Reverse mortgage is also a ‘home based’ loan. But it is different from our typical home loan.

The main difference is that, reverse mortgage is available only for elderly people, above 60 years of age.

In working, the reverse mortgage is just the opposite of home loan. Hence the word “Reverse” is used to name this type of loan.

In home loan, we pay EMI’s each month to bank. In reverse mortgage, we receive monthly payments from bank.

Let’s see how reverse mortgage works.

How Reverse Mortgage Works?

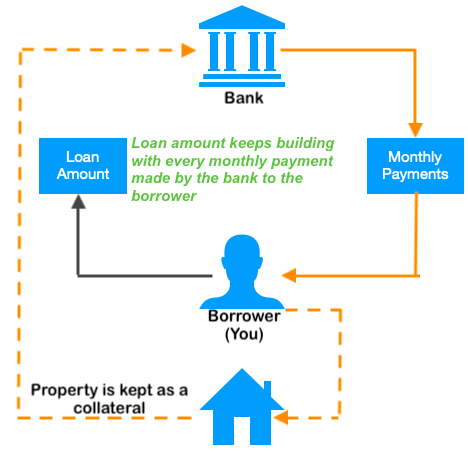

- Collateral: The bank takes the property (home) of the borrower as collateral (mortgage). Based on the valuation of the property, loan is issued to the borrower.

- Monthly Payments: Once the property is taken as a collateral, the elderly person becomes eligible for the monthly payments from the bank. Payments can also be made quarterly, annually, lump-sum based on rules, and requirement of the borrower.

- Loan Amount: On the first date of the loan disbursal, the loan balance will be zero. But upon every monthly payment, the loan amount will keep building during its entire loan tenure.

- Occupation of Property: The borrower & spouse can continue to live in the property (kept as collateral) till lifetime. Yes, they can continue to occupy it even after the loan tenure is over at no extra cost.

- Selling of Property: After the death of both the borrower and the spouse, the bank can sell the property and recover its loan dues. If there is a differential amount left after loan clearing, it must be paid to the legal heirs.

- Legal Heirs: After the death of the borrower and the spouse, their legal heirs can take possession of the property by clearing-off the loan.

Example:

Reverse mortgage can best be understood by help of an example. So allow me to take help of a hypothetical case.

Suppose Mr.Ram (59 years of age) is a government employee, who is about to retire from his job in next 3 months. He has a son who lives in USA.

During his service life, he bought a property for self-occupation in Bangalore. He currently is paying a home loan EMI for this property. The loan balance is Rs.50 lakhs.

Post retirement Mr. Ram will get the following retirement benefits:

- Rs.50 Lakhs – As lump-sum from his PF.

- Rs.10,000/month – As monthly income from his annuity (pension).

Giving priority to becoming debt free post retirement, Mr. Ram decided to use his full PF money to clear his home loan.

But after loan prepayment, Mr. Ram will be left with only Rs.10,000 per month income (from his pension fund). This was not enough. He needed more monthly income to maintain a decent lifestyle in Bangalore.

How to get more income? He decided to got for reverse mortgage.

1. Utility of Reverse Mortgage

For people like Mr.Ram, reverse mortgage is a good alternative of income generation post retirement. Hence, Mr. Ram approached his bank to enquire about reverse mortgage.

Mr. Ram’s property value at that moment of time was approx Rs.1.0 Crore.

The Bank informed Mr.Ram that, if he can keep his property as collateral, he can get a loan of 60% of property value sanctioned against reverse mortgage (Rs.60 Lakhs).

Other details provided to Mr. Ram related to reverse mortgage were as below:

- Max Loan Amount: Rs.60,00,000 (60%).

- Interest: 11% (MCLR of 9%+ 2%).

- Loan Tenure: 15 Years.

- Monthly Payments: Rs.13,000 per month.

Monthly payment is the income that Mr.Ram’s property will yield after availing reverse mortgage.

2. Calculation for Monthly Payments

Mr.Ram was ok with the Maximum loan amount, interest rates, loan tenure etc because these were as per the rules. But what he was confused about was the monthly payment.

Why he was confused?

Because of the mental calculation Mr.Ram was doing in his mind. If he took a bank loan of Rs.60 Lakhs at 11% p.a. for 15 years, he will pay the EMI of Rs.68,000 per month.

But when he is opting for reverse mortgage, he is getting only Rs.13,000 per month. Why?

| Description | Home Loan | Reverse Mortgage |

| Loan Amount | Rs.60 Lakhs | Rs.60 Lakhs |

| Loan EMI | Rs.68,000 | – |

| Monthly Income | – | Rs.13,000 |

The difference is because of the way bank’s consider the monthly payout of Rs.13,000 to Mr.Ram. They are treating it as investment. What does it mean?

Bank’s are considering that, had they invested Rs.13,000 per month in say a mutual fund SIP which yields 11% p.a. return, in 15 years their investment corpus would be Rs.60 lakhs. Check this SIP calculator here.

Hence, what the bank agree to offer (maximum) to Mr.Ram is an equivalent amount of their SIP calculation (which is Rs.13,000 per month).

3. When loan tenure ends…

Mr.Ram availed reverse mortgage for a period of 15 year. Till next 15 years, he and his spouse will continue to get the monthly payment of Rs.13,000.

What happens after the loan tenure ends? Mr.Ram will stop receiving the monthly payments, but he can still continue to occupy the property.

Even after his demise, Mrs.Ram (his spouse) can continue to live in the same property.

Banks can neither ask the borrower or the spouse to vacate the property after the lapse of loan tenure. Only after the demise of both the beneficiaries (joint borrowers), the bank can consider selling the property.

4. Property Sale

The property can be sold only after the demise of the borrower and the spouse. Who can sell the property? Only the bank.

Suppose Mr.Ram and his spouse survived for 5 more years after termination of loan tenure. In these 5 extra years, the value of loan (Rs.60 lakhs) will also appreciate @11% p.a.

The appreciated value of loan in next 5 years will be Rs.1.02 Crore.

After the demise of Mr. and Mrs. Ram, bank decided to sell the bangalore property.

The market value of the property at this point of time is say Rs.3.2 Crore (considering 6% p.a. price growth rate in 20 years).

Upon sale, the bank will take away its Rs.1.01 Crore against the loan outstanding, and the balance amount (Rs.2.18 Crore) will be paid to the legal heir of Mr.Ram (in this case his son living in USA).

In case there is no legal heir of the borrower, the banks can keep the full amount as its profit.

5. Legal Heir

It is important for Mr.Ram to declare his son as his legal heir (in his will). In case the same is not done, Mr.Ram’s son cannot make a claim on the property after the demise of his parents.

The legal heir of the property has the first right on the property, after the demise of borrower. A legal heir can do two things here:

- First: They can clear the loan balance and take possession of the property.

- Second: They can ask the bank to sell the property. Bank in turn will do it, and refund the extra amount to the legal heir as applicable.

6. Important Notes

- Loan Free Property: Mr.Ram must make the home loan balance zero to be eligible for the reverse mortgage

- Property Registration: Mr.Ram must have the property registered on his or his spouse’s name to get reverse mortgage.

- Joint Borrower: If Mr.Ram wants to include his wife as a joint borrower in Reverse Mortgage, her current age should not be below 55 years.

- Not Applicable: Banks cannot give reverse mortgage on, rented, inherited, and commercial properties. It must be a self occupied residential property. Hence, every year Mr.Ram will have to verify to the bank that he is regularly residing in that home.

- Income Tax: Monthly payments received by Mr.Ram as part of Reverse Mortgage will be tax free.

- Revaluation: Banks will do the property revaluation after every 5 years. In case the property value falls, the loan tenure (or monthly payment) may go down.

- Processing Fees: A processing fee of 1.5-2.5% will be applicable. This charge shall be born by Mr.Ram. Hence, due to the processing fee, the monthly payment of Mr.Ram will go down (only marginally).

- Property Up-keep: It will be mandatory for Mr.Ram to maintain a property insurance at his cost. Annual property tax payment will also be the responsibility of him. Mr.Ram must also take all care to maintain the health of the property.

7. Why not to consider Reverse Mortgage?

Why I am talking about “not considering“? Because this is a very important point one must know before availing reverse mortgage.

This is specially applicable for people like Mr.Ram who own a high value property and lives in a costly city like Bangalore.

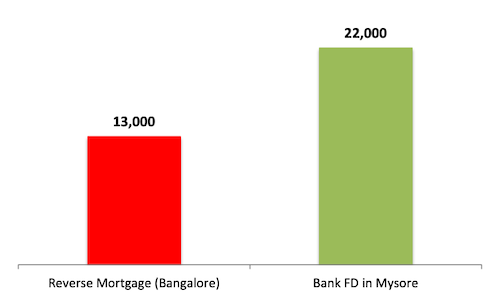

Mr.Ram wants to avail reverse mortgage, for which he is putting his property worth Rs.1.0 Crore as collateral. By doing this, he is able to earn only Rs.13,000 per month.

Now consider this, Mr.Ram has his home town in Mysore. He decides to sell his Bangalore’s property (@Rs.1.0 Crore) and buy a new property in Mysore.

A similar sized property in Mysore will cost Mr.Ram not more than Rs.55 Lakhs. After considering all cost (including relocation etc), Mr.Ram will still be left with Rs.37 Lakhs. See the working below:

- Bangalore:

- Property Value: Rs.1.0 Crore.

- Cost of Sale: Rs.5.0 Lakhs.

- Net Profit: Rs.95 Lakhs

- Mangalore:

- Property Value: Rs.55 Lakhs.

- Cost of Relocation: Rs.1.0 Lakhs.

- Other Costs: Rs.2.0 Lakhs.

- Total Cost: Rs.58 Lakhs.

- Free Cash: Rs.37 lakhs (95-58)

If Mr.Ram can put this free cash of Rs.37 Lakhs in bank’s FD @7.5% for next 10 years. His income will be more than Rs.22,000 per month.

| Description | Reverse Mortgage (Bangalore) | Bank FD in Mysore |

| Monthly Income | Rs.13,000 | Rs.22,000 |

Read more about where to invest retirement money in India.

So if Mr.Ram is ready to make the Mysore compromise, his quality of life will improve drastically. How?

- Mr.Ram is earning almost 70% higher than Bangalore.

- Cost of living in Mysore is less.

- Moreover, Mr.Ram will continue to earn Rs.22,000 per month as interest from his FD for lifetime.

- The principal amount of Rs.37 lakhs will also remain intact forever.

Conclusion

If you want to know more details about Reverse Mortgage Loan (RML) in India, I will suggest you to read these FAQ’s on RML published by National Housing Bank.

Reverse mortgage is a good scheme for elderly retired people who wants to generate some additional income.

This is also a good scheme for people who does not have the flexibility of shifting to another city (good low-cost-city for leading a quality retired life).

But for people who has this flexibility may find reverse mortgage less profitable (comparatively).

Considering that Mr.Ram is open to relocation to Mysore from Bangalore, this step will enhance his income by almost 70% as compared to Reverse Mortgage.

If I’m in a condition like Mr.Ram, I will be ready with the mindset of shifting to Mysore probably 5 years before retirement. This will make my transition smoother and devoid of any emotional troubles.

Indian banks which offer reverse mortgage are, SBI, Bank of Baroda, IDBI, United Bank of India, Axis Bank, Syndicate Bank, Central Bank of India, Indian Overseas Bank, etc.

I hope you liked this article. Please try to share your feedback in the comment section below.

thank you, sir, for giving knowledge reverse mortgage income system

it really helpful for those people who want to earn income by Reverse Mortgage especially job retired people

Hi there,

Its good to blog, write article & its equally important to give a real picture specially when one talks about “Financial Independence”. As many are layman to financial mgmt. & end up confused or stressed (for incorrect knowledge).

Yes you have shared good information.

If its okay may I add a bit:

* If property value is 1cr. then after expenses its 93lacs (& not 97lacs). One also needs to see the taxing part on sale of property (i.e. is it applicable or not?)

* It sounds good to get returns from FDs. Reality check – inflation needs to be considered, an household expense today of 10k will be high after 5, 10, 15years (at the same time FD rates are going down?) One needs to invest money wisely when they are specially looking income for monthly expenses?

I would say its very important to calculate how much will be ones future household expenses — as surely it will be more than what they incurr today.

People must be enlightened the right way, so they can think valid points & future.

There are financial professionals too (but many themselves miss important factors of being realistic about future needs/inflation). The layman in general need not panic, all it needs is recognize facts & keep tax, inflation & other applicable factors in mind & plan investments accordingly.

Hope I was able to share some value.

Regards,

Ashok

I agree with your point. It seems your knowledge on the subject in deep. Thank you for posting your opinion.

Hi Mani, thank you.

Regards,

Ashok Girnara

Thank you for enlightening me!

Hello MR. Mani,

I am a first time visitor of your blog and must mention the way you have articulated the subject is simple and intelligible.Now my queries are as follows 1) A widow who is now the owner of a flat of 35 years old flat can take the advantage of reverse mortgage or not? 2) After the death of the borrower when bank try to sell the property what is the guarantee the property price will only appreciate and if not would the legal heir be liable to pay off the loan amount taken?

(1) It is only in discretion of banks to offer Reverse Mortgage for old properties. (2) To take care of this, bank’s do the property valuation every 5 years.

Thanks for posting your queries.