It is essential to build ones financial literacy. Why? Because in todays world almost every human activity is in some ways dependent on money.

We need money to get access to even bare necessities of life like food, clothing, and shelter.

Our spending needs, does not stop with necessities only. We also need money for education, health, sanitations, hygiene, entertainment etc.

Like we need air to breathe, we also need money to lead a decent life. In addition to above, if one desires comfort and luxury – importance of money further increases. There can be no luxury without money.

What does it mean? It means we cannot escape handling money in our day-to-day life. Hence it is better to learn ‘how to effectively deal with money‘. How to do it? By building financial literacy for self.

Examples of bad handling of money…

Financial literacy supports us in handling money wisely. But what happens if one does not have financial literacy? Bad money related decisions are taken.

Few examples of bad money handling due to wrong decisions are as listed below:

- Negligible savings – month after month.

- No emergency fund.

- Living a debt dependent life.

- No wealth creation.

- Minimal contributions to retirement plans.

- Excess income tax outgo.

- No alternative income source, etc.

How to build financial literacy?

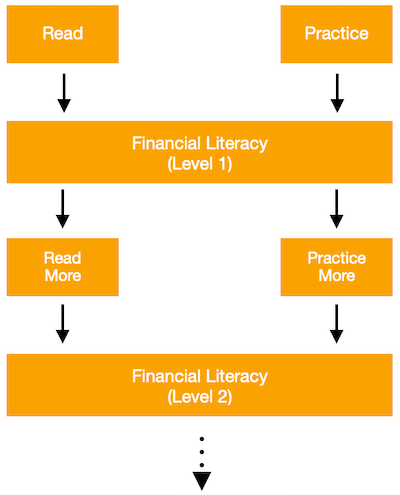

Financial literacy can be built only by reading about it, and then putting them in practice. There is no easy way out.

Yes, unlike our traditional education curriculum which favours theory, financial education needs more practice.

If you want to learn to save money, go save it.

If you want to learn to invest money, go invest it.

If you want to learn to save tax, go save tax.

In the world of personal finance management, there is not alternative to practice.

Where to start?

It’s always better to start with concepts. What is the concept of financial education?

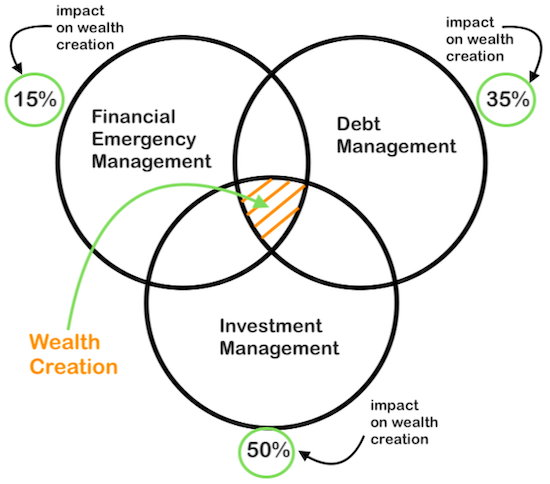

Financial education make people able enough, so that they can deal with the following:

- Financial Emergency Management.

- Debt Management.

- Investment Management.

If we can learn to do these three things wisely, we can build wealth for self in long term.

So the ideal starting point will be this realisation that, financial education is necessary for wealth building.

In order to build wealth, one must know how to handle emergencies, debt and investments.

#1. Financial Emergency Management

Ask yourself this question, “Can I pay today a medical bill of Rs.100,000 in case the emergency strikes?“

You will surprised to note that majority will have to look sideways in answering this question. Why? Because they have neither planned for it, and hence are caught unprepared.

How to be prepared for the emergencies? By taking following adequate preemptive measures before the occurrence.

- Build Emergency Fund: This should be the place from where a beginner should start. How much emergency fund to be accumulated? Six times ones monthly expenses. Once this fund is built, stack it aside in a fixed deposit.

- Buy a Life Cover: Life cover should be a Term Plan. This is a must for all earning members of the family. How much should be the cover? My personal thumb rule is 15 times the annual income.

- Buy a Medical Insurance: A mediclaim policy must be bought for all members of the family. One must try to get them in an ‘as early age’ as possible. How much cover will be enough? For a normal family, a cover of 10 times ones monthly expense should be enough.

- Buy a Motor Insurance: Maintaining a motor insurance is anyways compulsory. But in reality, it does save loads of money. Small road accidents keep happening. These days the vehicle repairs are costly. In absence of insurance, the person will have to pay it from personal savings. Better to avoid it.

- Maintaining an Emergency Cash: I’ve personally found it to be very useful. In our daily lives, some unforeseen expenses always creeps-in. In such times this cash will be helpful. How much cash to keep? 25% of monthly expenses should be enough. Read more about expense budget.

#2. Debt Management

Proper debt management has a very significant impact on long term wealth creation.

In debt management’s parlance, what is an ideal scenario? Remain Debt Free. But if zero debt is not possible, then what to do?

This is where the knowledge of debt management plays its virtues. People who know to handle debt, deals well in such times of need.

How to handle debt wisely? In the following ways:

- Limit Debt Load: Do not take more than 65% debt. Pay 35% from savings. Suppose you want to buy a house worth Rs.50 lakhs. Take only Rs.32.5L (65%) home loan. The balance Rs.17.5L shall be paid from savings. Rule is to delay the loan till 35% saving is built.

- Prepay The debt: Ideally one should remain debt free. But if debt is unavoidable, make sure to prepay it asap. How? By making regular prepayment. Suppose you have a home loan valid for next 15 years. Try closing the loan in 7.5 years. Idea is to make loan balance zero quickly.

- Prepay Costlier Debt First: Suppose you have two loans, a person loan and a home loan. Which you must close first? Personal loan, because its interest rate is higher. Note: Credit card debt is the costliest. Read more about paying off debt vs investing.

#3. Investment Management

What we have seen till now was “emergency” and “debt” management. Together they can contribute 50% to the overall wealth creation.

But this does not mean that buying insurance policies and loan prepayment will build 50% wealth. Actually, they only contribute indirectly to wealth creation.

What they are doing is helping us to churn out more savings. These savings in turn must be used wisely to build wealth.

How to use savings? Direct them to buy good investments.

Here are few investment related lessons which we must remember at all times:

- Buy Asset, Avoid Liability: What is an asset? Anything which generates income. Suppose we bought a thing which does not generate income (or incurs an expense), it is a liability. Read more about asset building.

- Cash Flow is Real Return: Suppose you are holding shares which you bought at Rs.10,000. Current value of these shares are say Rs.12,000. What is the return? 20%. But this is not ‘real return’. As my friend Asis once said, its a ‘virtual gain’. Once the profit is booked, virtual gain is converted into ‘cash flow‘. One must focus on returns, but never forget to book cash flow.

- Practice Value Investing: Buying low and selling high is trading. Avoid it. Focus on “buying quality assets at undervalued price – holding it for long term – then sell high“. This is value investing.

- Buy Undervalued Assets: The price of undervalued assets is bound to rise with time. The control point for investors is to always buy “quality assets” at good price.

- First Save Tax: Use savings to buy tax-saver investment plans. Once the tax-saving options are maxed-out, only then invest elsewhere. Read more about income tax planning.

- Reduce Risk of Loss: In the world of investment, risk of loss will always be there. Investment options like equity will always be risky. Hence investors must take actions to reduce the risk of loss. How to do it? By keeping ones investment portfolio well diversified (spreading money in cash, debt, equity, real estate, gold etc.).

Conclusion

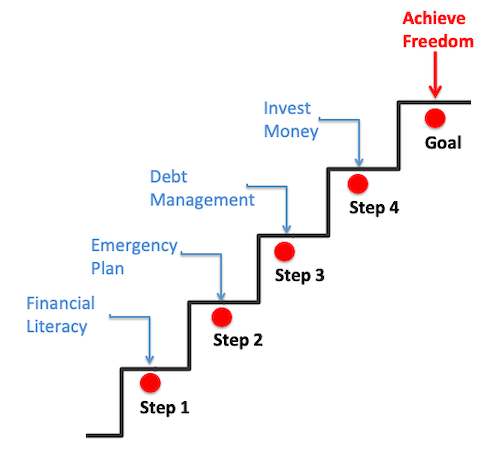

Building ones financial literacy can go a long way in assuring financial freedom for self.

Attaining financial freedom is the ultimate goal. But to achieve this goal, it is essential to take the necessary “first steps”. Which are the first steps?

- Building financial literacy.

- Emergency planning.

- Debt management.

- Wise investments.

- Financial Freedom.

Have a happy investing.

Is there any way people can invest in paytm, ola bacs, oyo roms before they go public???

I am live in new york so are there any NRI regulations regarding it??

Please reply

Thank you