Investing & speculation are two different strategies used in the stock market. Investing is a long-term approach that focuses on the fundamentals of a company. While speculation is a short-term approach that focuses on market trends and technical indicators. Which strategy, stock investing or speculation, is best for long-term investors? For quick answers, read the FAQs.

Introduction

Investing in the stock market is one of the most popular ways to grow wealth over the long term. However, not all strategies are created equal. Two of the most common approaches to investing in stocks are investing and speculation. Both can potentially yield high returns, but they differ significantly in their approach, mindset, and risk profile. In this article, we’ll take a closer look at stock investing versus speculation to help long-term investors determine which strategy is best for them.

At a basic level, stock investing involves purchasing shares of companies with the expectation of profiting from their future growth and earnings.

- Investing typically involves a longer-term approach, as investors focus on the underlying fundamentals of the companies they invest in. The fundamentals can be revenue, profits, and cash flows. Others factors such as industry trends and management quality are also counted as fundamental factors. Investing involves taking a conservative approach to the risk of loss as investors aim to minimize downside risk while capturing long-term upside potential.

- Speculation, on the other hand, involves purchasing stocks with the hope of profiting from short-term price fluctuations. Speculators often focus on market trends, momentum, and other technical indicators, rather than the underlying fundamentals of the company. Speculation can lead to higher returns in the short term, but it also comes with higher risks, as the market can be unpredictable and volatile.

In this article, we’ll explore the key differences between stock investing and speculation. I’ll try to make my point using real-life examples.

Video

Difference Between Stock Investing & Speculation

| Attributes | Stock Investing | Stock Speculation |

|---|---|---|

| Purpose | To buy and hold shares of a company for a long-term period, with the expectation of earning dividends and capital appreciation | To make quick profits by buying and selling shares in the short term, benefitting from the current price momentum |

| Time Horizon | Long-term investment horizon (years or decades) | Short-term investment horizon (days or weeks) |

| Risk | Generally considered to be a lower-risk investment strategy, with more predictable returns | Higher risk, as the best is on market fluctuations and price momentum |

| Strategy | Focuses on researching and analyzing a company’s fundamentals and long-term prospects before investing | Relies heavily on technical analysis of price movements, trading volumes, and moving averages. |

| Returns | Generally provides steady and consistent returns over a longer period of time | Returns can be highly volatile and unpredictable |

| Fees/Cost | Comparatively lower as the strategy is to buy and hold stocks for the long term | Involve higher fees, as frequent buying and selling can result in increased transaction costs |

| Tax Implications | Long-term capital gains tax rates are typically lower than short-term capital gains tax rates | Short-term gains are taxed at a higher rate, reducing the overall returns |

| Advantages | Provides an opportunity to build long-term wealth and earn steady returns, with lower risk and fewer fees | Decision-making is comparatively easier as the main focus is only on the price movements |

| Power of Compounding | Present | Absent |

Overall, stock investing provides an opportunity for investors to build long-term wealth and earn steady returns. Investing also offers lower risk and fewer fees than stock speculation. By opting to invest, one’s focus is on research and analysis of a company’s fundamentals and long-term prospects. Hence, investors can avoid the risks associated with short-term speculation, and reduce the potential for emotional decisions often triggered by market fluctuations.

Examples: Motivating Long Term Investors

Here are a few real-life examples long term weal creation through long-term investing.

Warren Buffett

Warren Buffett is considered one of the greatest stock investors of all time, and his company Berkshire Hathaway has a long track record of success in the stock market. Berkshire Hathaway’s investment philosophy is based on buying and holding shares for the long term. It focuses on fundamental analysis and a deep understanding of a company’s business model and management team. This approach has led to significant long-term wealth creation for Berkshire Hathaway shareholders.

Rakesh Jhunjhunwala

Jhunjhunwala is an Indian investor who is often referred to as the “Warren Buffett of India.” He has made his fortune by investing in stocks for the long term, focusing on companies with strong fundamentals and growth potential. He is a major shareholder in Indian companies, including Titan, Star Health, Tata Motors, and Crisil, and his net worth is estimated at over $5.8 billion (Forbes).

Radhakishan Damani

Damani is an Indian investor and founder of the retail chain D-Mart. He is known for his long-term investment approach and focus on value investing. He has invested in several Indian companies, including VST Industries, Sundaram Finance, India Cements, Mangalam Organics, and BF Utilities. His net worth is estimated at over $27.6 billion (Forbes).

Vijay Kedia

Kedia is an Indian investor who has made a name for himself by investing in small-cap and mid-cap stocks for the long term. He is a major shareholder in several Indian companies, including Tejas Networks, Vaibhav Global, Elecon Engineering, Cera Sanitaryware, and Mahindra Holidays. Know more about him here.

Porinju Veliyath

Porinju Veliyath is an Indian investor and founder of the Equity Intelligence India Fund. He is known for his contrarian investment approach and focus on small-cap and mid-cap stocks. He’s invested in several Indian companies, including Geojit finance, Sarda Plywood, KCP Sugar, and Premier Explosives. He has an impressive track record as a long-term investor.

Dolly Khanna

Dolly Khanna is an Indian investor who has made a name for herself by investing in small-cap and mid-cap stocks for the long term. She is a major shareholder in several Indian companies, including Chennai Petrochecm, Monte Carlo, KCP Ltd, and Nitin Spinners. Her net worth is about Rs.215 crores. She is one of the successful long-term investors in India.

Raamdeo Agrawal

Ramdeo Agrawal is an Indian investor and founder of Motilal Oswal Financial Services. He is known for his focus on quality businesses and long-term investment approach. He has invested in several Indian companies, including Hero MotoCorp, HDFC Bank, and Lupin.

Examples: Drawbacks of Speculation

Here are three real-life examples of stock speculation that highlight its drawbacks over long-term stock investing:

- The dot-com bubble of the late 1990s: During this time, many investors speculated on internet-related stocks, driving their prices to unsustainable levels. When the bubble burst in 2000, many of these companies went bankrupt, causing significant losses for those who had speculated on their stocks.

- The housing bubble of the mid-2000s: Many investors speculated on real estate, driving up housing prices to unsustainable levels. When the housing bubble burst in 2008, it led to a global financial crisis that caused significant losses for many investors who had speculated on real estate.

- Kingfisher Airlines: It was a popular airline in India, but it had weak fundamentals, with high levels of debt and losses. However, investors continued to speculate on its stock for quick profits. The stock price eventually crashed, and the company went bankrupt.

- Reliance Communications: It was once a leading telecom company in India, but it faced intense competition and had weak financials. Despite this, investors continued to speculate on the stock, hoping for quick profits. However, the company eventually defaulted on its debt and went bankrupt.

- Suzlon Energy: It is a wind turbine manufacturer in India, but it had weak financials, with high levels of debt and losses. However, investors continued to speculate on the stock, hoping for quick profits. The stock eventually crashed, and the company went through a debt restructuring process.

These examples highlight the risks of stock speculation, where investors ignore the weak fundamentals of a company. When the focus is on short-term price movements, ignoring weak fundamentals, it is a recipe for a loss. It is essential for investors to consider the long-term prospects and fundamentals of a company before investing in stocks.

Role of Fundamental & Technical Analysis in Stock Investing & speculation

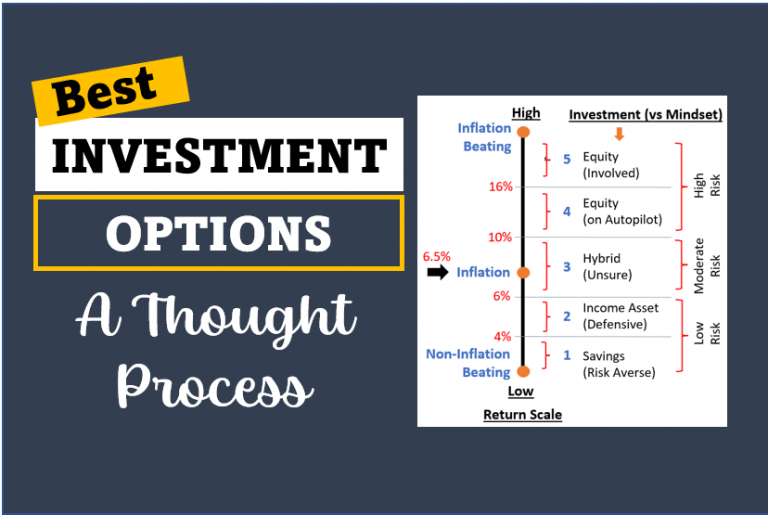

Fundamental and technical analysis are two common methods used by investors and traders to make decisions on which stocks to buy or sell. Fundamental analysis involves evaluating a company’s financial health, including its revenue, profits, debt levels, management team, and growth potential. Read more about the method to render an Overall Score of companies/stocks.

On the other hand, technical analysis involves analyzing charts and patterns to identify trends and make predictions about future stock prices.

- In stock investing, fundamental analysis is generally considered more important than technical analysis. Why? Because it helps investors determine the intrinsic value of a company and make informed decisions about whether to buy or sell a stock. For example, if an investor were considering investing in the Indian technology company Infosys, they might examine the company’s financial statements to evaluate its profitability and growth potential.

- In contrast, stock speculation often relies heavily on technical analysis, as traders are more interested in short-term price movements than a company’s long-term financial health. One example of this is the use of chart patterns to identify potential buying or selling opportunities.

However, it’s important to note that both fundamental and technical analysis have their limitations and cannot predict future stock prices with certainty. Hence investors can use a combination of both methods to conduct thorough research before making investments.

Supulators Lose On The Power of Compounding

An investor who is speculating in stocks typically buys and sells stocks frequently in an attempt to make quick profits. However, this approach can lead to the investor missing out on the power of compounding, which is the ability of an investment to generate earnings on its earnings over time.

For example, let’s say an investor purchases stock in Company A for Rs. 10,000 and sells it a year later for Rs. 12,000, making a profit of Rs. 2,000. The investor then uses that Rs. 12,000 to purchase stock in Company B, which they sell a year later for Rs. 14,000, making another Rs. 2,000 profit. If the investor continues this pattern of buying and selling stocks for short-term gains, they may end up with a series of small profits, but they won’t benefit from the power of compounding.

In contrast, an investor who takes a long-term approach to stock investing, and continues to stay invested, can benefit greatly from compounding. For instance, suppose in the above example, company A is Britannia Industries. The same investor had invested Rs.10,000 in Britannia and left it to grow for 17 years (Apr’2006 to Feb’2023). The average annual rate at which Britannia’s stocks grew in this period was 20.69%. In these 17 years, the investment size would have grown to Rs.2,37,606 due to the power of compounding.

Therefore, speculating in stocks may provide short-term gains, but it can prevent an investor from reaping the long-term benefits of compounding.

The impact of fees and taxes on long-term returns for stock investments vs speculation.

Here are a few examples to illustrate the impact of fees and taxes on long-term returns for stock investments versus speculation. I will use the example of a mutual fund to exemplify the explanation.

- Transaction Cost: Let’s say you invest Rs.10 Lakhs in a mutual fund with an expense ratio of 1%. If the fund earns an average of 10% annually for 30 years, you would end up with around Rs.1.48 Crores. However, if you had invested in a fund with an expense ratio of 0.5%, you would end up with around Rs.1.72 Crores. Over time, these fees can significantly impact your long-term returns. Likewise, speculators pay a lot more in transaction costs compared to long-term investors.

- Brokerage Fees: When you buy or sell stocks, you typically pay a brokerage fee. For example, let’s say you buy Rs.1,00,000 worth of stocks and pay a brokerage fee of 0.5%. That’s Rs.500 that you have to pay upfront. If you sell the stocks later for Rs.1,50,000, you will have to pay another Rs.750 as brokerage fees. Such fees can eat into your profits every time the share is traded. Speculators trade more frequently than investors.

- Short-Term Capital Gains Tax: If you speculate on stocks and frequently buy and sell them, you may be subject to short-term capital gains tax. This tax is higher than long-term capital gains tax and can significantly reduce your returns. For example, if you make a short-term capital gain of Rs.50,000 on a stock, and you’re in the 30% tax bracket, you would have to pay Rs.15,000 as taxes. Over time, these taxes can really add up and impact your long-term returns.

Fees and taxes can have a significant impact on your long-term returns when investing in stocks. It’s important to be aware of these costs and try to minimize them as much as possible to maximize your returns.

Stock Investing and Speculation: A Psychological Perspective

From a psychological perspective, there are several differences between investing and speculating. Here are some of the main differences:

| Parameters | Investing | Speculating |

|---|---|---|

| Perspective | Long-term | Short-term |

| Focus | On fundamentals and financial performance of companies | On market trends and price momentum of stocks |

| Goal | Wealth creation through ownership in profitable companies | Quick profits through market timing and price fluctuations |

| Mindset | Requires patience and discipline | Can be driven by emotions such as fear, greed, and FOMO (fear of missing out) |

| Risk Management | Idea is to keep the risk minimum through analysis and Diversification | Thrives of Risks and Bets (Like Gambling) |

To illustrate these differences, consider the following scenario:

- An investor is considering investing in a company called XYZ Ltd. The investor takes a long-term perspective, researching the company’s financials, management, and industry trends. Based on this research, the investor decides to invest in XYZ Ltd. with the goal of creating wealth over the long term.

- A speculator may look at the same company and focus more on short-term market trends and momentum. They may buy and sell shares of XYZ Ltd. based on price fluctuations in the market or news events, with the goal of making quick profits.

Over time, the investor’s strategy may result in significant gains due to the company’s strong financial performance and steady growth. In contrast, the speculator’s approach may lead to only small gains from XYZ Ltd as a result of early profit booking.

Overall, investing and speculating involve different mindsets and approaches. But if one knows how to analyze stocks, an investing mindset can lead to great wealth-building over time.

Conclusion

The decision between stock investing and speculation ultimately comes down to an individual’s goals, risk tolerance, and investment philosophy. While speculation may offer the allure of quick profits, it comes with inherent risks and requires a significant amount of market timing and analysis. On the other hand, investing for the long term with a disciplined approach and realistic goals has been proven to create wealth and financial stability over time. By focusing on fundamental analysis, setting realistic expectations, and understanding the power of compounding, investors can reap the rewards of the stock market while minimizing risks. It’s important to remember that investing is a journey, not a race, and the rewards of patience and discipline can be life-changing.

FAQs

Stock investing involves buying stocks with the intention of holding them for a long-term period. Idea is to benefit from the growth of the company. Stock speculation involves buying and selling stocks based on short-term market fluctuations for quick profits.

Stock investing is generally considered better for long-term investors. It focuses on buying and holding stocks for extended periods. Stock speculation involves taking risks for quick profits and may result in significant losses over time. Why? Because the focus of speculation is on profiting from price momentum. For a normal retail investor, it is almost impossible to judge price momentum as multiple external factors play their roles in moving prices.

Both, investing and speculation, can utilize technical analysis. However, stock investing tends to prioritize fundamental analysis and a long-term perspective. Speculation tends to focus on short-term price movements and trading strategies that may rely more heavily on technical analysis. Ultimately, the most effective approach depends on an individual’s preference. Generally, pro-long-term investors primarily use fundamental analysis with a blend of technical analysis as well.

Some potential risks include market volatility, lack of research, and emotional decision-making. To avoid these risks, investors shall avoid speculation altogether and opt for the long-term investing strategy. The focus shall be on conducting thorough research about the stock’s underlying business. One must also avoid making decisions based on fear or greed. Additionally, a diversification strategy can help minimize the impact of losses during rough market times.

Have a happy investing.