One of the most underrated activity is ‘expense management’. We tend to focus more on income generation, and less on ‘managing expenses’. Why?

[Read: About an Excel based tool which can budget & track expenses]

The reason is perhaps simple. We tend to give more importance to things which are harder to get.

- Earning Money: To earn money, we have to first render hard work. This work in turn generates income (paycheck) every month. The income so generated is also fixed (income growth is even tougher).

- Spending Money: But spending is not as difficult. We often spend our own money. Hence there is much lower resistance while we are spending our savings.

Till we have money spare, we can continue to spend as much as we like.

Benefits of Budgeting & Expense Tracking

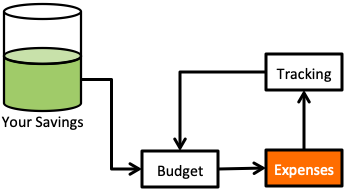

As expending money is easier, we often fall prey to overspending. So, one of the immediate benefit of budgeting and expense tracking is that, it prevents overspending. How? Read about an alternative approach of how to stop overspending.

Budgeting makes us aware of where we spend our money. Once we know this, it then helps us to fix a limit. What is this limit? It is the maximum amount of money we are allowed to spend on different expense heads.

Budgeting and expense tracking works like a control. It continuously gives us feedback about our spending patterns. This is what is called expense tracking. It makes us aware of how well we are performing on our different budgeted expense heads. What is performance?

When we cross the budget (limit), it is bad performance. When we stay within our budget (limit), it is good performance.

But this is not all, the benefits of budgeting and tracking expense has more far-reaching benefits.

So lets decode its hidden benefits. The objective of this article is to motivate its readers to get into the habit of budgeting and expense tracking.

Why to Avoid Spontaneous Spending?

Spending without budgeting and tracking is spontaneous spending. What happens due to it? As a result of it, we start living a financially dependent life. Spontaneous spending makes us fall into a acute salary dependency. Read more about the drawbacks of salary dependency.

Extended periods of spontaneous spending can have disastrous effects on our personal finance. Lets look into some of the bad-effects here:

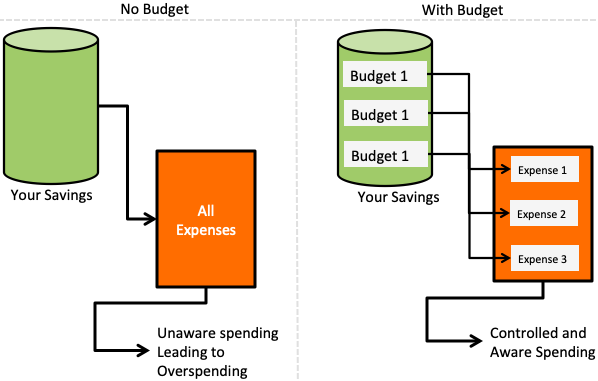

- Overspending: Spontaneous spending is easy. But this way people tend to overspend. Why? Because there is no indicator which tells a ‘spontaneous spender’ that he/she is crossing the limit. How to become aware? The first step will be to finalise a budget. Read more about 50-30-20 rule of building a budget.

- Unlimited Access: When we live a no-budget life, we actually give ourselves unlimited access to our money. This unlimited access confuse us, and leads us to overspending.

- Unrealised Financial Goals: We all have our own financial goals of life like buying a home, child planning, retirement, financial independence etc. How to plan for these goals? By savings and investing money. It becomes doubly effective and sustainable if we can first budget our goals and expenses, and then take the next steps. Investing without planning, budgeting, and expense tracking eventually leads to unsatisfactory results. Read more about goal based investing.

Why we are earning money?

If we can answer the above question accurately, our future finances will be in order. So let’s see why we earn money in first place.

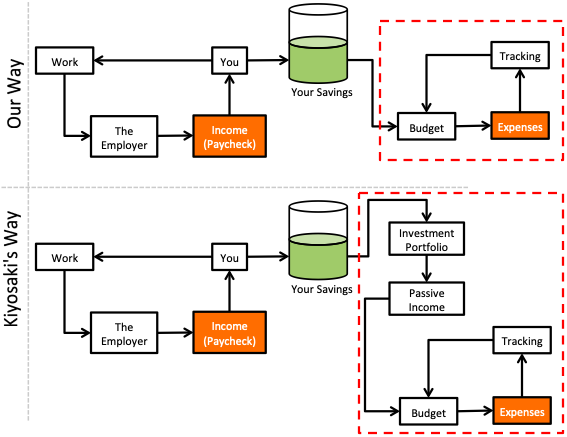

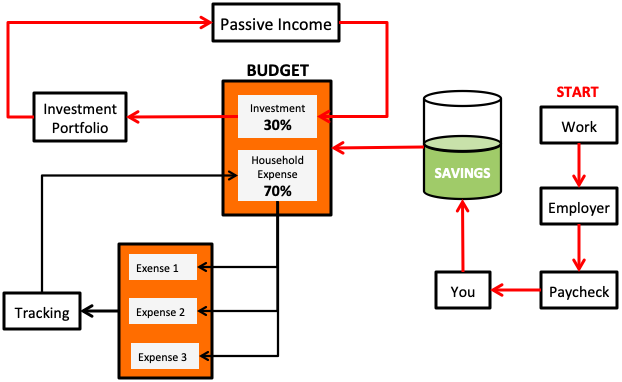

The above flow chart is the representation of how Robert Kiyosaki would like us to use our paycheck. Though it is an idealistic case, but it gives us a lot of clarity about how we must use our income, and what it means by financial independence.

Why we are discussing this process here? Please note the difference between where Kiyosaki would like us to use budgeting and expense tracking in our ‘money spending process’? Kiyosaki says:

- Investment Portfolio: First use 100% income from job to build an investment portfolio. Divert every penny of the earned money to buy bank deposits, mutual funds, stocks, real estate etc. The income generated from these investments (assets) shall be used for expense management. Read more about building investment portfolio from scratch.

- Passive income: Income generated from assets is called passive income. This income shall then be spent, and all spendings be tracked to ensure no overspending is happening. Read more about how to build assets.

Kiyosaki wants us to first generate passive income, and then spend the ‘passive income’ according to a budget. But where actually we start budgeting, and spending money? As soon as our paycheck is credited into our savings account.

What is the point? We are actually miles away from the Kiyosaki’s ways of managing our expenses. Unfortunately, it is only this way that can make us rich (work – earn – invest – passive income – budget – spend – track).

How to reach this stage of life? This can also be achieved by effectively budgeting and tracking our expenses. Let’s see how.

How to budget & Track Expenses?

To get started with budgeting and expense tracking, one of the easiest way is to use the free version of the google sheets. You can also build your own expense tracking software in excel. You can also use mobile apps for expense tracking.

Before you can go ahead and start using these formats, let me tell you how to budget your expenses in first place. This concept of budgeting will be in line with what we have discussed above (in why we are earning money).

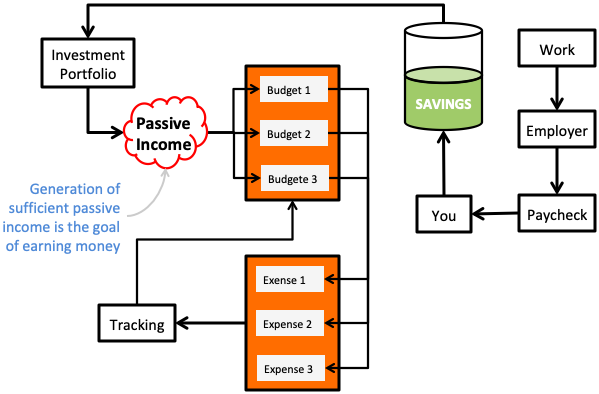

In the above flow chart, following are the important points to note:

- 30% Investment: Out of all the income (paycheck), 30% must be budgeted for investment. What does it mean? It means, if one is earning $100, $30 must go towards buying investments. Read more about how to ‘pay yourself first’ to ensure 30% goes into investment.

- 70% Household Expense: The balance 70% income can be used for managing household expense. Detailed budgeting of all ‘household expense heads’ must also be prepared. Read more about how to calculate daily expense for self.

- Reinvest Passive Income: As important it is to invest and generate passive income, it is equally import to reinvest all passive income. Reinvestment of passive income is key in the achievement of the ultimate goal (financial independence). Read more about the concept of passive income.

If you are not able to comprehend how to budget your expense, I’ll suggest you to use the 50-30-20 rule of building a budget.

Conclusion

I personally consider the activity of budgeting and expense tracking as one of those things which has profound benefits in long term. The benefits are so huge that it may lead to financial independence.

People who’ve practiced yoga for an extended period of time, will vouch for its benefits on physical and mental health. “Budgeting and expense tracking” can have similar positive impact on ones financial health.

If you desire to improve your personal finance, it cannot be bettered by saving or investment alone. The activity must start with budgeting and tracking expense. People who do not do this can also be successful, but people who believe in budgeting and expense tracking may eventually become crorepati.

Download a budgeting and expense tracking (works in MS Excel)

Great work.illustration of the strategy is the most important aspect of this topic since most of these topics just cover the way and lacks such examples. These examples make understanding simple to follow.Keep the good work going sir.

Thanks for the awesome comment.

It was nice reading your blog. Marvelous work!. A blog is brilliantly written and provides all necessary information I really like this site.

Nice Article!

It was an eye opener. Thanks for sharing.