There are hundreds of people around who can share their property investment ideas with us. Almost everyone, at some stage in their life, has experienced a property dealing.

We’ve seen our parents, elder siblings etc buy a property. It has enriched our knowledge. Even listening about property dealing from friends also adds to our knowledge base. But nothing is more valuable than self indulgence.

Which are those deeper insights about property investment which experienced buyers use as their guide? How a beginner can invest in real estate in India as a pro?

This is what we are going to discuss in this article. But before that, lets’ refresh some basics about the property market in India.

Topics

- Property market in India.

- Why property investment?

- Tread with caution.

- How to invest in real estate?

- Conclusion.

Property Market of India

In last few years, Indian real estate market has faced major hurdles. Though RERA is now in place, but this sector is not reviving.

Incomplete projects, finished inventory, lack of demand etc has contributed to the lacklustre performance of this sector. But still in major cities in India, prices of decent real estate properties are not declining.

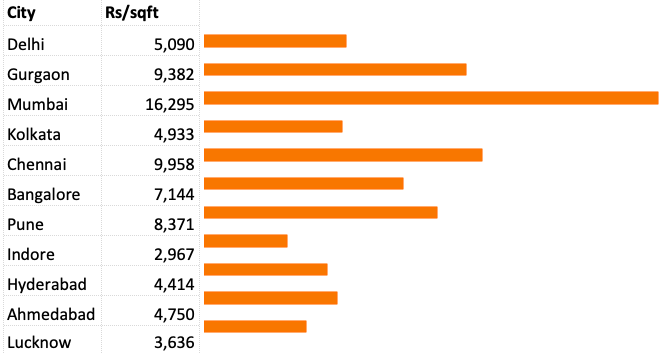

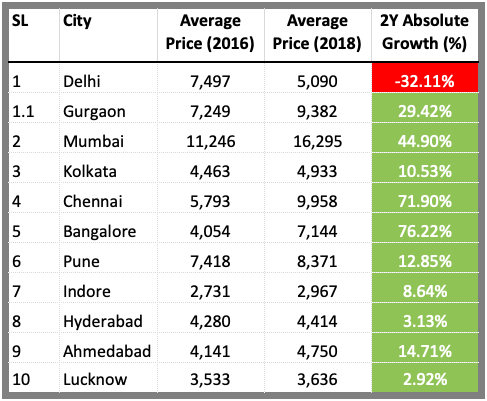

Check the below price chart. Except for Delhi (not Delhi NCR), property prices in major cities has gone up in last 2 years (source: makaan.com).

In the above table, it is clear that property prices continues to increase in India. The rate of price appreciation is different for different cities. If we buy a property in Hyderabad, capital-appreciation will be relatively slow. If we buy a property in Gurgaon, capital-appreciation will be faster.

But no matter where ever is the property located in India, its price will increase. Why? Because of the growing population and increasing purchasing power of Indian middle class.

Cities like Mumbai, Delhi NCR, Bangalore, Chennai, Ahmedabad, Pune etc have seen healthy rise in property prices. Why? These are cities where people generally migrate from other states for jobs and business.

The price momentum of Metro cities is reflected in other smaller cities. On an average, in last 5 years, property prices in India has at least gone up @5% per annum. In addition to this, add the rental yield of approx 3.5%. This takes the overall all return to 8.5% p.a.

Why Property Investment?

Rich and wealthy invest in real estate directly. They own multiple residential or commercial properties. Steady and decent capital appreciation of their real estate property is common.

But the part which makes property investment so dear is its capability of generating stable short term income. The short term income is generated in form of “monthly rents“.

The rate at which the rental income grows, generally beats inflation in long term. This is specially true for Metro, Tier1, and Tier 2 Cities. As the monthly yield of property grows, this also pushes the overall property price up.

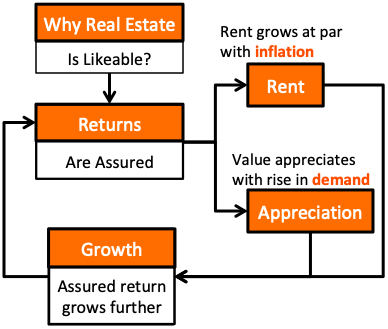

What is shown in the above infographic? Real estate investment generates assured returns. The returns are in form of rent and capital appreciation.

The rental yield (fixed income) grows with time. Generally this growth keeps pace with the inflation. Capital appreciation will happen due to demand growth. India being a growing and young population, demand for property keeps rising.

This dual effect (of assured rent and value growth) makes the real estate sector generate unparalleled returns, unlike any other asset.

Property investment is one of the best inflation hedge. This is the reason why big investors like Robert Kiyosaki and Donald Trump has special liking for it.

Tread With Caution

Why? Because, except for few Indian cities, real estate market has not really matured in India? Why I say so? Because we still see random development of properties in majority cities in India.

A good real estate property must be developed, sold, and maintained as per a master plan incorporating all facilities.

Unless property has a master plan, its long term value appreciation is doubtful. In most cases, value of such properties depreciates with time.

The problem is, most of the properties are by either unplanned or are developed by below-par developers. This makes real estate investing in India slightly risky.

How To Invest In Real Estate?

So how to go about it? Here are few ideas which a beginner can use to understand about how to invest in real estate property market in India. Also read about REITs in India.

1. Estimate Affordability

Real estate property is one of the costliest investment one indulges in, in life. Property prices in India can range from few lakhs to multiple of crores. Hence, before venturing out, it is essential to answer, “how much I should spend in a property purchase“. How to know?

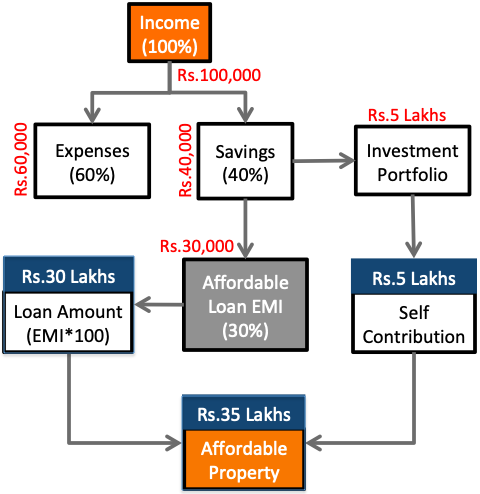

This can be done from the thumb rule shown in the above flow chart. A person whose income is Rs.100,000, and has a saving of Rs.5 lakhs can afford to buy a property of Rs.35 Lakhs.

Apart from ones income & savings capability, ones credit rating also plays a major role in getting home loan. Unless one has a reasonably high credit score, getting loan is difficult.

There is one more aspect which increases the cost of real estate property. There are statutory charges associated with any property purchase. Approximately “other charges” costs around 10% extra. This further effects ones affordability. Typical break of this cost is shown below:

- Stamp Duty (6%).

- Registration (0.5%).

- Brokerage (0.5%).

- Advocate Fees (0.1%).

- Home Loan Processing Fees (0.1%).

- Tax Deducted At Source (TDS-1%).

- Society Administration Charges (1%).

2. Prepare For Home Loan

First one must check his/her credit score. If the score is low, take steps to improve it. Why credit score needs checking?

Because banks will not give loan if the credit score is below 700. Hence checking the score before loan application is better. You can check your credit for free on website of CIBIL.

In addition to the credit score, the banks will also like to double check the “EMI paying capability” by scrutinising other documents. Hence for a borrower, it is better to keep these documents handy:

- Latest salary slips (of last 6 months).

- Income tax Return (ITR) of last year.

- Bank Statements (of last 6 months).

- Statement of Assets (financial & physical).

- Address Proof.

- Identity Proof.

- Other documents as asked by the bank.

A combination of “credit score” and “EMI paying capability” will decide ones home loan eligibility. Check: Income based loan eligibility calculator.

What to do to enhance ones loan eligibility? Before applying for loan, try to make other loans zero (like credit card debt, personal loan etc).

It is a good idea to take home loan eligibility letter from bank before starting property search.

Also, compare the loan eligibility numbers with the affordability calculation done in step 1 above. If step #1 says that, loan eligibility is Rs.30 Lakhs, and in step #2 bank is ready to give Rs35 lakhs – go for the lower number.

3. Criteria For Property Selection

Target should be to buy a good property. What is a good property? It must display at least two characteristics: (a) Attractive Project Plan, and (b) Value for money.

What is attractive project plan? Distribution between open area and occupied land (by buildings) must be optimum. The more is the open area, the better.

What is value for money? Property should not be expensive. How to define expensive? I follow this rule of thumb for myself. Rental yield of the property should not be less than 3.0%. Suppose the property is valued at Rs.35 Lakhs. If put on rent it wil fetch Rs.10,000 per month. Its rental yield will be 3.4% (10000×12/3500000).

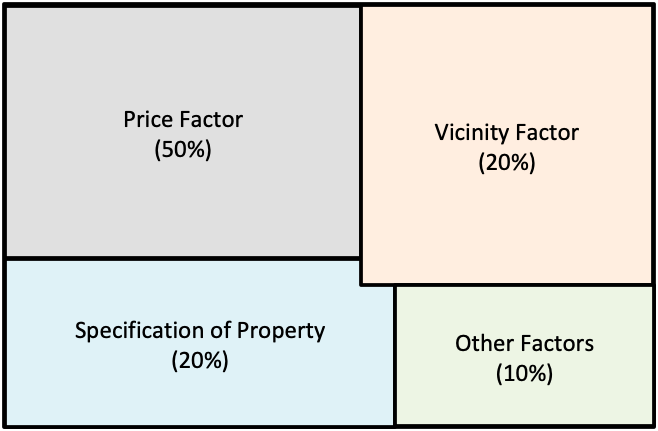

For a beginner, it is essential to know what to look at in a property. Investing in real estate cannot be done just on basis of aesthetics. Proportional weightage must be given to at least 14 parameters listed below:

Price

- 3.1 Affordability: If ones affordability is Rs.35 Lakhs, and the property on offer is costing Rs.40 Lakhs, it is clearly not affordable. This is one reason why affordability calculation in step #1 is essential before making a commitment.

Vicinity

- 3.2 Location: Property investment must be done in a location which is known to the investor. Investing in an unknown city/town shall be avoided. Location of property within the city is also important. A property which has schools, markets, hospitals nearby is preferable.

- 3.3 Transportation: Approach road is important. If there is a broad and paved road connecting the property, it’s a big thumbs up. Public transport connectivity like metro, bus depot, auto rickshaw stand, Ola/Uber connectivity also adds to the value.

- 3.3 Negatives: Special attention must be given to the drawbacks of the property. Typical ones can be like busy roads, too close to railway station or airport, traffic noise, remote location, old society etc. These factors cause hardships & also lowers the quality of life of the residents.

Specification

- 3.4 Type of House: If the preference is a row house, multi-storeyed apartment will not work and vice versa. Before venturing out for property search, type of house must be finalised.

- 3.5 New or Used: Second hand homes can be great value for money. They have an advantage of ready possession and established locality. They may also have pre-built facilities like internet, heaters, wood work, modular kitchens etc. But a new property also comes with its own advantages.

- 3.6 Number of bedroom: For a small family, even a studio apartment is enough. For others, requirement may range from 1/2BHK to higher size flats. I personally like evaluating property first on basis of their size (in SQFT), and then on the number of bedrooms it can offer.

- 3.7 Open Floor: There are some properties which has slots & pockets for wardrobes, cabinets, fridge etc. Such homes offer better ‘open floor space management’ after the furnitures are put in place. Generally speaking, a house must be able to accommodate your special furnitures (like over , bicycle, pram etc).

- 3.8 Parking: If you own a car, two wheeler etc the property must offer an adequate parking facility.

Other Features

- 3.9 Communication: If the property has facilities already laid for services like cable TV and broadband etc, it can save few bucks. Generally speaking, look for mobile & internet connectivity in the area. There are some areas which has inherently poor mobile network connectivity.

- 3.10 Extension: Over a period of time, owners like to extend their living space. Properties which has provisions for extension may prove handy in times to come.

- 3.11 Gardening: For some, building a hanging garden in their balcony is a big plus. If you are looking for a row house, check if the open space provides the possibility of gardening. Property with such provisions becomes desirable.

- 3.12 Present Condition: Check the ‘built condition’ of the property. If it is a new property, no problem. But in a second hand house, rework or repairs may be required. Being aware of this extra cost before taking the possession is advisable.

- 3.13 Condition on Outside: Apartment may be good from inside, but the outside building is equally good? Make sure to check the property from outside. Scan the painting, cracks, seepage, loose wirings, encroachments, quality of parking etc.

- 3.14 Security: These days the societies are plagued with random thefts and pilferages. Make sure to check if the property has a dedicated security protection.

It is also a good idea to visit the property at least thrice before taking a final call.

- Visit 1: Try to reach the property from your office etc during peak hours. It will give you an idea of the traffic congestion.

- Visit 2: See the property during the night. You will be able to judge the ambience during those hours. There are properties which looks too gloomy in dark. Avoid them.

- Visit 3: Try to visit the property in weekends. It will give a new outlook and you may also be able to socialise with few existing occupants.

4. Ask Your Property Agent

What is done in step #3 above takes care of the “big things”. There are also minor queries that needs attention. A property agent will be able to answer these question (honestly).

There are like strategic questions which must be posted to the agent or to the present owner:

- Remained Unsold: For how many days the property has been in the market for resale? Some properties gets sold in days. Some properties take time. Idea is to know the cause of the delay. The reasons could be overprice, bad Vaastu etc.

- Occupation History: Preferably, buying a property which has multiple occupations in the past shall be avoided. Buying a second or third hand property should be the goal. If the property was occupied by the first owners themselves, it is a big plus.

- Current Possession: Who is currently occupying the property? If there are no people living inside, no problem. But if the property is occupied (say by a tenant), when they are going to vacate? Since how long they have been staying?

- Seller’s Direct Contact: Before taking the final decision, it is always better to have a one-on-one discussion with the owner. One may not like to buy a property from a shady or inappropriate character.

5. New Home: Extra Points To Take Care

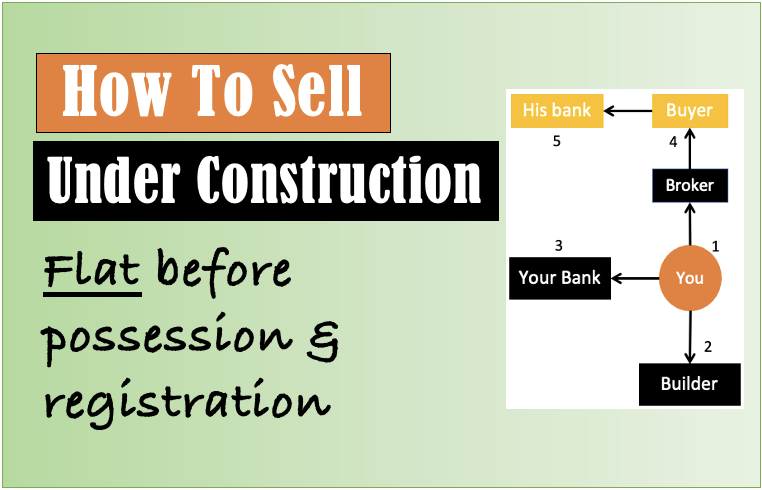

There are few unique features comes to face only with a new (under construction) real estate property. They also needs separate attention and handling:

- Booking Amount: Purchase of new, under construction property is often initiated after inspecting a “vacant land” and an “approved plan”. To initiate the purchase, the buyer pays a booking amount to the builder. Make sure to ask for the refund policy before making the payment.

- First Deposit: If you are going for the home loan, the first deposit (which will be your self contribution) needs to be paid soon after booking. Why? Because only after this the loan disbursement process will be initiated. Make sure to keep your own legal advisor informed about these payments.

- Pre-Approved Loans: The builder may lure you to go for their pre-approved lender (for loan). You are not obliged to take their advice. You can go with your own bank.

- Completion Time Line: From the date of booking, a typical Indian builder may take upto 3 years to complete the project. Make sure to ask the builder about the time lines (& milestones) of the project. Ask how the builder is going to compensate in case of delays.

- Withdrawal Clause: There may be a condition where you may want to exit the deal mid way. This is where withdrawal clause becomes handy. Read and discuss it with your builder. How much will be your loss? How the already paid money will be returned etc.

- Warranty: Generally, a newly constructed buildings has a 10 year warranty for structural faults. There is 2 years warranty for general defects. Make sure to ask your agent/builder about the same.

- Finish House: What is included in the finished house? Final paint, electricity fittings, plumbing, finished flooring, modular kitchen, wardrobes, furnitures etc. Idea is to know, in what finished condition the house will be delivered to you.

6. Check The Builders Reputation

Try to find out the reputation of the builder. Some developers are prone to carry problems related to plan approvals, last minutes changes, work delay, bad quality construction etc. Idea is to not fall for such developers.

The best way to identify a good developer is by visiting their old sites. If possible, meet few residents to get a feel. Few key attributes of a good developer is:

- Timely completion.

- Quality project (outside ambience) layout.

- Good flat layout (inside design).

- Superior construction quality.

- Quality of installed fittings (lighting, faucets etc).

A combination of ‘good developer’ and a ‘cost effective property’ means good investment.

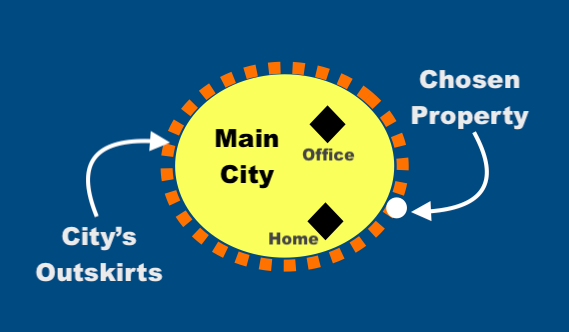

7. Look for A Property On The Outskirts

Often, properties which are within the city are expensive. There is a way to identify a good and inexpensive property.

Look for properties which are coming up right on the city’s outskirts. Do not go too far out of the city. Idea is to remain in the city – but at the outer boundaries. I have found this method of locating projects very helpful.

At the time of purchase, such properties may look slightly distant. But within 2-3 years, they become the next city hub. Buying such properties, and holding them for 3+ years can prove profitable.

8. Book Property In Its Project Launch

Project launch is that moment of time, when the developer is first displaying its project plan to the public. At that time, the developer is also gauging publics perception about its project.

Booking property at project launch can be more profitable. Builders are often quoting 20-30% less price in its launch.

If the response of public is good, during project launch, price of property will go up. For public, project launch price is often the best price to buy. Keeping an eye on project launches of good developers in your city is a good idea.

It must also be noted that, during project launch, the builder may not have already taken the necessary project approvals. Hence it is essential for buyers to ask about the schedule of approvals. Only after the approval, construction will start.

9. Look For A Small Property

We often get lured into buying an oversized property. This is a mistake. It not only costs more, but it also means higher long-term maintenance costs.

Reports have proved that, smaller sized properties are often better value for money for the investor. Compare a 2BHK and 3BHK apartment. Which will get sold first? 2BHK, as it is more affordable.

Similarly, a 1BHK apartment can be bought and sold the quickest. Small size apartments are always in higher demands. Even high net-worth investors, would like to buy multiple 2BHK homes over large penthouse. Why? Two reasons:

- Less money is locked in one property.

- As size is small, liquidation becomes easier.

- There will be bigger range of buyers for small properties.

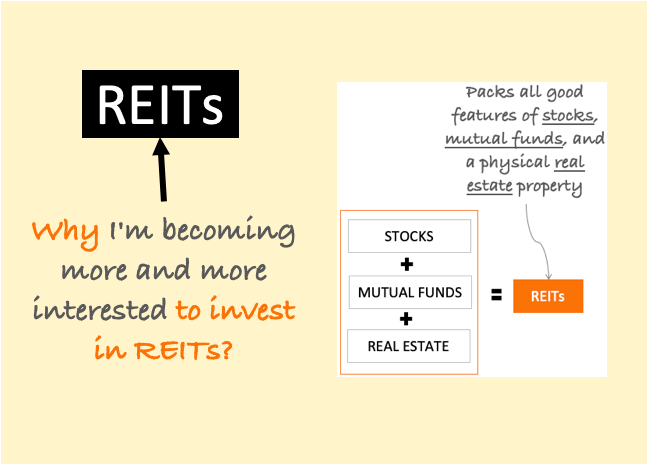

Other ways to invest in real estate sector

One of the main drawbacks of property investment is that, it is very capital intensive. Moreover, buying and selling of a physical property is also not as easy as shares or mutual fund.

Hence, there are few investors who prefer to stay away from property investment. But there are ways of investing in real estate without indulging in physical property. Here are few of them:

- Real Estate Mutual Funds: There is only one real estate fund in India. This scheme is launched by Aditya Birla Sun Life. It comes under “Fund of Funds” category. They mainly invest in real estate sector across the globe. 95% of this fund’s portfolio constituent is taken by ING Global Real Estate Fund. Currently there are no real estate ETF’s in India.

- REITs: After physical property, REITs is the next best alternative of investing in real estate sector. But again, there is only one REIT currently launched in India (Embassy REIT). Once the REIT market matures slightly more in India, this will be one of the best ways to invest in this sector.

- Shares of Real Estate Companies: This is also a decent alternative of investing in real estate sector. How to find good companies operating in this sector? Check the list of constituents of S&P BSE Realty Index. Currently (as on Nov’2019), there are 10 constituents of this index (see below). Buying shares of these companies at discounted price levels can be considered.

Conclusion

These property investment ideas may sound basic, but they are effective. For a beginner, these suggestions can help in framing a right strategy.

- Location of property.

- Size of property.

- Affordability.

- Acceptable quality & amenities.

- Time of purchase.

- etc.

These days, one of the biggest spoiler of property investment is “project delays”. Though not all delays are due to the builders, but they will always have the onus on them.

Good, reputed developers always seems to find a way out and complete the project within schedule. In property investment, there could be noting better than a timely completion.

I hope these ideas will give you some food for thought for your next property purchase. Please do write in the comment section below and share your point of view.

Have a happy investing.

Suggested Reading:

Is property investment still a smart move in today’s market?

Yes sure, rich cashflow but low yield.

Is it better to invest in residential or commercial property as a beginner in India?

For a first timer, residential will be better. Dealing with businessmen in commercial property arrangement is more complicated.

Great Read!

I especially like the different checklists provided for affordability calculation, loan preparation, property selection criteria covering price, location, specifications etc. These will be very handy for first time real estate investors to follow.

very informative blog on property investment

Your blog stands out for its authenticity and genuine voice.

Information is incredibly helpful. It provides guidance as to where we should go. We can at least have an idea of what should be obtained in the short term and what should be obtained in the long term.

very nice platform. thanks

great content. thanks for sharing

Amazing content really made a difference for me. Regards for the sharing.

A very useful post with attractive infographics. Totally in agreement. One of the best investments that is comparatively safer than other investments is real estate. Prior to making a real estate investment, research is equally crucial. I found this blog, which offers some really great concepts and details on Real Estate Financial Research. Thanks

Well written Mani. Continue your good work.

I wish to sell my jubilee hills property.

Very informative. This will shows the actual picture of Real Estate industry and why one should go with real estate for investment.

Now, Based on this investors can invest more wisely where they want and will get absolute minimum return.

Nice, Keep posting.

I came across this article and really found it helpful. Thanks for sharing such an informative article.

Thank you for Posting the informative blog regarding the homes.

Very good blog keep going on like this.

There are so many blog i read right know but any one of them satisfy me but this one is so informative blog.

Very helpful article!

Tons of Thanks!!!

Please keep up the good work you are doing!

amazing information , thank you for sharing very valuable information with us, keep posting more content.

Thanks for writing this down. Thinking of investing in real estate through REITs so as to get regular income. Is this good?

I think that is one of the such a lot vital info for me. And i’m happy reading your article. However should observation on some general things, The web site taste is perfect, the articles is really excellent

I came across this article and really found helpful. Thanks for sharing such an informative article.

Hi Mani,

I am not able to access your blogs for the last 2 days.Not sure where the issue is.

Regards

Malcolm

I confirm, the blog has been up and running all these days.

I read your article. Really appreciate the deep understanding of every real estate investment aspect. good guidance. I follow few articles about fractional investment. could you please put some light upon it.

Reference :

https://www.cnbctv18.com/personal-finance/is-fractional-property-a-better-investment-option-than-ppf-9524761.htm

Not a bad idea. Groups of people have been doing it all over. But it has its own share of risks.

Worth informative article thanks for sharing.

Thankyou For sharing nice information about property investment and also nice article on Property.

Thankyou, For sharing nice information about the real estates, and also how to invest on real estate….

One of the amazing articles I read till now. Such amazing content for beginners to learn how to invest in Real Estate. What are all the things to be considered like the location of the property, Size of property, Affordability, Acceptable quality & amenities, Time of purchase.

It was surprising to learn about the growth of Delhi. Probably the too hot or too cold climate is making the difference.

Hi Mani, Although real estate marketing is a tough task, This is a good and informative article about the real estate business. This information can be helpful for those who are thinking about investing in the real estate business and want to go for property dealing projects. Anyways Keep on doing good work.

I am real estate from India, Tamil nadu, Coimbatore . I am trying to find invester

Very good info. I have a question that I believe will benefit other readers too:

Let’s say you have 50lacs, will you rather invest in a land that’ll surely appreciate rather than a house for rental or own occupation (apartment or even an individual) which is going to depreciate in value (buildings depreciate)??

The point is I see is, if you want to create wealth, it’s better to scout for land and wait for the long term rather than a house that is surely going to depreciate.

Your thoughts pls.

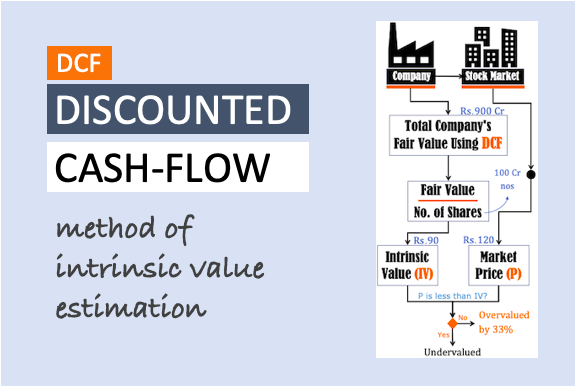

The value of an asset is defined by its ability to generate future cash flows.

As a person, correctly analyzing and estimating “future cash flows” of a piece of land (an asset), is a challenge.

People who have an eye for land will prefer investing in it over other assets.

Thank you for posting your point of view.

This is an outstanding post that’s filled with so many useful nuggets. Thank you for being so detailed on Property Investment.

I read your article it’s fabulous. Some of my friends and relatives are really searching for this information. So I’m sharing these articles with them. So they too get the benefit. Thanks for sharing this article. Keep on sharing this kind of article. Keep us more updated

I read your article it’s fabulous. Some of my friends and relatives are really searching for this information. So I’m sharing these articles with them. So they too get the benefit. Thanks for sharing this article. Keep on sharing this kind of article. Keep us more updated.

I read your article it’s fabulous. Some of my friends and relatives are really searching for this information. So I’m sharing these articles with them. So they too get the benefit. Thanks for sharing this article. Keep on sharing this kind of article. Keep us more updated

It gives knowledge of purchasing property, the insights that are so informative to buyers listed in this article, a really nice article.

Great article shared by getmoneyrich, gave good guidance and a lot of information to property investors, they get good knowledge through this article.

Many aspects are covered. Good article. I would like to know how you see investment in residential plots and agricultural land in India.

Great posty!

Greetings !!!

We are Pvt.Ltd. Firm engaged in hospitality & real estate business . We want developers to invest in our on going Real Estate project in Maharashtra ,India .Can you guide us as to get contacts of such Developers .

A very informative post and the infographics are nice too. Couldn’t agree more. Real estate is one of the golden investments which is comparatively safer than other investments. Doing research before investing in real estate investments is equally important. I came across this blog which outlines some real nice ideas and information on Real Estate Financial Research. Thanks

It is very important to know the DATE and TIME any article is published, in order to be able to make an informed decision about its applicability etc. This is generally true of all blogs and news sites etc.

Otherwise this is a great website. Thank you.

You are right. But for the moment the post must run without them. Thanks

Thank you for the qualitative information shared. It really helps real estate investors and first-time buyers. Property investment is the best way to get higher returns.

You made a good point that calculating strength is very important to easily overcome the qualities that are well within my budget. I plan to start buying real estate every year to prepare for my retirement, which is getting closer and closer to my retirement. I am hoping that I can find homes that can be easily liquidated if I need them, I cannot plan to sell them if I go to my grandchildren someday.

This article is very useful for me. I always gaining knowledge from your articles. I hope you are continuing to building our knowledge. Thanks for sharing.

Good article. This information is very useful. I always gaining knowledge from your articles. Thanks for sharing valuable knowledge with us.

Asif,

How can I get in touch with you

Regards

You made a good point that affordability calculation is very important in order to easily cross out properties that aren’t well in my budget. I’m planning to start buying real estate property every year in order to prepare for my retirement that’s getting closer and closer. I’m hoping that I can find houses that can easily be liquidated if I need to but are also attractive enough that I can pass down to my grandchildren someday in case I don’t plan on selling them after all.

really you are doing great..

Hi there, thanks for sharing this article very much informative! Hope you will share more

in the future!!

Nice to read. Very useful article for me and will be helpful for those who really want to start investment in real estate.

Amazing piece of content really helped me a lot. thank’s for sharing.

I am a consultant to buy a properties auctioned by the leading India Bank.

I have good experience about that type of property.

I have much more property which as provided by bank 25% less by the market Price.

So I want to share my experience with your company.

Plz feel free to contact me this is my pleasure to work with your company

This is basic but very useful information for beginners.Is there any online course for india market?all courses i found are US based

My writing are mostly basic and target beginners.

Thanks Mani,

You have simplicity and ease of understanding for a common manless literate people. Very lucidly written articles.

Thanks again

hello . i have a question . like in the us people generally buy a property on down payment say 20% and rent it out . and the rent pay their mortgages plus if something left is added benefit. eg $100000 house at 20000 down . they get rent around say 1200$ and mortgage is 1000 so profit . can we do the same in india or any other way like this to own propeertty and earn . i calculated a basic emi could be around 66k rs for a 80 lakh property but the rent we get is hardly 20krs per month . this is hyd im talking about . so any property hack to own property like in us.

thanks

Buying property on loan for income generation is not a good idea. It worked in US only during times like 2008-09 where properties were selling at distress price levels. But now, it neither works in India nor in US.

Information I was craving for so long. Being a beginner … information I found quite beneficial.

Thanks for posting your comment.

Mani,

Are the returns I REIT guaranteed

Hi. Its all about Residential properties. Is a commercial property better option for investment purposes? E.g. shop, office space, godown space etc.

Information is very very useful. It gives direction where we have to go. We can have a idea atleast that what should we get in short term and what should be in long term

Thanks for taking time to post your comment.

Yes perfect! Property investment is indeed one of the best and high returns investment. The post is very informative and helpful for property investment.

That’s a very indepth article written. I was also searching for such a great piece of work.

I have a question in my mind, if you could put light on that–

owing a piece of land is good as compared to having a builder floor watching the current situation where many projects has been delayed and many of property builder has gone bankrupt

As land on its own cannot generate income (like gold), valuing land is not as simple. Hence many other aspects needs to be considered to estimate a “right price” for it. For people who lacks this skill may end up with a bad decision. A developed property is always a better bet for novice. For experienced investors, land can fetch higher (and faster) ROI’s.

very helpful post for initial investors. THANKYOU. keep up the good work.I would also love to know more on the rental property investments with very less money down. Or if you could also explain if brrrr strategy is applicable in India at this time?

Thanks for sharing the article. Lots of useful tips!

thanks for sharing your good post.

Hi, thanks for the informative Blog the article is very useful.

One of the comprehensive articles on the subject. It covers a wide range of topics about real estate investing.

Thanks for posting your views.

Your article on property investment is fabulous and gives a lot of useful information .your suggestion to buy a flat at the launch of project is really good .Wish to continue with more useful information to the public .Thanks alot

Thanks a lot for your feedback.