ELSS Investment Calculator

Plan your ELSS investments, estimate returns, and see tax savings!

Summary:

- Explores ELSS as a tax-saving and wealth-building investment. We’ll compare it with ULIPs, NPS, Flexi Cap, and Large Cap funds to highlight its unique balance of high returns, short 3-year lock-in, and Section 80C benefits for beginners and long-term investors. Check this comparison tool to compare ELSS with Ulip, NPS, etc.

Introduction

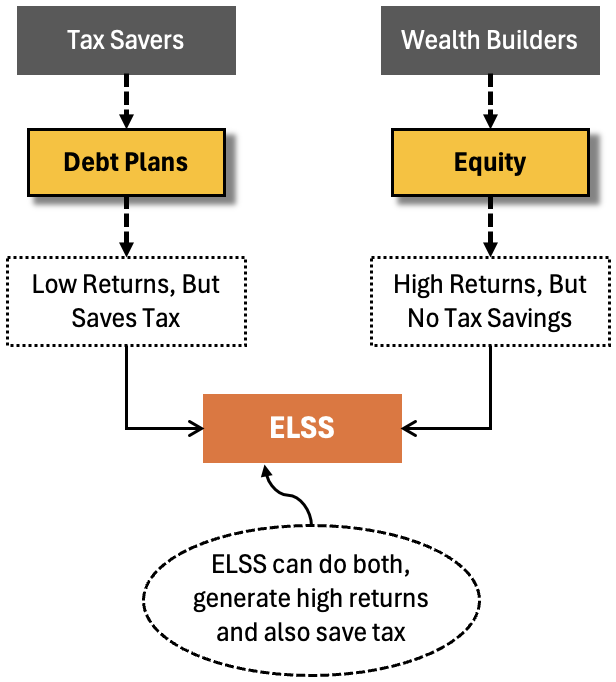

It is not easy for beginners to decipher where to part their hard earned money. Should you go for something that saves tax? Or focus on building wealth for the future? Ideally, it shall be a combination of both, right?

I’ve been down that rabbit hole, and today, because someone in his early 20s asked me this pointed question: save tax or build wealth – which is the preferred option for her. So, in this post I’ll talk about one such investment plan.

It is ELSS (Equity Linked Savings Scheme). We’ll explore if it really that great an investment option as it’s made out to be?

We’ll compare it with other options to know how it stack up against other popular choices. We’ll also explore close alternatives like ULIPs, NPS, Flexi Cap funds, etc?

Let’s dig deeper into ELSS funds and understand what makes it an equity product worth exploring, especially for the beginners.

Why ELSS Gets So Much Attention

When people are scrambling to save tax before the financial year ends (March end), they find that ELSS is an excellent option to save tax and also build wealth.

If you’ll ask your CA (how to save tax), he will also send you a list of 80C options, PPF, NSC, fixed deposits, and then there will definitely be ELSS.

Unlike the others, ELSS promises not just tax savings but also the potential for high returns. Sounds exciting, right?

ELSS is a type of equity mutual fund that qualifies for a tax deduction of up to Rs. 1.5 lakh under Section 80C.

This means if you’re in the 30% tax bracket, you can save up to Rs.46,800 a year in taxes.

ELSS, invests at least 80% of its corpus in equities. It means that it portfolio holdings are majorly tied to the stock market. That’s why it’s often pitched as a “tax-saving plus wealth-building” option.

What makes ELSS stand out is its lock-in period. At just 3 years, it’s the shortest among tax-saving investments.

Let’s compare the lock-in period of ELSS with other options:

| Lock-in Period | Years |

|---|---|

| ELSS | 3 |

| PPF | 15 |

| NSC | 5 |

| ULIPs | 5 |

This difference will tell you why many people, who hate lock-in periods, find ELSS more appealing.

But does this short lock-in and equity exposure make it a one-size-fits-all solution (tax savings + wealth generator)?

Let’s explore further.

Who Should Consider ELSS?

I’ve met two kinds of investors in my life.

- First, there’s the tax-saver, like Anil, who invests only to cut his tax bill.

- Then there’s the wealth-builder, like Priya, who doesn’t care about tax benefits but wants her money to grow over decades.

Can ELSS work for both?

For tax-savers, ELSS is a no-brainer.

You invest Rs. 1.5 lakh, save Rs. 46,800 in taxes (if you’re in the 30% bracket), and get exposure to the stock market. Historically, ELSS funds have delivered 12-15% annualized returns over 10 years.

Compare this return with other tax savings options like PPF’s 7-8% or NSC’s 6.8%, it is way better.

Even if you redeem just after 3 years, you’ve saved tax and potentially earned decent returns.

For wealth-builders, ELSS is just as compelling

It’s essentially a diversified equity fund, investing across large, mid, and small-cap stocks. These days we call it multi-cap funds.

Take a look at these top returns generating ELSS funds:

| SL | Funds | Expense Ratio (%) | Net Assets (Cr) | Return (10Y) % |

|---|---|---|---|---|

| 1 | Quant ELSS Fund (D) | 0.50 | 10,873 | 20.67 |

| 2 | Motilal Oswal ELSS Fund (D) | 0.70 | 3,897 | 17.72 |

| 3 | DSP ELSS Fund (D) | 0.75 | 16,218 | 16.92 |

| 4 | Bank of India ELSS Fund (D) | 0.95 | 1,324 | 16.37 |

| 5 | JM ELSS Fund (D) | 1.03 | 189 | 15.97 |

| 6 | Kotak ELSS (D) | 0.71 | 6,077 | 15.27 |

| 7 | Tata ELSS Fund (D) | 0.61 | 4,405 | 15.27 |

| 8 | Bandhan ELSS Fund (D) | 0.69 | 6,806 | 15.23 |

| 9 | Canara Robeco ELSS Fund (D) | 0.56 | 8,516 | 15.00 |

| 10 | SBI Long Term Equity Fund (D) | 0.95 | 28,506 | 14.89 |

Funds like Quant ELSS or Motilal Oswal ELSS have posted 10-year returns of 20% and 17%, respectively. That’s not far off from top Flexi Cap funds. In the same period (10-Years), flexi cap funds like Quant Flexi Cap (D) and Parag Parik Multi cap have generated 19.7% and 18% returns, respectively.

The 3-year lock-in in ELSS also forces us to stay invested. This is what makes our EPSS a great for riding out market ups and downs, for all types of investors.

Investors who are planning for their dream home in next 20 years, could easily keep her ELSS investments going long after the lock-in.

Whether we are loojing for tax savings or dreaming of a big corpus, ELSS seems to tick both boxes.

But is it the best option out there?

Let’s compare it with ULIPs, NPS, Flexi Cap funds, and Large Cap funds to find out more.

ELSS vs. ULIP

A Comparison

| Parameter | ELSS | ULIP |

|---|---|---|

| Purpose | Wealth creation With Tax Saving | Life insurance, Equity exposure With Tax Saving |

| Investment Type | Pure Equity Exposure – minimum 80% | Premium split between life insurance and investments in equity, debt, or hybrid funds. |

| Lock-in Period | 3 years | 5 years |

| Returns Potential | 15-18% CAGR in 10-Year Period | 8-10% CAGR in 10-Year Period |

| Tax Benefits | Deduction up to Rs. 1.5 lakh under Section 80C. Long-term capital gains (LTCG) above Rs. 1.25 lakh taxed at 12.5%. | Deduction up to Rs. 1.5 lakh under Section 80C. Maturity proceeds tax-free under Section 10(10D) |

| Charges | Expense ratio typically 0-1% (Direct Plans) and 1-2% (Regular Plans) | Max 2.25% over a 10-Year period. |

| Flexibility | Limited flexibility; fixed equity focus with no option to switch to debt or hybrid funds. | High flexibility; allows switching between equity, debt, or hybrid funds based on market conditions. |

| Risk Level | Higher risk | Moderate risk |

| Liquidity | Liquidity after 3 Years lock-in | Liquidity after 5 Years lock-in |

| Transparency | Portfolio holdings very visible | Portfolio holdings, vert low visibility |

| Who Should Buy | Investors seeking high returns with a tax saving also as their goal | People who are in looking for life insurance (for tax saving) buy also wants some returns |

ULIPs (Unit Linked Insurance Plans) are another Section 80C top contender, like ELSS.

ULIPs combine investment and insurance. It sounds like a neat package. But let’s be honest, when I first looked at ULIPs, I got too confused by the use of jargon in it. Premium allocation charges, mortality charges, fund management fees, it was kind of a distractor. It felt like a puzzle and hence chances of ignoring a ULIP becomes too high.

Neverthless, it is a fair investment option, so allow me to explain how ULIPs work:

- First, you pay a premium.

- A part of your premium will buy the life insurance for you.

- The rest is invested in equity, debt, or hybrid funds.

Like ELSS, ULIPs qualify for a Rs. 1.5 lakh tax deduction. The best part of a ULIP is, the maturity amount is tax-free under Section 10(10D).

But there is also a catch. ULIPs come with a 5-year lock-in and high charges. In the first few years, fees can eat up 10-20% of your premium, leaving less money to grow.

Talking about returns, ULIPs typically deliver 7-12% over 5 years, much lower than ELSS’s 15-20%.

My neighbor invested in a ULIP 10 years ago, hoping for a big payout. He was disappointed to see his corpus barely beat inflation after fees.

ELSS, direct plans, with its lower expense ratios (0.5-1%), leaves more of your money working for you.

ULIPs might make sense if you need insurance and investment in one go. But for pure wealth-building or even tax-saving, ELSS is the clear winner.

Why pay for insurance you might already have through a term plan?

ELSS vs. NPS

A Comparison

| Parameter | ELSS | NPS |

|---|---|---|

| Purpose | Wealth creation With Tax Saving | Retirement Planning With Tax Saving |

| Investment Type | Pure Equity Exposure – minimum 80% | Custom Portfolio: Mix of equity, corporate bonds, and government securities |

| Lock-in Period | 3 years | Until retirement (age 60); partial withdrawals allowed after 3 years under special conditions. |

| Returns Potential | 15-18% CAGR in 10-Year Period | 8-12% CAGR in 10-Year Period |

| Tax Benefits | Deduction up to Rs. 1.5 lakh under Section 80C. LTCG above Rs. 1.25 lakh taxed at 12.5%. | Deduction up to Rs. 1.5 lakh under Section 80C + Rs. 50,000 under Section 80CCD(1B). 60% withdrawal tax-free at maturity |

| Charges | Expense ratio typically 0-1% (Direct Plans) and 1-2% (Regular Plans) | und management fees capped at 0.09% |

| Flexibility | Limited flexibility; fixed equity focus with no option to switch to debt or hybrid funds. | Customize equity/debt) or auto (lifecycle-based) plans |

| Risk Level | Higher risk due to equity exposure; suitable for medium to high risk appetite. | Moderate risk; diversified across asset classes, with option for conservative debt-heavy allocation. |

| Liquidity | Liquidity after 3 Years lock-in | Locked until 60 Withdrawal allowed only under special conditions after 3 years |

| Transparency | Portfolio holdings very visible | Portfolio holdings very visible but updates are less frequent. |

| Who Should Buy | Investors seeking high returns with a tax saving also as their goal | People who wants government backed (safe) retirement planning with equity exposure (for higher returns than EPF) |

Next we will compare ELSS with NPS (National Pension System).

The NPS has been specifically designed as a retirement product. Hence, it has gained good traction from salaried people.

NPS lets us allocate your money across equity, debt, and alternative assets, with up to 75% in equities. It’s also tax-friendly as the contribution to NPS are deductible from Rs. 1.5 lakh u/s Section 80C. An additional deduction of Rs. 50,000 under Section 80CCD(1B) is also available for NPS contributors.

For people who are in the 30%, full NPS contribution can save about Rs. 62,400 each year.

But NPS comes with a big trade-off: it’s locked until you turn 60.

If you’re 35, that’s a 25-year commitment. At maturity, 60% of your corpus is tax-free, but 40% must be used to buy an annuity, which is taxable. Annuities often yield low returns, around 5-6%, which isn’t exciting for long-term wealth-building.

Returns-wise, NPS equity funds have delivered 10-12% over 5 years. It is solid but not as high as ELSS.

People like me, who always saw my EPF grow at about 7.5% levels, NPS giving even 10% returns is still a big thumbs-up. But the same NPS seen from the ELSS perspective, dosen’t look as exciting.

ELSS vs. Flexi Cap and Large Cap Funds

Flexi Cap and Large Cap mutual funds don’t offer tax benefits, but are excellent for wealth creation.

- Flexi Cap funds invest across large, mid, and small-cap stocks, much like ELSS.

- Large Cap funds stick to the top 100 companies. This way, their NAVs are less volatile but potentially less rewarding (in terms higher returns).

Flexi Cap funds, like JM Flexi Cap fund has given a return of 16% in last 10 Years. In last 5 years, its CAGR is about 28% per annum. It has slightly outperformed ELSS..

But we must not forget that ELSS also gives us tax savings. If we take this into consideration, net return of ELSS will be better than reported.

For example, if you invest Rs. 1.5 lakh in a Flexi Cap fund, you get no tax break. In ELSS, that same investment saves you Rs. 46,800 in taxes, effectively reducing your out-of-pocket cost.

Large Cap funds, like ICICI Prudential Bluechip has yileding 14.8% over last 10 years. In last 5 years, its return is about 25% per annum (so high due to covid effect). In normal circumstances, large cap funds can yield about sub 16% per annum.

Large cap funds are great for conservative investors. I think, people who do not like NPS as a returement builder, large cap funds can be a better alternative.

For people who are comfortable with some risk, ELSS or Flexi Cap funds could yield better returns.

The biggest advantage of Flexi Cap and Large Cap funds? No lock-in. You can redeem anytime, unlike ELSS’s 3-year commitment.

But I think, for long-term investors, that lock-in isn’t such a big worry. Many stocks in my portfolio has been there for 7-10+ years.

Are ELSS Funds Large Cap or Something Else?

A common question I hear is whether ELSS funds are just Large Cap funds in disguise.

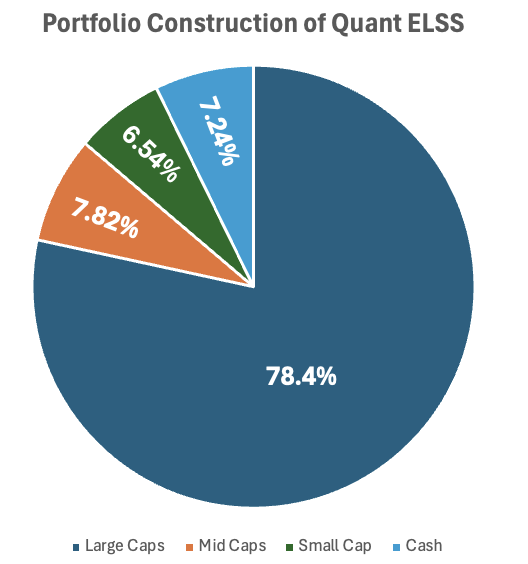

Not quite. ELSS funds are mandated to invest at least 80% in equities, but they’re free to allocate across large, mid, and small-cap stocks.

In practice, most ELSS funds lean heavily on large caps for stability. Companies like Reliance or HDFC Bank, ICICI Bank, etc constitute 50-60% of ELSS fund’s portfolio. But they also sprinkle in mid and small caps for growth.

For example, Quant ELSS Tax Saver has a mix of 78.4% large caps, 7.82% mid caps, and 6.54% small caps. This makes ELSS funds more like Flexi Cap funds than pure Large Cap funds.

Is ELSS Better Than Other Mutual Funds?

ELSS is a type of mutual fund, so comparing it to “other mutual funds” is like comparing apples to oranges.

- If you’re looking at equity funds like Flexi Cap or Large Cap, ELSS holds its own with similar returns (15-18% over 10 years) plus tax benefits.

- Against debt funds or hybrid funds, ELSS is riskier but offers higher growth potential.

The real question is whether ELSS fits your goals.

If you want tax savings and equity exposure, ELSS is hard to beat.

If you’ve already used up your Section 80C limit or need liquidity, Flexi Cap or Large Cap funds might be better.

It’s not about “better” but about what suits your needs. If you are a beginner who has full section 80Cw wide open for use, ELSS becomes the best choice. I think, it will even beat direct stock investing.

Comparison: ELSS, ULIP, NPS, Flexi Cap, and Large Cap Funds

To make things crystal clear, here’s a side-by-side comparison of these options.

I’ve assumed you’re investing Rs. 1.5 lakh per year for 20 years, in the 30% tax bracket, aiming for wealth creation.

Who Should Choose ELSS?

Imagine you’re someone in 30-year-old age bracked and a salaried professional earning about Rs. 1 lakh a month.

Your goal is to buy a house in the next 20 years. Till date, You haven’t used your Section 80C limit, and you’re okay with some market risk. What’s the best pick?

For me, ELSS stands out. It’s like getting two birds with one stone, tax savings of Rs. 46,800 a year and a potential corpus of Rs. 2.6 crore in 20 years.

The 3-year lock-in is short enough to give us the flexibility, and the equity exposure aligns with long-term wealth goals.

- ULIPs? They’re too costly and underperform for wealth-building.

- NPS is great for retirement-focused folks, but the lock-in till 60 feels like a cage if one wants the access sooner.

- Flexi Cap funds are fantastic for high returns and liquidity, but without tax savings, I think they fall just short of ELSS.

- Large Cap funds are safer but won’t grow our money as fast.

If you’ve already maxed out Section 80C, Flexi Cap funds could be a smarter pick.

Conclusion

ELSS is one investment option that can spice up our financial plan.

It will offer tax savings and wealth-building in one go.

Compared to ULIPs, NPS, Flexi Cap, or Large Cap funds, it strikes a unique balance of flexibility, returns, and tax benefits.

But we must also remember that no single option is perfect for everyone. Our goals, risk appetite, and financial situation matter.

So, take a moment to reflect. Are you saving for a dream home? Planning for retirement? Or just trying to cut your tax bill? Whatever it is, ELSS could be a great starting point.

Have a happy investing.

Very thorough and qualitative analysis, kudos !

Thank you

thanks for a realistic, fat free information.

🙂 Thanks

The best article on Tax Savings Schemes especially ELSS that I have ever read. Very informative and helpful. Thanks

Thank you for posing your feedback