Stocks, also known as shares or equities. It represent ownership in a company. When you purchase a stock, you own a small piece of that company. This ownership entitles you to a portion of the company’s profits and assets. You can also influence decisions through voting. Stocks can appreciate in value, offering potential financial growth for investors.

Understanding what stocks are is the first step to becoming a savvy investor. Many people hear about stocks on the news or from friends, but not everyone knows what they actually are. Stocks can seem complex, but they are simply a way to own a piece of a company. Think of a stock as a small slice of a big pizza. When you buy a stock, you own that slice of the company.

Imagine you love a popular brand like a Tata. By buying stocks in these companies, you become a part-owner. This means you share in their successes and setbacks. If the company performs well, the value of your stock can increase. If it struggles, the value can decrease.

This guide will explain stocks in simple terms. I’ll try to make it easy for beginners to grasp the concept. I’ll break down the basics, using everyday examples, to help you understand how stocks work.

Topics:

A Story About What Are Stocks?

Hello to all. Ever wondered what stocks are? Let me explain it to you with a simple story.

Imagine your friend Ria, who owns a bakery store. Her cakes are famous, and the shop is always packed. But Ria wants to expand her bakery and open more locations. She needs money to do the expansion.

Ria decides to sell small pieces of her bakery shop to raise money. She divides her bakery into 100 pieces, called shares.

In that bakery, you decided to buy one share. Now, you own 1% of Ria’s bakery. Interesting, right? This means you have a stake in the bakery’s success.

As the bakery grows and makes more money, the value of your share also increases. If Ria opens more branches and her sales go up, your share becomes more valuable.

But remember, there’s risk too. If the bakery faces problems, like fewer customers, higher costs, and losses, the value of your share can go down.

Being a shareholder also means you can vote on big decisions. You can vote for decisions like whether to open a new shop etc. Shareholder’s voice matters, even if it’s a small piece of the pie.

So, stocks are like owning a tiny part of a big business. As a shareholder, you share in the success and the risks.

Now you know what stocks are. So go ahead and start with getting an overview of stock investing.

Point #1. Definition of Stocks

Stocks, also known as shares or equities, represent ownership in a company. When you purchase a stock, you buy a small piece of that company. Each stock you own makes you a part-owner of the business.

Think of a company as a large cake. If the company decides to divide this cake into 1,000 pieces and you buy one piece, you now own 1/1,000th of the company.

Owning stocks gives you certain rights. You can vote on important company decisions. For instance, you can help choose who will be on the board of directors. This is like having a say in who runs the company.

Stocks can also earn you money in two ways. First, if the company performs well, the value of your stock might increase. You can sell it for more than you paid. Second, when companies pay dividends. Dividends are a portion of the company’s profits given to shareholders. It’s like getting a reward for being a part-owner.

Point #2. How Stock Represents Ownership

When a company decides to raise money, it can do so by issuing stocks. This process involves selling small portions of the company to investors. Each stock corresponds to a fraction of the company’s total value.

For example, if a company has issued 1,000 shares and you buy 10, you own 1% of the company. This means you have a stake in the company’s overall success and performance. Your ownership in the company is proportional to the number of shares you own.

Issuing stocks is a common way for companies to raise capital. The money raised from selling stocks can be used for various purposes. It can used for expansion plans, paying off debt, or modernization the existing facility. For the company, issuing stocks is advantageous because in this case the repayment is is not legally mandatory (like a loan). Instead, the company shares its profits with shareholders.

As an investor, buying stocks means you believe in the company’s potential to grow and generate profits.

If the company does well, the value of your shares increases. Conversely, if the company performs poorly, the value of your shares can decrease. This potential for profit and loss is what makes investing in stocks both exciting and risky.

By buying stocks, you become a part of the journey of the company. You’ll benefit from its achievements and will also sharing the risks. This fundamental concept of ownership is at the heart of investing in stocks.

2.1 What a Shareholder actually owns in the company?

But what does a shareholder actually own after buying shares? If you own 1% of the shares in a company, it doesn’t mean you can go and ask for 1% of the total cash parked in the company’s bank account. You cannot go and sell 1% of the company’s inventory.

Ownership through stocks means you have a claim to the company’s assets and earnings, but not direct access to them. Your ownership is represented by the value of your shares and your rights as a shareholder.

2.2 Rights of Shareholders

As a shareholder, you have certain rights. These include the right to vote on important company matters. These matters can be like electing the board of directors or approving major corporate actions like mergers and acquisitions.

You also have the right to receive dividends. If the company decides to distribute profits to shareholders, you are eligible to receive it. Dividends are usually paid out in cash and represent your share of the company’s earnings.

However, there are limitations to what you can do as a shareholder. You can’t just walk into the company’s office and start making decisions or using its assets.

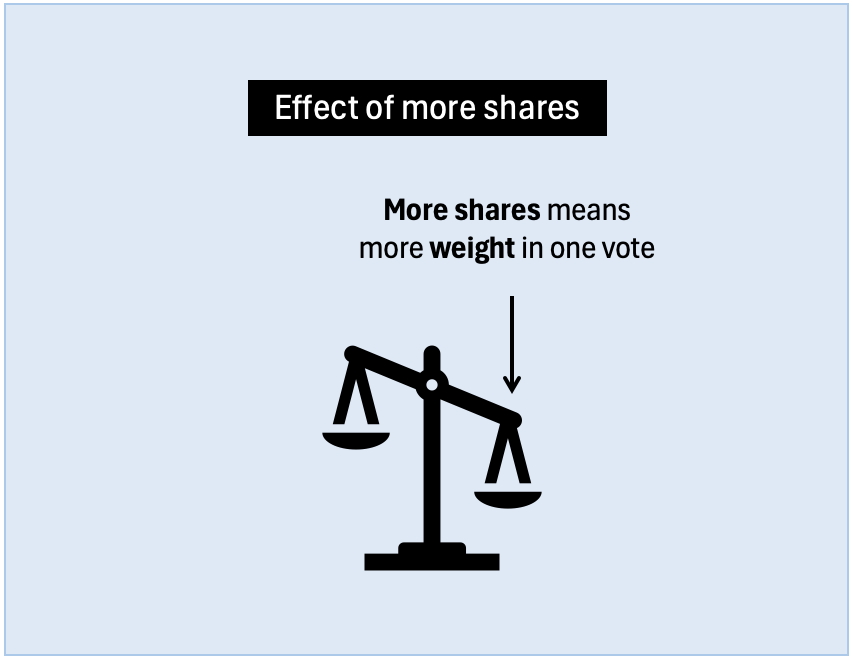

Your influence comes from voting on company’s key decisions. For example, if you own many shares in a company, you might influence the decision of choosing a particular individual in the board or directors. If the company wants voting to decide whether to approve or reject a project, your vote will count more than others. This voting power gives shareholder’s a say in the company’s direction.

The day-to-day operations and management of the company are handled by the company’s executives and board of directors.

2.3 Difference Between Minority Shareholder & Majority Shareholder

There is also a difference between minority shareholders and majority shareholders.

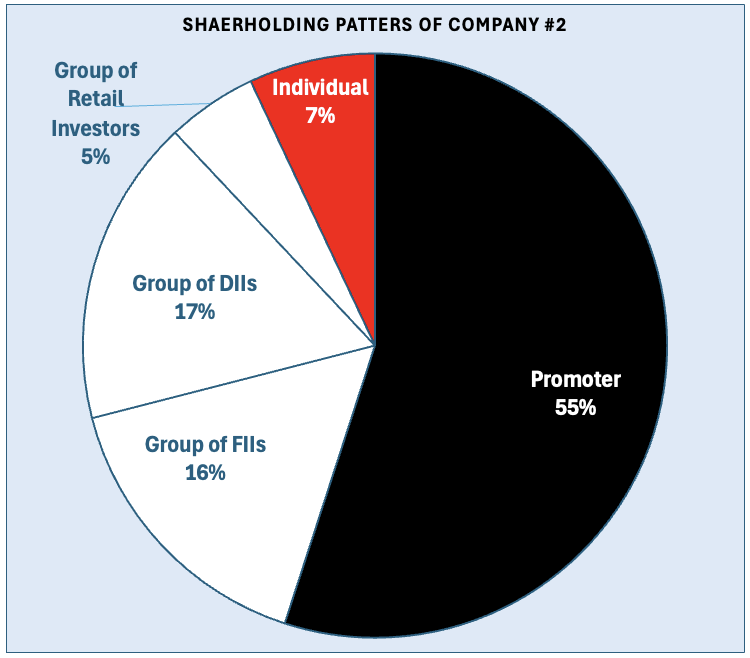

- A minority shareholder is someone who owns a smaller portion of the company, typically less than 50% of the shares. As a minority shareholder, your influence on company decisions is limited. You can participate in voting and receive dividends, but you don’t have control over the company’s direction.

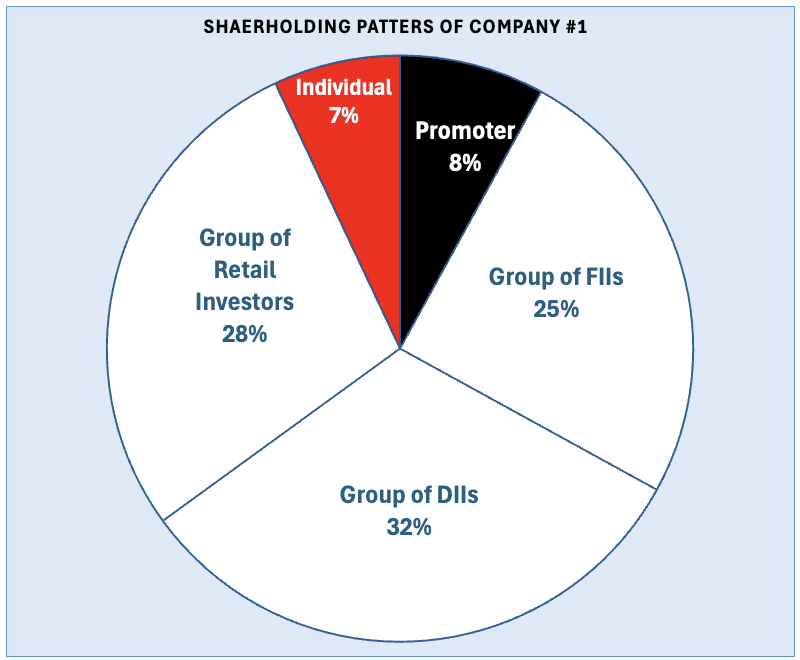

- Note: But there are exceptions to this the 50% rule. Suppose there is a company whose promoters and founders themselves have a vey small ownership left in the company. A few such examples are ITC, L&T, HDFC Bank, Zomato, where the promoters stale is almost 0%. Most of the shares of such companies are owned by DIIs and FIIs. In such a company, even a 7% ownership (for example) can give a lot of weight to an individual’s vote.

- Majority shareholders, often the founders or promoters of the company, own a significant portion of the shares. This can be more than 50% of the total shares. Majority shareholders have a greater influence on company decisions because they hold more voting power. They can effectively control the company’s strategic direction and have more say in important matters.

- Note: In a company where the promoters hold a majority stake, a shareholder who owns only 7% stake will have only limited influence in the company’s decision making. Major decision will be still be influenced by the promoters.

Point #3. Example: Owning Shares of Reliance Industries

Consider a well-known company like Reliance Industries (RIL). When you buy shares of Reliance, you are purchasing a small part of the company.

There are about 676.6 crore number share (100%) of RIL in the stock market. Out of these about 49.11% is held by the promoters. Now, suppose you decided to invest about Rs.10 crore in this company. At the current stock price of about Rs.2900 per share, you will get about 34,485 number shares.

Even after investing a big amount like Rs.10 Crores, the ownership that you could buy in RIL was only 0.00051% [= (34,485) / (676.6 crore)].

Buying these shares of Reliance Industries, it means you own a part (0.00051%) of the company. Though you are no where near to being the actual owner of the company but you will benefit form it. How?

In the last 10 years, the company’s stock price has grown at a rate of about 20% per annum. Assuming that the company will grow at the same rate for the next 10 years, your Rs.10 Crore investment will become Rs.62 crores.

You benefit when the company grows, but you also share the risks. Understanding these dynamics is crucial for any investor.

Conclusion

Understanding stocks is fundamental for anyone looking to invest and grow their wealth. Stocks represent ownership in a company and come with both opportunities and risks.

By buying stocks, you become a part-owner of the company, sharing in its profits and losses. This ownership also gives you voting rights. It allows you to have a say in important company decisions.

The value of stocks can fluctuate based on the company’s performance and market conditions. This why it is crucial to stay informed and make educated investment choices.

Whether you’re a beginner or an experienced investor, grasping the basics of stocks can help you make smarter financial decisions and build a robust investment portfolio.

Investing in stocks offers a way to participate in the economic growth of businesses, potentially leading to significant financial gains over time.