).

Hence we can say that the use of working capital will be as follows:

- Inventory Building – purchasing new raw materials, finished goods, and spares inventory.

- Payments of outstanding loan dues (new loans taken in current FY).

- Maintaining a minimum cash and emergency reserve.

- Clearing account payables (of current FY).

- Payment of salaries of employees in current FY.

In some months, the WC may go into negative. This can happen due to delayed payments from customers or unforeseen large cash requirements. In such a case, the company can opt for a working capital loan to make up for the deficit.

A company that has a history of positive WC will find it easy to get a working capital loan.

Current Ratio of “One” vs. “WC Positive”

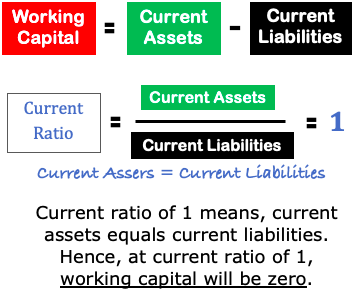

There is a difference between remaining WC positive and maintaining a current ratio of one. What is current ratio? It is a ratio of current assets and current liabilities. When the current ratio is about one, the working capital will be nearly zero. How? Check the two formulas shown below:

The current ratio of about one means, the level of current assets is just enough to meet the requirements of current liabilities of the past financial year (FY). But at this level, current assets will not generate working capital for the new cash needs.

The current ratio must be greater than one (1) to yield a positive WC. So for valuation purposes, experts consider a current ratio of two and above as a good number.

To run the operations smoothly, the company will need a surplus cash flow (as shown here). This cash flow surplus is what we refer to as being a working capital positive company.

Staying cash flow surplus is a big challenge. A company that stays consistently at these levels can demand premium pricing. Not many companies around can boast about such a financial health.

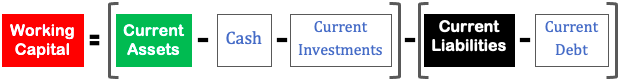

Non-Cash Working Capital

It is a more accurate representation of surplus cash available with the company after provisioning for all current liabilities. Value investors use non-cash working capital, instead of working capital, for valuation purposes.

The formula for non-cash working capital looks like this:

In the revised formula, cash and current investments will not be used as the component of current assets. Moreover, current debt obligations will also be deducted from current liabilities. What is the rationale behind it?

- Cash & Current Investments: Generally, a majority portion of company’s cash is parked in money-market funds, bank deposits, and short-term government securities (like T-sec and short term bonds). These investments earn returns, though in small amounts. But we must also remember that these are risk-free investments. The company will not liquidate them unless emergency strikes. Hence, in most cases, the cash & cash equivalents are not available for current expense management. For a similar reasons, experts also remove current investments from current assets.

- Current Debt: For valuation purposes, the short-term debt reflected as a component of current liabilities shall not be considered. Companies will not take the risk of missing the due debt payments. They keep a separate provision for it so that it gets paid on the due date. Hence, this amount of capital will not be available for WC management.

Conclusion

The planning and usage of working capital is critical to a firms financial health. High profit and profitability numbers will mean nothing if the company is not able to remain working capital positive.

Suppose a company stays working capital positive for most of the time. What does it mean? It means that the company has excess cash. Will it be wise for the company to use this capital to fund its Capex needs? The immediate answer will be no. Why? Because working capital requirement can be very volatile. The company may be in a good cash position today, but the situation can change within months.

Hence, keeping a bit of extra cash parked for unforeseen future needs will not be a bad idea. Though a large pile of emergency cash is not advisable, but at least one cannot fund Capex with working capital surpluses.

Thank you for reading. Have a happy investing.

Hi Manish,

Is it possible to create and track index of our own set of stocks? In order to track PE, PB and other valuation ratios? I amtryning to write a python program for this. Possible to help with mechanism on high level?