When I was in my mid-twenties, my father advised me to start investing money. Hence, he helped me to buy my first life insurance endowment plan. In later years, I started buying mutual funds regularly through SIP route on my own.

This is the way majority invest money, right? There is nothing wrong with this approach. At least we are not needlessly spending the money. The invested money is in a way ‘saved-money’.

But only because we are buying few mutual funds, stocks etc regularly does not qualify as a ‘good investment’. Why? Because there is a process that must be followed as a part of good investment practice.

If I had to advice a beginner on how to start investing money, my suggestion will be to “follow a process“.

Investment Process

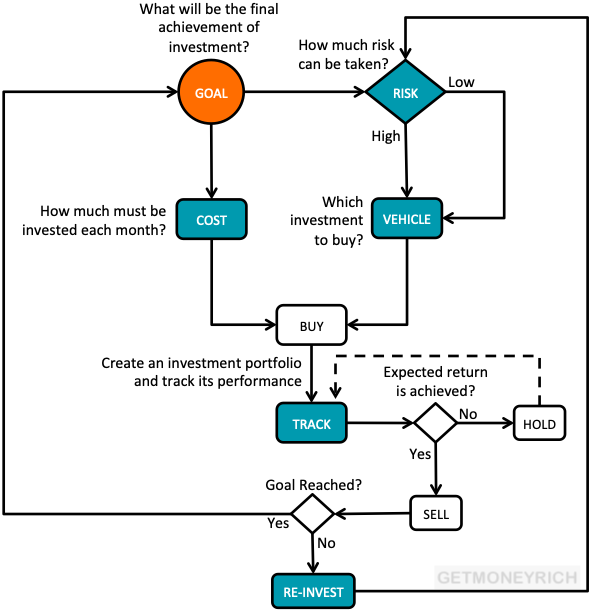

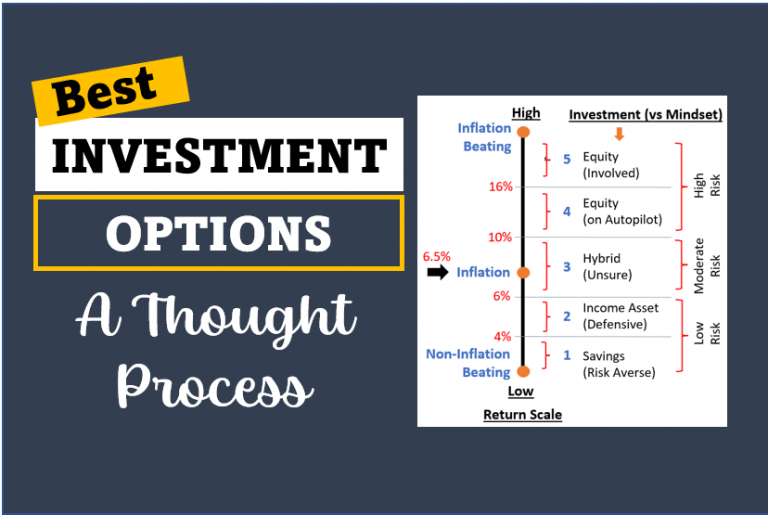

The above flow chart highlights the main steps involved in the process of investing money. You can see that ‘buying and selling’ of investments are only one of the steps. More important steps are listed below:

- Goal: Even before a single penny is invested, it is essential to identify and quantify the goal. The question that must be asked is, “why I’m investing money?” The answer should have at least two parts: (a) To build a corpus of Rs.x, and (b) Money is needed after ‘n’ number of years. So, one will invest money to build ‘Rs.x’ in ‘n’ years. This is the goal. Read more about goal based investment.

- Risk/Vehicle: Once the goal is clear, the next important step is ‘risk analysis’. As a general rule of thumb, when the goal is long term, one can invest in more risky investment vehicles like stocks, equity funds etc. When goal is short term, less risky options like balanced funds, long term debt funds etc are suitable. Read more about how to invest risk free and earn high returns.

- Cost: What will be the cost of investing? This is the monthly cost out-go from ones pocket. Suppose ones goal is to have Rs.2.5 Lakhs in next 3 years. Based on the risk profile, the person has decided that a return of 10% p.a will be enough. Hence, to build a corpus of Rs.2.5 lakhs, the person must invest Rs.6,000 per month as SIP. [Rs.6,000 per month for 3 years is the cost of investing]. Check this online SIP calculator to figure out the monthly contributions.

- Track: As important it is to buy a good investment, it is equally important to track its performance regularly. Why? Because tracking will help to ‘judge’ the right selling time. Suppose you bought stock with an expected price appreciation of say 12% in next 12 months. Upon tracking you found that 12% is reached in the first 6th month itself. So what you will do? You must sell the stock. But this is only possible if you are tracking your portfolio regularly. Read more about building stock’s portfolio tracker.

- Re-invest: Tracking suggests us when to sell our holdings. But selling may not necessarily mean that our target of ‘Rs.x’ is reached. Hence, if the target has not reached, the money must be reinvested. The focus must be on the final goal (Rs.x). In the process of reaching the goal, we may end up buying and selling few investments more than once.

This is a simple investment process. One can follow this approach and start investing money. I am sure, the long term benefits of ‘clear investment decisions’ yields more satisfaction.

Allow me to exemplify furtheron the above five (5) steps. This will help in getting a clearer perspective of how a beginner should start investing money.

1. Goal

How to finalise the goal? Look deeper into your needs. Do not concentrate only on near-term needs. Make a comprehensive list.

Once a comprehensive list is ready, sort them on the basis of priority. Goals which gets the highest priority should be selected for investment.

Example: Suppose you have finalised that you need to buy a car in next 3 years. The car will cost you Rs.10 lakhs. Hence you decide that you will take a car loan of Rs.5 lakhs and the balance, Rs.5 lakhs will be funded from your investment.

What is the goal? Building a corpus of Rs.5.0 Lakhs in next 3 years.

Like this, there will be several other priorities of life. Each priority will ask you to invest money differently. How to do it? For each priority, try to implement the decision making as shown in the above investment process flow chart. Read more about financial planning for future needs…

2. Risk/Vehicle

Before we invest our money, it is essential to understand the risks involved. Accordingly we can take a calculated risk. How to take a calculated risk? By selecting the right investment vehicle.

Example: In our example, the goal is to build a Rs.5.0 Lakhs corpus in 3 years. This is neither a long term goal, nor a short term goal. It is a medium term goal. Which is the investment vehicle which offers least risk in medium term, but also generates good returns?

We must understand here that, in India, in medium term horizon, one can easily expect a return of 10-11% from ones investment. Which is the vehicle which can assure this much return (with minimum risk of loss)? An ‘aggressive hybrid mutual fund’. These funds has a cap of 70% equity exposure.

What is the point? Note the ‘thought process’ which goes behind selecting a right investment vehicle (for a specified time period). A suitable investment vehicle will take care of the ‘risk of loss’ associated with the investment.

Tip: Depending on the available time horizon, one must pick the right investment vehicle. Read more about the types of mutual funds. It will help you pick right investments depending on the available holding time.

3. Cost

In this step, the investor will know how much he/she must invest each month to build the corpus in time.

Example: In our example, goal is to build a Rs.5.0 Lakhs corpus in 3 years. It has also been identified that a 10% p.a. returns can be expected in this holding period. Hence an ‘aggressive hybrid fund’ is selected as a suitable investment vehicle. Now the question is that, how much the investor must contribute each month to this investment (SIP)?

How to find the answer? You can use my below SIP return calculator. It will help in finding the monthly contributions necessary to build the required corpus.

To build a corpus of Rs.5.0 lakhs in 3 years @10% p.a., one must invest Rs.12,000 per month as SIP.

| Corpus to be Built (Rs.) | |

| Expected Return p.a. (%) | |

| Time (in years) |

| SIP (monthly contribution) (Rs.) |

Read more about SIP Return Calculator here.

4. Track

One of the better ways to track ones portfolio holdings is to do it online. Portfolio tracking facility provided by yahoo finance, moneycontrol, economictimes, valueresearchonline etc to track ones holdings is good.

One can also use Google Finance Attributes to track performance of stocks in ‘Google Sheets’.

Example: In our example, investment of Rs.12,000 was necessary to build a corpus of Rs.5.0 lakhs in 3 years at 10% per annum. Suppose after 1 year, you found that the hybrid fund (70% equity exposure) was giving a return of 14% per annum. What you can do? On an average, a hybrid fund generates a maximum return of 12%. Hence 14% return is like an outperformance. In this condition the investor may think to redeem and book profits.

Please note that, here the investors expectation was 10% per annum. The mutual fund was showing an actual return of 14% after one year. Hence the decision of redemption was taken.

But this decision could be taken only because the investor was tracking his/her holdings. Without tracking, such timely profit booking will not be possible.

5. Re-invest

When reinvestment should be considered? When the investor has booked profits, but target corpus has still not been built.

Example: Investing Rs.12,000 per month for 1 year at 14% p.a. will build a corpus of Rs.1.55 lakhs only. The goal is to build the corpus of Rs.5.0 Lakhs. Hence in this case, the investor must continue investing Rs.12,000/month for next 2 years. In addition to this, the redeemed amount of Rs.1.55 lakhs must also be reinvested to earn a return of < 10% per annum for next 2 years.

Timely profit booking and reinvestment is a very necessary step of the investment process. Till the goal is reached, one must continue doing the following:

- Track ones holdings,

- Book profits when necessary, and then

- Reinvest the total amount.

Conclusion

What has been explained in this article is the process of investment. Let it be a beginner or an experienced adult, anyone can use this process to practice purposeful investment.

This article is specifically more useful for those people who wants to start investing money, and is skeptical about the next steps.

This article has explained the total investment cycle from starting to end.

I hope you have found this article helpful.

Have a happy investing.

Further Reading:

Thanks for sharing

this is really amazing nd unique content sir thanks for sharing this articel really i appriceate you

thank for sharing such a helf full and lovely content sir

Thanks

Very good article for beginners who want to invest money in SIP, properly explain by taking flow chart.

Good morning. In terms of % of investment, how much of salary should go towards investment

It will be decided based on the financial goals you like to achieve through investment.

Hi, You have really explained well and easy to understand. Systematic investment plans Mutual fund SIPs or equities may be your ideal way to profit.

Very nice article for beginners who want to invest in stock market.

Thanks for sharing such a useful guide for investment.