You can check my mutual fund calculator here. It has been coded to help beginners to estimate how much to invest for a financial goal.

| Lumpsum Investment (Rs.) | |

| Monthly Contributions (Rs.) | |

| Rate of Return (% p.a.) | |

| Investment Horizon (Years) |

| Final Lumpsum Amount (Rs.Lakhs) | |

| Fianl SIP Amount (Rs.Lakhs) | |

| Total Amount (Rs.Lakhs) |

But why we need such a calculator? Why we cannot simply start a SIP in mutual funds based on our current savings? This way no calculation is necessary, right?

Yes, in fact this is the way most of us invest money. As because we are saving few bucks from income, we consider it prudent to invest it. No problems. The thought process is not wrong.

But why not give more structure to the way we think about investments. How to do it? By adding more strings to our decision making process.

Let’s talk a little bit about decision making involved in investments.

Decision Making While Starting To Invest

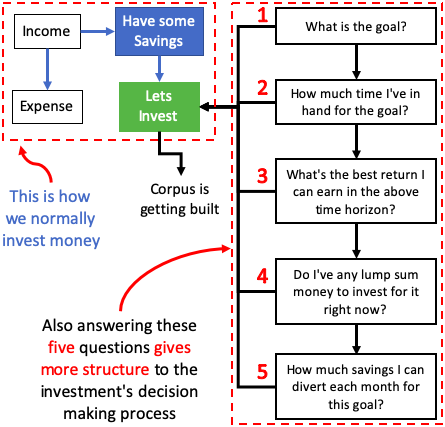

When a person is making some savings out of his/her income, this money can be invested. The money so diverted for investing builds a corpus. Over a prolonged period of investing, the corpus becomes sufficiently big to render a meaningful utility.

But there are few open-ended questions in this style of investing. To give more structure and meaning to the decision making process, at least five question needs answering. The answers to these five questions must be known before starting to invest.

Here are those five questions:

- What is the goal? Why I’m investing money? For what I plan to use the built corpus? What are those future needs for which I must start investing from today? These are few basic question that must be asked before investing. The purpose is to give our investments a definite direction, otherwise it’ll get lost on the way. Example: one such goal can be Retirement corpus building. Read: Goal based investment.

- How much time I’ve in hand? Here we are answering, after how many years, the goal will need attendance. Example: if we want to buy a car, we must know when we want to buy it. If we have funds, we can buy today. But if we don’t have funds, we must know how much we can wait for this goal. Why time is required? To build funds for it. Read: Time is money.

- What will be my return? What will be the best return I can earn in the above time horizon? The more time we’ve in hand, higher returns can be earned. How? Because when time horizon is long (above 3 years), we can afford to delve in equity. Equity can fetch higher returns. For shorter horizons, we’ll have to rely on debt (gives lower returns). Read: How to estimate returns.

- Lump sum investment is possible? If one is clear about the available time horizon and expected returns, lump-sum investing can help build the corpus faster. So, before investing, asking this question is vital. If one is not sure about how to invest lump sum money, systematic transfer plans (STP) of mutual funds can be used. Read: Thought process of investing lump sum money.

- How much I can contribute monthly? For common men, lump sum money may not always be enough to reach the goal in time. Hence each month, one must invest-more for the cause. This additional investment is done by the way of monthly contributions (SIP). Think, how much monthly SIP will be more than enough for the goal? Further more, also think about how much you can afford each month for the SIP? Read: About systematic investment plan (SIP).

About Mutual Fund Calculator

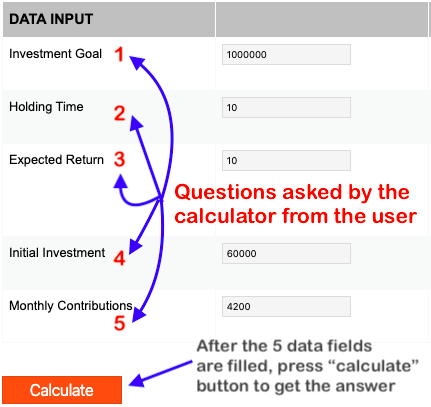

My mutual fund calculator has been coded to shape ones investment considering all of the above five questions. How?

It asks these same five questions from its users (see below). The user must enter these values, and then click the “calculate” button. The calculator will then do the balance computations in a jiffy and display the report.

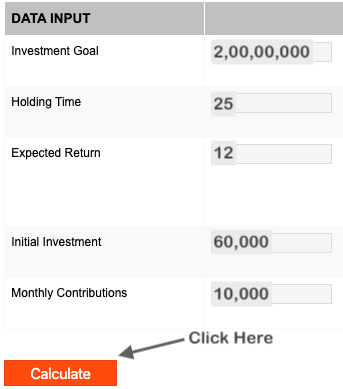

Let’s take an example to understand how to use this calculator. Suppose one wants to invest money for building a retirement fund of size Rs.2.0 Crore. But he is not able to understand how to go about it. This is where my mutual fund calculator can help. Let’s see how.

- Retirement Fund Building:

- Goal: Rs.2.0 Crore

- Time in hand: 25 Years.

- Expected Return: 12% p.a.

- Initial Investment: Rs.60,000

- Monthly Contribution: Rs.10,000

What we are doing here is to check that, whether a combination of Rs.60,000 (lump sum) and Rs.10,000 (monthly contributions) are enough to build the retirement fund. The target to do it is in 25 years @12% p.a. returns.

Let’s see how the calculator spells out the result:

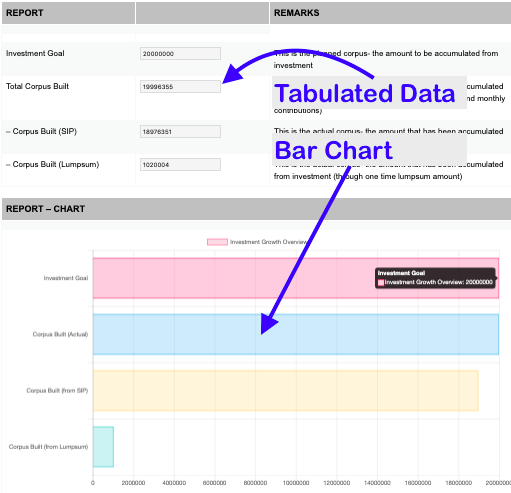

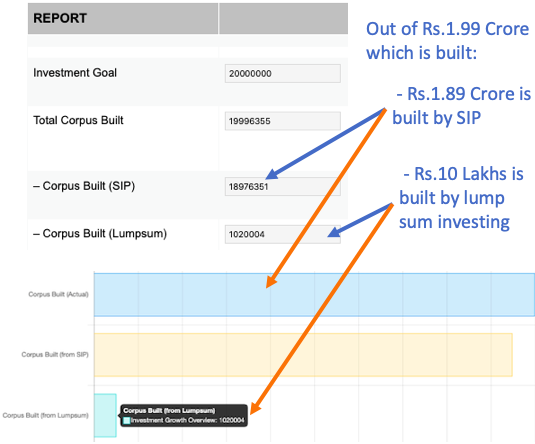

There are two important details displayed in the result:

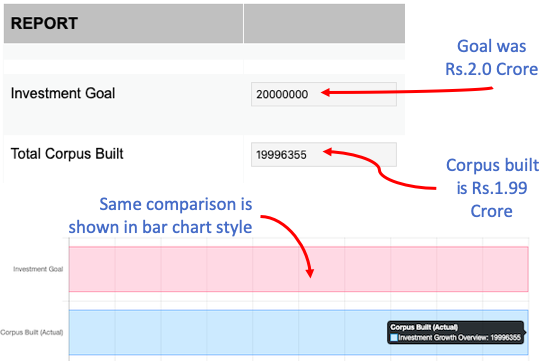

- Whether Goal Is Reached? The goal was to build a corpus of Rs.2.0 Crore. The first thing a user must look at is, whether the given set of numbers are able to carry him to the goal. How to check that? By comparing the goal vs the total corpus built in the report section.

- How it Reached There? In the above example, we can see that the investment strategy is able to meet the goal. But there are two components of the strategy: (a) Lump sum investing, and (b) monthly contributions. Here we can ask, which strategy is contributing most for the goal? How to check that? This is also highlighted in the report section of the calculator.

1. About Expected Returns…

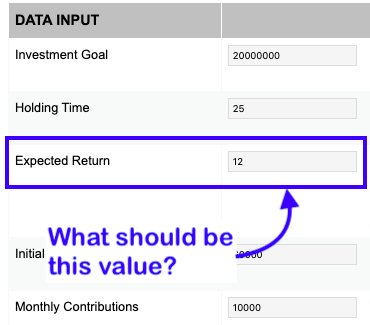

In the mutual fund calculator the user is asked to enter a value called “expected returns”. This is an important data that needs to be defined further for clear understanding of the readers.

What value must be entered in the “expected returns” cell? How to judge which value is right for the moment?

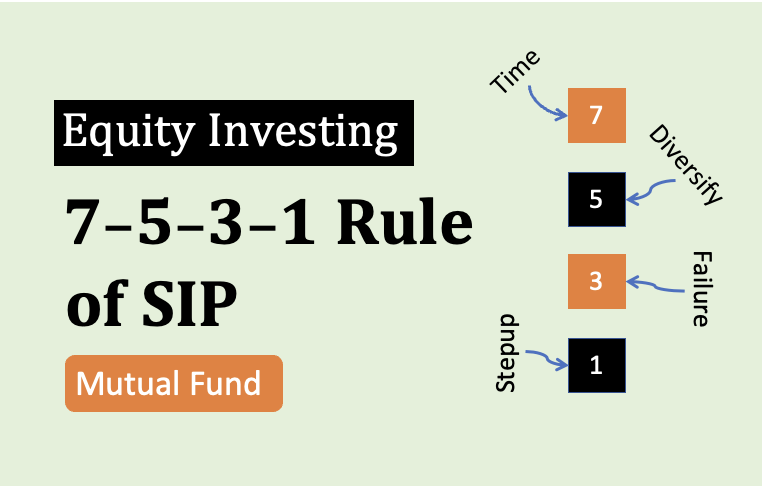

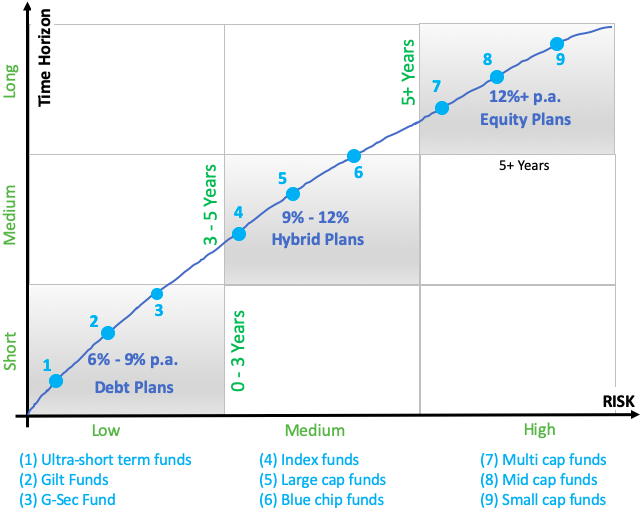

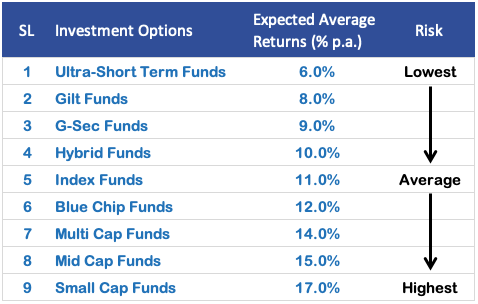

The value can be judged based on a rule of thumb. The rule of thumb is dependent on the the time horizon available for investment.

| Expected Returns | Description | Time Horizon |

| 6% to 9% | When the available time horizon is short | 0 – 3 Years |

| 9% to 12% | When the available time horizon is medium | 3 – 5 Years |

| 12% + | When the available time horizon is long | more than 5 Years |

What is the logic behind the specified return numbers?

- Short Term: When time horizon is short, one cannot invest in high return vehicles. Why? Because in short term, their returns are very volatile. So what? In this case, investing in them has a high chance of capital loss. So one must stick to debt plans. Their returns can range between 6% to 9%. Read: SIP in debt funds.

- Medium Term: When time horizon is more than 3 years but less than 5 years, one can afford a balanced portfolio – debt plus stable equity. Such a portfolio can yield returns upto 12%. Read: Invest risk high returns.

- Long Term: When time horizon is long, one can invest in high return vehicle. Though their prices are volatile in short term, but in long term their returns are more assured. As available holding time is longer, going with high-risk equity becomes viable. Equity heavy portfolio can yield 12%+ returns in India. Read: How to invest in share market.

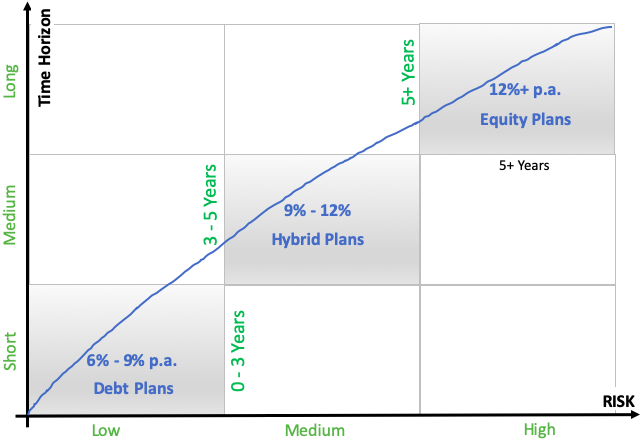

So now we have understood, what investment returns to expect on basis of an available time horizon. But there is one more question that must be answered. Where to invest money to earn those returns?

2. Where to invest money?

This calculator may not be able to tell you about ‘where to invest money’, but it can point specifically towards it. How? For that we will have to look at the ‘expected return’ numbers in the calculator.

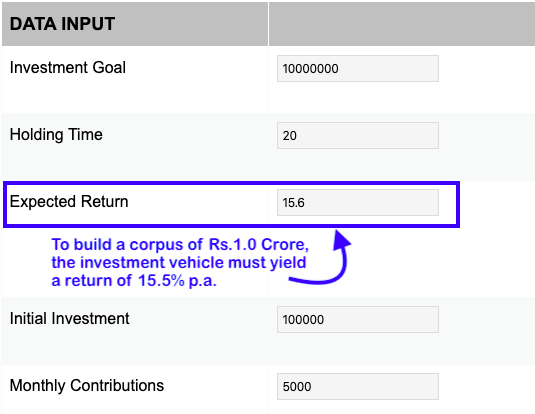

In the above example, we can see that to build a corpus of Rs.1.0 Crore in 20 years, one has planned to invest Rs.1.0 Lakhs in lump sum, and Rs.5,000 per month.

But these combination of numbers will only work if the investment is generating an expected return of 15.6% p.a.

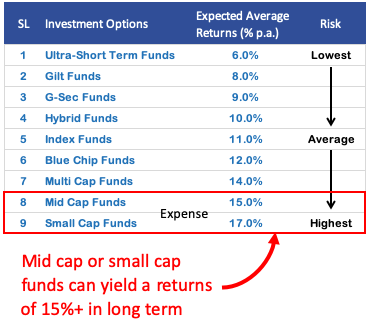

Now the question that must be asked to one self is, where to invest money to get return of 15.6%? To get an answer we’ll have to see the below graphical representation:

Let’s see how the above infographics can help in picking a suitable mutual fund (where to invest money?):

The calculator is showing an expected returns of 15.6% p.a. will be required to build a corpus of Rs.1.0 crore in 20 years. Now, look into the infographics shown above. Two things needs to be seen:

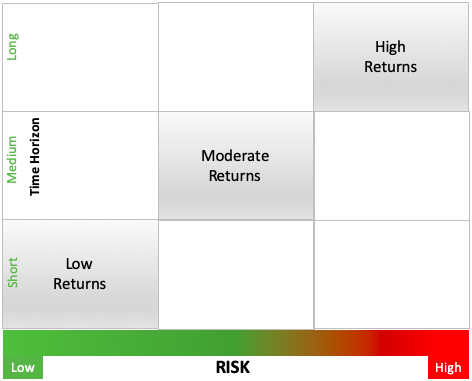

- First: The expected return numbers are landing us into which quadrant. There are basically three quadrants shown in the infographics: (a) Low Risk-Short Term, (b) Medium Risk – Medium Term, & (c) High Risk – Long Term. In case of expected return being 15.6%, it is only possible in the third quadrant.

- Second: In the third quadrant, there are three type of mutual funds which can generate returns above 12% p.a. Out of these three funds which type of fund can yield 15%+ returns? According to the graphics only mid cap and small cap funds can generate such high returns (in long term). Read: Small cap and mid cap funds.

I will suggest you to self-prepare one such “infographics” for your personal use. I have one for myself. It has more constituents than shown above. Suggested Reading: Mutual Fund Investment [Basics].

So this way, with assistance from your “infographics”, a simple calculator can single-out a right investment option for you.

Note of Caution: Try to stick to your quadrant. Never get lured by high returns and decide to invest in the upper quadrant. Let’s read why?

3. Stick To Your Quadrant

Question: Investment options which gives highest returns is always the best choice? Not always.

Some might think that, why to invest in a debt fund when equity funds are promising double the returns? This is one dilemma that all investors face while investing.

Why there is a dilemma? Because there is a temptation to pick investments which are yielding “higher returns”. It is really tough to ignore this temptation.

But why not pick the investment which is giving the maximum returns? It also sounds reasonable, right? Not always. The problem lies in the risk that is associated with high return investment options.

So what is the solution? Always sticking to ones quadrant. Why? Because the quadrant provides the “best balance between the available time horizon, risk and possible return“.

Hence, if your calculator is pointing at hybrid fund, do not opt for a small cap mutual fund.

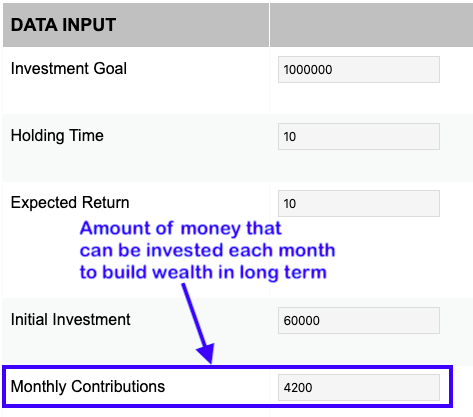

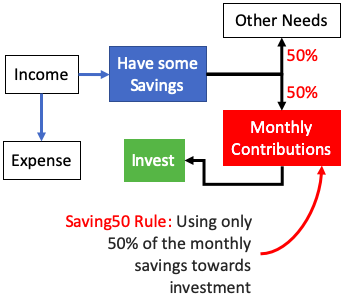

4. About Monthly Contributions

For a common man, the most practical way of wealth building (in long term) is by regular investing. How to do it? By giving monthly contributions to an investment continuing for long term (this is what we called as SIP).

A special care must be taken to finalise monthly contributions. How to do it? By following a rule of thumb. I call it Saving50 Rule. What is it?

Saving50 rule tells us to use only 50% of current savings for investing. Why? Because it ensures sustainability. How?

Suppose my monthly savings is Rs.5,000. If I’m using all of Rs.5,000 for SIP, I may face hurdle to continue this way in future. How? Example: In case of emergency I’ll have to stop my SIP to pay for it.

Hence, better will be to use only as much savings which will continue to feed my SIP irrespective of any situation.

So, while using the mutual fund calculator, always remember the Saving50 rule. Idea is to prevent oneself from overcommitting and ending with a default.

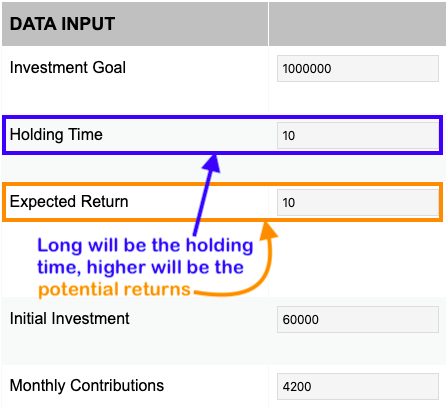

5. About Holding Time

As important it is to decide upon a right expected return and monthly contributions, holding time is equally important.

The idea behind using this mutual fund calculator is to build wealth for a future goal. In planning, figuring out a right time horizon is essential. Why? Because this is the time for which you must hold your investments.

Holding time is key. Why? Because the longer will be the available holding time, higher will be the potential returns.

So make sure to give yourself as much time as possible. This way you can invest in those investment option which can yield higher returns (see #1 & #2 above).

Conclusion

Use this mutual fund calculator to figure out what is your future goal and what is its financial worth. You must also decide how much time is available to meet this goal.

Once you know these 3 details, use the mutual fund calculator to find how much you must invest to build the corpus.

Depending on the available time horizon, use this article to judge what shall be your expected return (see #1) on investment (ROI).

Once the ROI is known, use this article to know where to invest money (see #2) to generate those yields.

Note: Please remember to always invest by remaining in your identified quadrant (see #3). It is also essential to follow the Saving50 rule (see #4) in finalising your monthly contributions.

Have a happy investing.