The stock market is a platform where companies raise funds by issuing shares. Investors buy and sell these shares to earn returns. It’s like a marketplace where buyers and sellers meet to trade in company ownership. The stock market plays a vital role in economic growth. It allow companies to raise capital for expansion and modernization. For example, a company like Tata Steel can raise funds to invest in new projects, creating jobs and driving growth. Similarly, investors can buy shares in companies like Tata Steel or HDFC Bank to earning returns through dividends and price appreciation.

India has two main stock exchanges: Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). BSE, established in 1875, is Asia’s oldest stock exchange, listing companies like Tata Motors and Infosys. Read about the history of BSE.

NSE, established in 1992, is India’s largest stock exchange by trading volume. It hosts companies like Reliance Industries and HDFC Bank.

Most major companies of Indian are listed in both NSE and BSE.

Both exchanges facilitate buying and selling of shares. They provide a platform for companies to raise funds and for investors to participate in growth stories.

For example, an investor in Mumbai can buy shares of a Chennai based company listed on NSE. While another investor in Delhi can sell shares of a Kolkata based company listed on BSE.

Topics:

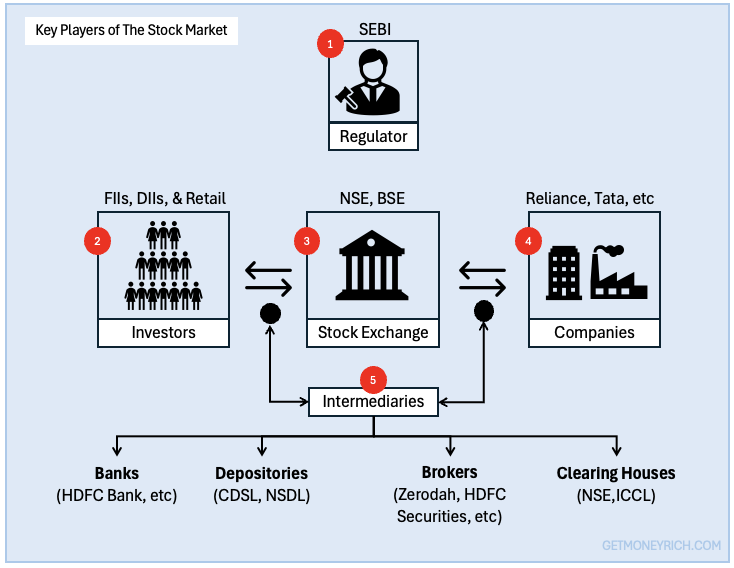

Point #1: Key Players of the Stock Market

The stock market is a complex system with many key players involved. These players ensure smooth functioning and fairness. Let’s understand who they are and their roles.

- (1) Regulator: SEBI (Securities and Exchange Board of India) oversees the stock market. SEBI’s role is like a referee in a sports game. They ensure all rules are followed. They also protect investors from fraud. SEBI’s job is to keep the market transparent and fair.

- (2) Stock Exchanges: The two main exchanges are the NSE (National Stock Exchange) and the BSE (Bombay Stock Exchange). These exchanges are like marketplaces where stocks are bought and sold. Think of them as a supermarket for stocks. You can buy and sell stocks through these platforms.

- (3) Listed Companies: Companies issue shares that we can buy in the stock market. When a company goes public through an IPO (Initial Public Offering), it lists its shares on an exchange. For example, in 2023 Tata Technologies went goes public. We as investors could have bought its shares in IPO through the NSE or BSE.

- (4) Investors: There are two types of investors, one who investors for the long term (called investors). Others buy-sell stocks frequently frequently to profit from price changes (called tradders). For example, if one buy’s shares of a company and hold them for years, he/she are an investor. If he buy’s today and sell tomorrow, he is a trader.

- (5) Market intermediaries: These include brokers, depositories, and clearinghouses. Brokers help you buy and sell stocks. Depositories hold your stocks in electronic form. Clearinghouses ensure the correct transfer of stocks and money. Here are some well-known Indian companies that perform the roles of brokers, depositories, and clearinghouses: Brokers (Zerodha, HDFC Securities, ICICI Direct), Depositories: (NSDL, and CDSL), Clearinghouses: (NSE Clearing Limited for NSE, Indian Clearing Corporation Limited (ICCL) for BSE).

In addition, banks act as intermediaries by providing clearing and settlement services for transactions in the stock market. They ensure transfer of funds between buyers and sellers.

Banks also offer demat account services. Demat accounts are actually managed by depositories like CDSL and NSDL. Banks only act as depository participants (DPs), facilitating the opening of demat accounts for investors through their partnership with these depositories.

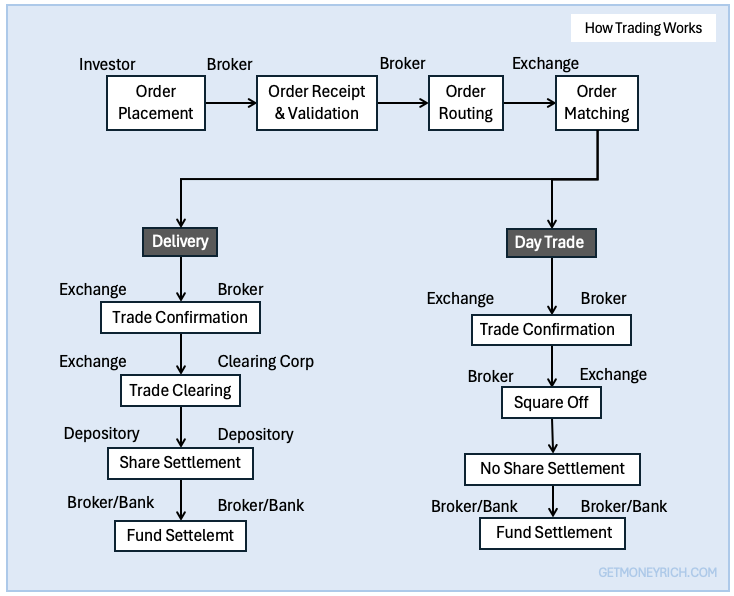

Point #2. How Trading Works

Buying and selling shares involves investors placing orders with stockbrokers. The brokers then execute trades on their behalf. Investors can buy or sell shares through various order types, including limit, market, and stop-loss orders.

Let’s understand the whole process of order execution in steps. Remember, there are mainly two types of trades that are executed in the stock exchange: Delivery and Day Trade.

2.1 Common Steps for Both Delivery and Day Trade:

- Placing an Order: Investor places a buy or sell order with their stockbroker.

- Order Receipt: Stockbroker receives the order and verifies the investor’s details.

- Order Validation: Stockbroker checks the order for validity, including price, quantity, and account balance.

- Order Routing: Stockbroker routes the order to the exchange (e.g., NSE or BSE).

- Order Matching: Exchange’s trading platform matches the order with opposing orders.

- Trade Execution: The trade is executed at the matched price.

2.2 Delivery Trade:

- Trade Confirmation: Exchange confirms the trade to the stockbroker.

- Clearing Corporation: Exchange’s clearing corporation (e.g., NSCCL or ICCL) processes the trade.

- Shares Settlement: Shares are transferred from the seller’s demat account to the buyer’s demat account.

- Funds Settlement: Funds are transferred from the buyer’s bank account to the seller’s bank account.

2.3 Day Trade:

- Trade Confirmation: Exchange confirms the trade to the stockbroker.

- Square-off: Stockbroker automatically squares off (closes) the trade before market close.

- No Settlement: No transfer of shares or funds occurs, as the trade is closed out.

Note: In Day Trade, the trade is closed out before market close, so there is no need for settlement. In Delivery Trade, the trade is settled, and shares are transferred to the buyer’s demat account.

Point #3. Market Structure

Let’s look at various types of market present within our Indian stock market.

- Primary Market: The primary market is where companies issue initial public offerings (IPOs) to raise capital. Investors buy shares directly from the company, providing capital for growth. For example, a company like Paytm issues an IPO, and investors buy shares to become part-owners.

- Secondary Market: Day trades and delivery orders of individual stocks are placed in the secondary market. Day trades are a subset of the secondary market and are often referred to as the cash market. They involve immediate settlement (typically on the same day or next day).

- Derivatives Market: The derivatives market allows trading in futures and options contracts, enabling investors to manage risk or speculate on price movements. Futures obligate buyers and sellers to execute trades at a set price on a specific date. Options give the buyer the right, but not the obligation, to execute a trade. For instance, buying a Britannia futures contract to purchase shares at a fixed price on a specific date. Read about option chain analysis.

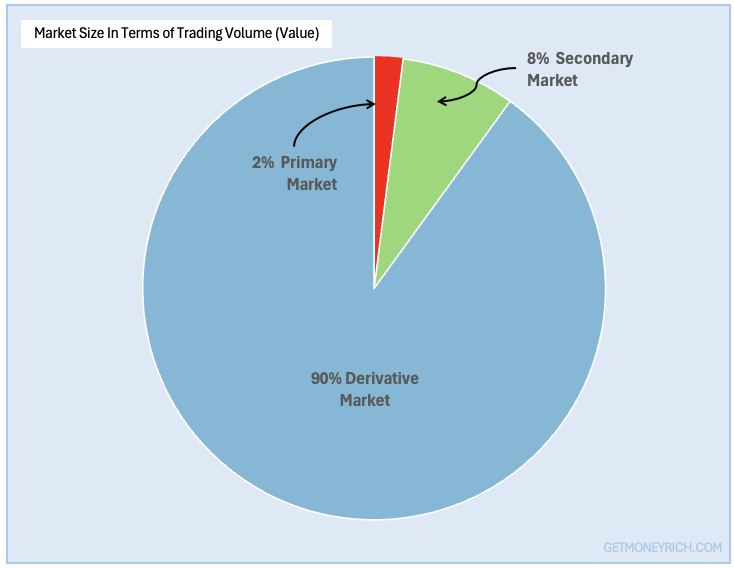

3.1 Trading Volume

Here are the trading volumes in the Indian equity market (my estimates):

- Primary Market: Less than 2%: The primary market is where initial public offerings (IPOs) are issued. Although it’s a significant market, its trading volume is minuscule compared to the other two.

- Secondary Market: Around 8%: The secondary market is where existing shares are traded. It’s a significant market, but its trading volume is dwarfed by the derivative market.

- Derivative Market: Around 90%: The derivative market is where futures and options are traded. It’s the most significant market in terms of trading volume, with a huge daily turnover.

The derivatives market’s dominance is attributed to its speculative nature and the high leverage it offers. Hence, it attracts significant investor interest. Read about the whole financial market here.

Point #4: Trading Mechanisms

A trading mechanism is a set of rules and processes that govern how trades are executed in the stock market. It ensures a fair and efficient market by providing a framework for buyers and sellers. It sets a rule for the traders to interact, determining prices, and facilitating the exchange of securities.

- Auctions (Opening and Closing): The stock market uses auctions to determine prices at the opening and closing of trading sessions. In an auction, buyers and sellers submit bids and offers, and the price is determined where the demand and supply meet. The opening auction sets the initial price for the day, while the closing auction determines the final price.

- Price Discovery (Determining the Fair Price of a Share): Price discovery is the process of determining the fair price of a share through the interactions of buyers and sellers in the market. It’s a dynamic process that reflects the constantly changing expectations and perceptions of market participants. For example, if a company announces strong earnings, its share price may rise as investors bid up the price.

- Market Hours and Trading Sessions: The Indian stock market (NSE and BSE) operates from 9:15 am to 3:30 pm. There are two trading sessions: the morning session (9:15 am to 12:30 pm) and the afternoon session (12:30 pm to 3:30 pm). During market hours, orders can be placed, and trades are executed. Outside market hours, orders can be placed, but trades are not executed until the next trading day.

These trading mechanisms work together to ensure a fair and efficient market, allowing investors to buy and sell shares with confidence.

Conclusion

The stock market is a complex system that enables buying and selling of shares. It facilitates capital allocation and risk management.

Key players like stock exchanges, brokers, and depositories ensure smooth trading, settlement, and ownership transfer.

Trading mechanisms like auctions, price discovery, and market hours govern the market’s functioning.

Understanding how the stock market works is not essential but can be advantageous for investors like us. Such deep understanding of the stock market can help us manage risk, and maximize returns. It can help us to participate in the growth story of Indian companies.

Frequently Asked Questions

A: The stock market is a platform where companies raise capital by issuing shares, and investors buy and sell these shares. It works through a network of exchanges, brokers, and depositories, facilitating trading, settlement, and ownership transfer.

A: Common stock market orders include market orders, limit orders, stop-loss orders, and day orders. Each order type executes trades at specific prices or conditions. It allows investors to manage risk and maximize returns.

A: Stock prices are determined by supply and demand forces in the market. The price at which buyers and sellers agree to trade is the market price, reflecting the company’s performance, industry trends, and overall market sentiment.

A: Stock market investments carry risks like market volatility, price fluctuations, company performance, and liquidity risks. Investors should understand these risks and diversify their portfolios to minimize them.

A: Regulatory bodies like the SEBI oversee the stock market, ensuring fair trade practices, protecting investor interests, and preventing fraud. They set rules, monitor activities, and enforce compliance to maintain market integrity and investor confidence.

Thank you for this amazing knowledge

It’s really helpful to understand the concept of share market

Thank you for the wonderful information

Thanks for the information

Hey !! It was awesome going through your blog. You have gained so much knowledge in the Stock Market after your job. Moreover, we are a broking firm, it would have been amazing if we can link… Thank You

Thanks for the valuable information. You cleared all my doubts.

thank you for helping me and clear my doubts thank you so much