I’m a firm believer of the concept of tracking all expenses. If financial independence is the ultimate goal, then tracking expenses is first step which can lead us there. 50/30/20 budgeting rule is the foundation based on which the expense tracking tool will work.

If you need to improve your personal finance, then start with building an expense budget. What you should do? Start recalling and recording all expense that you make in your day to day life.

First list down all expenses. Then give them a value. How? I do it like this. I ask myself : how much you spend on them each month? Example: Grocery & Vegetables (Rs.15K), Electricity Bill (Rs.2K), Rent (Rs.20K), EMI (Rs.35K), etc.

You can also include your family members in this process. Let them all suggest any expenses that they recall. Record all of them. Ignore nothing. Once this list is ready, you are ready to apply the 50/30/20 budgeting rule.

But before that, let’s see the bigger picture. Ask yourself this question? Why should I budget my expense in first place? If you do not know the answer, let me help you see it.

The Bigger Picture

We are creating an expense budget to improve our financial health. Expense tracking is one piece of the jig saw puzzle. What is the puzzle? How to achieve financial independence.

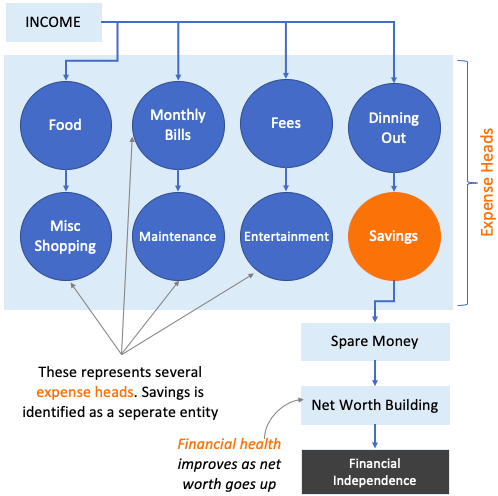

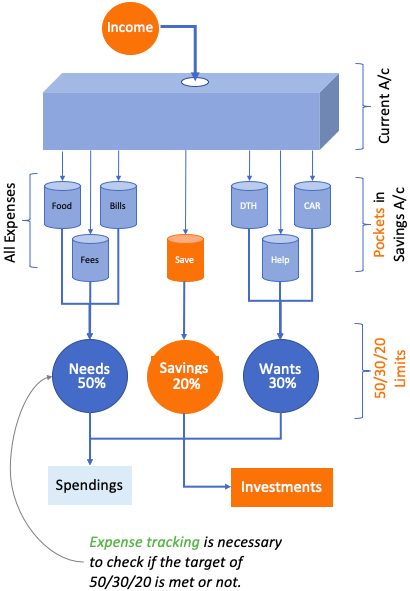

What you see in the above infographics is an expense budget. Circles represents expense heads in the budget. Our income gets distributed, in a specific quantum, among all the expense heads – including savings.

Why we are doing it? To ensure that savings target is met each month. We are doing this exercise to build savings. What are savings? These are spare money. They are called “spare” because it’s not needed to manage present needs of life.

What to do with the spare money? It shall be suitably invested. Investments will eventually build our net worth. It is the size of our net worth which will ultimately decide when we will become financially independent.

Just remember these keywords in the same order: savings, investment, net worth, and financial independence. In order to trigger these keywords in our life, we need to start with building a nice expense budget for ourselves. Read: The process to become rich.

Why 50/30/20 Budgeting Rule is required?

When we create a non-realistic budget, it will lead to non-compliance in future. The 50/30/20 rule helps in building a practical monthly budget which is also very effective.

What I mean by practical budget? If the budget is too strict, it will be hard to practice. As a result, people end up not following the monthly budget altogether. If it is too lenient, it will not yield the desired end results.

A practical monthly budget is always a balanced one. It will not only guide in payments of monthly bills, loan prepayment etc, but will also gives spare cash (savings).

In todays society where extravagant spending’s are triggered automatically, a practical expense budget can be our self-regulator. Read: How to prevent overspending.

Understanding 50/30/20 Budgeting Rule

Elizabeth Warren and Amelia Warren Tyagi (mother and daughter duo) co-wrote a book called “All Your Worth: The Ultimate Lifetime Money Plan“. In this book the writer suggest that all money-related problems can be eliminated using 50/30/20 budgeting rule.

The author points out that, for most people the money struggle never cease to exist. No matter how hard people try to build savings, it seems never enough. What is the problem? How to solve it? An effective answer is hidden in 50/30/20 budgeting rule. How?

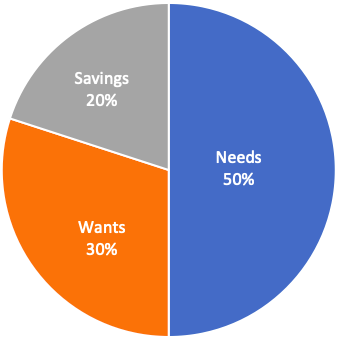

The rule asks us to spend our money in a certain way. Not more than 50% shall be spend on needs. Limit of 30% shall be maintained for wants. These two maximum limits shall be maintained to allow at least 20% savings.

Income Distribution

- Needs (50%): Out of all daily expenses that one has, identify ones which are like unavoidable. Example: rents, loan EMI’s, bills, fees, food & cooking, basic clothing, transportation, basic health care, taxes, education, maintenance etc. We must carefully budget all needs in such a way that in totality they do not consume more than 50% of our income. Read: How to use a credit card.

- Wants (30%): What are wants? These expenses are not essentials but we want to include them in our life. Why? Because it gives us that sense of security and comfort. Example: internet, DTH, vehicle, house-help, dinning out, Miscellaneous shopping, celebrations, vacations etc. This is that expense category where we often overspend. This category of expenses should be limited to 30%.

- Savings (20%): Maximum limits of ‘needs’ and ‘wants’ has been kept to maximise savings. A minimum savings of 20% of income each month is essential. The higher the better. How this savings needs to be utilised? A middle class Indian must use it in a certain way. How? It must be used for emergency fund building, and becoming debt free. Once these two targets are met then use it for investments.

How I Use 50/30/20 Rule?

- Income & Current A/c: I’will explain how I visualise the whole process. I imagine my income as a source which continuously pours money in my current account. The money from current account flows into savings account.

- Savings A/c in Bank: The money parked in savings a/c is broken down as per my expense budget. If I’ve Rs.100 as savings, I always know out of total; Rs.10 is for grocery, Rs.8 is for bills, Rs.12 is for fees, Rs.5 is for entertainment etc. I call these individual money sinks as “pockets“. These pockets keeps money inside it. Every time I need cash for a thing (say for a movie), I will reach a specific pocket. This way I’m always saving first for a thing, and then spending.

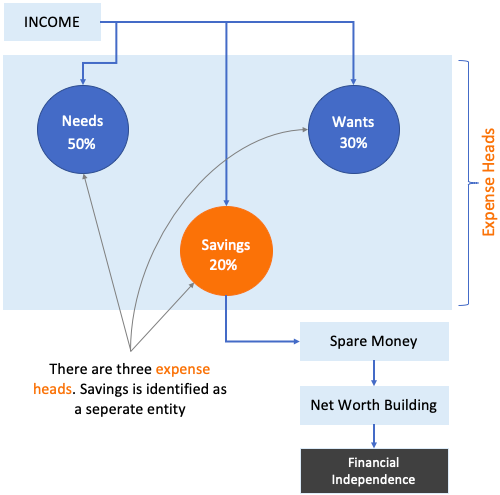

- 50/30/20 Rule & Expense Tracking: As I’ve already categorised all my expense line items, every time I spend, it adds into either of the three heads (a) needs, (b) wants, or (c) savings. I also track my expense which in turn highlights whether the targets set by 50/30/20 budgeting rules is meeting or not.

- Investment: The idea behind tracking all expense is that, I should never miss the minimum requirement of 20% savings each month. I let my savings accumulate. I’m not much of a habitual investor. I would rather let my savings lie in a Fixed deposit, instead of forcefully going for a SIP. I prefer waiting for my moment of investing and then going all guns blazing. 🙂

Conclusion

Go ahead and prepare your own excel sheet and start budgeting and tracking your expenses from today. It will not take you more than half a day to build your own budget.

Use the 50/30/20 budgeting rule to check if all expenses has been properly quantified or not. For a newbie, this simple rule will give a lot of clarity about what are essential expenses and which are non-essentials.

Moreover, it also highlights “savings” as a separate entity. What is the need? No matter how frugally we are spending, but at the end of the day if we are not saving enough, net gain is zero. Why I say so?

Because our bigger goal is to improve our financial health and achieve financial independence. Without enough savings we will never reach there.

Recommended Reading: What is passive income? What role it plays in our endeavour to financial independence.

Thanks for telling us in India about money matters. May God bless you.

Great learning I have from this article appreciated your efforts.

Concept of budgetting & saving is EXCELLENT as explained in the article . I wish that every Sr citizens should teach the youngsters to adopt the methology of savings for future NEEDS . I am a retired Engineer From SAIL & I keep impreesing on the people to adopt regular savings .

Contrary to this, Govt in budget 2020-21 discouraged savings ( alternative choice ) & asks to pay slightly less Tax .

Can anybody justify to ean & spend without any Savings for future ??

Thank you, sir, for posting your views.

I am so thankful for your article.

As a parent, as much as we need to improve our budgeting tricks, we also need to make sure that our children learn about budgeting as well, starting at an early age so that they can grasp the concept of budgeting and savings. We can teach them about this 50-30-20 rule by involving them in the family budgeting (as we ourselves apply these concepts mentioned in this article) Wouldn’t that be useful? What do you think about that?

Good idea. Thanks