One day I was sitting with my group of friends. We were randomly gossiping about things, when the topic of investment came up. People were eager to know about it, but they only wanted quick answers for queries like ‘where to invest money for high returns‘.

Frankly speaking, there are no quick answers when one is dealing with high returns. Why? Because high return investments comes with high risk of loss. One must not invest in them without developing the basic know-how.

Which is the basic know-how? The following:

- Do Your Best: No matter if you are a beginner, always try to give your best to investment. How to do it? By investing in things about which you know enough. Example: If you want to invest in stocks, do like Warren Buffett does it. If you want to invest in mutual funds, do it like Jack Bogle. Even if we can emulate 10% of these people, our investments will do good.

- Invest for Long Term: All high return investments are risky. One of the easiest way to deal with the associated risk is by staying invested for long term. Example: Just buy a good mutual fund, and then hold on to it for 5+ years. Read: Long term investment strategy.

- Always Diversify: This is also a way to minimise the risk of loss. In diversification, we prevent self from investing all money in one type of investment. Instead, we spread money in different, non-related options. Example: Equity, debt, real estate, gold etc.

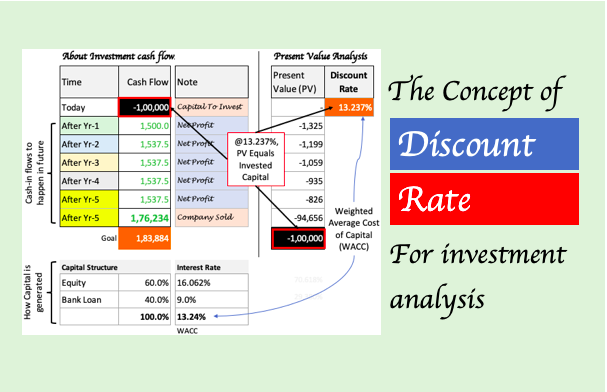

- Know Fair Price: When it comes to high return investment, nothing is more important than buying them at ‘fair price’. Why? Because high return investments generally trade at overvalued price levels (higher than its fair price). As an investor we must know how to estimate its fair price. Example: To know fair price of stock, one must estimate its intrinsic value.

What is the utility of developing ones know-how? This know-how will help the investor to earn high risk premium. Let’s know a bit about higher risk premium.

The Concept of Risk Premium

When we say ‘high returns’, what does it mean? To understand this we must know two essential terms (a) Risk Free Rate, and (b) Risk Premium.

What is Risk free rate? It is that rate of return that any investor can generate by investing in debt plans. Example: Fixed deposit.

What is Risk Premium? The return that we earn over and above the ‘risk free rate’ is called risk premium. How to earn risk premium? By investing in riskier investment option. Example: Stocks, equity mutual funds etc.

The higher is the risk premium, the higher will be the total return.

Hence, the formula for high returns looks like this:

Once we are aware of the need to develop the “basic know-how” of investment, and the concept of “risk premium“, we are ready to know about few high return investment options.

We will try to see these high return investment options from the optics of their potential to generate high risk premium.

1. Real Estate Property (before launch)

| Risk Free Rate | Risk Premium | Holding Period |

| 7.0% | 7.5% | 3+ Years |

Professional real estate investors target to buy premium properties at pre-launch rates. Why? Because at this stage, even reputed builders/developers are ready to offer decent discounts. When such properties are held for a period like 3-4 years, total return can be in the tune of 14.5% p.a. (Risk premium of 7.5%).

By the time such properties are ready for occupation, one can easily expect steep price appreciation. It will not be wrong to say that, in 4/5 years the property price will double. In cities like Bangalore, Mumbai, Delhi, Pune, such price growths are not uncommon…know more…

2. Value Stocks

| Risk Free Rate | Risk Premium | Holding Period |

| 7.0% | 8.0% | 3+ Years |

By investing in such stocks which is trading at undervalued price levels, one can fetch high returns. In our stock market there are more than 5,000 number stocks. Out of all these stocks, probably only 10% is worth considering as good for investing. Which are good stocks? Stocks of quality companies, trading at attractive price levels.

Attractive price levels means, ‘stock is trading at a price below its intrinsic value’. An investor who knows how to estimate intrinsic value of stocks (even if approximately), can make good money in stock investing. Read more about value investing here.

3. Mid Cap Funds

| Risk Free Rate | Risk Premium | Holding Period |

| 7.0% | 10.0% | 5+ Years |

Generally, small investors prefer to stay away from smaller and lesser known companies. If we are interested to earn above par returns, we cannot ignore them. But problem with such small companies is that, majority of them are of low quality.

Hence it is better to invest in them via mutual fund route. There are quality mutual funds which invest in mid cap stocks. Over last five years and more, the return of good mid cap funds has been quite phenomenal. Know more about such mutual funds here.

4. REIT

| Risk Free Rate | Risk Premium | Holding Period |

| 7.0% | 7.0% | 7+ Years |

REIT is a new investment vehicle in India. Its IPO closed only on 20th-Mar’19, and it got itself listed in BSE and NSE on 1st-April’19. At present it is trading at market price of Rs.310+ with minimum lot size of 400 nos available for investing. Which mean, one must invest about Rs.1.25 Lakhs to get hold of REIT. Know more about Embassy Office REIT here.

If we can ignore the limitation of 400 nos lot size, REIT has a potential to give phenomenal returns for its investors in long term. Why? Because at present, for a common man, there is only one way to invest in real estate property – physical property purchase. Its disadvantage is, investing in physical property requires large capital (like Rs.10+ Lakhs).

But in case of REIT, capital required (at present) is much lower (like Rs.1.25 Lakhs shown above). This will motivate more investors to participate in real estate sector (like they do in stock market). In next 6-7 years, REITs is expected to do well in India.

5. Index ETFs

| Risk Free Rate | Risk Premium | Holding Period |

| 7.0% | 6.0% | 5+ Years |

Index ETFs are tailor made to give average returns over long term. But I will discuss a trick which can give higher returns.

On an average a Sensex based ETF has generated a return of 13% p.a. in last 5 years. But using my trick, one could have increase this yield by at least 1.5%. What is the trick?

Every time the NAV of Index ETF falls by 1% or more (in a day), buy the ETF. Continue this process for at least next 5 years. Keep accumulating ETF units this way. This process can generate a fractional better returns (at least 1.5%+) more than a typical systematic investment plan (SIP).

Conclusion

High return investments are never risk free. This is the reason why, before investing in them, one must build the adequate know-how of investing. You can read about investment basics here.

Once you are done with the basics, it is necessary to pick the right investment option. There are people who makes money from commodities, arts, derivatives etc. How they do it? By building the necessary skill to deal with them. These are right investment options for them, but it may not work for me and you.

Always deal with those investment vehicles about which you have sufficient know-how. I have mentioned five such investment vehicles in my blog post.

Do you have some ideas of your own about high return generating investment alternatives? Please pen it down for us in the comment section below.

Handpicked Articles:

Cryptocurrency market has really grown drastically, such as others should be able to trade for themselves, even from the comfort of their homes from every corners of the world. All investors should keep up their goons so as to stay invested and be among the millions to benefit from the uprising in Bitcoin.

It’s a nice post very informative.Useful for many investors.also visit

Yes, you are right this will be the best investment plans I liked the way you have described. But I think Mutual fund will also be a good option to go for investment like short term and long term. Thank you and keep it up.

Mid cap funds has been mentioned in sl no 3.

Give the details of tax saving Fixed Deposit plans