The objective of this article is to highlight the importance of building the right thought process to practice investment successfully. Beginners worry about how to invest money wisely. In this article, we take the matter of wise investment from its very core. We discuss what, why, and where about investing from the perspective of a retail investor. For quick answers, read the FAQs.

Introduction

For a beginner, the puzzle of how to invest money wisely needs solving. How to do it? The investor must first build a thought process that will trigger wise investment habits.

For a first-timer, the world of investment is like new waters. Before this, the person has not thought about money in this context. To date, to him/her, money was only a means to save or spend. This concept that one can also make money grow through investments was unknown.

We know that sufficient money is required to meet the needs of life. How to ensure money sufficiency? Most of us know only one way to do it, through work. The understanding is not wrong, but money need not always be a byproduct of work. It is also possible to make money from money.

Well-invested money will grow on its own. It needs no work done on the part of the investors. Just invest it wisely, and the money growth will happen automatically.

Video

Investment & Wealth

This part will tell us the purpose of the investment.

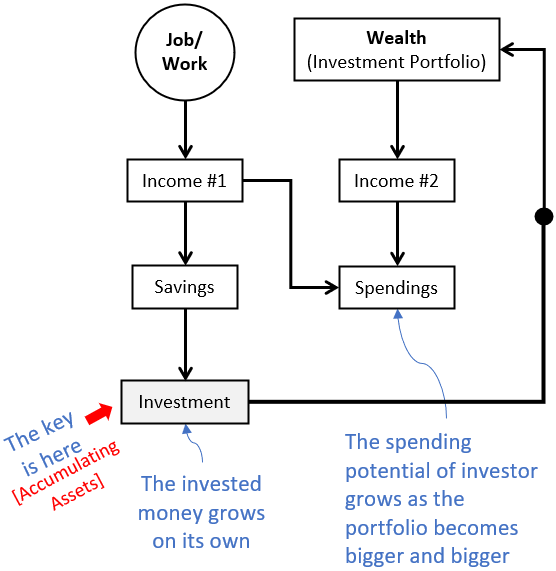

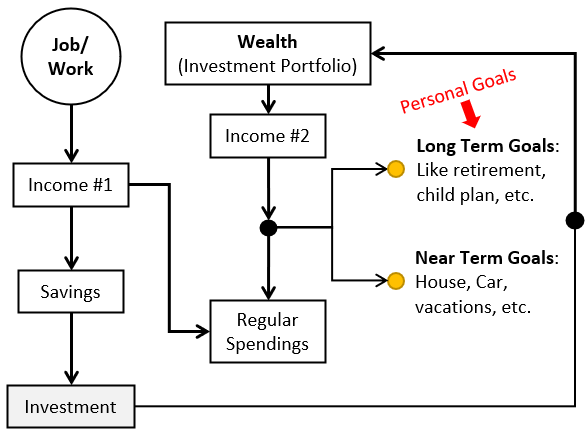

People need money to lead a fulfilling life. Our income must suffice our growing spending needs (our aspirations). There are two ways to increase one’s income (spending potential).

- Effective Work: We study hard and get good grades in the pursuit of knowledge and information. This know-how in turn makes us skillful to render our work more effectively. Effective workers have the ability to make their organization grow over time. Hence, the organization in turn rewards its people for their effectiveness through improved monetary perks and benefits. This is one way to grow income that a majority acknowledge.

- Wealth Building: One can also save money regularly from our earned income and invest it. This invested money is our wealth. The invested money grows over time. The more we invest, and let the money stay invested, the bigger it will become with time. This gradual building of wealth will become our alternative income source, thereby enhancing our spending potential.

The purpose of investment is wealth building. This built wealth (investment portfolio) eventually becomes an alternative income source for the investor. For successful investors, the size of income emanating from the investment portfolio is so big that it can replace the dependency on a job/business for income. This is the ultimate state of financial independence.

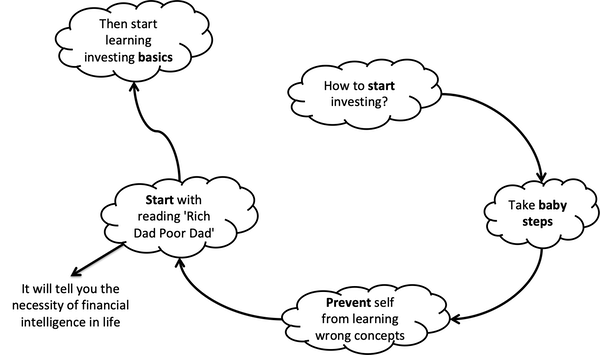

How to Invest Money

In our endeavor of figuring out how to invest money, starting with baby steps is more effective. Why? Because we cannot afford to learn it in the wrong way. After all, it’s our hard-earned money that we are investing, right? So, what should be the first step?

The first step is to learn the basics of investing.

Basics of Investing

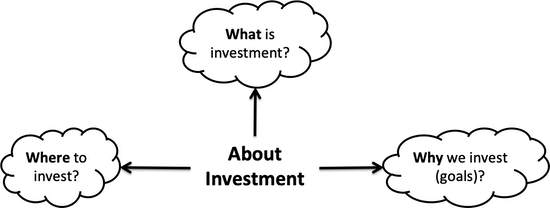

Investment basics is a vast subject. To make it concise, specific, and practical, I have broken it down into the following three (3) logical questions:

If we can answer these basic questions, it will automatically trigger the right investment decisions in times to come.

#1. What is called investment?

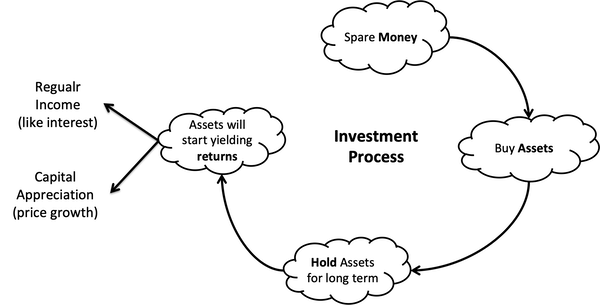

Investment is the process of buying an asset with the objective of (1) income generation and (2) Capital growth. The key is to remember that, both these objectives cannot be realized immediately. It will start happening gradually over time.

The concept says, to build some spare cash and use it to buy assets, then hold the assets for the long term. The accumulated assets will yield returns. Reinvesting the generated returns to buy more assets will ensure capital growth over time.

With how much spare money one can start investing? Regular investments can start even with Rs.500 per month. Such small-small amounts, when invested regularly, can build a large wealth over time. This power of building substantial wealth over time happens by the compounding of money.

How to ensure the compounding of money? Follow a simple rule of investing.

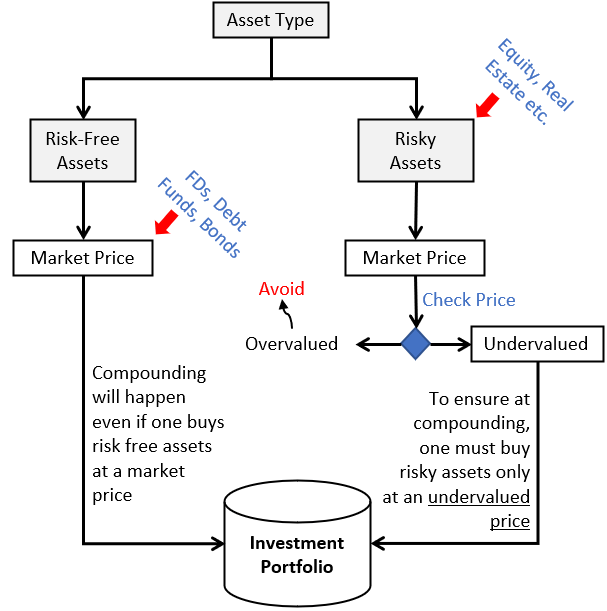

Broadly speaking there are two types of assets available for investing:

- #1. Risk-free assets: They are available for purchase almost at a fixed price. The price volatility of such an asset is low. They yield a fixed return but their yield is much lower compared to risky Assets.

- #2 Risky assets. Their buy price remains volatile, fluctuating between highs and lows. These types of Assets can yield good returns only if one buys them at a lower price (undervalued price).

So, before investing money one must first decide on the choice of an asset. If the pick is a risk-free asset, one can go ahead and buy them at the market price. If the choice is a risky asset (like stocks, etc), one must first check its price. A risky asset shall be purchased only at an undervalued price level.

#2. Why invest money?

If the question is how to invest money wisely, the most appropriate answer will be to practice investment targeting specific personal goals.

Investment of money is done for the bigger purpose of wealth building. But it sounds too broad, right? How about calling it wealth-building for retirement, or wealth-building for the first house? It sounds more specific, right? This is what is called goal-based investing.

Wealth building takes time. Here the period can range from 15 to 35 years. It is a long time duration. Hence, breaking down the purpose of wealth building into more visible goals helps.

A goalless investing eventually loses its steam and will come to an abrupt stop. Even worse, the invested money will get spent on needless things. So, telling oneself, “I am investing my money to build wealth is a first step.” But breaking it down will further ensure its continuity and effectiveness.

For example, a well-targeted purpose of investors should look like shown in the below infographics. Attaching personal goals to the purpose of investing can increase the effectiveness of an investment by leaps and bounds.

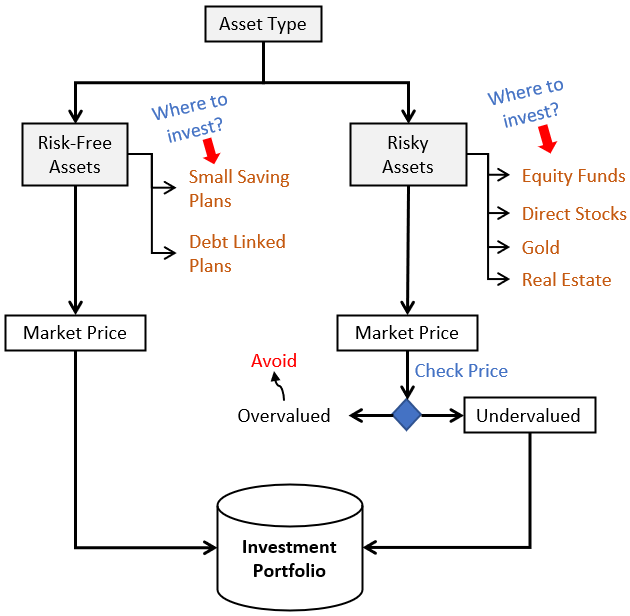

#3. Where to invest money?

Ultimately, the whole question about how to invest money wisely bottoms down to where to invest. This is where a beginner’s guide like this becomes more practical. We’ll discuss a few investment alternatives one can use to park money for the long and short terms.

Risky Assets (Equity)

- Stocks: In stock investing, one basically buys a share in the company’s profits. Buying shares worth 1% ownership of a company means, out of the total profits, current and retained earnings of the past, the investor has a claim of 1% on it. The company can do two things with its profits, they can either distribute it as dividends or retain it. The distributed dividends are received by the shareholders as cash. The retained earnings are used by the company to fund its working capital and future growth. This way the company grows its revenue and profits followed by the share price growth. Read more about stock investing basics.

- Equity Mutual Funds: To practice stock investing successfully, one must know the method of stock analysis. For others, equity investing can be practiced through the mutual fund route. Here, instead of buying direct shares, investors buy units of a mutual fund scheme. Each scheme has its own portfolio composition consisting of a mix of stocks. A unit of a scheme represents a percentage stake of the scheme’s portfolio. So, in a way, the unit holder indirectly owns a stake in stocks of the portfolio. A fund manager who is an investment expert manages the portfolio. Hence, compared to direct stock investing, mutual funds are safer. Read more about the basics of mutual fund investment.

Risky Assets (Others)

- Gold: Compared to equity, gold investing is less risky. As gold is an asset class of its own, adding it to an investment portfolio ensures diversification. Gold is a reliable inflation hedge. In the long term, the price appreciation of gold beats inflation. Hence, this asset class is useful for people investing for the purpose of capital protection. It is possible to invest in physical gold and gold in an electronic form like gold funds, bonds, etc. Read this guide on how to invest in gold.

- Real Estate: Like gold, real estate is also an independent asset class. It is neither related to gold nor equity. Hence, adding it further improves the portfolio’s diversification. A real estate property is one of the most reliable regular cash-flow generators in the form of rent. Though a physical property can be very capital-intensive, its reliability is unquestionable. These days one can also invest in the shares of REITs to gain exposure to this sector. REITs are a lot less capital intensive, like shares and mutual funds. Read this guide on property investment for beginners.

Non-Risky Assets (Debt-Based Plans)

- Fixed Deposits (FD): The safest investment for a retail investor is to keep money parked in a fixed deposit of a reliable bank. If an investor is not clear about where to invest the money, better keep it in an FD. Moreover, for a portfolio that is equity-heavy, adding FDs is a good way to diversify and lower the risk of loss. Read about how to value an FD.

- Debt-Based Mutual Funds: It is a type of mutual fund that keeps debt instruments in its portfolio. The portfolio composition of a typical debt fund can be debentures, corporate debt instruments, government securities, etc. The yield of a debt fund is better than a bank FD. Hence, if one wants to add a debt component to the portfolio for diversification, debt funds will be a better choice. Read this beginner’s guide on debt mutual funds.

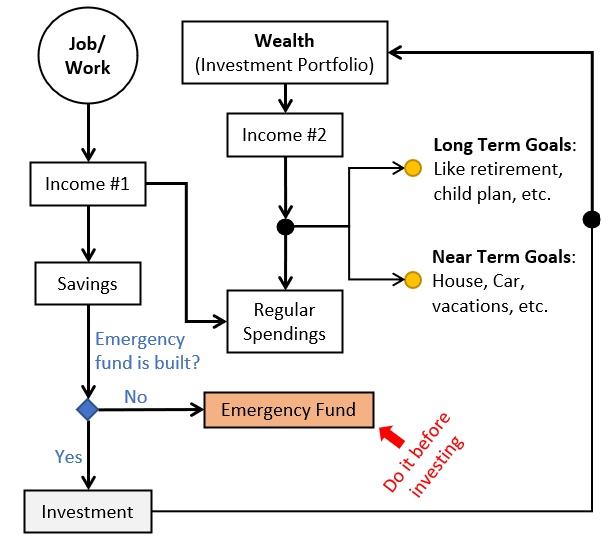

It is also essential to remember that investment takes care of only one aspect of life, planned future goals. But life is uncertain and everything does not go as planned. Hence, one’s financial portfolio must also include other instruments that take care of the emergencies of life. In fact, experts suggest that we must treat other instruments as a precondition to investing. First, buy these instruments, then proceed with investing as explained above.

Preconditions To Investment

This is a rule which is worth remembering. It is as powerful as the investment itself. We can consider it as a stepping stone to investment. Why it is necessary? Because investment is a risky proposition. The invested money, especially in equity, must be left undisturbed for long periods of time to ensure compounding. It means, once our money goes into the investment portfolio, it is kind of inaccessible. So, during this period when our money is locked for compounding, how to handle emergencies as it comes?

If one can build the following emergency portfolio, it will act like a safety cushion. It will prevent us from digging into our investment portfolio to manage emergencies of life.

Four typical components of an emergency fund

- #1. Emergency Cash: This cash is basically a fixed deposit stashed aside for use during emergencies. The size of this deposit is six (6) times our monthly expenses. Suppose your fridge broke down and you’ve no money in your maintenance fund. In such a case, money can be taken from here, and then shall also be replenished over time. Read more about saving money.

- #2. Health Insurance: Buy a health cover that is at least five (5) times your annual income. Such insurance policies come cheapest if bought during one’s twenties. Please note that there is a three-year waiting time for all health covers. During this period getting a cashless claim approved is tough even in genuine cases. Hence, one can assume that in the first three years of the policy term, there will be virtually no disbursement. Read more about a health insurance purchase.

- #3. Term Life Insurance: Though it may sound like a needless expense, having a term plan is a must. From the perspective of building an investment portfolio, its use is paramount if an emergency strikes. In case of the demise of the earning member, a life cover should take care of at least first ten years’ expense requirements of the family. They need not touch the investment portfolio which will become much bigger if it’s not redeemed for another 10 years. Keeping a life cover that is at least ten (10) times one’s current annual income is needed. Read more about how to use life insurance money.

- #4. Reduce debt: I think, it is needless to invest money when one is reeling under a load of debt. I’ll first become debt free and then start investing. But everyone may not have the motivation to act in this line. Hence, I’ll suggest this cross-checking. Check if your monthly EMI is less than 30% of your monthly paycheck. This paycheck is net of all deductions. It is the money that lands in your bank account each month. If the EMI is less than 30% of this paycheck, one can start investing. Read more about the concept of leading a debt-free life.

All the above four to-do’s together, constitute an emergency portfolio. If the size of this portfolio is big enough, as explained, one is ready to start investing.

Remember: Investing is not Trading

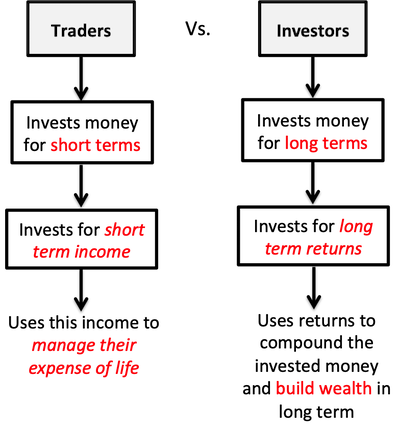

There are two types of people available in the world of investing. First are those people who use their capital to trade (frequently buy and sell assets) and earn a livelihood. They are called traders. Second, are people who invest money to build wealth gradually. They are called investors.

Beginners must aspire to handle their money like investors (Warren Buffett, Rakesh Jhunjhunwala, etc). Why consider investing over trading? Because in trading the risk of loss is too high. Why? In trading, one deals with shorter holding periods. Especially in equity, expecting positive growth in the short term is like expecting a win in a game of gambling.

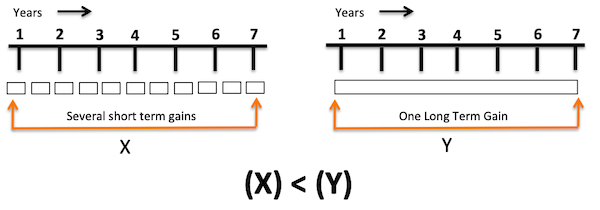

Note: In the short term, one can only make smaller gains. Over the same period of time, even several small-small gains will be less than one long-term gain. Why? Because in short-term investing the power of compounding is lost.

How tough is making money from an investment?

Frankly speaking, earning smaller returns from investing is easy. The difficulty creeps in when we aspire for higher returns. What’s the need for higher returns? To beat inflation. Let’s understand it like this, there are investment alternatives in India that can yield small returns with almost zero risk.

These are debt-based investment plans. A few examples of debt-based plans with their potential returns are, savings account at 3.5% per annum, fixed deposits at 7% per annum, retirement plans at 7.5%, and debt funds at about 8% per annum.

The problem with these investment alternatives is that they cannot beat inflation. If at all they do, like in retirement plans or debt funds, the money must stay invested for a very long term (7-8 years). But why park money in debt funds if the holding period is so long? In such time periods, an equity plan can easily earn above 12% per annum returns (with the risk of loss reduced to almost zero).

So we can say that, in India, earning a 12% per annum return in long term is easy. One can buy an index fund and earn this return with holding periods of 5-7 years.

If the target is to earn a return above 20% per annum, that is tougher. Why? Because here one needs to opt for stock investing. How to do it? One can use a tool like Stock Engine to build a perspective about good and bad stocks. Once sufficient know-how is gathered, the investor can take an informed decision about investing or avoiding stocks.

Conclusion

Investing money in the right way is a necessity. It must be done after building a correct thought process about investment. Our financial well-being is dependent on the success of our investments.

So, how to invest money wisely? Buying a few stocks and mutual funds here and there in the name of investment will not work. What is essential is the following:

- Building a strong foundation of investment know-how.

- Using this knowledge to build a strong equity-heavy portfolio.

Why equity? Because it is equity that will help us to beat inflation in long term, and also build the required wealth.

Have a happy investing.

FAQs

The best way to invest money is to build a diversified portfolio. This portfolio can have a mix of asset types like equity, debt, gold, and real estate. The safest way to invest in equity and debt is through mutual funds. One can buy gold through gold funds or sovereign gold bonds. People who cannot afford a physical real estate property can invest in this asset type through REITs. Read more about ways to invest money.

The definition of good returns is one that beats inflation. Equity-based investment can beat inflation in the long term. The most hassle-free way to beat inflation is to buy an index fund or index ETF and hold it for the long term. If the target is to earn higher returns, a multi-cap fund or direct stocks can fetch good returns.

A beginner should start investing money through the mutual fund route. The most suitable type of fund will be a hybrid fund. These funds have diversified portfolios with a mix of equity and debt. For a beginner, hybrid funds are best to get a feel for investing. Once they become more comfortable with the market, they can graduate to index funds, multip-cap funds, or even direct stocks.

Investing cannot happen if there are no savings. So yes, in a way we can say that saving is more important than investing. But not investing the saved money will be a wrong choice. It is always better to invest the saved funds in long-term investment options like equity funds, stocks, gold, etc. Once the money is invested, leave it undisturbed long enough (like 10 years) for compounding. Read more about compounding.

The priority of a retail investor is different from that of a rich person. When the person has enough money, his priority changes from growth to capital protection. Rich people also prefer those investment options where they can park large capital in one go. Hence, the preferred choice of rich people is often real estate property. A retail investor, who is looking for growth, should focus on equity.

Great article. I have a article about 7 best investment options in 2019. If you love it please link back

Awesome article!

Thank Nigam.

Very Basic & informative

Thanks

Very nice information on investing , It is good for those who are scared to invest in equity. It will be better for beginners to invest through mutual funds , direct equity investments may be risky if you make wrong decisions. Invest in good 4 to 5 funds for long term ie 20 to 25 years , you will definitely create large corpus . Thank you

Thanks a lot for taking time to post your views. Awesome.