According to Robert Kiyosaki, not anyone can generate investment income.

One must first build mindset of an investor to start generating investment income

Investment income generation starts with saving money.

Saving money is as difficult as investing money.

It takes maturity and perseverance to accumulate savings.

People are psychologically drawn in the habit of needless spending.

To save money, we have to first fight this psychological disorder of needless spending habit.

Bad spending habit makes saving money so daunting.

So, before we can actually start generating investment income, we must learn to save consistently.

Few wise ways to save money is discussed in my other article.

Here we will concentrate on investment income generation.

If idea is to generate investment income. Saving money is only half-job-done.

Investing the saved money is the next step.

Like saving money, investing is also one of the most ignored trait by humans.

#1. Investment must be a priority…

Investment ignorance is trigger from the fact that money management are not taught to us in schools.

Common men’s know-how of investment is very poor.

Majority end up making only loses in investment.

If we only knew how to invest wisely, generating investment income will become easy.

Wise investment will be trigger by our financial intelligence.

Generally people invest money with objective of quick gains.

As a result they end up taking up too much risk.

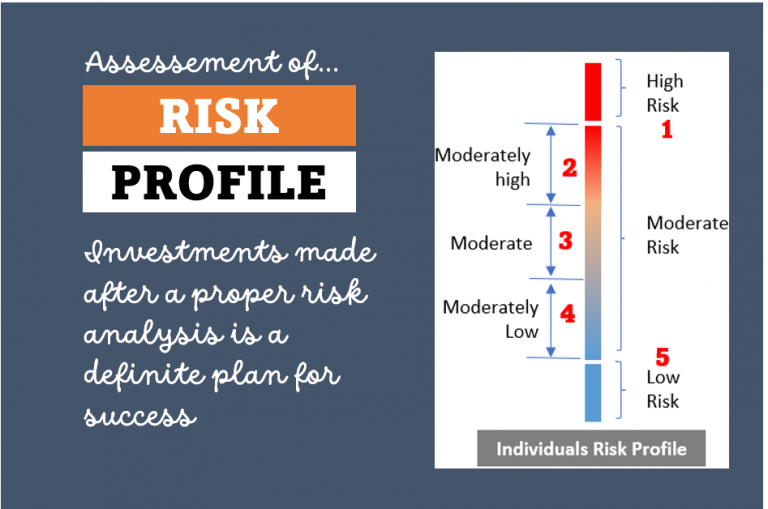

Risk taking is common in investing, but un-calculated risk must be avoided.

Low financial intelligence leads people to take weird risks which ultimately translates into losses.

My suggestion is to see investment as ‘income generating avenue’ instead of source to make ‘quick gains’.

#2. First, build mindset of an investors.

This mindset can generate more investment income.

Start thinking like an investor.

Start with a self analysis. Idea is to transform self into an investor.

Only investors mindset can generate more investment income.

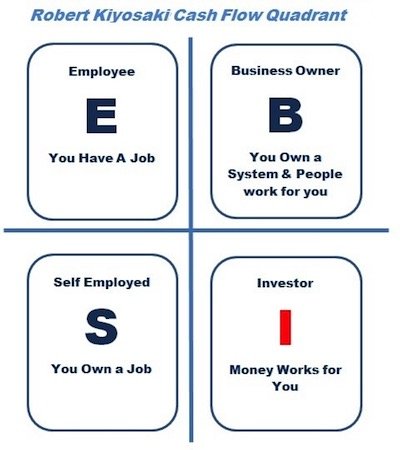

Robert Kiyosaki has categorised people in 4 broad categories.

Categorisation has been on the basic of how people generates income for themselves.

Most people like me and you has mindset like QUADRANT E & S.

People in quadrant E&S hopes to generate income like QUADRANT I.

But this will not happen unless we start thinking like quadrant I.

There is no alternative.

#2.1 About Quadrant E:

In this quadrant there are those people who are Employees.

In our schools we are only taught to be in Kiyosaki’s quadrant ‘E’.

We study hard to become a good employee.

Then we join a good job with purpose of earning a handsome salary.

We only feel secure in life if we are living in quadrant E.

Even our parents tell us that the best way to can generate income is by doing a job.

In today’s world what we know about generating income as:

“…going to good business school and entering a great job...”

Our society has made us believe that a fat salary is the only way of income generation.

But this is a big lie.

Income from job is a “easy way” not the “only way”.

#2.2 About Quadrant S:

In this quadrant there are those people who are Specialists.

A good example of a specialist is a doctor.

A doctor can open his own clinic and sort of generate his own income.

This is one step better than employees.

In quadrant S, income is more in control of the specialist.

But in E, income is totally dependent on how you are seen by your boss/employer.

But the effort that is required to generate income in quadrant S is equivalent to E.

In both the quadrant one has to work extra hours to generate income.

#2.3 About Quadrant B:

In this quadrant there are those people who are Businessmen.

Common example of a businessmen is a owner of a machine shop, owner of retail shop etc.

These people are basically employers.

Depending on the size of business they employ people of quadrant E.

These are the people who delegate most of their jobs to Employees (E).

Generation of income is in complete control of these businessmen.

The only thing they manage themselves is is their clients.

Even though most of the activities of a Businessmen are delegated, but still they have to ‘keep a watch‘ & supervise everything.

Effort required to generate income is no less compared to E & S.

#2.4 Be in the Quadrant I:

In this quadrant there are those people who are Investors.

Majority people in this world are people of Quadrant E, S or B.

But here our talking point is Quadrant-I.

People in quadrant I generates all income from investment.

In other words they are financially independent.

The word independence is important. People of quadrant I are really free.

They do not have to struggle whole day to generate their income.

The most keeps flowing in irrespective of whether they work or not.

The money flow is effortless.

Example:

Suppose you have to travel a 50 km.

If you decide to jog this distance, probably you will take 2-3 days to cover it.

But if you take a motor bike, you will cover this distance in 1 hour.

When one jog’s energy is consumed. Our energy is scarce and limited.

There is a limit how much spend it in a day.

Even if one covers 10km jogging, but what happens after 50km? Next 2 days you will do nothing (take rest).

In Investment, idea is to cover maximum distance with little effort.

Investment income is just like that, it keeps flowing-in without you putting effort.

#3. Why to invest money?

We invest money to generate an alternative source of income.

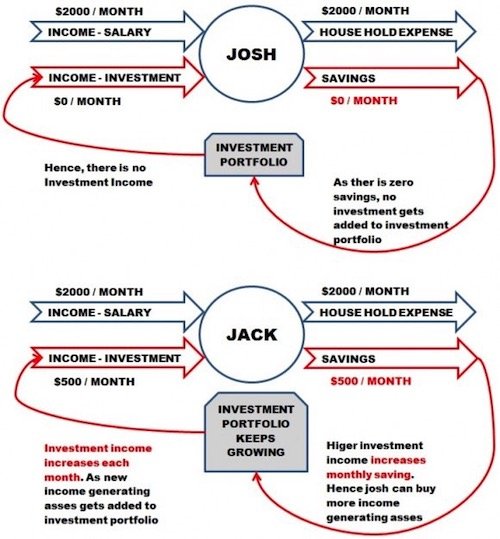

Josh is a salaried employee who earns $2000/month.

Josh pays all the expenses of his family using his earnings from job.

This way Josh is 100% dependent on his salary.

If by any chance Josh loses his job, the chances that his family will be in deep trouble is cent per cent.

Another young man Jack earns $2000/month from his job.

But during the course of his employment Jack has invested wisely.

Jack has managed to accumulate few income generating assets. These assets generate income for Jack.

His investment income is approximately $500/month.

In other words we can say that jack in only 75% dependent on salary from Job.

Unlike Josh, Jack has reduced his dependency by 25%.

The way Jack is proceeding, the days are not far when his investment income will dominate other incomes.

It is important for Jack to continue investing wisely in income generating options.

#4. What is investment income?

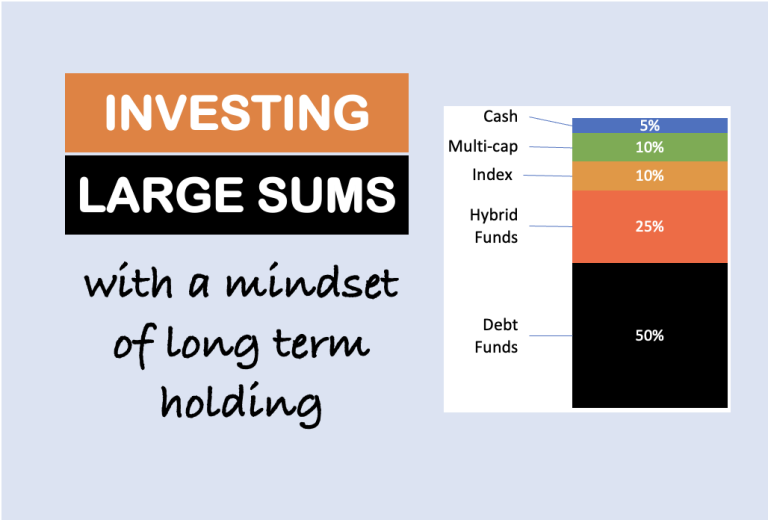

We invest money to generate streams of investment income.

By increasing investment income consequently we decrease our dependency on job.

No matter how small is present investment income, bigger goal shall be to go on increasing it month after month.

Let us see what type of income can be classified as investment income.

There are 5 types of investment income:

- Income in form of Interest,

- Dividend/Rental,

- Capital Appreciation and (

- Income Tax Reliefs.

Majority of us buy investments only for getting tax relief.

Some people also buy investment for interest income.

Less people practice investment to earn dividend/Rental income and for capital appreciation.

Even less can practice it profitably.

#4.1 Income in form of Interest

Debt linked options has potential to generate investment income in form of interest.

Interest income from debt linked options are small as compared to other options.

But why interest income is small compared to other options?

In order to understand this we shall ask a simple question.

Why interest is paid to investors who buy debt linked investments?

When we do not invest we either:

- Spend it or

- Keep the money in savings account.

Spent money is lost, we can do nothing about it.

But in savings account we can earn interest @ 4% per annum.

By buying debt linked investment we are selecting not to keep money in savings account.

It means we are agreeing to compromise on our liquidity.

Investors must be compensated for the compromise they are making.

Interest is the compensation paid to investors.

Suppose one is investing in Banks Fixed Deposits.

Interests offered on banks fixed deposits are close to 7.5% per annum.

Which means that risk compensation provided to investors is 3.5%.

Risk Free Interest (4%) + Risk Compensation (3.5%) = Actual Interest Earned (7.5%) risk compensation.

The same logic applies for all types of investment option.

In debt linked investment options risk compensation is smaller.

This is because investors are exposed to comparatively lower risk levels.

In debt linked option one can assume that the interest rates will always be slightly lower than average rate of inflation.

Debt linked options will can never beat inflation.

Most frequently use debt linked investment option are:

- Recurring deposits, Fixed deposits,

- National savings certificates,

- Debt linked mutual funds,

- Life insurance schemes,

- Company deposits etc.

Debt linked option are for those investors who are risk averse.

The income generated from debt linked investments are most predictable.

#4.2 Income in form of Dividend /Rent

Companies pay dividends to its shareholders.

Profits are shared with shareholders in form dividends.

Shareholders are like owners of the companies, so they are entitled for profit sharing.

But not all companies pay dividends.

And if at all they pay dividends, the yield is small.

On an average dividend income is close to 2% per annum.

In order to maximise dividend income, investors must select stocks carefully.

For dividend income we should select only those stocks that pay dividends to shareholders.

But it is also important to increase dividend yield.

Suppose you bought a share at $10 per share. The company pays you $0.5 as dividend income.

It means your dividend yield is 5%.

Assuming that the same stock I bought for $15 per share.

In this case dividend yield for me will be 3.3%.

So the lower the price we pay to buy a dividend paying stock the higher will be the dividend yield.

As a dividend investor our target shall be select those stocks whose dividend yield is equal to interest offered by debt linked options.

A similar parallel can be drawn about residential property investment.

#4.2.1 Real Estate Property:

Like stocks, owning a residential property also generates investment income in form of rent.

Unlike interest income which is fixed, dividend & rental income grows with time.

Investors shall target quality stock & value property.

Consistent dividends & rental income will be generated automatically.

Investors must also keep a check that they buy stocks & properties NOT a overvalued price levels.

If stocks / property is overvalued its Dividend / Rental yield will be too low.

Such assets are not interesting for qualified investors.

#4.3 Income in form of Capital Appreciation

Investors are passionate about capital appreciation.

I am still to find a investor who invest in stocks with no liking for capital appreciation.

But capital appreciation as income generation option is very risky.

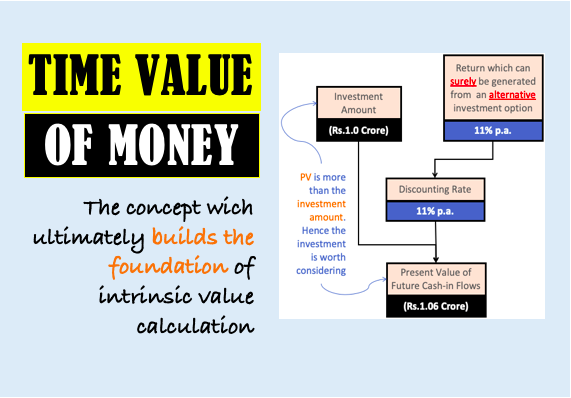

When people invests $1 and expect it to become $2 in certain time is capital appreciation.

Value investors aims at buying stocks which gives both dividend income and long term capital appreciation.

The word long term is very important when it comes to ‘capital appreciation’.

It is wrong to assume that the market price of stocks will always appreciate.

If we see history, people have lost fortunes by making this false assumption.

Growth stocks is my suggestion to earn fast capital appreciation.

We must learn to use key technical/fundamental indicators like:

- EPS growth rate,

- P/E,

- P/B,

- PEG ratio etc.

EPS growth rate & PEG is most important for growth investors.

Growth investors shall keep a close watch at the EPS growth rate of stocks.

If a EPS is growing, you can rest assured that the market price will also appreciate in long term.

But a check must be kept on P/E ratio.

If price earning ratio (P/E) is too high then it means that the stock is overpriced.

Buying a overpriced stocks is not good.

So investors must use the value indicator called as PEG ratio.

PEG =P/E divided by EPS growth rate.

If PEG ratio is less than 1.2, it means the stock is a good long term buy from point of view of capital appreciation.

Equity:

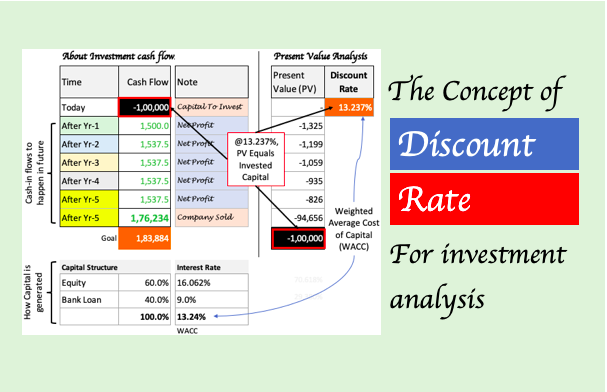

When a person invests in equity (stocks), he is compensated for this investment risk.

Equity investing is most risky.

Hence investors demands maximum risk compensation in equity.

In equity investing investors are compensated for their risks in two ways.

First they are paid dividends and secondly they are compensated by capital appreciation.

On an average, a combination of dividend plus capital appreciation for any stock shall compensate for the risk taken.

Risk compensation shall be close to 8%-10% per annum.

#4.4 Income in form of Tax Saving

Almost all governments across the world encourage people to invest their money.

Giving income tax rebates to people on account of investment is very common.

Like in India these days people get good tax rebate if they invest in long term infrastructure bonds.

Similarly people who are investing in long term retirement plans are rewarded with decent interest rates and tax exceptions.

Probably it is advisable that people must first save their tax.

Only then start investing in debt linked and equity linked schemes.

Conclusion

For investors it is very important to focus on how to generate investment income.

For investors is important to see investment as income generating option.

Today majority of us see investment as only means of ‘buying low and selling high’.

Accumulating savings is only half battle won.

Investing savings in such a way that start generating income for you is ideal.

Long term investors shall invest in equity with the following objectives:

- Maximising their dividend income and,

- To get long term capital appreciation