What it means when we see an oversubscribed IPO? In an IPO, when the demand for shares of a company overshoots its supply, it is referred as ‘oversubscription’. Let’s see an example:

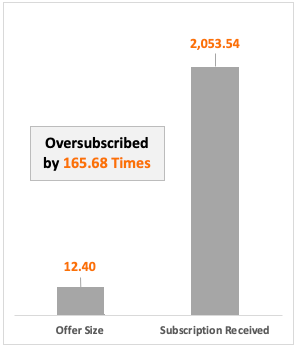

On 2nd-Dec’19, bids for Ujjivan Bank’s IPO was requested. Total number of shares offered for subscription (supply) was 12.40 crore numbers. Total numbers of subscription received (demand) was 2,053 crore numbers.

This is an example of oversubscribed IPO by 165.68 times (=2053.54/20.40).

The demand for shares far exceeds its supply. In this case how allotment of shares is done in IPO?

Here the treatment is done differently for different type of investors.

- QIB: These are Qualified Institutional Buyers. They get it proportionally. See example here.

- HNI: These are High Net Worth Investors. Anybody who is investing above Rs.2 Lakhs in IPO, falls under HNI category. They also get it proportionally. See example here.

- RII: These are Retail Individual Investors. Anybody who is investing less than Rs.2 Lakhs falls under this category. For them, the allotment process is slightly different. In case of oversubscription, they get shares by computerised lottery system. See example here.

For more clarity, I’ll explain the process of allotment (specially for retail investors) using an example of Ujjivan Bank’s IPO.

Ujjivan Bank’s IPO

Before we get into the IPO oversubscription scenario, let’s see what the Ujjivan Bank IPO was offering:

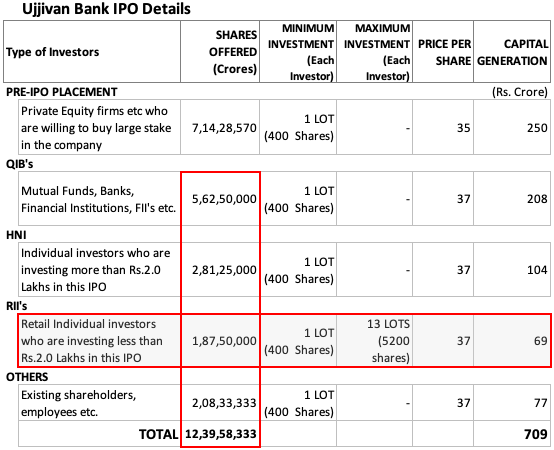

In an IPO, shares are always allotted in lots. One cannot bid for one number share in an IPO. In case of Ujjivan Bank, one lot was of 400 number shares.

Moreover there is also a cap for each category of investors. This ensures that all category of investors gets decent number of shares of the company. Let’s see what was the cap for Ujjivan Bank’s IPO:

- QIB: For these investors, the maximum amount of shares allocated was 5,62,50,000 nos. This was about 45% of the total shares on offer.

- HNI: For these investors, the maximum amount of shares allocated was 2,81,25,000 nos. This was about 23% of the total shares on offer.

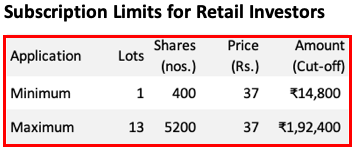

- RII: For these investors, the maximum amount of shares allocated was 1,87,50,000 nos. This was about 15% of the total shares on offer. For RII’s there is a cap of Rs.2 Lakhs. Hence, in this IPO the maximum shares they can bid for is 13 Lots (13 x 400 x 37 = Rs.1,92,400).

There was also Pre-IPO placements. Here big investors, who are willing to buy high stakes in the company are offered share at preferential prices. Such investors gets the shares even before the IPO.

In Ujjivan’s case, they were given 7,14,28,570 number shares. This fetched Rs.250 crore for the company before the IPO.

1. Ujjivan Bank’s IPO Oversubscribed

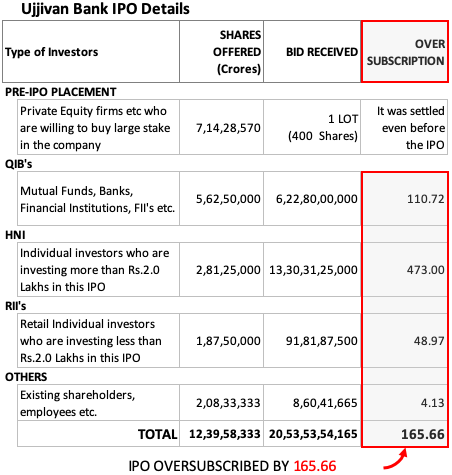

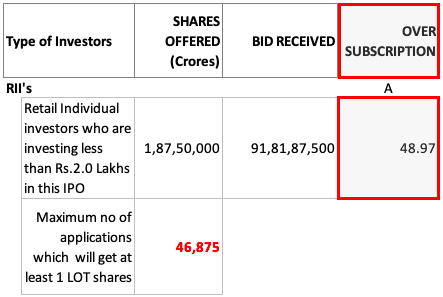

This is the data which shows that, under each category how much this IPO was oversubscribed.

On an average, Ujjivan Bank’s IPO was oversubscribed by 165.66 times. It means, compared to the total share on offer, it received bid for 165.66 times more.

The most oversubscribed category was HNI. It was oversubscribed by 473 times. QIB was oversubscribed by 110.72 times. RII’s was oversubscribed by 48.97 times.

Such oversubscription of IPO’s are not uncommon. Recently, IPO’s of IRCTC (111.91 times) and HDFC AMC (82.99 times) were also highly oversubscribed.

So what is the solution? How shares are allotted in case of oversubscription? Let’s see this for each category of investors:

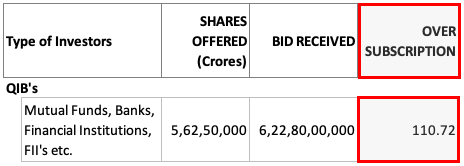

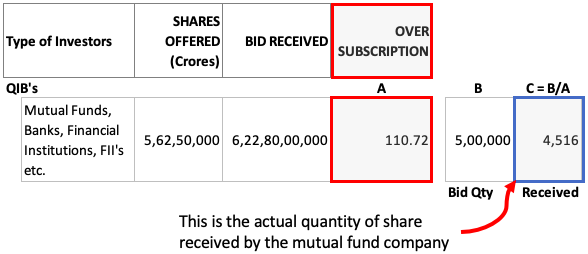

2. Allocation to QIB’s

In case of Qualified Institutional Investors (QIB’s), IPO has been oversubscribed by 110.72 times. How shares will be allocated to them? It will be distributed proportionally. How?

Let’s take a hypothetical example to understand the proportional distribution of shares.

Suppose there was a mutual fund which bid for 1,250 Lots of Ujjivan Bank’s shares. 1,250 Lot means 5,00,000 number shares (1250 x 400).

As the IPO has been oversubscribed by 110.72 times, hence the mutual fund will received only 5,00,000/110.72 number shares (4,516 nos).

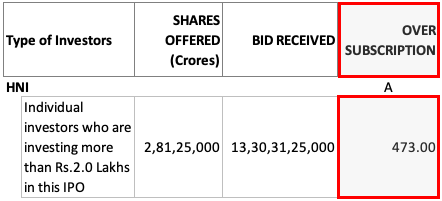

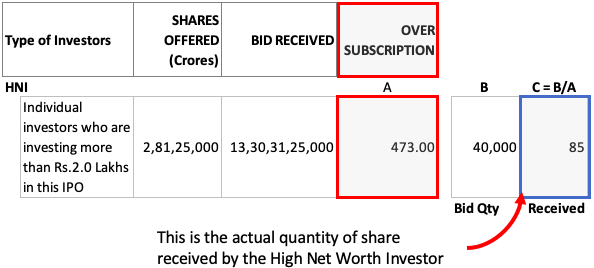

3. Allocation to HNI’s

In case of High Net Worth Investors (HNI’s), IPO has been oversubscribed by 473 times. How shares will be allocated to them? Here also it will be distributed proportionally among all investors.

Let’s suppose a high net worth investors submitted a bid for 100 Lots of Ujjivan Bank’s shares. 100 Lot means 40,000 number shares (1250 x 400).

As the IPO has been oversubscribed by 473 times, hence the investor will receive only 40,000/473 number shares (=85 nos).

4. Allocation to RII’s

Allocation of shares to Retail Individual Investors (RII’s) is slightly difficult. Why? Because their bid sizes are smaller. Hence, their allotment is done in two stages.

- Stage #1: Calculation of the maximum number of applications which can be allocated at least 1 Lot shares. This is done by dividing the total number of shares available for RII’s by the lot size. In cause of Ujjivan Bank’s IPO, this number is 46,875 (=1,87,50,000/400).

- Stage #2: Check how many applications has been received.

- Case #A: If number of applications received is less than 46,875 numbers, everyone first gets at least 1 LOT shares. For the balance shares allocation is done by lottery.

- Cast #B: If number of applications received is more than 46,875 numbers, shares allocation is done by lottery.

[P.Note: If a retail investor bid for 13 lots, but he received 0 Lot or say 1 Lot. In this case the balance amount will be automatically refunded back into the bank account]

Key check points related to IPO’s:

- #A. Ensure Technical Compliance: Fill the IPO subscription form with utmost care, without mistake. Otherwise there are chances of bid rejection due to technical non-compliance.

- #B. Choose bid price carefully: For IPO’s of good brands, better is to bid at the uppter cut-off price. Because if the IPO becomes oversubscribed, shares will be allotted at cut-off price only. Lower bids may not be considered for allotment.

- #C. Retail Investors can Invest 2.0 Lakhs: One can invest in IPO’s in lots. The size of each lot (no of shares in one lot) is declared in the IPO prospectus. The maximum amount that a retail individual investor can invest in an IPO is Rs.2.0 lakhs. So the upper limit of investment is fixed.

I did not get any shares for TATVA CHINTAN IPO. I applied for 22 lots (286 shares). The IPO was oversubscribed 181 times. Maybe it goes as per lot. If the subscription is 100 times, and I apply for 100 lots (not shares), then I get 1 lot. If I apply for 99 lots or less, I get nothing.

I applied for Anand Rathi issue for 351 shares in retail . Issue was oversubscribed 10 times. Minimum lot was 27 . I did not get any share . What could be issue?

Thank you for your detailed explanation

If ipo is oversubscribed & I have applied for 5 different demat accounts in my single bank account ( sbi). What are the chances to got alloted? Is it better to apply from different bank aacounts?

Good article sir.

I have a doubt in Allotment to HNI Category.

Suppose a guy apply for 14 lots in this IPO(i.e. 5600 shares). As the HNI category is oversubscribed by 473 times, will he get 5600/473 = 11 or 12 shares?

Or the minimum allotment has to be one lot?

I have exactly the same question. In the HNI category the minimum allotment is on per lot OR per share basis ? For the example of the article , the HNI will get :

– 0 lots /0 Shares – If its per lot basis

– 85 shares (85/400= .0005 LOT – Not sure if it means anything) – If its per share basis

superb article

Very detail and through example. Really like the article.

One Question. A normal person having a demat account can invest in the HNI category?

Yes, you can apply in HNI category. But you will get very less number of shares. It’s better to bid for more shares in HNI category else apply in Retail investor category and try your luck.

Yes. But you should invest above 2 lakh rs.