Zee Media Corp. is a company which is in the business of TV news broadcasting. Main channels which comes under the umbrella of Zee Media are: Zee News, Zee Business etc. In totality, Zee Media owns 10 such TV channels.

Why Zee Media Stock?

Report generated on my stock analysis worksheet.

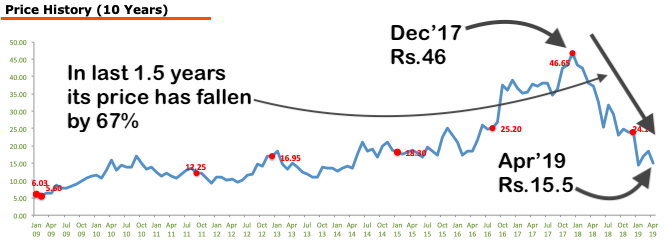

Above what you can see is last 10 years price history of Zee Media. What makes Zee Media’s stock interesting, is its last 1.5 years price pattern.

In last 1.5 years (since Dec’17), the market price of Zee Media stocks has fallen by 67% (from Rs.46 to Rs.15). Almost all Zee Group companies are facing similar problems. What could be the reason for the price fall?

The reason is attributable to the investments made by the group. They invested aggressively in infra sector, and also acquired Videocon’s D2H service. Though the logic behind these investment were not wrong, but the IL&FS crisis did not help.

So it is clear that, what triggered the price fall. But was it justified? To answer this question, let me give you some numbers.

Zee Media – Recent Performance

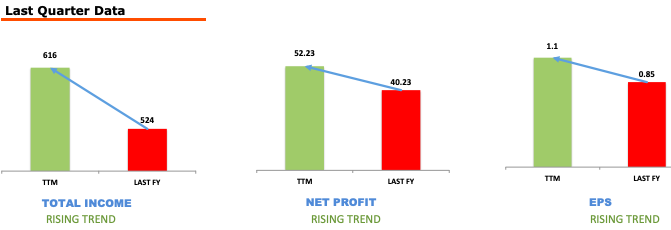

These are the trailing twelve months (TTM) figures for Zee Media:

Report generated on my stock analysis worksheet.

| Description | Last FY | TTM | Growth |

| Total Income (Rs.Cr.) | 524 | 616 | 17.6% |

| PAT (Rs.Cr.) | 40.23 | 52.23 | 29.8% |

| EPS (Rs.) | 0.85 | 1.1 | 29.4% |

Income, net profit and EPS – all three has grown at fantastic rates in last 12 months. But the price of Zee media stock is still falling. This is not a normal behaviour.

If we want to look deeper into the business fundamental, let’s see its profitability numbers. In last 3 years, net profit of Zee Media has increased from Rs.38.19 (Mar’17) to Rs.52.23 (TTM Dec’18). This is growth rate of 16.9% p.a.

The profitability margins of Zee Media has almost held itself in last 12 months.

Report generated on my stock analysis worksheet.

What I mean to say is that, from business fundamentals side, I do not see a major shift which can cause the share price of Zee Media to correct itself so drastically (falling by 67%) in last 1.5 years.

What does it mean? This is a good hint that the current share price (of Rs.15) of Zee Media may be trading at undervalued price levels.

Detailed Stock Analysis of Zee Media…

Report generated on my stock analysis worksheet.

I use my stock analysis worksheet to do the number crunching of my potential stocks. Zee Media was one of those stocks which I have kept in my watchlist for some time now.

After this stock has corrected itself by more than 67% in last 1.5 years, I was expecting more from this stock. Frankly speaking, I was almost sure that my stock analysis worksheet will give it a thumbs up. But the outcome was not as per my expectation.

What kind of thumbs-up I was expecting?

- Undervalued Price: This happens when current price of a stock is below its estimated intrinsic value. But in case of Zee Media, my worksheet has estimated its intrinsic value as Rs.10.2 against its current market price of Rs.15.

- Overall Score: For a stock to get a thumbs-up, it must achieve an overall score of 85%+. But Zee Media could fetch only 72.5%.

Why this deviation from my expectation? My stock analysis worksheet gives lot of weightage to the last 10 years performance (specially EPS and PAT). In this time horizon the growth rates shown by Zee Media has been as below:

| Description | Mar’09 | TTM | 10Y Growth |

| EPS (Rs.) | 1.55 | 1.1 | -3.4% |

| PAT (Rs.Cr.) | 37.09 | 52.23 | 3.5% |

My high expectations from Zee Media is based on its last 3 years data, which is encouraging. But my stock analysis worksheet looks at a much bigger data base.

It analyses performance of companies based on its last 10 years data. In this time period, Zee Media’s performance has been below average.

So what we can conclude from here?

Conclusion…

Though my stock analysis worksheet is not giving a thumb-up to Zee Media but we cannot ignore the correction of 67% in last 1.5 years.

Moreover, the whole Zee Group company stocks are under pressure. I presume that, after the next Loksabha Election results in May’19, Zee shares will further improve.

The business fundamentals of Zee Media looks be on the right footing. Its reserves, net profits, margins has only been improving in last 5-7 years.

I will continue to keep Zee Media in my watchlist, and any further correction will make it an even more likeable stock.

My personal estimation is that, Zee Media’s stock price will go up by at least 15-20% in next 6-12 months.

| Date | Advisor | Buy Price | Target | Time Horizon | Upside |

| 17-Oct-18 | Prabhudas Lilladher | 26 | 39 | 12 months | 50.00% |

| 17-Oct-18 | ICICI Direct | 26 | 33 | 12 months | 26.92% |

| 25-Jan-18 | Prabhudas Lilladher | 22 | 38 | 12 months | 72.73% |

Any update on the Zee media? Its CMP is 5.25..

Money pro (Money control ) has recommended to buy NALCO share

I honestly feel zee and all dth services may have tough times ahead, thanks to Jio. It may soon have a major impact on the TV industry just like it had on telecom.

Mani, what is your view ?

I feel the impact of affordable, high internet speed, will be more obvious in couple of years from now. But talking about DTH, it downfall has begun. Unfortunately it is not so triggered by the Airtel/Vodafone/Jio as it is done by the new “TRAI” rule (applicable from Dec’18). Moreover, when services like Netflix and Amazon continue to provide contents like they are doing, DTH has tough days ahead.

Dear Mani

I read your all watch list stocks, for layman like me it was very interesting to read all analysis. I have been regular reader on stock market, but your analysis is quite interesting and convincing . On the basis of your analysis, today I bought Hindustan Zinc, Venkey and Navinflourine. Keep up with your suggestions it helps us lot, In due course if you get time please share your views on Indo count industries. Lot of thanks

Hi Mani,

I red almost all posts from this site, very impressive and eye openers. Good Job, Keep posting.

I am planning to buy stock analysis sheet, but I have office 2007 versions, is your sheet supports 2007 Version office/Excel.

Thanks ,

Sivaprasad

Hi, thanks for asking. I’m not so sure about it, but I don’t think there should be an issue because the user only needs to copy and paste the data. Even at the backend there are only excel formulas running (no macros or VBA)

Hi Mani,

I purchased and started using Analysis Sheet, it’ working perfectly no version restrictions.

Thanks!!

What I liked about this article and approach 1. You use a mathematical model and that definitely gives an indicator. 2.You also have expressed your personal judgement that is also needed 3. with both you are doing deep diving to see what can be better rather than blindly judging one way or other by moving to watch list… A recommended approach for analysis particularly needed for beginner . Glad I purchased your products. Best investment I have ever made for share market!!!

I/m glad that you liked the work. These are the kind of feedbacks which keeps the bloggers motivated. Thanks, it means a lot.

Hi Mani,

How can this stock be good? The company has pledged almost 98% of their share.

You are right. All Essel Group companies are facing this problem, because of few bad investments made by the group head. Considering that Zee media has good fundamentals, it may be in problems today, but in times to come it will bounce back. This is my personal estimation which I’ve shared on my blog.