The year 2020 was tough (COVID-19). The second wave in the year 2021 seems to be even more lethal. During these times, people have realized that good money habits can prove to be saviors.

Whenever humanity comes under stress, people tend to resort to basics. Food, shelter, health, family takes priority. But to better manage these pressing matters, people need sufficient money.

People do jobs and business to earn money. But this money must also be spent in a certain way.

Generally, people spend all of their income on food, bills, fees, entertainment, travel, etc. These are also needful things, but it is not a complete list. Including few more specific expense heads is necessary. We will talk about those expense heads and more in this article.

The idea is to present this article as a quick guide for building good money habits.

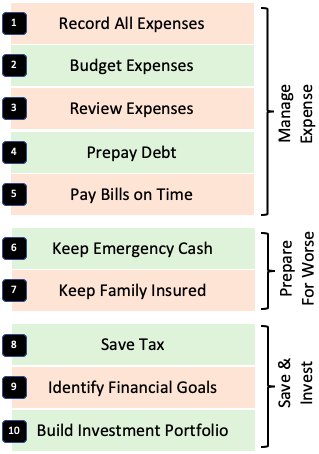

10 Good Money Habits

Here is a list of habits that can go a long way to build wealth over time. It is also worth noting that bad money habits can deplete one’s wealth. Hence, as important it is to develop good habits, it is equally critical to stay away from bad habits.

So, here is our list of 10 personal financial habits to learn and follow:

Manage Expenses

If we can keep our spending under control, it preps us for building other good money habits. Check the five points listed below. These habits can give control of spendings in our hands:

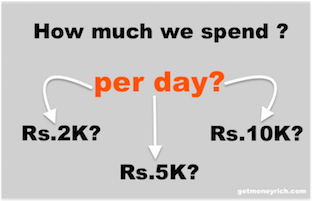

1. Start recording all expenses

The roots of all good finance habits are in expense control. How to control the expenses? The first step is to start recording every spending. One will have to do this data-entry task again and again for years to come. It is not easy. Out of all habits, it is the toughest. But its effectiveness is also proven.

2. First Budget Then Spend

We know that expense control is essential. But how to do it in a foolproof way? Execution of it is possible through another habit. How? By preparing and updating an expense budget once every year. The budgeted value for each expense head gives us a reference. Expending beyond the budgeted number will count as overspending.

3. Review Expenses

All the hard work done in the above two steps becomes futile without its review. Build a habit of reviewing your expense report once every six months. The bigger goal behind doing this exercise is to prevent overspending. Reviewing the expense report highlights the overflowing expense heads.

4. Prepayment of Debt

Bank debts like home loans or education loans are often large values. Hence it takes time for repayment. Depending only on EMI payment to bring the loan to zero is a slow process. To speed it up, we must build the habit of loan prepayment. We must try to make at least one prepayment each year.

5. Pay Bills on Time

We receive bills with a constant frequency. Hence it is possible to keep it organized. But we often handle it shabbily. Why? Because we tend to forget paying them on time. What is the solution? First, list down all your bill and then categorize them. How to do it? Base it upon their frequency of occurrence (monthly, quarterly, annually). Also, note their last due date. Keep a habit of reviewing this list once every month, and pay them as you do it.

Prepare For The Worse

In the next step, we will try to keep ourselves prepared for potential financial emergencies. It can be medical and non-medical. It is a known fact that when an emergency strikes, the money flows out incessantly. We cannot stop it, but we can prepare ourselves for such times.

Achieve it with the following two habits:

6. Keep Emergency Cash

We keep facing minor emergencies regularly. These are mainly unplanned and unavoidable events of life. Most of them demand money outflow. The money should come from our accumulated emergency fund. Start a habit of putting aside 1.5% of your monthly income into the emergency wallet. Let the size of the wallet grow over time.

7. Keep Family Insured

When the emergency is major, our cash wallet may prove insufficient. That is where the insurance planning will help. A typical Indian family must keep these insurance covers handy: life, health, and motor insurance.

The size of life and health covers must be sufficient. Buying a minor cover just for namesake will not help. Make a habit of reviewing the size of life cover and medical cover your need once each two years. With age and standard of living, the insured amount must grow. Make sure that your insurance policies provide the needful cover as reviewed.

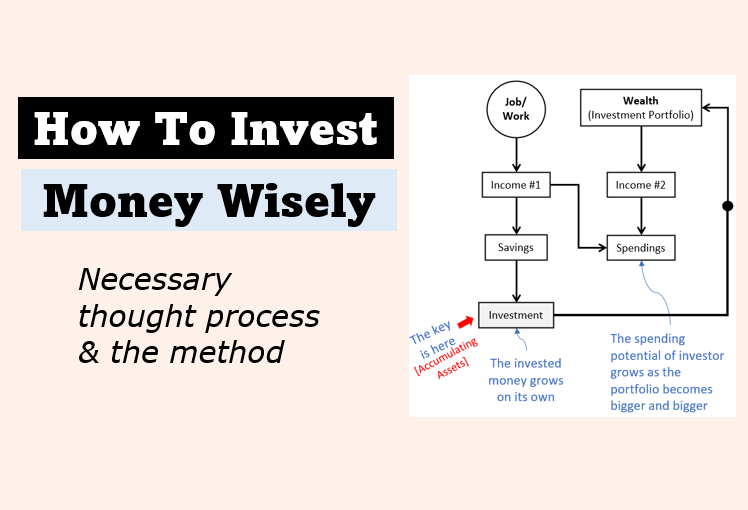

Save and Invest

All that we did in the above seven (7) steps was to increase our ability to save more money. If savings are more, we can invest and make it grow faster. Ultimately everything boils down to investments. We are building good habits to give ourselves the ability to invest money.

8. Save Tax

One of the major leaks in our wealth is the ‘income tax.’ But there are ways to reduce our tax burden. The first step is to become aware of one’s income tax liability based on the tax slabs. The next step will be to buy the tax savings instruments. These spendings will then qualify for “tax deductions.” In turn, they will reduce our tax liability. We must build a habit of claiming the maximum tax deduction possible.

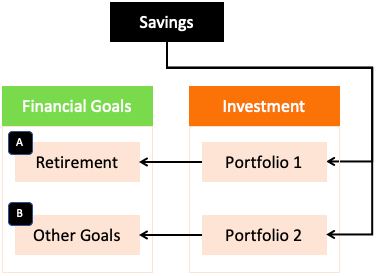

9. Identify Financial Goals

Till step #8 what we have done will ensure enough cash deposits (savings) in our bank account. It is better to invest idle cash. But before that, we must know why we are investing money. To realize it, we must identify all financial goals of life. That will give a definite direction to our money-related activities.

In this concept, we must build a habit of listing down any forthcoming (big or small) requirements of life. Once the activity is listed, quantify it in terms of its financial cost. Example: Higher education of child might cost Rs.25 Lakhs after ten years from now.

10. Build Investment Portfolio

We must invest the accumulated savings. The best step forward will be to create two separate investment portfolios. First, one should be focused only on retirement corpus building. The second one should be catering to all other goals.

Why two portfolios? Because mixing retirement with other goals might lead to confusion. Immediate financial goals will look more urgent than retirement planning. Hence retirement gets ignored, and focus is more elsewhere. In this regard, two separate portfolios can do the trick.

Once we are saving enough and are also aware of the future goals, we are ready to follow an investment strategy. For the majority, using mutual funds as their preferred investment vehicle will help. But for people who can take more risks can include stocks in their portfolios.

Suggested Reading: NPS for retirement corpus building.

Conclusion

These ten personal finance habits are the cornerstones for the bigger plan to achieve financial independence in life.

The whole process of money management deals with giving us the ability to save and invest money. But as critical it is to invest money, it is equally important to stay invested for the long term. Investing for shorter time horizons like 2-3 years is not so effective. In order to take advantage of the power of compounding, the invested money must stay locked for 10-15 years.

It is also necessary for people to learn to analyze their investments before investing. There are two steps to learn it. Start investing only in risk-free options where the need for analysis is minimal. In this step, one not only gets the feel of investment but also learns analysis. For example: How to value a fixed deposit.

The next step will be to venture into equity investing through the mutual fund route. Here the person can learn how to pick good mutual funds. Once the person is feeling confident about his/her abilities with mutual funds, the next venture will be stock through value investing.

Thanks for reading and, have a happy investing.

The infographic is amazing which software do you use

Dear Manish Sir,

I have just get your site through Google search today. I read your 2-3 articles that seems me very realistic & approach are also realistic and informative. I request to develope an app for which your site will be accessible for all at all times. You have to start free trail also, it will overloaded you but in long run it will definitely help you to extend your business.

My also love personal finance , so my best wishes for you & your sites also.

Hi Mani(sh),

Well written article, really appreciate your way of presenting the topics in a structed and lucid way.

I would appreciate you covering the topic of portfolios. Starting with what is portfolio and how many different forms of portfolios are there and how one should pick and choose each of the portfolios. What should be the basics and how different age groups of people should look into the portfolios and its implementation.

Thanks for your consideration.

Keep up the good work and GOD BLESS.

N. Gopal

Dear Danish,

God bless you.

I have been learning how to handle money the hard way by picking up tidbits of information from here and there. I was astonished to find out this website of yours where you are giving free advice to anyone who is willing to listen on all that is there to know about money. And it seems, there are no strings attached.

But I am afraid, the very simplicity of your advice makes people ignore it. People like complexity!!

Dr. Shivananda Prabhu

Thank you for the awesome feedback.