When you’ll Google the term “become debt free“, the search result will also display a query: “is it good to be debt free?“

This dichotomy related to debt has remained since ages. Why?

For Banks, NBFC’s, government, and employers – loan (debt) strapped, EMI paying people are an asset. Hence they publicise debt as a good thing. Read: Business model of banks.

Bank’s & NBFC’s will go out of business if people do not take loans. Government wants more debt in the economy to keep “public spending” always on rise.

Employers (silently) wants employees to be under debt. Why? Because people stay glued to their job (even unwillingly) because they fear missing their loan EMI’s. Read: What happen if loan EMI is not paid?

But the REAL fact of the matter is, becoming debt free is a GREAT idea.

Introduction: Financial Dependency

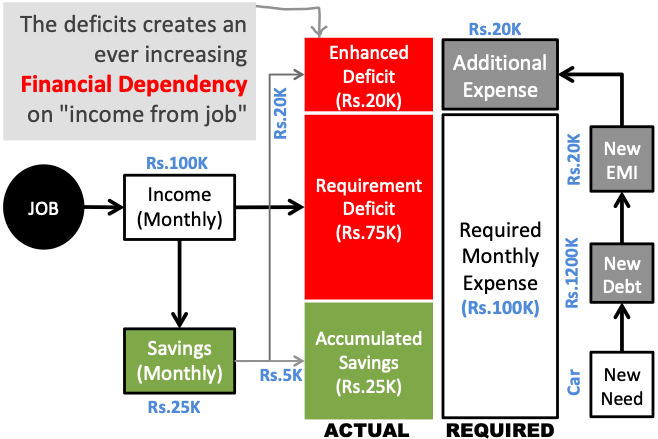

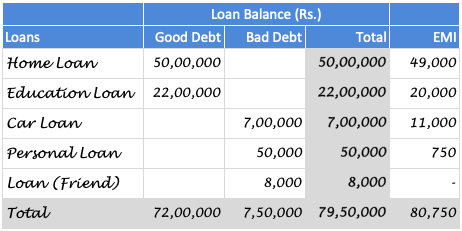

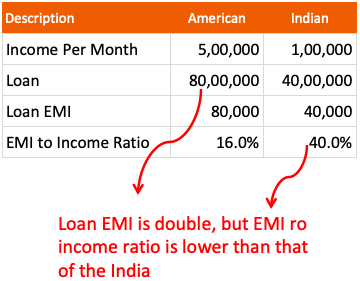

The above infographics highlight how debt (loans) enhances ones financial dependency. Allow me to explain it with an example.

Suppose there is a person whose monthly income is say Rs.100,000. His Required Monthly Expense is say Rs.100,000. The person has Rs.25,000 as Accumulated savings. This creates a Requirement Deficit of Rs.75,000.

How the person makes up for this deficit? By doing a job and earning a paycheck. Read: Paycheck to paycheck dependency.

Suppose this person decides to buy a car. He takes a car loan of say Rs.12 Lakhs. At @9.25% interest rate for 7 years, the EMI that the person will pay is Rs.20K per month.

The Additional Expense is Rs.20,000 in form of EMI of the new loan. What this new loan does is to enhance the requirement deficit further.

| Description | Before | After (New Loan) |

| Requirement Deficit | 75,000 | 95,000 |

| Income | 1,00,000 | 1,00,000 |

| Savings | 25,000 | 5,000 |

So what if the requirement deficit is enhanced? It is a problem, as it eats into the savings further.

Initially when the saving was Rs.25,000, after loan, the saving got reduced to just Rs.5,000.

This way, new loan (debts), takes people further away from being financially independent. In fact it makes people financially more dependent on their job. Read: About financial independence.

Debt & Affordability

Debt is dangerous because it builds a false belief of “affordability” in our mind. How? Ideally speaking, we must own only those things that we can afford to buy, right? But debt has created a new definition of affordability in our mind.

“If we can pay the loan EMIs, it means it is affordable”.

The real definition of affordability is,

“If we have enough savings for a thing, it mean we can afford to buy it”.

It is essential to erase the wrong definition of affordability from our mind.

No matter if ones income can support regular EMI payments, what debt does wrong (silently) is creating financial dependency. Under debt, people become slaves of their jobs (employers).

A Debt Free Life

Why it essential to become debt free? Because living a life under the debt burden is stressful. Only a debt free life can be “free & happy” in real sense.

When life if free, we can work to earn money for “self”. Every penny that is earned can be used the way “we” want.

The paycheck comes in, and there are no EMI’s to be paid, because there are no debts. The person will be sitting on a pile of huge cash savings. This saving can than be used for more important things like:

- Emergency fund creation,

- Net worth building,

- Building funds for achieving financial independence,

- Improving ones standard of living etc.

Characteristics of Debt Free People

Debt free people are not those people who have never taken a debt. Instead, most of them were knee deep in debt at some point in their life.

When they were drowning in debt, they’ve realised the power of “debt free living”. Since that day onwards, they starting prepaying their debts. Read: About loan prepayment.

Here are the few characteristics of typical debt free people:

- They Buy Differently: They do not use credit cards to earn reward points. They do not buy cars just because they can afford its EMIs. Even they buy homes with virtually zero debt. They do not rely on education loans for their child’s higher education. Debt free people are uniquely different.

- Cash is Preferred: The like to pay for things in cash. Why? Because cash payment is a sign of affordability. In today’s modern world, debit card swipe, UPI payments, and internet banking payments are a convenient extension of cash. They pay more using these payment models. Read: How BHIM UPI works.

- They Delay Gratifications: People who can delay it are mentally super-strong. When it comes to purchasing new things, probably debt free people spend more than any one else. But there is a difference. They first budget and save for it, before committing an expense.

- They Follow A Money Plan: Becoming debt free is a final outcome. What made one reach there were a series of steps taken earlier. What are those steps? (a) Having a financial plan. (b) Spending frugally. (c) Savings more. (d) Prepaying loans.

If you like these characteristics of debt free people, I’m sure you will also like to become debt free one day.

How to do it? Let’s see a plan to become loan free…

Being Debt Free

By the time I was in my 40’s, I was able to take myself out of the debt cycle. I will share in this article my simple plan to get out of debt in an effective and implementable way.

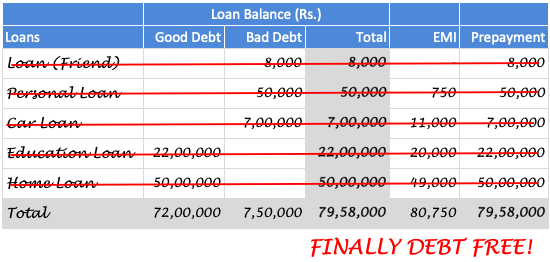

It took me close to 6 years to finally become loan free. Actually, the plan was to become loan free in 10 years. But the smaller the loan outstanding became, it motivated me to try harder.

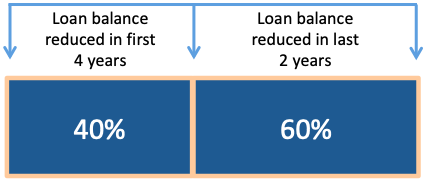

After my fourth year, a stage came when I started pushing myself more aggressively to become debt free. In the first four (4) years, I could reduce only 40% of my total debt. In the final two (2) years, the debt burden reduction was 60%. How?

But important was not the last 2 years, critical was the initial four years. Why? Because in last 2 years the motivation was high. In the initial 4 years, it was tougher to keep myself goal-bound (there was less motivation).

The plan which kept me glued to my goal was this:

A Plan To Get Out Of Debt

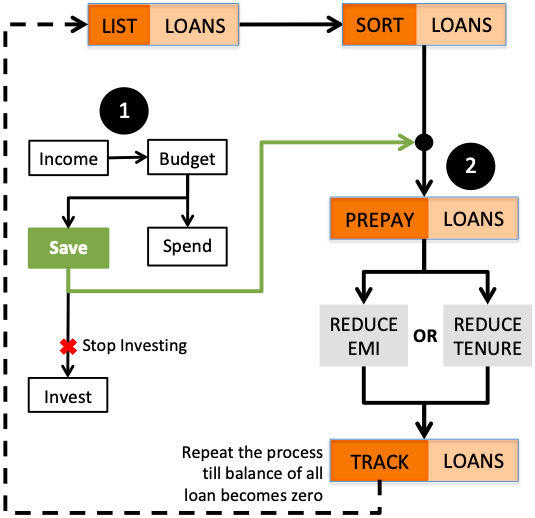

There are two main parts of getting out of debt: first is building savings, and second is loan prepayments.

The idea is to generate enough savings, and then use these savings to get out of debt.

One cannot get out of debt (quickly) by paying only the EMI’s. Extra payments has to be made. These extra payments towards a loan are called “prepayments”.

So, in addition to loan EMI’s, one must also spend extra money in form of prepayments (to become loan free).

Though the process looks simple, but I prefer to approach it will a more clearer perspective. How?

I Built two compartments in my mind:

I let one compartment think only about saving money, and the other compartment think only about loan prepayment. This helped. Let me show you how…

#1. How to Save Money

“Prepayment of loans” can make one debt free. But to do this one has to generate savings first.

There are two ways to do it, (a) Borrow from family, or (b) Generate your own savings. Lets see an effective method of generating ones own savings:

- Growing Income: For a salaried person, growing income can happen by giving more to job/work. This effort in turn will be rewarded in terms of salary increments and performance bonuses. Till the last penny of debt is being paid-off, growing income should be the focus. Read: About investment income.

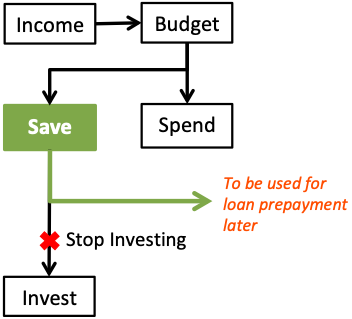

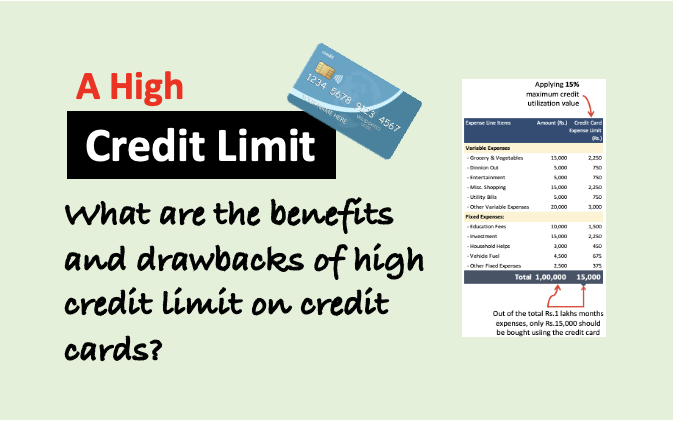

- Budgeting Expenses: When priority is loan prepayment, one cannot afford to overspend. So how to stop overspending? By preparing an expense budget and sticking to it at all times. While building a budget, set a target for savings. Pay yourself this amount first thing in the month’s start. Read: About a tool to stop overspending.

- Stop Investments: I took this call. Before, ‘being debt free‘ became a priority of my life, I used to invest reasonably in mutual funds and stocks. But I stopped all of that – for few years. Whatever extra I was saving from my income, I was diverting most of it for loan prepayment. Read: Paying off debt vs investing.

- Frugal Spending: Practising Frugality can work wonders for your savings. By living a frugal life, there are people who can save 50% of their income. How they do it? They spend only on things which they absolutely require. Read: Where people spend money.

- Saving: Which is the best way to save money without a miss? It can be done by following a theory called “pay yourself first”. This way, there is almost a cent per cent chance that one never overspends. Read: About pay yourself first concept.

By following these 5 simple lessons of saving money, I’m sure even a beginner can easily save 25% of ones income. If you want to know more about the process of saving money, please read this guide on saving money.

#2. How to Prepay Loans

I have written a separate blog post on loan prepayment. I will request you to read that piece as well. It will surely add another dimension to your understanding about loan management.

Digging deeper into my loan prepayment plan – there were 4 important sub-plans to it.

- #1. LIST LOANS: This is the best way to start. Try to recall all your debts. It can be home loan, car loan, personal loan, education loan, credit card debt etc. Why to do it? This makes one fully aware of all the liabilities which are currently active.

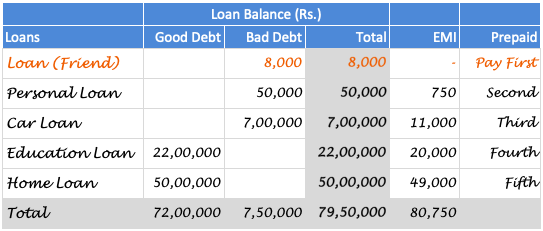

- #2. SORT LOANS: Expert will prefer sorting the above list in order of decreasing interest rates. I personally prefer sorting in order of increasing loan balance. Means, I’ll start paying off the smaller loans. Why? Because it will help me strike them off sooner. Seeing a strikethrough row acts as a motivation for bigger loan closure.

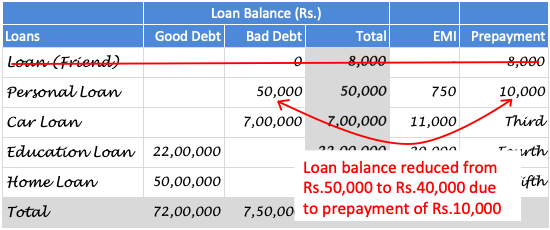

- #3. PREPAY LOANS: Out of the above loans the smallest loan (in value) shall be paid first. In the above example (list of loans) loan taken from a friend will be paid first because its value was only Rs.8,000. It’s the easiest one to make zero quickly. Once that is paid, it must be strikethrough.

- #4. TRACK LOANS: Keep the list of loans handy. Continue entering the data in the list after every prepayment. The idea is to keep tracking till the loan balance becomes zero. The list will look like this when balance is zero.

Other Steps Which Can Lower Debt Burden

What if ones EMI itself is very high, hence savings are already bare minimum.

How such a person can approach the goal of “being debt free”. They must go slow.

Instead of thinking about prepayment, their focus should be on other minimalistic solutions.

Few of them are listed below:

- Take a side job: Find a way to earn couple of dimes extra. Offer your help to others in exchange of a compensation. My suggestion will be to look online. These days, almost everyone can earn a small pocket money online. One such way of doing it to join an affiliate program.

- Build A Bare Bone Budget: It depends how deeply you want to become debt free. There was a phase in my life (for almost a year), where I saving close to 50% of my income. I was diverting majority portion of it to payback my loans. How I did it? By budgeting my expenses to save more. Follow the 50-30-20 rule of budgeting.

- Sell Things You Do Not Need: This can generate extra money. We all have junk stacked in our storage cabinets. Monetise them. How? Items like old mobile phones, gaming consoles, watches, books, newspapers, gadgets, furnitures, utensils, old car/scooter, bicycle etc. These days everything can be sold in second hand online stores (Like OLX, Quicker, eBay etc).

- Negotiate Your Interest Rates: The first thing you must do here is to check your credit rating. If your credit rating is above 750+, you are a candidate who can negotiate. Approach your bank with your credit rating report. Ask them to reduce your interest rates. Tell them politely that, you are getting better rates from other banks. While you are negotiating with your bank, approach other banks for a cheaper loan. Read: Reducing balance method (loan).

- Switch Loans: The exercise done in step #4 works as a back-up. If your bank is not budging on their offered interest rates, go for a switch. But make sure that the overall cost of switching the loan is lower than the money saved due to the lower interest rate. Read: Home loan transfer to SBI.

- Forget Annual Bonus: Most of us earn annual bonuses in our jobs, right? Divert 100% of it to prepay your loans. I personally found this method to be very effective. It will be tough on the day the bonus gets credited into your account. The temptation to spend it elsewhere will be high. But do no delay. Issue the prepayment cheque to the bank the same day. Do let the bonus money to remain idle in your salary account. Read: When to do when EMI is high?

An American’s Debt Vs Indian’s Debt

There is difference between an Indian trying to become loan free, and an average American tying to achieve the same goal. What is the difference?

Americans handle loans differently than us. They have a more casual approach towards it. But in India, people handle loans more carefully.

This is not because Indian’s are better in handling money. It is because, American’s are more affluent. They can afford to handle debt with some carelessness.

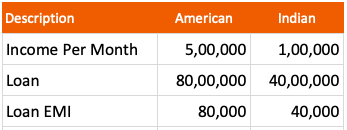

Example: Suppose there are two people, one American and other Indian. Their income and loan balance is shown below:

What do you think, who is more likely to handle the EMI with greater caution?

Though EMI of the American is double the Indian, still the Indian will be more cautious. Why?

Because for the American, his EMI is only 16% of his monthly income. But for the Indian, his EMI is 40% of his income.

The Indian will handle his loan EMI’s more carefully. Why? Because a major portion of his income is getting used by the loan.

What is the point?

We often see affluent people around us handling loans. Seeing them, we think that loan is a good thing.

Yes, loan is a good financial tool. But it is like a double edged sword. If not handled carefully, it can do more harm than good.

How to handle it carefully? By maintaining a low “EMI to Income Ratio”.

As a rule of thumb, never allow your EMI’s to cross the ratio of 25%.

Rich people may be laden with hundreds of crores in debt. But you will often find their “EMI to Income Ratio” below 25%.

Staying Debt Free

It takes years to become debt free. Take my example, it took me six years to get out of debt.

What happens when a person becomes debt free. Suddenly there will be a pile of cash, and you will not know what to do about it.

In this moment of euphoria, people have tendency to go back into the overspending spree. This is where one has to focus ones attention away from overspending. Why?

Because if not done, one may fall back into the debt spiral. This is human psychology. All the years of effort will go to vain.

How to prevent it? By focusing on building financial independence for self.

Final Words

It is easier to avail debt, but it is a lot tougher to make it zero. People often fall prey to the habit of debt.

It is always better to look debt from the “screen of affordability“. What you can afford to buy? Things for which you already have money parked into your savings.

Instead of worrying about debt, worry about how to increase your savings.

Why I abhor debt so much? I do not, but what I love more is “financial independence“.

Debt is one of the biggest hinderance to financial freedom. Because not only it increases our expenses, but it also lures us to take more of it. This further increases our expenses. It’s a vicious loop.

I’ll suggest you, not to fall into the debt spiral in first place. But if you are already in debt, start becoming debt free from today.

Have a happy debt free life.

In case you want to give your point of view on debt free living, please post them in the comment section below. I will be glad to read your point of view on it. Thanks to you in anticipation.

Useful, thanks

Thanks.. Very useful information and motivational guidance.. Really it will work

Due to home loan income tax rebate on interest is of 2 lakhs. What if I keep my loan to bare minimum to utilize this tax benefit instead of prepaying the whole amount of home loan, will it be a good idea ?

The overall benefits of being debt-free far exceed the tax advantage offered by debt.

VERY USEFUL POST THANKS……

Thanks

Hi,

Excellent post. I want to connect with you. Please share your contact number. My number is 9654090007. I need some financial advise.

PIZ SEND ME NEW NUMBER

Useful and valuable article. Thank you sir.

Thank you for the feedback.

That’s a superb article.

Thanks

HI!

Your BLOG become debt-free really helped me to free a bit debts, and improve my CIBIL Score!Thank you

Thank you very sharing such wonderful ideas.

This is a great post and each and every statement was interesting to know.

Hope I can use these techniques in my own life and become debt-free soon.

Thanks. I’ll suggest you to read section in this article called “the plan to get out of debt”. It will answer your query.

Thanks a lot! Useful post.

Becoming Debt free seems attractive proposition but they say home loan is a good debt and useful for our tax on earned income. What is your opinion on it?

The advantage of being debt free is far more outreaching.