In India motor insurance is mandatory. It must be availed by law. Without an insurance, no vehicle can run on the roads.

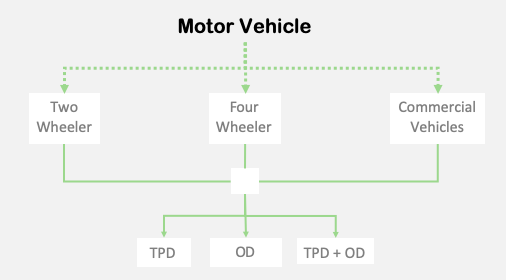

It is applicable for all type of vehicles: two wheelers, four wheelers and commercial vehicles.

There is a reason why motor insurance is made a mandatory requirement. It helps the insurer to deal with the mishaps.

Not only it protects the policyholder from own damages (OD) but also covers the third party damages (TPD).

We will see more about OD and TPD in this article.

Change in Rules [2019]

Applicable from 1st-September 2019, IRDAI has made a change in the motor insurance rules. Earlier, policies were sold either as a third-party cover or as a comprehensive cover (TPD + OD).

But now, insurers are allowed to sell OD and TPD policies separately. This way, buyer can choose to take OD policy from one insurance company and TPD from other.

This rule is applicable for both new and old cars. Standalone Own Damage (OD) covers will now be sold in the market for both cars and two wheelers.

Insurance companies will continue to offer comprehensive covers (OD + TPD). Such deals are often more cost effective than two separate policies (OD & TPD).

Then why people will opt for OD & TPD separately? Because it is only the third-party cover which is compulsory.

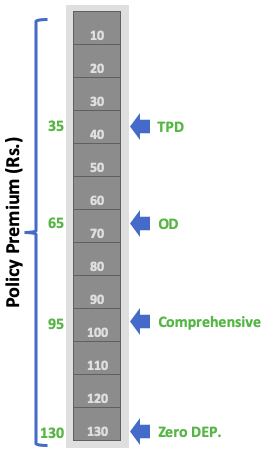

If a person wants, he/she can opt to take ONLY the TPD policy. This will drastically reduce the cost of insurance premium (check their price difference). Though it is not advisable by experts.

Often the losses due to OD far exceeds TPD. Hence, if one has only TPD policy, then own damage repairs must be paid from ones own pocket. Insurance company will not cover it.

Types of Motor Insurance Covers in India

All motor insurance covers can be categorised based on two parameters: (a) type of vehicle for which it is used, and (b) the extent of cover provided by the policy.

It means, if you want to buy motor insurance cover for your vehicle you will have to answer the following two questions:

(a) What is the type of vehicle?

Generally speaking, all vehicles running on the road can be categorized into three broad types (for sake of insurance). Depending on these three types, motor insurance policies are issued to the owner:

- Four Wheeler Insurance: Cars used for personal use will fall under this category. All vehicle starting from a hatch back, sedan, SUV, MPV, Electric vehicle etc are included here. This insurance covers the monetary loss caused due to an accident. The extent of loss can be in form of vehicle damage, bodily injury, property damage, death etc. The beneficiary can be policy holder or the effected third party.

- Two Wheeler Insurance: Scooters and bikes owned by public will fall under this category. This policy covers the monetary loss caused to the vehicle owner (and third-party) due to accident, theft, natural disaster etc. In this policy, third party and personal accident cover is compulsorily included.

- Commercial Vehicle Insurance: Any vehicle which is not used for personal use falls under “commercial category”. Such vehicles can be trucks, buses, taxis, auto-rickshaw, tractors etc.

(b) How much cover is required?

Once the type of vehicle is identified, it becomes clear that out of the above listed 3 policies, which is applicable. Now it is time to consider the extent of damage which shall be covered by the policy.

There are three range of covers which are provided by standard motor insurance policies (see below). One can also utilise add-ons to further increase the range of these covers.

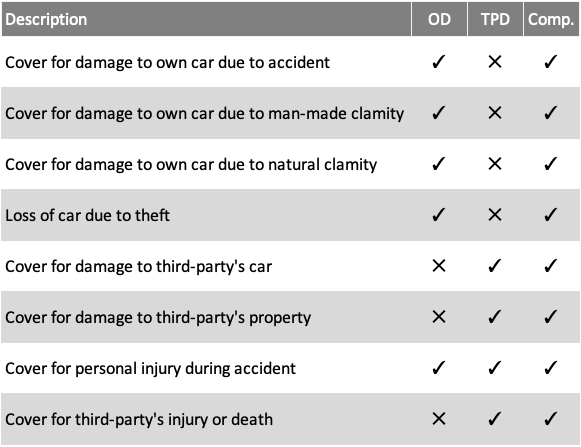

- Third Party Cover (TPD): Here the beneficiary of the policy is not the policy holder but the third party. The policy holder’s damages are covered in OD cover. TPD covers bodily damages, personal injury etc only to the third party and his/her vehicle or property. The damage can be caused due to an accident between the third party and the policy holder. Buying a TPD cover is compulsory for all vehicle owners.

- Own Damage Cover (OD): It covers self inflicted damages to ones vehicle or to self (during driving). The damage may be caused due to a calamity (like fire, theft, flood, earthquake, riot etc), or an accident (damage to car parts). Buying an OD cover is “not” compulsory for the vehicle owner.

- Comprehensive Cover: A comprehensive policy covers both OD and TPD. Generally speaking, premium of OD covers are higher. Why? Because self inflicted damages are more frequent. Premium of TPD covers are lower. Hence a combination of OD & TPD cover is more cost effective for the policy holder.

Comparative: TPD, OD & Comprehensive Cover

- OD: Own Damage Cover.

- TPD: Third Party Cover.

- Comp.: Comprehensive Cover.

Car Insurance Add Ons

In case the insurance buyer needs a wider cover than provided by standard OD & TPD or a comprehensive policy, then add-ons can be availed.

For every add-on, the buyer will have to pay an extra premium. Let’s see the variety of add-on covers available for cars in India:

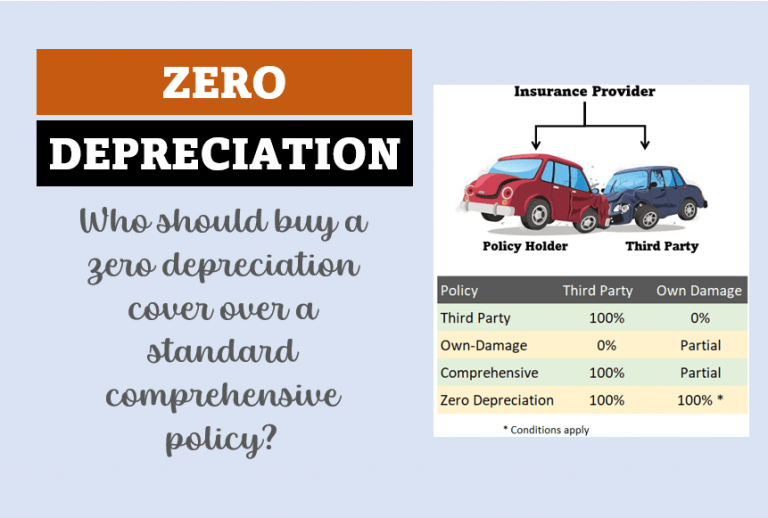

- Zero Depreciation Cover: The value of car and its parts depreciates with time. If the value of a door of a new car is say Rs.10,000. After two years, due to age, its value depreciates to Rs.8,000 (say). In this stage, if the door got damaged during an accident, the insurance policy will cover only Rs.8,000. The balance Rs.2,000 shall be paid by the policy holder. But in case of zero depreciation cover, full cost of repair (Rs.10,000) will be paid by the insurance company. Read: Why to buy zero depreciation car cover.

- Engine Protection Cover: Normal insurance policies does not cover ‘non-accidental’ damage to the engine. Non-accidental damage can be caused due to age/use (wear & tear) of vehicle. It can also be caused due to improper maintenance (like no oil change etc). Such damages are not covered under normal insurance policies. But one can buy this add-on cover to include these damages as well.

- Return To Invoice Cover: Suppose you bought a car of Rs.10 lakhs. After two years, this car got totally damaged (beyond repair) in an accident. In this case, insurance cover will only pay you the depreciated value of the car (70% of Rs.10 Lakhs). But one can buy this add-on cover to get full on-road cost of vehicle from the insurance company.

- NCB Protect Cover: No Claim Bonus (NCB) is actually not a bonus but a ‘discount’ on premium. When a policy holder does not make a claim in a financial year, insurance company rewards the user by giving this discount. But if a claim has been made, NCB is not applicable. But one can buy this add-on cover to get NCB irrespective of claims made. Read: When to avoid car insurance claim.

Which add-on is most useful? It depends from user to user. Generally speaking, a driver who drives with utmost care and lives in a safe city may not need any add-ons.

But if one lives in Metro city and usage of car is daily, then OD+TPD+add-on will prove beneficial. For me, a zero depreciation cover is useful. For a cab/taxi, Zero depreciation cover plus engine protection cover will be a value for money.

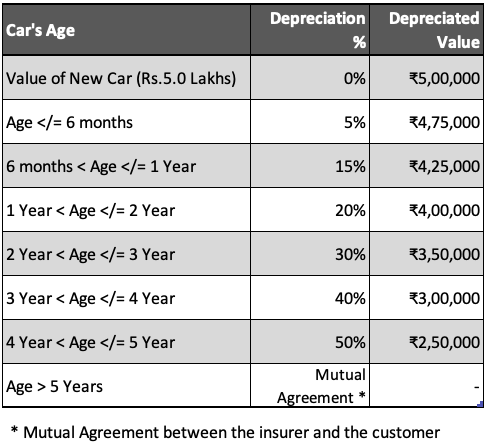

What is ‘IDV’ and what is its utility for the policy holder?

IDV is an acronym for “Insured Declared Value”.

Suppose you own a car whose IDV is say Rs.5,00,000. In case your car got totally damaged in an accident, or it was stolen, it is the IDV that you’ll get from the insurance company.

IDV is the maximum value fixed by insurance company for your car which they will pay in case of total damage or theft of the car.

How insurance company calculate IDV?

IDV = Market Price * (1 – depreciation %).

Depreciation of ‘car value’ happens with its age. The depreciation percentage (%) of the car to be used for IDV calculation is shown in the below table:

Interesting FAQ’s on Motor Insurance

As motor insurance is mandatory in India, people often buy it without going into the details. But buying motor insurance without reading the fine print may lead to future surprises.

Allow me present you few FAQ’s which will shed some lights about those fine details of motor insurance which can actually benefit you:

- Q1. How can I reduce my premium?: While settling an insurance claim, the company pays only a part (say 75%) of the claim. The balance (25%) needs to paid by the policy holder. In this example the “deductible” is 25%. The higher is the deductible for the insurance company, lower will be the premium. If the policy holder willingly increases the deductible threshold, insurance company will charge lower premiums.

- Q2. Bought a new car. My NCB accumulated in old car will be lost?: Accumulated NCB (No Claim Bonus) for the old car can be transferred to the new car. Even if you are switching to a new insurer, NCB can still be transferred.

- Q3. What is the difference in premium between TPD, OD, Comprehensive & Zero Depreciation policy?: Premium of the third-party cover is lowest. The occurrence possibility of OD claim is more frequent, hence its premium is higher than TPD. As comprehensive policy is an amalgamation of OD+TPD hence its premium is higher than individual OD and TPD policies. Approximate price comparison between them is shown below:

- Q4. Damaged caused to car engine due to flood is covered?: Suppose your car got stranded on road which is flooded with 5 feet high water level. If the driver will crank the engine in this situation the car engine will seize. Such engine damage is not covered by a normal motor insurance. An add-on cover called engine protection cover will cover it.

- Q5. Is it compulsory to take insurance for new car from the dealer?: No it is not compulsory. It is also true that car insurance provided by the dealer are often expensive. Why? Because dealers take a cut from the insurance company. Hence, buying insurance by self will save cost. Note: Only TPD insurance is compulsory to bring the vehicle on the road.

- Q6. Is it ok to let the car insurance lapse?: If old insurance lapses, then you can always buy a new one. But the new insurance will come at a higher cost. Insurance companies will charge a higher premium to people who let their insurance lapse.

- Q7. I have multiple cars, can their insurance be clubbed?: Yes it is possible. Clubbing insurance for multiple cars into one policy is possible. This may also result in lower premium.

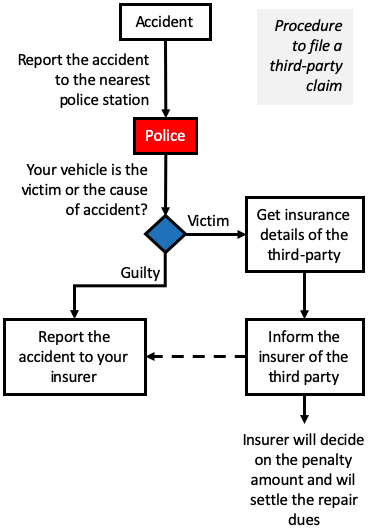

What is the procedure to file a third-party claim?

Third-party insurance claims are rare. This is why their premiums are also low. Do you know why such claims are low? Because of the tedious procedure to file such claims. Moreover, it also involves going to a police station to file an accident report.

Allow me to explain it by use of a flow diagram.

Suppose you were driving on a road and a reckless driver hits you from behind. As a result, your car got damaged. Due to no fault of yours, now your car will need a repair.

But you shall not use your own car insurance to cover such damages. What you should do? Follow these steps:

- First: Along with the other driver reach the nearest police station and lodge a formal report of the car accident. Make sure to describe the accident in detail. Police will ask you and the aggressor to sign on the report.

- Second: Ask the other driver to give you the details of his/her car insurance. You will need the details like vehicle number, policy number, name of the insurer, contact details of the insurer etc. Take a photo of the drivers licence and policy papers.

- Third: Immediately call the insurer of the other car and inform them of the road accident. Also inform them about the reporting of the accident in the police station.

- Fourth: Also keep your insurer informed about the recent accident that has happened in your car.

- Fifth: Take the vehicle to your service station. Ask the service station to call the third-party insurer as well. Then they will coordinate and arrange for the proceedings.

Conclusion

Having a car insurance, third-party cover, is compulsory. But it is always better to keep a cost effective comprehensive motor insurance policy in place.

If you are living in a crowded city where minor accidents are common, better will be to keep a zero depreciation motor insurance. This is specially true for cars which are heavily used.

In case you are driving an expensive car, maintaining an add-on called “Return To Invoice” will be a good idea.

![If A Bank Closes What Happens To The Deposits? [DICGC]](https://ourwealthinsights.com/wp-content/uploads/2021/06/If-a-bank-closes-what-happens-to-deposits-image2.png)

You have written an awesome article I myself was planning on purchasing a new vehicle and was going through articles when I found yours. The details provided are very good and it has made me understand the importance of motor insurance.

My policy lapsed. What should I do now? Please guide me.

If the policy is not lapsed since long time, the insurer might consider. Please approach them…

insurer will inspect ur vehicle and grant u insurance. there is no issue, u just need to visit insurer office once

Your article on Motor insurance is extremely good , explaining about types of insurance, Insured

value , add on cover , procedure for claims etc . Regarding procedure for Third party claim and wish to say that third party vehicle damage claim is not generally entertained by the insurer .

The vehicle owner has to file a case before the court by submitting FIR , Repair bills ,survey report etc .

Thanks for your comment.