Advance tax payment is not only applicable to the rich Bollywood stars and Businessmen.

Even a salaried person may require to pay advance tax.

How a salaried person can pay advance tax?

This is what we will see in this article.

But before that, lets understand the conditions under which a salaried person may be required to pay the advance tax.

Generally, TDS is deducted by the employer from the employee’s monthly salary.

So, if a person has no “other income”, other than the salary from job, the TDS deducted by the employer will suffice.

Payment of advance tax separately by the employee is not required.

But if there are other source of incomes, over and above the salary from job, it may be necessary to pay the advance tax.

#1. Advance Tax and other source of income?

What are other source of income?

Other source of income for a salaried person can be as following:

- Interest income from Savings A/c, Fixed Deposit, Recurring deposit etc.

- Capital Gain from sale of shares, mutual funds etc.

- Rental income from house property etc.

- Earning income as a freelancer.

- Earning income from a side business.

There may be case where your “other income” is a combination of all or few of above.

Hence, it is better to keep a note of other source of income in a separate excel sheet?

Why it is necessary?

If your total tax due is more than Rs.10,000 you must pay the tax in advance.

How to know what is your total tax due?

Here you have two source of income:

- Income from salary.

- Other source of income.

Suppose your income from salary is Rs.X.

Based on this value of Rs.X, your income tax liability was Rs.25,000.

Here your employer will deduct these Rs.25,000 from your salary and pay tax to the government.

But suppose your other source of income is Rs.Y

Now your total income is Rs.(X+Y).

Based on this value of Rs.(X+Y), your income tax liability was Rs.37,000.

Rs.25,000 is already paid by your employer. So the balance is Rs.12,000

As the balance tax due is more than Rs.10,000, advance tax payment will be necessary here.

How to pay these Rs.12,000 advance tax? We will see the procedure later in this article.

#2. How often one must pay the advance tax?

A salaried person who has “other source of income” must do a necessary calculation every three months (quarterly).

What is the necessary calculation?

Computation of total tax due based on salary (X) and other source of income (Y).

Why there months?

If the due tax is aboveRs.10,000, its payment must be made every quarter.

Other wise there will be a penalty of 1% per month (simple interest).

Quarterly advance tax payment schedule as confirmed by tax authorities is as below:

- 15% of Total Tax Dues – On or before 15th June.

- 45% of Total Tax Dues – On or before 15th Sep.

- 75% of Total Tax Dues – On or before 15th Dec.

- 100% of Total Tax Dues – On or before 15th Mar.

What means by the above advance tax payment schedule table?

Suppose your total liability (for Income X + Y) for the year is Rs.100,000

- 15% (Rs.15,000) – this much cumulative tax to be paid by 15th June.

- 45% (Rs.45,000) – this much cumulative tax to be paid by 15th Sep.

- 75% (Rs.75,000) – this much cumulative tax to be paid by 15th Dec.

- 100% (Rs.100,000) – this much cumulative tax to be paid by 15th June.

After 15th March, the tax dues should be zero.

What if one did not pay advance tax as scheduled above?

It is important to pay 100% tax dues on or before 15th of March.

But it is equally important to ensure that your interim schedule targets of 15%, 45%, 75% are also met.

Otherwise penalty will be applicable.

#2.1 Self assessment tax

But there can be cases where unplanned income falls in ones hand (say between 16th March to 31st March)

What can be done in this case?

For salaried people such a probability is very rare. Even if it happens, the employer will take care of the tax liability portion.

In case of freelancers or people with side business, the probability of facing this miss is higher.

15th March deadline has crossed and your tax dues is still not zero.

What they can do in case of such unintentional default?

In this case, you can pay your balance dues as “Self Assessment Tax”.

This can be paid after 31st March but before filing your income tax return.

Like “Advance Tax” can be paid between with the financial year, “Self Assessment Tax” can be paid after the lapse of financial year, but before tax filing.

Generally, interest under section 234B and 234C needs to be paid while one pays the Self Assessment Tax.

#3. How to pay advance tax?

Payment of advance tax is easy and seamless.

Thanks to Government of India, the process of advance tax payment has been kept very simple.

Just follow the below steps and your advance tax can be paid within minutes:

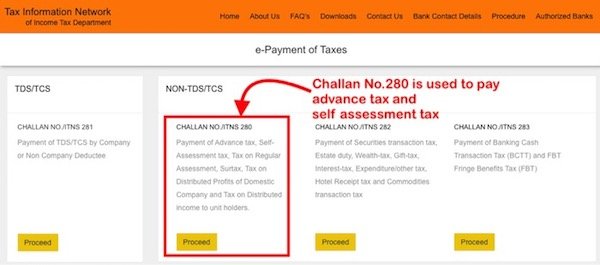

#3.1 Visit the government portal

Government has created a portal where online payment of the due taxes can be made.

You can click this link to visit the webpage created by the GOI.

You can use this webpage to pay your advance tax dues.

The webpage will look like this:

#3.2 Select Challan No.280

Challan No 280c can be used to pay the advance tax.

The challan 280 can also be used to pay self assessment tax after 31st March.

Before payment of advance tax, one must first fill the Challan No.280 form.

Click the “Proceed” button to fill the form.

#3.3 Fill the Challan No.280

It is essential to fill the below details correctly:

- Tax Applicable : Code 0021 for paying income tax by an individual.

- Type of Payment : Code 100 for payment of advance tax.

- Mode of Payment : Choose the name of the bank which you will use to pay the advance tax.

- Permanent A/c No : Give your PAN card number here.

- Assessment Year : Select the Assessment year (eg: for FY 2017-18, AY will be AY2018-19)

Fill the Challan No.280 and click the “Proceed” button as shown below:

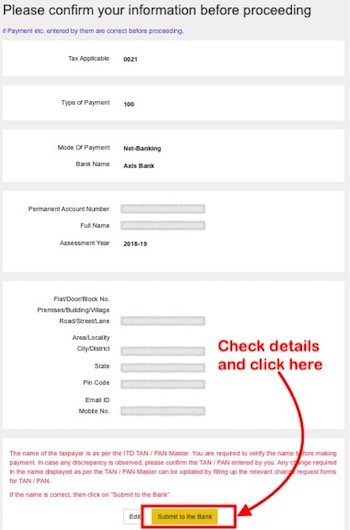

#3.4 Recheck and confirm the filled details

Once you click the Proceed button, you will be taken to a page which will display your filled in details (as done in step #3.3 above).

Double check each data entered by you in Challan No.280

Once you are satisfied that all filled in details are correct, click “Submit to Bank” button as shown below:

#3.5 Use Online Bank A/c to Pay Advance Tax

One you click the “Submit to Bank” button, you will be taken to your selected online banking account.

Use your online banking login id and password to pay your advance tax.

#3.6 Download the Receipt of the Advance Tax Paid

Once you have paid the advance tax using your online banking account, you must download the tax receipt.

This step is essential.

You will need this advance tax payment receipt while filing your income tax return.

The below detail provided in the receipt will be used while filing of the tax returns: