I generally write about fundamental analysis of the business. I got this feedback that such articles are less helpful for the novice. They would prefer a more basic write-up that covers stock investment for beginners. So, I thought to give it a try in my writing style.

Stocks trade in the stock market. So allow me to start with a mention of Mr.Market and online trading.

In my 20s, whenever I used to hear about the stock market, my initial thoughts were not pleasant. It only brought images of shouting, commotion, and crowd. People of my generation had the same feelings. Right? Moreover, parents used to dislike it. The stock market was equivalent to gambling for them. It was a negative bias for sure. Suggested reading – Starter’s guide for the stock market.

It was an age when online trading was not available. The trading happened directly on share market floors. Traders used to use hand gestures and shout to execute a buy-sell order. For people like us, finding a competent trader was as complicated.

Today, the situation has changed. These days, stock market floors have become silent. All stocks are bought and sold online. Individual investors can buy-sell stocks independently, and no third-party intervention is required.

Furthermore, individual investors have also matured. More are investing than speculating. Investment and speculation are different? Yes. Investing is done upon analysis for long-term gains. While speculating in stocks, analysis is shallow, lacking depth.

Takeaways: First, online trading has made buying and selling stocks easier. Second, speculating is not investing. Third, if one wants to practice investment, the assets must be first analyzed and then bought for the long term. Know More: How to practice long-term investment.

Why Invest In Stocks

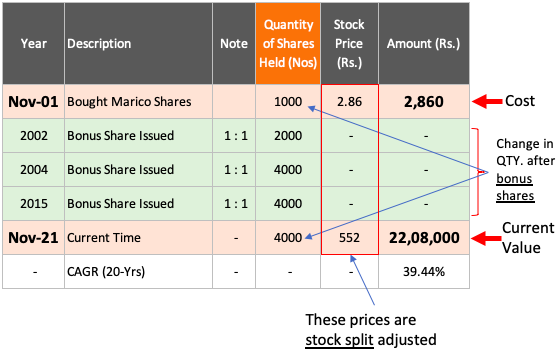

Good stocks have the potential to grow fast over time. Here is an example of a listed company called Marico. Suppose there is an investor who has held on to its shares for the last 20 years. Allow me to show the value of his investment as of today.

An investor named Pradeep bought 1000 number shares in Nov-2001. He continued to hold on to his stocks till today, Nov-2021. So, let’s calculate the present value of his holding.

Between the YR-2001 and 2021, the company issued bonus shares to the shareholders thrice (see the above infographic).

[Please note that I’ve not considered the effect of stock-split on the holding quantity as the prices are already split-adjusted.]

So, to calculate the long-term return for Pradeep, we must consider two factors:

- Price Growth: Marico’s share price has grown from Rs.2.86 to Rs.552 in 20-years.

- Bonus Shares: The quantity of holding shares for the investor grew from 1000 to 4000 numbers due to the bonus shares issued.

Considering these two factors, the return offered by Marico to Pradeep is a massive 39.44% per annum.

Takeaway: the price of good stocks grows with time. If the company also offers bonus shares, it is like the icing on the cake. But to enjoy the benefit of bonus shares, it is essential to hold on to the stocks for a very long time (like 10-20 years). In this case, the ROI offered by it is unmatchable from any other investment options.

Shareholders Are Owners?

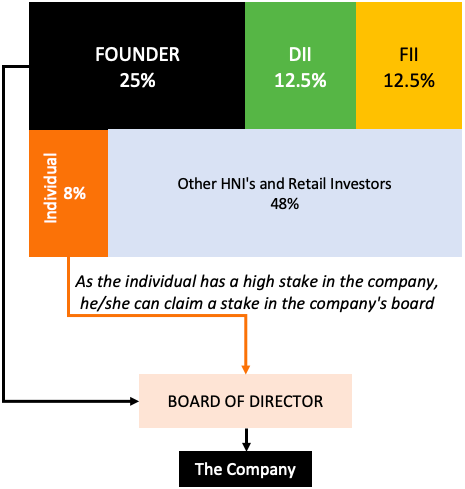

A stock (or share) is a small portion of a company. When one owns one share of a company, it is like holding proportional ownership in that company.

This ownership is not exactly like what Ratan Tata may enjoy over Tata Group. Shareholders have a claim on net profits (PAT).

Example: Suppose there is a company that has 100 shares in the market. You own one share of that company. The company makes Rs.1,500 in net profit. Then as a shareholder, your claim will be Rs.15 (1500/100).

You may not dictate terms on how to run the business, but the company is obliged, but not binding, to share with you Rs.15.

Why no binding? Because it is within the company’s rights to retain the profits instead of giving them to shareholders (as dividends).

Takeaway: A shareholder is a proportional owner of its company. If the shareholding is high, the person’s (or a nominee) inclusion in the board of directors is possible. This way, the shareholder has the option to run the company as an owner.

Stock Price and Business

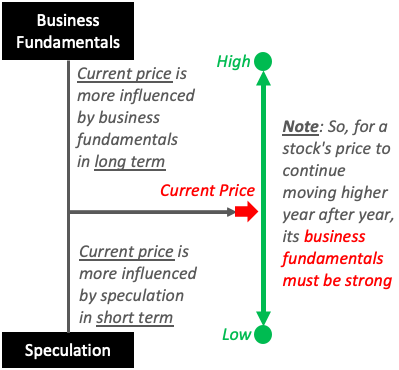

Stock prices move up and down every few seconds. This volatility makes stocks both risky and builds value at the same time. But why do stock prices move up and down?

To understand it, we will classify the price movements into two parts:

- Short Term change: Price movements in the short term are due to demand and supply imbalance. When demand for a stock is high (more buyers), the price goes up. When supply is high (more sellers), the price falls. Between 1-day to 1-quarter, price fluctuations are mainly random. It is either triggered by some non-financial news about the company or by speculation. Beyond one quarter (3 months), there can be a rationale behind the volatility. Why? Because companies publish quarterly reports for the stock market. Price movements, within a year, are less driven by business fundamentals and more by market sentiments or speculative behavior of the investors.

- Long Term change: Long-term price movements follow a trend. If the business fundamentals are good, the stock price will rise and vice versa. Though the quantum of price rise/fall may not match the change in business fundamentals, at least they are relatable. What are business fundamentals? Sales, profits, net worth, asset base, profitability, cash flow, etc. Read: How to identify good stocks?

Takeaway: We must realize the relationship between time and the price of a stock. Its current price is more influenced by speculative forces when holding time is shorter. When the holding time is high, business fundamentals drive the price. It is the reason why experts advise buying shares of a strong company.

Finding A Strong Company

It is from here onwards that stock investment for beginners may start to look complicated. But not to worry, the explanation will be simple.

While buying stocks of a company, the focus should NOT be only on price. Attention should be more on the business. We know it is the business that ultimately influences price in the long term.

But if we are trading in stocks for the short term, we may not care about business fundamentals. But we can combine investing and speculating to get good results. How?

People who are pro-traders have tools that can suggest to them when to buy and when to sell. Moreover, these investors trade in stocks in high volumes. For them, even 1-2% gains are enough.

But retail investors who invest tiny amounts in a company, the volume game will not work. Here they rely more on assured high returns, like 12% per annum for 10-Years. Read about compound interest & its utility in investments.

How to combine investment and speculation?

In Four Steps:

- Step #1: Buy stocks of only fundamentally strong businesses. If implemented well, with other steps, it can substantially reduce the risk of loss.

- Step #2: Make sure to buy them at a fair price. Buying good stocks at a discount can seal the deal. From this point onwards, the investors almost have a cent percent chance of making profits.

- Step #3: When you buy stocks, do it with the intention of long-term holding. Why? Because in the short term, the price is volatile. If the mindset is for long-term holding, this volatility will not matter.

- Step #4: Buy stocks by fixing incremental milestones. Example: 10% up in 1-day. 12% up in 1-month. 15% in 3-months. 20% in 6-month. 35% up in 1-year holding. Sell the stocks at the target prices. Alternatively, hold them for long periods.

[Suggested Reading: Analysis of stocks in excel]

Trading In Stocks Is Advisable?

Stock investment for beginners is about buying good stocks at a fair price and holding on to them for the long term. So, if a trading opportunity comes, what to do? My suggestion will be, do not trade.

We do not have the right tools available to trade stocks. Hence timing the stock purchase will be inaccurate. Read more about day trading.

So what to do? See the steps shown above in this article.

Use an online trading platform. It is a refined form of investing in stocks. One can use a trading platform and buy/sell stocks from the comfort of home. These days there are online brokers (like ICICI Direct, Axis Direct, Sharekhan, Zerodha) who provide such platforms. Suggested Reading: how to start investing in the share market.]

Using these trading platforms, one can self-trade stocks. The dependency on the brokers is gone. Agents/brokers do not execute buy/sell orders on share market floors. Automatically the trades are executed – online.

Following A Process

Investing in stocks has become too easy. If you have a smartphone and an internet connection, you can start buying stocks within minutes. But do not start so quickly. Get the process right before buying your first stock.

The process:

#1. Know Why You Are Investing?

What is your goal of investing in stocks? If you can answer this question, it completes the first step.

Fix a goal and its timeline. Knowing how far it is from today is a necessary realization before investing. One must also assign a value to it. This way, the goal will get quantified.

For beginners, if the goal is less than 3-years away from today – preferably avoid stocks. If the goal is further away – stocks could be a good choice.

Follow these sub-steps to finalize the goal:

- Name It: Make sure to name your financial goal. It can be like retirement, funds for children, marriage, car, home purchase, etc. An example of this can be a downpayment for the home.

- Quantify It: How much funds are required to meet the goal? Indicate the value in your local currency. One example is Rs.20 lakhs for the downpayment for a home loan.

- Time: The time available to meet the goal must be known. It is the time horizon we have in hand for investing and building the capital. One example is 5-years to accumulate funds for the downpayment.

- Cost: How much the goal will start costing you, starting from today. For example, investing Rs.23,000 per month in stocks will build a corpus of Rs.20 lakhs in 5-Years at 15% per annum return.

Check the below investment calculator to quantify your cost:

| Corpus to be Built (Rs.) | |

| Expected Return p.a. (%) | |

| Time (in years) |

| SIP (monthly contribution) (Rs.) |

How do I fix my goals? I avoid including goals like vacations, car purchases, etc. My preference is to invest money either for a priority or for asset building.

- Priority – can be like child care, parents care, education fund, financial independence, emergency fund, etc.

- Assets building – buying such assets which can eventually generate streams of passive income for me. For example, a real estate property, annuity, dividend stocks, etc.

#2. Purchasing Stocks

Purchasing stock of strong businesses at an undervalued price is a must. We already know this. Right? But how to identify such companies?

There are two steps involved here:

- 1. Fundamental Analysis: In this step, analyze the business behind a stock. How to do it? First, create your list of shares (only 3 to 5 nos). The best way is to keep a ready list of stocks having a quality business. How to identify them? By doing a fundamental analysis of its business. I keep it in my google finance spreadsheet. Make sure to eliminate troubled companies like Idea, Jet Airways, Kingfisher, etc.

- 2. Price Analysis: After analyzing the businesses and preparing a list, go for price analysis. In the list, assign a target buy price for each stock. Now, start tracking-price of these stocks in a google sheet. Whenever the price falls, compare it with your target price to check if the buy time is near. To set a suitable target price, one can also estimate its intrinsic value.

I use my stock analysis worksheet to do a thorough fundamental and intrinsic value estimation of my list of companies.

Takeaway: Before buying any stock, it is better to do as much digging as possible about its business. Reading the latest news about the company helps to know the latest insights. I subscribe to google alerts to get it right into my inbox. Reading about the board of directors of the company is also good. We can also look into the website and products of the company. Knowledge of current customers of the company will also build a perspective.

Do Not Want To Trade in Stocks? These Are The Alternatives

Stock trading may not be for everyone. Hence, exploring the alternative is necessary. There are two excellent alternative options. The first is index funds, and the second is exchange-traded funds (ETFs).

People who are busy and cannot do self-research can follow this approach. Start a systematic investment plan (SIPs) in these types of mutual funds.

- Index Fund: It offers the best investment diversification in equity-based investing. Here the investor can earn average market returns with minimum possible volatility and risk. But the only control point is that the investor must stay invested for the long term (5+ years). Read about index investing.

- ETFs: Exchange Traded Fund is a hybrid product. It combines the benefits of stocks and mutual funds. In India, there are three types of ETFs. Index ETF, Bank ETF, and Gold ETF are most prevalent. The price of ETF is as volatile as stocks. Hence prospective investors can take advantage of price volatility and trade in ETFs. Read: About ETFs.

Suggested Reading: Index Funds vs. ETFs – which is a better alternative.

For a beginner, the ideal starting point will be index funds. Once some investing experience is built, including ETFs in the portfolio will be a good idea.Stick to ETFs for some time. Soon you will feel that now you are ready for direct stock investing. At this point – go for it. Read more: How to make money in the stock market.

Suggested Reading:

![Compare Indian Banks: A Quick Fundamental Analysis [2023]](https://ourwealthinsights.com/wp-content/uploads/2021/05/Compare-Indian-Banks-Image4.png)

I found great pleasure in reading your thoughtful blog article. The views and concepts you expressed were tremendously useful.

I am Beginners, Thanx For This Artical.

Hi Sir

Do enhance the “coverage of stocks” in your stock analysis sheet and also advise on “GRANULES INDIA”- DECLINING PRICES-is ur score the same.await feedback

Hi, as of today the worksheet can analyze 850+ stocks. Few more stocks are under consideration. Granules India looks interesting at the current levels. A deeper analysis will bring out the real facts.

Thank you for being an avid reader of the blog.

Thanks for sharing this informative article. I am also a beginner in trading and will remember all these key points and information for a good start in this

Hi Mani, Your articles are very good and informative. The way you have explained, even the paid seminar speakers dont explain in such indepth technicalities. Thanks a lot for clearing my doubts. I have another doubt regarding dividend stocks, should I sell them and reuse the profits on another growth stock or accumulate such dividend stocks for healthy income post retirement?

Growth stocks and dividend stocks serve two different purposes, price appreciation, and income generation respectively. One should take a call depending on their investment objective.

Thank you for the feedback

Hello Mani,

Please advise me a good trading platform.

Thank you,

Santosh

The ideas and insights are very worth reading. You really gave valuable information. Great information! I’ve been looking for something like this. Thanks!

Thanks.