If we have a credit card & we do not know how to use credit card it’s a problem. It is like not-knowing how to use a knife. To cook food use of knife is essential. But knife can also injure a person if not used properly. Similarly, improper usage of credit card can cause serious problems to ones financial health.

Suggested Reading: Utility of credit utilization ratio explained with examples.

What makes credit card usage so risky?

The risk comes from its ability to let us purchase things we can’t afford.

As a result we default while paying credit card bills at the end of the month.

But the problem does not end here.

Credit card debt is the most expensive debt.

[Earn Air Miles every time you swap your credit card]

Credit Card interest rate…

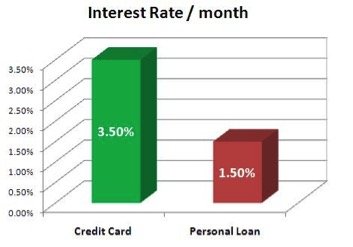

Just to gauge how expensive is credit card debt, let me give you an example.

- Personal can cost @ 14% p.a. of interest.

- Education loan can cost @ 13% p.a. of interest.

- Home loan can cost @ 10% p.a. of interest.

But if we miss to pay our credit card bill on time, interest is charged @ 36-42% per annum (3-3.5%per month).

Carrying such high interest burden should be avoided by all means.

This threat of being charged with such high interest rates makes credit card usage sound so evil.

One must learn to wisely use credit cards.

Payment of credit card bills without any default is the keyword.

In case one can’t afford to buy something, do not use the credit card.

Instead ponder on the need and if its unavoidable opt for personal loan.

One must use credit card as if it’s a debit card.

Debit card allows us to spend only that amount which is parked in your savings account.

I have seen people stacking half a dozen credit cards in their wallet.

They display cards as if its some kind of a status symbol.

But in reality it’s a financial disaster to have more than one credit card.

Please do not take me wrong, I am NOT asking you to avoid use of credit card.

I personally use credit card for almost 60% of all my expenses.

But I use credit card as one of the means to save money.

Avoid interest charged on credit card…

We must not give opportunity to credit card companies to charge interest on us.

Clearing full bill amounts within last payment date is essential.

Some people use credit card as their gateway to buy anything.

Once we fall in this trap the debt burden keeps increasing.

When credit card outstanding starts to increase, the possibility of payment-default increase further.

People fail to clear their bills within credit free period.

As a result they end-up paying astronomically high interest rates.

Credit card purchases are easy.

But this facility can really harm us if we do not know how to use credit card.

Bills must be cleared within credit free period.

But before that we must learn to treat credit card as a debit card.

[Earn Air Miles every time you swap your credit card]

How to use Credit Card without making it look evil?

- Use credit card as it if it is a debit card.

- Clear 100% dueseach money by making payments within credit free period

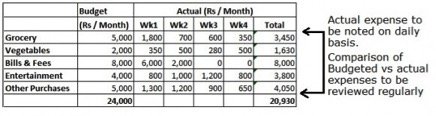

- Track all transactions made by credit card.

Track all transaction made by credit card using an excel sheet.

Before this its important to set a expense budget.

Tracking expense made by credit card and comparing it with budget will keep a check on overspending.

Generally people loose track of how much they have spent in a credit card.

Till the monthly bill is received, people go on swapping card as if its for free.

Example:

Let see an example of how credit card interest burden compounds in case of default.

There were two friends Jack and Allan.

Both had credit card debt of Rs 100,000.

Jack decided to clear dues 50% of total bill amount.

Allan decided to clear dues 80% of total bill amount.

Interest rate charged on their credit card was 3.5% per month on outstanding balances.

Lets see how such high interest rates effects Jack and Allan.

It took Jack 7 months to payback his debt of Rs.100,000.

Allan was able to clear his dues in only 4 months.

Just because Allan was making higher payments, he not only cleared debt sooner but also paid less.

In span of 7 months Jack paid Rs.3,559 extra.

Whereas Allan paid just Rs 875 extra due to interest.

| Month | Payment = 50% of Due Amount | Payment = 80% of Due Amount | |

| Credit Card Loan | Credit Card Loan | ||

| Jack | Allan | ||

| 1 | Total Balance (Principal) | 1,00,000 | 1,00,000 |

| Minimum Amount Due @5%/month | 5,000 | 5,000 | |

| Payment Made | 50,000 | 80,000 | |

| Net Balance (Principal) | 50,000 | 20,000 | |

| 2 | Interest Charged @ 3.5% per month | 1,750 | 700 |

| Credit Card Bill for Month 2 | 51,750 | 20,700 | |

| Minimum Amount Due @5%/month | 2,588 | 1,035 | |

| Payment Made | 25,875 | 16,560 | |

| Net Balance (Principal) | 25,875 | 4,140 | |

| 3 | Interest Charged @ 3.5% per month | 906 | 145 |

| Credit Card Bill for Month 3 | 26,781 | 4,285 | |

| Minimum Amount Due @5%/month | 1,339 | 214 | |

| Payment Made | 13,390 | 3,428 | |

| Net Balance (Principal) | 13,390 | 857 | |

| 4 | Interest Charged @ 3.5% per month | 469 | 30 |

| Credit Card Bill for Month 4 | 13,859 | 887 | |

| Minimum Amount Due @5%/month | 693 | 44 | |

| Payment Made | 6,929 | 887 | |

| Net Balance (Principal) | 6,929 | 0 | |

| 5 | Interest Charged @ 3.5% per month | 243 | 0 |

| Credit Card Bill for Month 4 | 7,172 | 0 | |

| Minimum Amount Due @5%/month | 359 | 0 | |

| Payment Made | 3,586 | 0 | |

| Net Balance (Principal) | 3,586 | 0 | |

| 6 | Interest Charged @ 3.5% per month | 126 | 0 |

| Credit Card Bill for Month 4 | 3,712 | 0 | |

| Minimum Amount Due @5%/month | 186 | 0 | |

| Payment Made | 1,856 | 0 | |

| Net Balance (Principal) | 1,856 | 0 | |

| 7 | Interest Charged @ 3.5% per month | 65 | 0 |

| Credit Card Bill for Month 4 | 1,921 | 0 | |

| Minimum Amount Due @5%/month | 96 | 0 | |

| Payment Made | 1,921 | 0 | |

| Net Balance (Principal) | 0 | 0 | |

| Total Interest Paid | 3,559 | 875 |

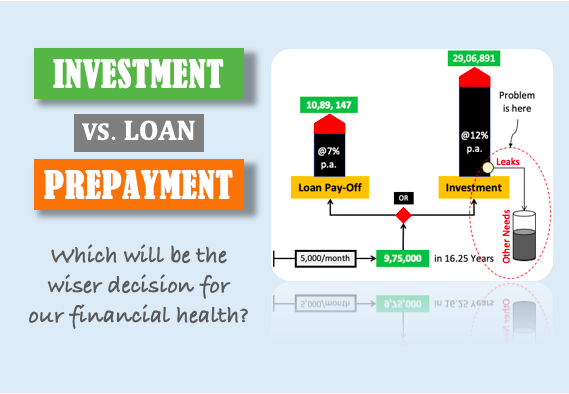

Clear Credit Card Debt before Investing…

Should we clear credit card bill or invest money in shares?

What rate of return you one can expect from stock investment?

Stocks market can give an average return of 12%.

On one hand we have an investment which earns returns of 12% per annum.

On other hand we have credit card debt which is costing interest of 42% per annum.

Look at the interest rates charged by credit card (42%) and return from stocks (12%).

Its a simple mathematics will tells us to clear credit card debt first.

Pay off your credit card debt before investing in stocks or mutual funds.

[Earn Air Miles every time you swap your credit card]

Conclusion

Never allow interest to be levied on credit card dues.

Pay all debts within the credit free period.

If at all you decide to carry forward the debt, take care to pay it off in first 2-3 months.

This will save a lot on interest.

But why you shall use credit card debt at all when you have a cheaper option of personal loan?

Credit card charges astronomical interest rates.

One must also remember that accumulating high credit card debt also negatively influences ones credit rating.

If one does not pay credit card bill on time it further lowers ones credit rating.

![Home Construction Loan: What is The Process To Get Such Loans [India]](https://ourwealthinsights.com/wp-content/uploads/2013/08/Home-Construction-Loan-image.jpg)