Dividend paying mutual funds are my favourite investment vehicle. Why?

I like them because it can generate short term income.

“Income generation” and “equity investments” does not go hand in hand.

This is why, regular dividends from equity based funds makes it unique. I love it.

But income seekers must play cautiously with mutual funds. Why?

Because regular income from equity is not as predictable.

Debt linked plans can pay income more regularly.

But I still prefer equity linked mutual funds to generate income.

The thing that I like about them is their potential to “grow dividends” over time.

In debt linked plans, yield remains same.

But in equity plans, dividend yield can go up-and-up with time.

#1. Dividend : direct stocks vs mutual funds…

Why not buy stocks directly and earn dividends?

Yes, this is a good idea.

But stock investing requires more skill.

Dividend income generation from direct stocks is not as simple.

Dividend paying mutual funds can earn you dividends much easily.

What is the problem with direct stocks?

It is not simple to identify stocks that can pay consistently higher dividends.

For a longer time horizons (like 10-15 years), the complexity doubles.

Experts ca buy direct stocks for dividends.

But for non-experts, mutual funds is a better alternative.

Why direct stocks investing is tricky?

Identification of a good dividend paying stocks requires digging into its financial statement.

Do we know to read Balance Sheets etc of companies? No.

Without analysing stocks like this, one cannot buy good stocks.

So what is the way out?

Buy dividend paying mutual funds instead of direct stocks.

The main objective of these mutual fund is to maximise the dividend yield for its investors.

#2. Dividend Yield of Mutual Fund

How mutual funds yield dividends?

They sell their share holdings to generate cash.

This cash, generated from redemption, is distributed as dividends.

Dividend paying mutual funds redeem a portion of their holdings on regular basis.

The profit portion obtained from redemption is distributed to unit-holders as dividends.

Suppose NAV of a mutual fund is $20 per unit.

This mutual fund decided to distribute $1.5 per unit as dividend.

In this case the dividend yield will be 7.5% (1.5/20).

As a rule of thumb, dividend yield above 4% can be considered reasonable.

#3. Dividend mutual funds are convenient…

Investors who buy dividend paying funds need not worry the details like:

- Which stocks to buy?

- When to sell stocks?

- How much shares to sell? etc

Investors can simply focus on the mutual fund price, and keep buying it time and again.

The details are taken care by the Fund Manager.

Who are Fund Manager’s?

They are generally MBA’s from top Institutes like IIM’s.

It is the job of Fund Manger to buy good stocks on our behalf.

They are heavily paid to do this job. The stocks they select are prime & perfect.

These stocks in turn ensures consistent dividend income for we investors.

#4. Dividend Mutual Funds – no capital appreciation..

NAV of Dividend paying mutual funds does not appreciate with time.

What does it mean?

Every time the dividend is paid, NAV of these mutual funds falls back.

One “cannot” take the dual advantage from investing in dividend mutual fund.

Dual advantage means?

- Capital appreciation (price growth).

- Regular income (dividend).

What to do if one wants to invest for capital appreciation?

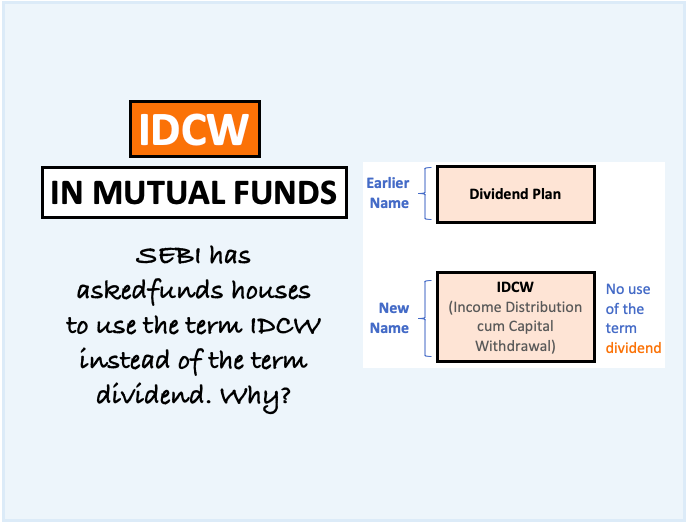

Generally all mutual funds offer following two plans:

- Growth (G).

- Dividend (D).

For capital appreciation, invest in mutual funds offering Growth (G) plan.

#4.1 Difference between growth and dividend plan – Profit Booking

Both type of mutual funds (growth and dividend) regularly book profits.

Non-dividend paying fund, use their booked-profits to buy more stocks/assets.

Hence these type of mutual funds ensures long term capital appreciation

Dividend paying fund, us their booked-profits to pay dividends to unit-holders.

Generally mutual funds pay dividends one or twice in a year.

#5. How dividend is paid by Mutual Funds…

Dividend is paid from the profit booked by the fund in last one year (say).

If there is no profit, there will be no dividend disbursement.

These days dividend is credited directly to the investors bank account.

Even in dividend mutual funds, there are two options:

- “Dividend payout” option and,

- “Dividend reinvest” option.

In case of dividend reinvest option, dividend will not be paid to the unit holder.

The payable money is used to buy more units of the same mutual fund.

In case of dividend payout option, the unit holder will receive dividend in his/her bank account.

#6. Dividend distribution tax (DDT) on dividends.

Dividend earning from equity linked mutual fund were not taxed before Feb’18.

But after the new rule, 10% DDT has been imposed on dividends.

Earlier DDT was applicable only on dividend paid by debt linkedmutual funds (@28%).

Equity linked funds were spared.

But post Feb’18, 10% DDT has been imposed on

Courtesy, imposition of LTCG on equity investment.

How to distinguish between equity linked or debt linked funds?

Look into its portfolio composition.

If weightage of equity in portfolio more than 65%, the fund is equity linked.

#7. Dividend mutual funds always pay dividends?

Dividend earning from mutual funds is not assured.

Dividends are paid from the “booked profits”.

If the profit could not be booked, there are no dividends available for payment.

When this situation can arrive?

When mutual fund NAV has not appreciated.

Hence, in case of bullish market, probability of getting dividends are higher.

#8. Yields of Growth Funds are higher?

In long term, returns of both funds will be similar.

In dividend payout option, money is credited to investors bank account.

To further increase the returns, investor must re-invest this money.

It is very important to keep this cash rolling.

Best Dividend Paying Mutual Funds in India

(Updated as on Apr’2019)

Terminologies used in the below table…

- Name = Name of Funds (Regular Plans)

- DY.L (%) = Latest Dividend Yield (%)

- A.DY.3Y (%) = Average Dividend Yield in Last 3 Years.

- A.DY.5Y (%) = Average Dividend Yield in Last 5 Years.

- Div.Pay.21Y = No of Times Dividend Paid in Last 21 years.

- Div.Pay.10Y = No of Times Dividend Paid in Last 10 years.

- VR = ValueResearchOnline Rating.

- NAV = Net Asset Value per unit (Rs.)

- Exp.Ratio = Expense Ratio (%)

- AUM = Asset Under Management (Rs.Cr.)

Dividend Yield History

| SL | Name | DY.L (%) | A.DY.3Y | A.DY.5Y | Div.Pay.21Y | Div.Pay.10Y |

| 1 | Reliance Vision (D) | 8.75% | 11.26% | 11.76% | 17 | 10 |

| 2 | Franklin India Bluechip Fund (D) | 9.07% | 9.50% | 9.33% | 21 | 10 |

| 3 | Birla Sun Life Focused Equity Fund (D) | 0.00% | 8.18% | 10.49% | 12 | 9 |

| 4 | ICICI Pru Value Discovery Fund (D) | 12.40% | 13.16% | 12.23% | 15 | 10 |

| 5 | Franklin India Equity Advantage Fund (D) | 8.58% | 10.39% | 10.43% | 14 | 10 |

| 6 | DSP Equity Fund (D) | 11.30% | 19.82% | 17.50% | 18 | 10 |

| 7 | Kotak Bluechip Fund (D) | 0.00% | 7.23% | 12.30% | 18 | 9 |

| 8 | HDFC Top 100 Fund (D) | 11.22% | 10.88% | 9.99% | 19 | 10 |

| 9 | SBI Magnum Equity ESG Fund (D) | 0.00% | 5.45% | 9.63% | 13 | 7 |

| 10 | HDFC Long Term Advantage Fund (D) | 10.16% | 10.38% | 10.04% | 18 | 10 |

| 11 | Reliance Growth Fund (D) | 9.34% | 12.11% | 11.32% | 17 | 10 |

| 12 | HDFC Capital Builder Value (D) | 10.54% | 11.82% | 11.50% | 16 | 10 |

| 13 | Franklin India Equity Fund (D) | 7.40% | 7.85% | 7.40% | 21 | 10 |

| 14 | Franklin India Prima Fund (D) | 0.00% | 6.75% | 7.61% | 20 | 9 |

| 15 | Reliance Multi Cap Fund (D) | 8.50% | 11.85% | 11.83% | 13 | 9 |

| 16 | HDFC Equity Fund (D) | 10.20% | 10.20% | 10.00% | 19 | 10 |

| 17 | ABSL Frontline Equity Fund (D) | 0.00% | 4.90% | 7.62% | 15 | 9 |

| 18 | SBI Magnum Taxgain Scheme (D) | 7.49% | 9.13% | 10.21% | 18 | 10 |

| 19 | DSP T.I.G.E.R. Fund (D) | 10.25% | 11.74% | 12.04% | 14 | 9 |

| 20 | Axis Long Term Equity Fund | 9.80% | 10.86% | 10.60% | 8 | 8 |

| 21 | UTI Mastershare (D) | 0.00% | 5.94% | 7.07% | 20 | 9 |

| 22 | IDFC Multi Cap Fund -A (D) | 5.11% | 6.29% | 8.67% | 11 | 10 |

| 23 | UTI Core Equity Fund (D) | 0.00% | 5.15% | 6.11% | 14 | 6 |

Other Details of Funds

| SL | Name | VR | NAV | Exp.Ratio | AUM |

| 1 | Reliance Vision (D) | 2 | 37.95 | 2.13% | 2,981 |

| 2 | Franklin India Bluechip Fund (D) | 2 | 38.59 | 1.97% | 8,009 |

| 3 | Birla Sun Life Focused Equity Fund (D) | 4 | 16.34 | 2.02% | 4,268 |

| 4 | ICICI Pru Value Discovery Fund (D) | 3 | 26.77 | 2.26% | 16,592 |

| 5 | Franklin India Equity Advantage Fund (D) | 3 | 15.48 | 2.13% | 2,766 |

| 6 | DSP Equity Fund (D) | 3 | 44.24 | 2.00% | 2,660 |

| 7 | Kotak Bluechip Fund (D) | 3 | 34.54 | 2.21% | 1,427 |

| 8 | HDFC Top 100 Fund (D) | 4 | 49.04 | 2.08% | 16,610 |

| 9 | SBI Magnum Equity ESG Fund (D) | – | 33.02 | 2.12% | 2,269 |

| 10 | HDFC Long Term Advantage Fund (D) | 4 | 39.35 | 1.40% | 1,482 |

| 11 | Reliance Growth Fund (D) | 3 | 59.26 | 1.99% | 6,745 |

| 12 | HDFC Capital Builder Value (D) | 3 | 26.09 | 2.30% | 4,624 |

| 13 | Franklin India Equity Fund (D) | 3 | 37.18 | 2.01% | 11,893 |

| 14 | Franklin India Prima Fund (D) | 4 | 61.77 | 2.08% | 7,116 |

| 15 | Reliance Multi Cap Fund (D) | 2 | 28.64 | 2.20% | 10,464 |

| 16 | HDFC Equity Fund (D) | 3 | 51.49 | 2.06% | 22,503 |

| 17 | ABSL Frontline Equity Fund (D) | 4 | 26.77 | 2.25% | 22,175 |

| 18 | SBI Magnum Taxgain Scheme (D) | 2 | 40.20 | 2.05% | 7,103 |

| 19 | DSP T.I.G.E.R. Fund (D) | 4 | 15.61 | 2.31% | 1,198 |

| 20 | Axis Long Term Equity Fund | 5 | 20.78 | 1.77% | 18,852 |

| 21 | UTI Mastershare (D) | 3 | 33.07 | 2.18% | 5,973 |

| 22 | IDFC Multi Cap Fund -A (D) | 2 | 32.66 | 2.15% | 5,580 |

| 23 | UTI Core Equity Fund (D) | 2 | 33.69 | 2.40% | 927 |

Read more about dividend yield here .

Mani

Can you carryout analysis of affordable housing as an investment and write an article about for passive income generation. There days find lot of them coming around Gurugram.

Pl give MF DIRECT DIV MONTLY OPETION. WITH GOOD RETURN

You have not mentioned HDFC BAL ADV F DIRECT DIV

which is the best dividend paying mutual fund and what is the rate of divident

You can get some insights on dividend paying mutual funds here…

http://ourwealthinsights.com/high-dividend-paying-mutual-funds/

Nice article. My query 1) When is the best time to sell i.t.c share .purchased at 260