Mostly it is the business men who become richer than others. But how can a salaried person become rich?

Smart business men tend to become rich more frequently than salaried people.

Yes, the keyword to become rich is “smart”. One need to handle ones paycheck (income) smartly.

Smart and rich business men tend to handle their income in a better way.

There are two reasons for it:

- Business people are more money focused.

- They have more provisions to utilise their income better.

Money Focused: “Doing business to generate money” is different from “doing a job and earning paycheck”.

In terms of work-done, probably both are equal.

But in terms of output, smart business men are more efficient.

So will it be right to make a statement like this:

“All Business men are richer than salaried people”. No.

What will be the right statement?

“Smart business men are richer….”

An even better statement will be…

“A smart salaried person can be as rich as a smart business man…”

So here comes our question again. How can a salaried person become rich?

The answer is, by handling money in a smart way.

What is the smart way?

- Think like an astute business man.

- Pay all your money to “yourself”.

Sounds selfish and mean? Read more…I am sure you will begin to like it.

#1. Think business.

Business?…not that crap again. Heard this concept before?

I know, you already want to stop reading and flip this blog post.

But give me a chance. Allow me to explain, how a salaried person can think business.

So lets start from the very basic. How majority handles money?

As soon as the paycheck is received, money is allotted for expenses.

This is a problem.

Spending money is not bad. Perhaps we earn money to enable us to spend on things we like.

So where is the problem?

The problem lies in how the money gets routed towards expenses.

The basic rule is, our paycheck must first do a useful work before getting spent.

When I say “our paycheck”, I mean each and every penny, received every month, year after year.

What is useful work for a paycheck? Building a business.

But are we not addressing salaried people in this blog post?

How they can build a business?

For salaried people, their job is their business.

Salaried people must treat their job as their own business.

It will make a world of difference.

This is the first step.

See, thinking business was easy, right? Now we are ready for step 2.

#2. Create pay-yourself-first account.

Pay-yourself-account is that bank account where all income must first go.

Yes, pay 100% of all earnings to “Yourself First”.

How Pay-yourself-account is different from our salary account? Technically there is very little difference.

Except of the fact that, the treatment of money in pay-yourself-account is drastically different.

Be prepared to unlearn what you already know.

As you are treating your job as your business, likewise forget salary account, create a pay-yourself-account.

As some great man said, its all in the mind. It you think right, right things will happen.

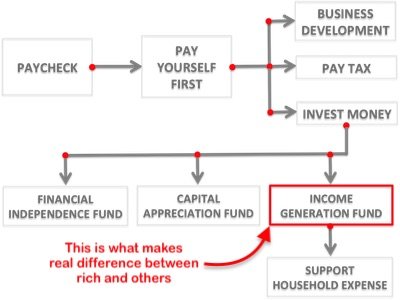

Money from pay-yourself-account gets spread to do useful work.

How the money is spread? In 3 different heads:

- Business Development: Reinvestment back into business.

- Tax Payment: Tax liability must be separated out.

- Invest Money: Balance all money must be invested.

Oops, but what about our favourite household expenses?

Yes your observation is right. There is no separate head for household expenses.

For a moment forget about household expenses. Don’t worry we will take care of it as well.

We will allot money for household expenses, but at the last. Yes sure, we will not miss it.

Believe me, it is not an impractical approach.

Remember what we are trying to learn here, “how can a salaried person become rich”.

It is not such a goal that can be achieved by continuing to do our normal things. We must do things differently.

Lets first allow our paycheck to do some useful work for us.

Spending from the word GO is not useful work…

#2.1 Business Development.

What is your business? For a salaried person, job is his/her business.

When a business man reinvests money back to business, it is called “retained earning”.

How companies use their retained earning? They use it for:

- Working capital,

- Buying assets,

- Prepay debts, etc.

How an individual can use retained earning? For business development.

Let me explain it with few examples.

Example_1: Suppose you are Virat Kohli.

What is your job/business? Playing cricket.

Virat Kohli will like to use his retained earning to improve his fitness. Why?

This in turn will help him play better cricket.

Means more future income than today.

Example_2: Suppose you are Rajkumar Rao.

What is your job/business? Acting.

He will like to use his retained earning to improve the following:

- Acting skills.

- Fitness.

- Skills

This in turn will help him become more likeable with his audience.

Means more future income than today.

Example_3: Suppose you are a medical Doctor.

What is your job/business? Treating patients.

A doctor wold like to use his retained earning to update his medical knowledge.

This in turn will help him treat his patients better.

Means more future income than today.

Example_4: Suppose you are a Software Engineer.

What is your job/business? Coding softwares.

A software engineer wold like to use his retained earning to improve his/her coding skills.

This in turn will help him to write more effective and lighter codes, in less time.

Such skills can make a person more valuable for the employee.

This will eventually translate into more future income than today.

Example_5: Suppose you are a Salesman.

What is your job/business? Market and sell products.

A sales man would like to use his retained earning for the following:

- Improve networking by socialising.

- Get training on Sales and Marketing.

This in turn will help him to sell more.

Such a salesman is invaluable for the employee.

Means more future income for the salesman than what is today.

To conclude the topic of business development – reinvestment…

The point is, business men reinvests part of his income back into business to keep it running and growing.

Similarly, a salaried person must also reinvest part of his income on himself.

Generally what we do? We do not reinvest at all. Why?

Because we think, it is our companies job to do it. Yes its true.

But a more sure way for salaried person to become rich is, “to do it by self”.

Do not wait for the company. If it does, its good. If not, you will do it yourself. Why?

Because your job is “not your job”. You are treating it as your business.

To make a business grow continuously, reinvestment is a must.

Did you note, Step 1 and Step 2 are totally in your control.

Step 3 will be even easier.

#2.2. Tax Payment.

There are no tax heavens for ethical common men. Its always better to be tax-ready.

How to do it? Simple, maintain a separate tax account.

Like you have a salary account, and pay-yourself-account, create a “tax account”.

What must go in tax account?

As a rule of thumb, transfer at least 12% of your income to tax account.

Example: Suppose your monthly paycheck is Rs.50,000. Transfer Rs.6,000 (12%) to tax account.

As the income grows, the transfer percentage must also grow.

Just for example, when income is:

- < 75,000 – 15%

- < 100,000 – 20%

- > 100,000 – 30%

What is the objective? To remain tax-ready, always.

Being tax-ready does not only mean keeping money in tax account. Needful tax must also be paid on time.

As per income tax rules, all due taxes must be paid in advance.

For a salaried person (individual) in India, it is mandatory to pay tax within the following schedule:

- 15th_Sep – 30% of total tax due.

- 15th_Dec – 60% of total tax due.

- 15th_Mar – 100% of total tax due.

If ones tax account has sufficient funds, following this payment schedule will be a piece of cake.

But what is the point? How tax payment can make a person rich?

Yes, there is a very important correlation. Lets read further…

Tax Evasion:

We have this concept that, rich people find ways to evade tax.

Hence they pay less than what’s actually due.

Tax evasion is a crime. Over a period of time, it starts to get onto ones nerves.

Probably tax-evasion is not as big a problem as its psychological impact on the evaders mind (rich or poor).

A salaried person already has too much on his/her plate. Why to add more by evading taxes.

Let government take what is due, and have your piece of mind.

This “piece of mind” can work wonders for us.

It will enable us to focus on right things like, how to become rich, instead of focusing on tax evasion tricks.

Tax Savings:

We cannot evade tax. But tax can be saved.

There are several lawful ways in which we can reduce our tax liability.

Government allow us to reduce tax liability in following ways:

- Investin certain things and claim tax deduction.

- Spendon certain things and claim tax deduction.

Few examples are as below:

- Investing: EPF, PPF, NSC, FD, ELSS etc.

- Spending: Life insurance, medical insurance, home loan, etc.

But remember that “investment” and “spending”, to save tax, should not be done from tax account.

This requirement will be managed from elsewhere.

Savings in tax account must be used only to pay advance tax.

If this account is overflowing with money, enjoy watching it. But do not touch it till you are rich.

So, you are actually beginning to think like a business man.

You are not only investing to improve your skills, but is also contributing to the nation by paying the due taxes.

What’s next? Lets play some investment game.

#2.3 Invest Money

The balance money must be used for investment.

Why to invest money? For the following objectives:

- Financial independence.

- Capital Appreciation Fund.

- Income generation.

Yes, it is important to bifurcate the money meant for “investment” into 3 heads.

One, dedicated for Financial independence.

Second, dedicated for earning capital appreciation.

Third, focused on buying income generating assets.

Bifurcating funds like this, will help one to take care of all priorities of life. How?

Lets read more…

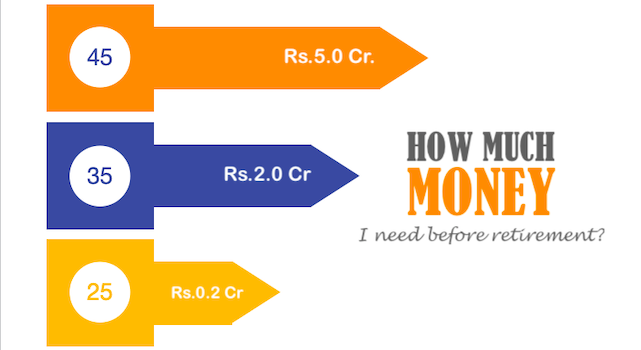

#2.3.1 Financial independence fund

This will ensure a decent standard of living after retirement.

How to build financial independence fund?

One can invest in the following investment options (example):

- Employee provident fund (EPF).

- Employee Pension Scheme (EPS).

- Balanced Mutual Fund.

[P.Note: “Retirement savings” plus “income generation fund” together will give financial independence]

#2.3.2 Capital Appreciation fund

This will ensure availability of funds for managing certain priorities of life like:

- Downpayment for home.

- Car purchase.

- Higher Education for child.

- Child’s marriage etc.

How to build capital appreciation fund?

One can invest in the following investment options depending upon the available time horizon:

- Short Term Goals (< 3 years):

- Medium Term Goals (< 7 years):

- Balanced Mutual Funds.

- ELSS

- Long Term Goals (> 7 years):

#2.3.3 Income generation fund

This is where the “Rich people” kills it.

People who are rich, has a huge asset base. These are all “income generating assets”.

There is a difference between “asset” & “income generating asset”.

Assets can do 2 things for us:

- The can provide capital appreciation.

- They can generate regular income.

Assets which generate regular income are called “income generating assets”.

To become rich, we must have loads of income generating assets in our investment portfolio.

The income from these assets supports the “standard of living” of rich people.

So if you thought that rich people lead a lavish life because they have high paycheck, then you were wrong.

They live a lavish life, thanks to the passive income coming from their “income generating assets”.

Its their passive income that let them do the following human things:

- Pay bills.

- Buy groceries.

- Pay fees.

- Fuel car.

- Pay EMI’s.

- Buy vacations.

- Shopping etc.

[Read about source of income of rich people and passive income ideas here]

Conclusion

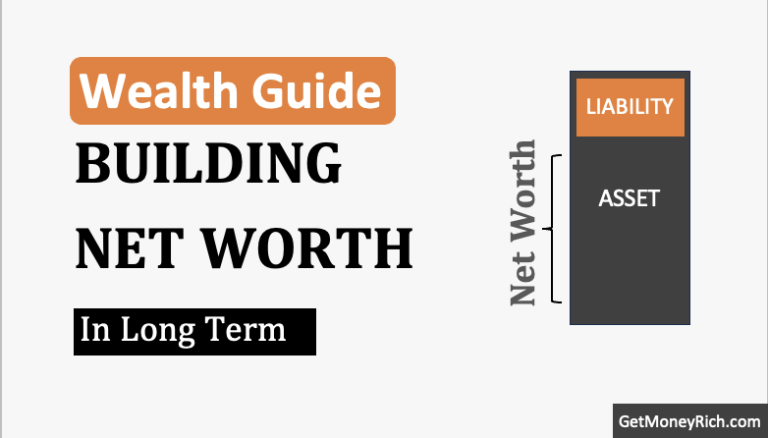

How can a salaried person become rich? By handling money in a smart way.

What is the smart way?

- Invest in yourself (business).

- Pay your taxes.

- Protect your retirement.

- Manage other goals.

- Have loads of income generating assets.

To become rich, one must divert ones income to buy “income generating assets”.

These assets in turn will generate passive income.

The bigger is the passive income, the richer is the person.

Important: Rich people (like Warren Buffett), they do not overspend.

Yes, it is true. They may seem to be living a lavish lifestyle, but they do it as they can afford it.

Number one rule for becoming rich is to first stop overspending money.

If one can do this, balance all will begin to fall in place.

Have a happy investing.

![How Wealth Accelerates After Reaching One Crore [Compounding]](https://ourwealthinsights.com/wp-content/uploads/2024/09/How-Wealth-Accelerates-After-Reaching-One-Crore-Thumbnail-768x443.png)