These money facts has power to transform peoples lives.

They are not just words, but extracts from real life experiences.

How these experiences of life became facts, tells a lot about their utility.

People who follow these rules will vouch for it the thousand times.

These details would only highlight those essential facts about money that we all know well, but do not follow.

Why I say that these money facts are not told before?

I know it’s an overstatement, but even if you already know these, it must be hidden somewhere in the back of your head.

This blog post will help you re-write those money facts back into your conscious mind.

Lets begin with the top 10 money facts, and read them through the end.

Even while you are still completing the article, you will already start experiencing the change within you.

After you have finished reading, I am sure that you will no longer deal with money in the same way you have done in the past.

If I sound louder than words, then pardon me for my over reach, but I believe that these tips has great powers.

#1. Buy your first house when you are 25

At what age generally we buy our first home? At age of 35 to 40!

How about doing it 10 years earlier?

During the age of 25, generally people are in their first job. Income is less, and priorities are different.

This is the age of leading a free life with friends. Why to bother about home?

Yes its true, first job, first salary is something that people like to spend on things that they have craved since childhood.

Often boys buy motorbikes, mobile phones, gadgets etc.

A great deal of money is also spent on traveling, dinning and entertainment.

After doing all this what is left is utilized for the daily chores of life.

Where is the money to buy a house?

Its true, in that phase of life, money is always scarce. Indian parents often come in respite for help.

These are all reasons why one cannot buy first home in 25. The reasons are strong and understandable.

Many people will relate to these reasons as if these examples has been taken from their life.

But the cost of believing and adhering to these reasons is not cheap.

People who have taken this hard-step of buying their first house in 25, become millionaires by the time they are 50 years of age.

Yes, it is a tough step to take, but its benefits are unmatchable.

You need not buy a big home. Buy a small 1BHK apartment in a city that you know well.

Take help of your parents if possible to pay the 20% down-payment.

Banks will lend you the balance money as home loan.

Idea is to start paying the EMI from 25 years of age.

The reason for this being, start taking a feel of real world which you are going to face by the time you are in your late 30s.

If you buy your first home in 25, you will thank yourself million times for this decision when you are 40.

Buying first home early is one of those money facts that we know, but fail to implement as we do not want to delay our gratifications.

But when the priority of buying a home becomes unavoidable, by that time its already too late.

The same house will then cost a fortune.

So, if you have still not bought your first home, go ahead and buy it.

No matter whatever is your age (20s, 30s, 40s..), better to be late than sorry.

#2. Make 40% down-payment on loans

This statement may sound simple, but its implementation is tough.

I know, people who have recently purchased car, home etc using loans will understand the magnitude of this statement.

There will be people who might even rubbish my statement and stop reading here itself.

At the back of our minds we know that how costly it is on our personal finance to avail a debt like car loan and home loan.

But as we do not save enough, we end up taking maximum loan.

Banks will give us 80% financing to buy homes, because it is good for banks to do so. They make tonnes of money this way.

But taking 80% loan from bank is good for OUR pockets? Absolutely no.

Do we take a bank loan to buy groceries, to pay utility bills, to pay rent etc? No, because we save money for these activities.

We are aware that buying groceries, vegetables, paying utility bills & rents are priorities that cannot be compromised.

Hence we set aside a part of our income to manage these expenses.

This is what is called as saving money.

Why everyone of us save well for groceries, vegetables, bills, rents etc and not for buying a car or home?

We are better savers for those expenses that occur every day/week/month.

But it is becomes difficult for us to save for those expenses that are foreseen some time in the distant future.

This is why at times it becomes difficult for us to even pay our annual insurance premiums.

So coming back to our point of 40% down-payment on loans.

If you want to buy a car of Rs.500,000, pay Rs.200,000 from your pocket and balance from motor loan.

But from where you will get those Rs.2 lakhs? You will have to save for it from today.

Forecast when you will need a new car (say 24 months from now).

So to have Rs.200,000 after 24 months, you need to save Rs.8,300 per month from today.

Sounds tough? Yes, I know. This is why we find it difficult to save for our future needs.

But ignoring future needs will not help either. Better is to face the reality and start saving from today.

Similar strategy can be used to buy homes. Here I am talking about that second home.

The person is in 35-40 age bracket and is already earning decently compared to what he was doing when he was 25.

A person who bought the first home in 25, can sell his first property now, and the 40% down-payment for second home will will become very easy.

But if there is no first home, in that case the person needs to plan early.

Give yourself 7-10 years to save for build the down-payment fund.

This one of those money facts that has potential to change your life forever.

Ask an experienced banker how be buys homes for self.

They do not depend much on home loans to buy their home.

They will pay more than 50% as down-payment for their homes.

The trick is to plan early and start saving from today.

#3. Pay bills on time and build a good credit score

What is credit score? This is like your school’s report card.

Why credit score?

A good credit score will allow you to get cheaper loans from banks.

People who do not have good credit score find it hard to get loans in first place.

If at all they get loan, they will have to pay high interest rates.

We pay interest rates on credit card debt, education loan, personal loan, car loan, home loan etc.

Interest rate is everywhere. We cannot avoid interest rate and lead our lives these days.

Majority people in this world are paying some kind of interest all the time.

Interest payment is as an unavoidable thing as income tax payment.

So we can manage interest rates in a similar way as we manage our income tax.

Lets pay minimum interest as far as possible. How to do it?

By building a high credit score. A score in range of 750 to 900 is a good score which one must target.

How to ensure good credit score:

- (a) Never miss to pay credit card bills on time.

- (b) Do not let your EMI bounce due to lack of funds in your savings account.

- (c) Surrender unused credit cards.

- (d) Do not borrow multiple loans at a time.

- (e) Pay all your bills on time.

Building your creditworthiness is one of those money facts that every one must master very soon in life.

#4. Cut your entertainment, dinning-out and transportation bills

A research has highlighted that people are more likely to overspend on entertainment, dinning out and on their transportation bills.

When I bought my first car, in the first month the fuel bill peaked.

People who are foodie tend to overspend a lot on dinning out and ordering home delivery from outside.

Young couples tend to overspend on weekends in shopping malls for entertainment.

High earning individuals tend to overspend on foreign trips, cars and residential properties just for the sake of adding fun to their lives.

Out of all the other money facts, targeting this one is worth the effort.

Find ways to prevent overspending on these three areas.

It can save large sums of money over a period of time.

#5. Use credit cards as if its your cash

There are people who use credit card very carelessly.

Then there are people who are so scared with use of credit card that they NEVER use it.

There is thin minority who use credit card responsibly and without fear.

These are those people who consider their credit card as a money making asset.

How?

They use credit card like cash.

They use credit card to pay for all expenses. But they take care that they are not overspending.

How they do it?

These are the people who has their monthly budget deeply embedded in their minds.

They also track their monthly spending’s very judiciously.

They are always aware how much money they have already spent, and how much is still balance.

This kind of clarity is possible only if one has a budgets and also tracks the expenses regularly.

Though it may sound a very difficult task to do everyday, but my advice is to make it a habit anyways.

People who track their spending’s compared to their budget can use credit card like a master.

Swiping for all monthly expenses using credit cards and then paying bills on time can do one a world of good.

How?

These days credit card gives cash backs, reward points, free gift coupons etc.

One the spending’s that will happen anyways, if we start generating cash-backs on them, then nothing like. Its fantastic.

It is like those small-small discounts that we always crave for.

Out of all the money facts that I am going to declare here, this is something that I have used personally since last 5-6 years.

This is one of the best ways of making use of the credit card.

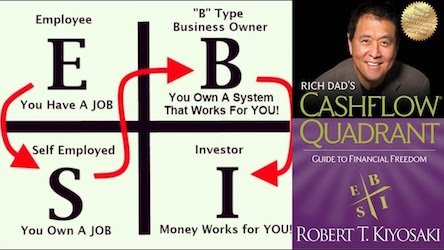

#6. Do your job but aim for financial freedom

Studying hard, getting good grades and then doing a nice job is a good thing.

But doing job and earning a fat paycheck should not be the ultimate objective of life.

Earn money from your job and take steps to give yourself the ultimate gift of financial freedom.

One of the best books that will help you learn more about the art of financial freedom is “Rich Dad Poor Dad” by Robert Kiyosaki.

So start taking steps from today to attain financial freedom.

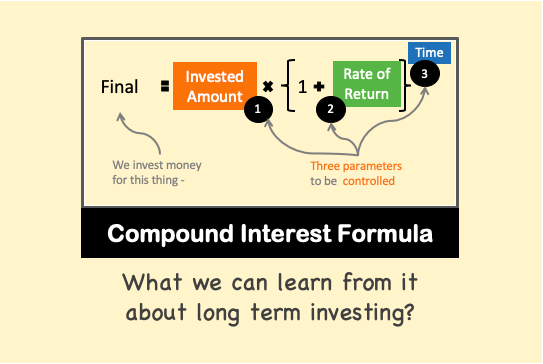

#7. Invest money in automatic-mode

How regularly you invest your money?

I know that a lot of answers will be say that they do not invest regularly.

We all know that investing money is essential. But still we do not do it regularly.

Why?

The reason being lack of know how and time.

Both these limitations can be managed very simply.

Just start investing in mutual funds through SIP route.

This is what will automate your investment activity. You will not have to do anything.

Just open an account in a web portal like Fundsindia.com and start your SIP journey.

Through such web services one can systematically invest in stocks, mutual funds, ETF’s, gold etc.

#8. Cash, Dividends and Rental income will make you rich, not your salary

In #6 we saw that the ultimate objective of earning money should be to become financially independent.

But how this can be achieved?

Unfortunately there are no easy ways of becoming financially independent. It takes time and effort to achieve this goal.

But this is no ordinary goal. Like there are only few rich people in this world, similarly there are only handful people who are financially independent.

What are the source of income of financially independent people?

Generally a person who has achieved financial freedom has multiple source of income. But they earn major from the following:

- Interest on cash that they keep in their savings account

- Dividend from stocks that they hold

- Rent that from reasl estate properties that they possess.

#9. Always prepay your loans

In #1 and #2 we talked about buying first home and second homes. We learnt how step 1 will help to achieve step 2.

But suppose you are someone who could not achieve what is said in Step1 and Step2.

What you shall do now to improve your finances?

Start prepaying your home loan.

Yes home loan prepayment is one tool that has power of giving us back our lost glories.

Bought home with 80% financing from banks? Paying interest of 9.5% on your home loan?

No problem. Learn the ultimate rule of loan prepayment.

If home loan prepayment are done on time, even rule #1 and #2 stated above will look insignificant.

Here the targets are like this: Take a home loan for 20 years tenure and finish it off in 10 years.

The savings in interest that one will make here on interest is huge.

This is perhaps THE best money fact that I will recommend to all my readers.

If you want to know more about the loan prepayment, read my blog post here.

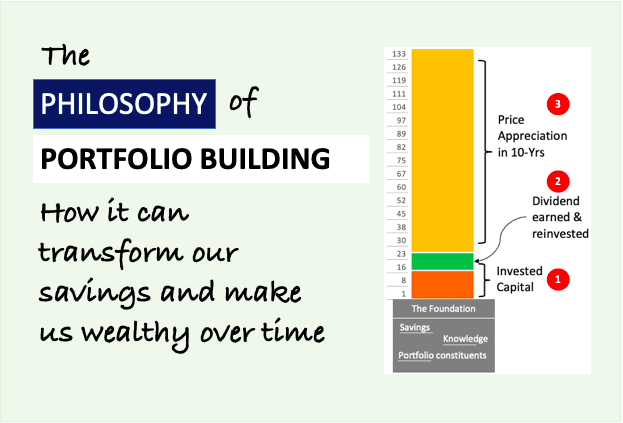

#10. Building wealth is more interesting than spending money

Who does not like to spend money and buy things.

But what if I will say that building wealth is more interesting than spending…

Yes this is true, building wealth is more encouraging.

If it is so, why majority of us are better spenders?

The reason for this is simple; most people do not have enough wealth to experience this distinction.

Does it mean that to experience the excitement of wealth building vs spending, we have to first become wealthy?

No. One has to just start the journey.

Let the money start getting accumulated in your savings account.

Let the funds start getting build up in your investment portfolio.

You will quickly realize how exciting it is to create wealth. Spending will start to look like evil.

How to build wealth?

What is the minimum savings that remains in your savings account by the end of each month? Suppose it is Rs.10K.

Give yourself a target of increasing this minimum savings from Rs.10,000 to Rs.100,00 in next 12 months.

What is the net worth of your investment portfolio as on today? Suppose it is Rs.5,000.

Give yourself a target of systematic investing in such a way that the worth of your investment portfolio increases 10 times in next 12 months.

The starting 12 months will be tough.

There will be too many temptations that will come your way and your will be inclined to stop your savings and investment plan.

Just don’t stop it.

Stick to your goal for 12 months.

Enjoy seeing the GROWTH in your savings and investment portfolio.

The power of seeing ones money grow, is magical. It creates a transformation withing you.

You will slowly start to like savings and investment more than spending.

But my suggestions is, to keep a careful balance between spending’s and investment.

It shall not happen that you lose steam just because you are diverting every penny towards your investment goals.