Tracking ones net worth growth is super important. Why? Net worth growth is Important for individual investors (small and big). But do we know about how to calculate net worth? Mostly No.

Suppose you have bought a stock, how many times in a week you check its price movements? Many. Generally we get too carried away with the concept of ‘return on investment (ROI)’. This specially happens with new investors.

People who know less about money management may think that ‘fast money growth’ is the only RIGHT THING. But this concept is not right. Focusing on ROI is not bad, but focusing ‘only’ on ROI is not good.

When we talk about return on investment, we are actually talking about ‘growth’. But what one will do with this growth? Some might be growing at 10% per annum. Some might be growing at 8% per annum.

The only clarity one draws from these statement is that the former (10%) is better than the later (8%). This is simple mathematics. But what is the conclusion? To draw a conclusion one must look at the ‘big picture’.

Looking at the big picture will make things easier to comprehend. Even a lay man, who is not a financial buck, will understand things in correct perspective. In fact, the main thing that matters to people are not available in questions like:

- Which-stocks?

- Which-funds?

- Which-property?

- What return? Etc.

These are details which are important but one must not spend too much time over it. So what a person should do instead? The right thing to do is to look at the big picture.

Net worth Calculator

| ASSET | LIABILITY | ||

|---|---|---|---|

| Future Asset Growth Rate (%) | Future Liability Growth Rate (%) | ||

| Home’s Current Value (Rs.) | Home Loan Balance (Rs.) | ||

| Other Property (Rs.) | Personal Loan Balance (Rs.) | ||

| Jewellery (Rs.) | Car Loan Balance (Rs.) | ||

| Cash (Rs.) | Education Loan Balance (Rs.) | ||

| Fixed Deposit (Rs.) | Credit Card Balance (Rs.) | ||

| Mutual Fund (Rs.) | Other Loan Balance (Rs.) | ||

| Stocks (Rs.) | |||

| Endowment Plan (Rs.) | |||

| Retirement Corpus (Rs.) |

| Total Asset (Rs.) | |

| Total Liability (Rs.) | |

| Current Networth (Rs.) | |

| Networth Worth After 5 Years (Rs.) |

What is this big picture?

The big picture should be, net worth growth.

In the world of investment, the big picture is individuals net worth growth.

No matter what ever we do with our money, the net worth must keep improving.

When one saves money he/she actually increases his/her net worth.

Stocks are bought to improve net worth. Property is bought to improve net worth.

Every money transaction increases or decreases ones net worth.

When we are spending, our net worth is decreasing.

When are investing (buying assets) our worth is increasing.

A wiser advise to my readers will be to focus more on the movements of net worth.

Price movement of stocks, mutual funds, property, gold etc are exciting to watch but their effectiveness is less.

May be one stock price fell from $100 to $50, but its effect on overall investment portfolio may be negligible.

I am not saying that one must not look at price movements.

But the point is, market prices are not the only thing.

Perhaps they are too small a parameter to be given much importance.

What should be interesting for people are their net worth.

We keep hearing about net worth of Warren Buffett, Bill Gates, Jeff Bezos and other billionaires of the world.

Do we know which stocks or mutual funds they currently hold? No.

Because its not important.

The important is, what is their current net worth and how much it has improved over a period of time.

I hope I am making my point clear.

Net worth is something which has special powers.

Focus on net worth…

Focusing on net worth works like a magic.

The movements of net worth is in YOUR hands.

One can actually do small-small things to improve ones net worth.

But what we can do to improve stock market price of APPLE? Nothing.

Take power in your hands. Start focusing on net worth and forget about everything else. How?

The formula for net worth is very simple:

Asset – Liability = Net Worth.

Individuals and companies both can use this formula to calculate and track their net worth.

How this formula can be used to calculate individuals net worth?

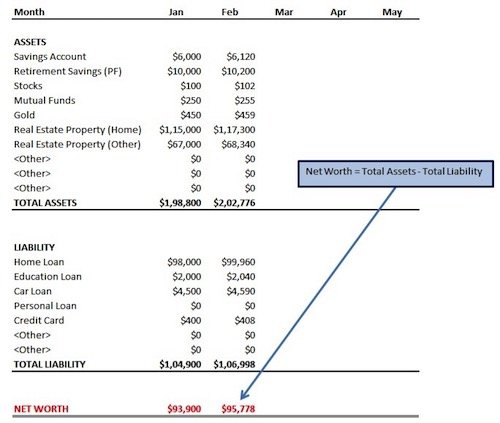

A simple excel worksheet is sufficient to calculate net worth.

A typical net worth calculation worksheet will look like this:

What we can learn from looking at this net worth worksheet? Observe closely:

Stocks, mutual funds etc are only one of the other component of ones net worth.

Hence they immediately start looking smaller and are no more as important.

Secondly, the main focus should be on net worth GROWTH over time.

As an individual one must take actions to keep increasing the net worth.

How to ensure net worth growth?

- By Increasing Assets.

- By Decreasing Liabilities.

How to increase assets?

- Every dollar added to savings account will increase net worth.

- Monthly contribution made to retirement fund will increase net worth.

- Every stock, mutual fund, gold, ETF purchase will increase net worth.

- Every property owned will increase net worth.

[Note: Generally, assets purchase increases ones income]

How to decrease liability?

- Clearing loans by prepayment will decrease liability.

- Reducing credit card debt will decrease liability.

[Note: Generally, liability purchase increases ones expense]

So, now lets comeback to our main topic of net worth and its importance.

Keeping our focus on that RED line (net worth) of worksheet helps.

A mere glance at it will give an idea of how well one is managing his/her money.

One’s improvement cannot happen just by purchasing few stocks, funds, etc here and there.

One must focus on hitting the bulls eye. The bulls eye in this case is Net Worth.

Generally people think that to increase ones net worth one must buy an asset.

But decreasing liability will also increase ones net worth.

Example:

Suppose a person carries a home loan of $98,000 (liability).

He also has $6,000 in savings account.

The money parked in savings account will earn interest @ 4% per annum.

But suppose he uses this money parked in savings account to prepay home loan.

This way he will save 9.5% interest on home loan.

Now a simple mathematics will tell that prepayment of home loan is more beneficial.

Suppose you bought stocks of company X worth $100.

Just make sure that you are buying stocks of a fundamentally strong company.

Just because you possess stock of a good company, your asset side will become heavier.

Every small drop added in asset side in terms of stocks, mutual fund etc will increase your net worth.

I hope you are already realizing the difference….

Here, your focus has already shifted from stock price to net worth.

The purpose for which one is purchasing stocks, mutual funds etc is to increase their net worth.

During this process, if the market price of stocks increase it’s a PLUS. Your net will further improve.

But even if it is not improving, simply holding stocks of a good company will contribute positively to you net worth.

[Please note that market price of good stocks may also fall in short term, but over a period of time their price trend is always upward. Moreover, some stocks also pays dividends. This will further add to your asset in terms of growth in cash (savings)]

The same is true for mutual funds.

I personally like to invest in equity through mutual funds.

In mutual funds one has a option of SIP.

Through SIP, one can keep buying small mutual funds units every month.

This process is like putting your asset growth on auto mode.

Every time a SIP buys mutual fund units, the net worth will automatically increase.

Again, the focus here is on increasing ones net worth and not on NAV of mutual fund.

Just buy mutual funds having higher CRISIL or VR ratings.

Over a period of time, value of mutual funds will only increase.

Final words…

People who taught us to look at investment returns, forgot to make us knowledgeable about the net worth growth.

We fight tooth and nail to identify best stocks which give good returns.

What if one says that returns are not as important as we think it to be?

I know the heavens will not fall, but our preconceived theory is shattered.

In fact it is in our best interest that our focus must shift towards net worth.

One must do everything to increase his/her net worth.

This can be done by ‘buying assets’ or by ‘reducing debt’. People who carry high loans must first reduce their debt burden.

People who carry no loans must buy more and more assets.

When we say that a person is a millionaire, we actually mean that the persons net worth is in millions.

People are better known in this world through their net worth figures.

Keep buying assets to assure net worth growth.