Why do we pay taxes?

The tax paid by us becomes a receipt (income) for the government of India. They use the receipts to fund essential expenses like defence, police, judiciary, public health, infrastructure etc. But you will be surprised to note that almost one quarter (23.31%) of the total government expense is spent on interest payments alone.

Generally speaking, we can say that the tax money is used to fund recurring and non-recurring expenses of the country. Recurring expenses can be like salaries paid to government servants etc. Non-recurring expenses are used to build long term assets for the country (example: airports, railways, roads, bridges, schools, colleges, factories etc). A growing economy focuses on non-recurring expenses (also called capital expense – CAPEX).

To understand how our tax money is used by the government, we will have to first understand what is union budget.

Topics

1. Union Budget

It is in the annual union budget that the incumbent government declares all its expenses at great length. But union budget is not only about expenses. The government also declares its receipts (incomes).

Like companies declare their income & expenses in P&L Accounts, government declares it in its union budget.

In the budget, the government announces where it is going to spend the money in coming fiscal, and what will be its source of revenue (receipts).

1.1 Source of Revenue (Receipts)

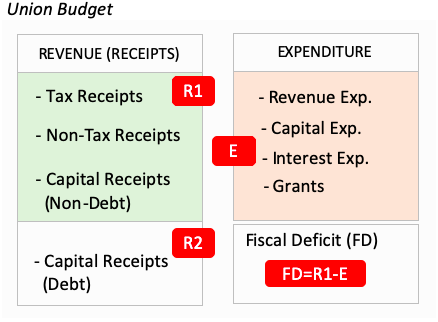

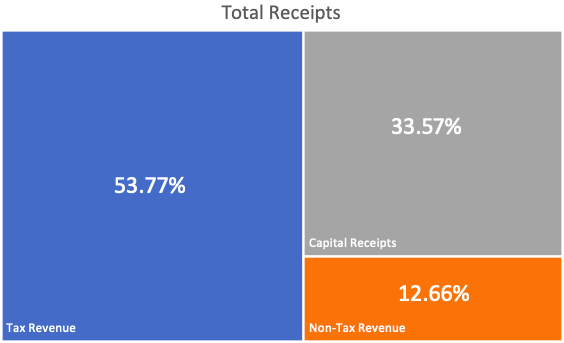

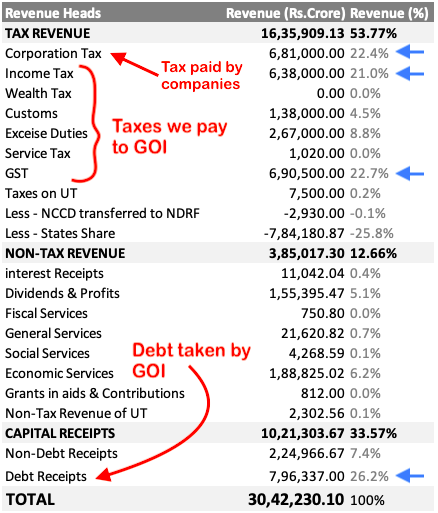

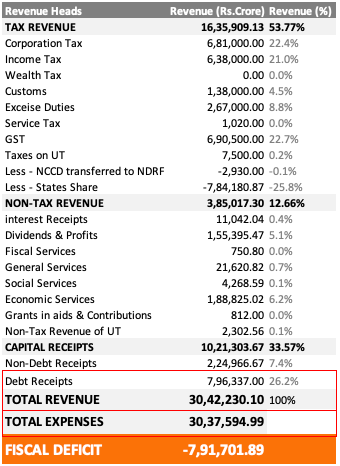

In Union Budget, Government of India (GOI) declares the total revenue foreseen in the coming fiscal year. There are three types of revenue receipts of GOI: (a) Tax Receipts, (b) Non-tax receipts, and (c) Capital receipts.

What does the above chart represent?

GOI not only generates cash from tax collection (53.77%), but there are other sources of revenue: viz capital receipts (33.57%) and non-tax revenue (12.66%). The income tax, corporation tax, GST, customs, etc that we pay to government comes under the head of “Tax Revenue”.

So it is not that we (Indian residents) pays for all expenses of the nation. Capital receipts (recovery of loans, disinvestment, debt etc) and non-tax revenue (dividends, interests etc) also contributes (about 46.23%) to the total receipts.

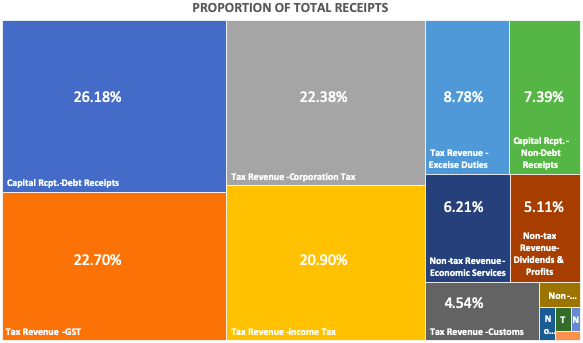

1.1a Revenue Break-up

If we will dig further down into the revenue break-up, we will get more compelling facts:

- Income Tax (21%): Income tax that we pay is 21% of the total revenue of the government. It is a form of direct tax which is levied on resident Indians (individuals, HUF’s, professionals, freelancers etc).

- Corporation Tax (22.4%): This is also a type of direct tax which is levied on the companies and businesses. Corporation tax weighs 22.4% of total revenue receipts of GOI.

- GST (22.7%): GST is a form of indirect taxation. Out of all indirect taxes, GST is the biggest revenue generator for the GOI. It generates 22.7% of total revenue receipts of GOI.

- Debt Receipts (26.2%): The GOI finances most of its capital expenses using debt route. Cash flow in form of debt accounts for 26.2% of total revenue receipts of GOI. What are debt receipts? It’s the funds raised by GOI by issuing Dated Securities (long term and short term), borrowing from savings schemes like PPF, PO savings etc. Read more.

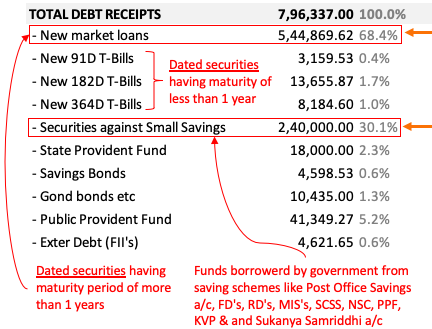

Debt Receipts Break-up is shown below:

Out of total debt of the government of India (Rs.7.96 Lakh Crore), following are its major components:

- New Market Loans (68.4%): Out of total, 68.4% is generated from market loans. What are market loans? These are basically dated securities (like T-bills) having a maturity period of more than 1 year. In common term we call them “long term dated securities”.

- Securities against Small Savings (30.1%): We (citizens of India) often save money in small savings schemes like Post Office Savings, Fixed Deposits, Recurring Deposits, Monthly Income Scheme (MIS), Senior Citizen Savings Scheme, National Savings Certificate (NSC), PPF, Kisan Vikas Patra (KVP) etc. GOI borrows funds from money deposited in these savings schemes. Read: More investment options.

1.2. Expenditure Heads

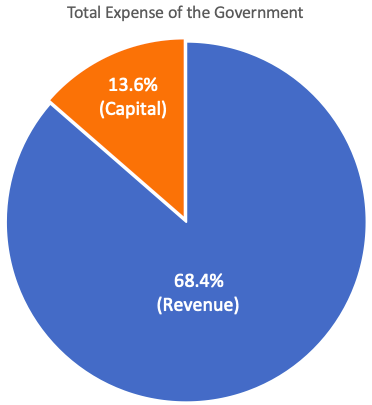

In Union Budget, Government of India (GOI) declares the total expenditure foreseen in the coming fiscal year. The whole government expenditure can be divided into two categories, Revenue and Capital expenditure.

- Revenue Expense (68.4%): Out of total government’s expenses 68.4% are revenue expenses. These expenses are of recurring in nature. These are such expenses which neither creates an asset or a liability. These expenses must be met to run day to day activities of the government. Example of revenue expenses can be: salaries of government employees, bills of government offices, operational costs of public sector enterprises, interest payment agains debts (see above) etc.

- Capital Expenses (13.6%): These are types of expenses which government spends to create assets in the country. For a growing economy like India, the greater is the capital spending more robust will be the infrastructure in times to come. Examples of asset can be roads, public buildings, bridges, dams, airports, railway stations, bus stations, power plants, steel plans, passport offices etc.

1.2a Expense Break-up

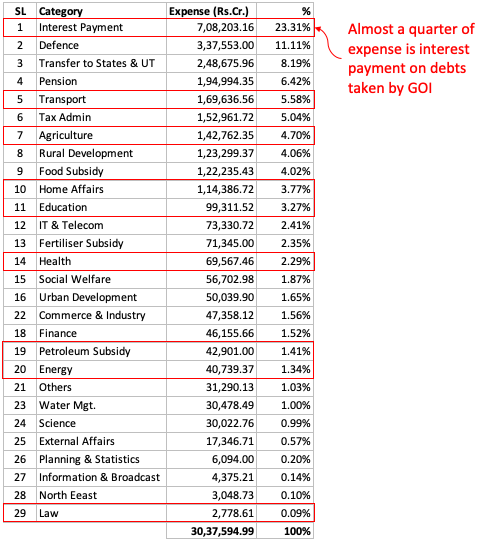

The above chart maps the total expense of our GOI. It breaks-down the total expense into 29 nos expense categories. Let’s know more about few major expense categories. These are those expenses where majority of tax payers money is getting spent:

- Interest Expense (23.31%): In the union budget 2020, out of total expense budgeted for FY 2020-21 (Rs.30.37 Lakh Crore), Rs.7.08 Lakh crore (23.31%) will be used to pay interest of GOI’s debts. These debts are mostly long and short-term dated securities like T-bills etc. The government also borrows money from small saving schemes of public. See the break-up of government debt here. Why government has to borrow money? To make up for the fiscal deficit.

- Defence (11.11%): For FY 2020-21 about Rs.3.37 Lakh crore (11.11%) is budgeted for defence. Out of these Rs.3.37 Lakh crore, 35.12% is capital expenditure. Here the money is spent on modernisation and expansion of armed forces. The balance 64.88% is revenue expense which is necessary to run the day to day operations of the armed forces.

- Transfer to States & UT (8.19%): A portion of tax collected by the central government, is given (as transfers and grants) to the states and UT’s for their development, emergency management etc.

- Pension (6.42%): Retirement benefits paid to the ex-defence and ex-government employees are paid as pensions. Out of total expense budget, Rs.1.95 Lakh crore (6.42%) goes in pension.

- Transport (5.58%): This expense head of GOI includes aviation, railways, roads and highways, shipping ports etc. The total “transport expense” budgeted for 2020-21 is Rs.1.69 Lakh crore. Out of this about 90% is capital expense, and 10% is revenue expense. Major investment (Capex) is envisaged in roads and highway construction (Rs.82K crore) and in Railways modernisation (Rs.70K crore).

- Home Affairs (3.77%): It is in this expense head comes few important spendings like police, cabinet among others. Out of total budgeted expense, about Rs.1.14 lakh crore (3.77%) will go is managing the home affairs.

1.3. Fiscal Deficit

What is fiscal deficit? It is the deficit between governments revenue (receipts) and expenditure. If a government’s revenue is lower than its actual/budgeted expenses, this is a condition of fiscal deficit.

To calculate fiscal deficit, we can use the following formula:

Fiscal Deficit = Total Revenue – Capital Receipts (Debt) – Total Expenses

Ideally speaking, there should be no fiscal deficit for any economy. But for growing economies like India, where capital expense requirement is huge, a slight fiscal deficit is like unavoidable.

To make up for this fiscal deficit, Government borrows money. Controlled borrowing is not bad if it is done to fund the country’s capital expenditures. Why? Because these capital expenses will create asset, which in turn will make the country more efficient. This way the nation will generate more revenue (tax and non-tax) for the government in times to come.

What will happen if we will not pay tax? Revenue of the government will fall and fiscal deficit will increase.

At present, the fiscal deficit of India stands at -3.72% of Nominal GDP. Over the past 5-6 years, the fiscal deficit has come down from about -5.9% to -3.72% (see here).

2. Does Everyone Pays Tax?

Yes, everyone pays tax, it is unavoidable. There are two types of tax collected by government of India.

- One is direct tax (Income Tax & Corporate Tax).

- Other is indirect tax (GST, Custom, Excise, Service tax, Cess etc).

Avoiding indirect tax is impossible. We have to pay indirect taxs on purchase of any goods or services. When we buy groceries, GST is included in its price. When we get our fridge repaired, GST is charged. .

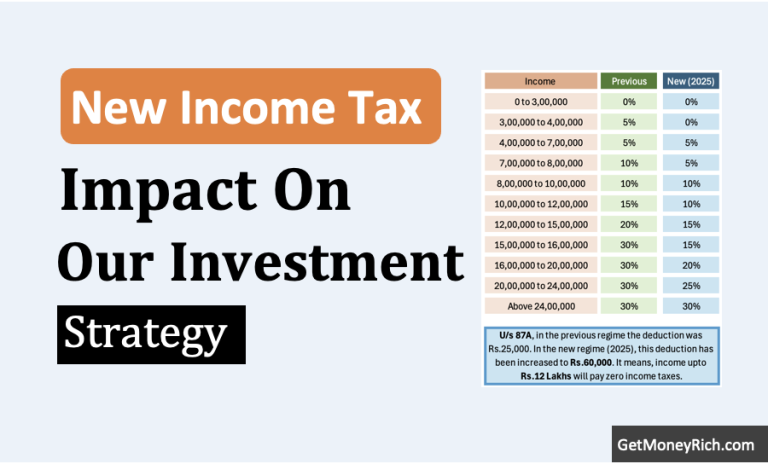

But it is possible to avoid direct tax. Depending on ones tax slabs and allowable deduction few people pay tax and some don’t. It is perfectly legal.

Total tax revenue of Indian government foreseen in year 2020-21 is Rs.16,35,909.13. This is approximately 53% of total receipts of the government (see here).

[Note: Out of Rs.16.36 Lakh Crore, Income tax (direct) is Rs.6.38 Lakh Crore, GST etc (Indirect) is about Rs.10.96 Lakh Crore, Corporation tax (direct) is Rs.6.81 Lak Crore. Out of all tax collected about Rs.7.87 Lakh crore is transferred to NDRF and to the states & UT’s.]

Conclusion

Paying taxes is an obligation. But it does not mean that tax is a bad thing. The cumulative tax that we all pay to our government is in turn used to make our nation better.

Consider the state of India’s infrastructure in 1947. Since then a lot has been done in India in terms of infrastructure development, defence strengthening, efficient tax systems, rural development, stronger internal security among other things.

All this was not possible had all earning members of the country has not contributed their bit in nation building. Payment of tax is our way of contribution for a stronger India in times to come.

superb article on income tax. Very helpful….

i accept the income tax direct deductions from corporate employees like software, this govt collecting 1.5 lacs approximately every year from me and other IT guys and not giving money to the same employees, when he is in jobless situation , a single NP , am jobless for more than a year, whether they helped me , Ans: NO NO NO ?then why the hell they deduct my hard earned money in the name of direct tax , ok next is after dedcution amount from my salary on monthly basis , if i am buying food or bike or anything why this govt takes money in another form in the name of GST, if you deduct one side , then you should not deduct in another end also , deduct from other persons , who doesn’t pay tax to govt in the name of grocery shop and cost price shop and lot of small shops not paying tax and enjoying , but we it guys suffer a lot and giving our money to all petty shops

Very wonderfully said and exactly thoughts are also the same. The government doesn’t pay any amount in return in case of someone losses a job and benefits like medical and government schools are not upto the mark. Also they are collecting money from SGST and CGST even after paying taxes from our salary and people who are doing businesses such as roadside bundies who are earning more than a software employee are not paying any taxes.

Iam impressed the way you explained about our Union Budget, I believe this is IAS stuff, you shud be teaching civil servant aspirants. Thanks for your article and all other articles about money, shares, mutual funds, finances, loans. All of them are gem of articles. The way you provided links, tables, charts for easy reference and even the spacing of the sentences, paragraphs, headings shows how much thought and effort you have put in each of the article is amazing and outstanding.

I don’t know if readers have ever noticed or acknowledged the fine details you embed in your articles, like icing on the cake, like the sweet dessert after a meal, your style and presentation skills are there somewhere in the stratosphere….

Man you are made of genius stuff, I agree you may have a team of researchers giving you all inputs or you yourself might have done all the spade work, but the way you have put it across is just brilliant.

Keep it up Mani, may God bless you and may you keep on enlightening people and kudos to your work….

Thank you for the awesome feedback.

Hi Mani

Thanks for posting updates.

I am 43 years old with two kids and till now I do not have any investment portfolio.My take home pay is Rs 60,000/-.

Where should I invest now?

I’ll suggest you to read this article on investment strategy. It will give you a lot of clarity about how to shape your finances through investments.

Very good article. But being one of the individual from a highest tax payer, our taxes paid are wasted on unnecessary mission for Mars, agriculture spending is very less, health spending is very less. What all, as people, we dnt need is only done by the Govt.Forest are not saved, Water which is to be supplied by Govt is privatised, education is privatised and hence we dnt feel happy paying our taxes., as the money is wasted.

Article narrated in layman’s language, I always used to struggle to understand the math of Fiscal deficit, but your writing has given be a better way to understand.

I’m really thankful for your article and efforts.

Pleasure is all mine. Thanks for the awesome feedback

Paying taxes is the duty of every citizen. Margret Mitchell said, “Death, taxes and childbirth! There’s never any convenient time for any of them.” Avoiding taxes is a criminal offense, and one that should be dealt with in a comprehensive, rather than punishworthy manner. The fact that our hard-earned money is being siphoned by the government for frivolous investments, like statues and divisive legislation,is enough to make anybody understandably man. One might even lose faith in the FinMin because of this.

I, Sanjeev Nanda, consider myself to be a simple man, but still realize the importance of paying one’s due in taxes. These are the means by which the government can help the civilians in the end. So irrespective of final outcomes, one shouldn’t refrain/ avoid their taxation duties.

Well said…Thanks for posting