Why investors should be concerned (or not concerned) about the low trading volume of ETFs?

Let me give you a history about the origin on this question.

The average trading volumes (30 day) of few stocks as on 03rd-Aug’18 are as below (in NSE):

- TCS: 37,63,490 nos shares.

- RIL: 90,05,800 nos shares.

- HDFC Bank: 26,59,164 nos shares.

- Scooters India: 1,824 nos shares.

- JK Bank: 1,90,117 nos shares.

- Mangalam Cement: 33,577 nos shares.

Similarly, the average trading volumes (30 day) of few high AUM ETFs as on 03rd-Aug’18 are as below (in NSE):

- CPSE ETF: 8,26,846 nos shares.

- SBI-ETF Nifty 50 Ltd: 26,449 nos shares.

- SBI-ETF Banking: 38,461 nos shares.

- Kotak Banking ETF: 35,078 nos shares.

- Reliance ETF Gold BeES: 8,816 nos shares.

- UTI-Sensex ETF Ltd: 106 nos shares.

- Some other ETF’s has volumes as low as: 200-300 nos shares.

What does these values indicate?

On an average, trading volume of shares are much higher than that of ETFs.

So this brings us to this question, which was put to me in last days by “Ashutosh“:

Since ETFs are traded like stocks, while selling ETFs, would there be adequate buyers for it? The volume of transactions for some top etf is in the range of 400 to 500 in a day. Will this be an issue while selling the etf?

This question has more weight than it sounds.

This question digs deeper into the very process of how ETFs are traded in stock market.

Before we proceed, lets get a small introduction about ETF first.

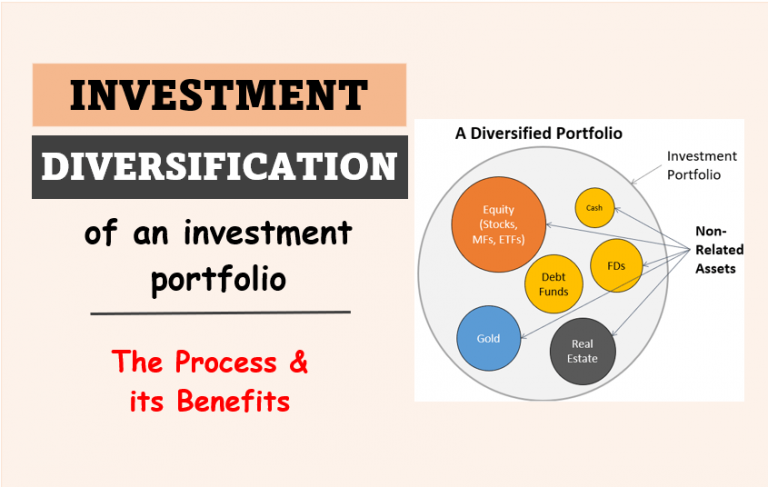

#1. What are ETFs?

ETF is an abbreviation for Exchange Traded Funds.

Two points to note:

- Which security is traded in stock exchange? Shares.

- What are funds? Mutual Funds.

Yes, here it is, ETFs are a combination of the following:

- Shares.

- Mutual funds (like index funds).

For people who are not very conversant with stock analysis, but still would like to trade in equity, ETF is a best alternative. How?

Mutual funds can be bought and sold only once in a day.

Shares can be bought and sold more actively throughout the day.

So how ETFs are combination of shares and mutual funds?

In a layman’s language we can say, “ETFs are such mutual funds which can be actively traded like shares“.

But why low trading volume of ETFs is making people worried? If it is low, so be it!. What’s the problem?

It could be a problem.

Let’s know what is trading volume. You will begin to appreciate its impact.

#2. How trading volume is important?

What means by trading volume?

Suppose a stock XYZ has been traded as below in a day:

| All day Trades | Buy Quantity | Sell Quantity | Price | Volume (nos shares) |

| 1 | 400 | 400 | 62.2 | 400 |

| 2 | 500 | 500 | 62.75 | 500 |

| 3 | 350 | 350 | 63.1 | 350 |

| 4 | 150 | 150 | 63.5 | 150 |

| 5 | 625 | 625 | 63.75 | 625 |

| 6 | 475 | 475 | 64.2 | 475 |

| 7 | 800 | 800 | 64.5 | 800 |

| 3,300 |

Trading volume is the number of times a share trades in a day.

If trading volume of a share is high, it means more people are buying and selling it.

If trading volume of a share is low, it means less people are buying and selling it.

Suppose you have 1,000 nos shares (A & B) in your portfolio. Average trading volumes of A & B are as below:

- A: 200,000 nos shares per day.

- B: 10 nos shares per day.

You want to sell A & B. What do you think which share will be sold readily?

A will be sold readily, as trading volume of A is 200,000 nos (more than 1,000 nos).

It will be difficult to dispose off shares of B in a day, as trading volume of B is only 10 (less than 1,000 nos).

- In the above example, “A” represent a normal shares of stock market (high volume).

- “B” represent a normal ETFs of stock market (low volume).

So this brings us back to our question, as trading volume of ETFs are low, will it pose a problem while buying/selling?

The answer is NO. Why?

To understand this, we will have to understand how ETF are “Created and Redeemed”?

But before that lets understand another basics, “the rule of demand and supply”.

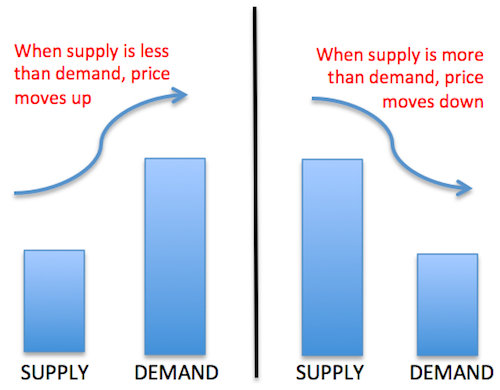

#3. Demand and Supply of Shares (ETFs)?

Stock can be created?

The supply of stocks are limited. They cannot be created.

This what drives the price of shares up and down. Lets see how…

The number of shares outstanding for stocks remains constant.

But ETFs can be created. What does it mean for the ETFs pricing?

Suppose number of shares of an ETFs already traded till a day is say 10,00,000 numbers.

What does it mean? It means, 10,00,000 shares of ETFs are already in hands of its buyers.

Suppose, you enter the market next day and want to buy a 10 nos shares of ETF.

But the problem is, all people who bought that ETF earlier (10,00,000 shares) are not willing to sell on that day.

Atypical example of zero trading volume.

What will happen? You will have to leave the market empty handed.

Situation is, you want to buy a ETF, but there are no sellers.

When it comes to stocks, if there are no sellers, buyer will have to go empty handed.

But the ETF buyer will not go empty handed. How?

Because, ETFs can be created.

Any surplus demand for ETF can be created and sold to the buyer demanding its supply.

#4. Creation and Redemption of ETFs?

ETFs shares are created by Authorised Participants (APs).

APs can create new ETFs if the demand is surplus. Let me explain:

- No of buy orders: 10 nos.

- No of sell orders: 8 nos.

In this case, the demand of ETFs shares is surplus by 2 nos compared to its supply.

To compensate this supply deficit, APs can create those 2nos additional ETFs shares and sell to the needy buyer.

Similarly, lets take another example:

- No of buy orders: 2 nos.

- No of sell orders: 12 nos.

In this case, the supply of ETFs shares is surplus by 10 nos compared to its demand.

To compensate this demand deficit, APs can buy those additional ETFs shares from the seller.

What does it conclude?

Due to presence of Authorised Participants (APs) in the market, shares of ETFs will always find its buyer and seller.

Hence, even if the current trading volume is showing as zero, it is not a problem.

#5. How ETFs shares are priced?

How price of stocks moves up and down?

When demand for a share is high (compared to supply), it price moves up.

When demand for a share is low (compared to supply), it price moves down.

But in ETF there will never be any demand-supply gap. Authorised Participants (APs) always fills this gap.

So how ETFs shares are priced?

The answer lies in the term called “iNAV“.

What is iNAV? Intraday Net Asset Value. What does it do?

iNAV estimates the current value of the “constituents of ETF” and then establish its price.

Whoff, what does it mean? 🙂

OK, lets slow down and break the definition into parts.

What are the constituents of ETF?

Most normally traded ETFs in market are index and gold based.

- Index based ETFs – constituents are stocks.

- Gold based ETFs – constituents are physical stocks.

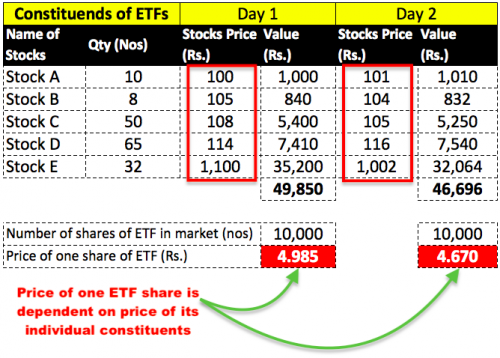

Suppose a index based ETFs has its constituents as below:

On Day 1, the individual price of Stocks A, B, C, D & E are mentioned.

Price of individual stocks are used to calculate price of one share of ETF (iNAV).

On Day 2, when the individual price of stocks change, the iNAV of ETF will also change.

- When stocks price moves up, price of ETF will also go up.

- When stocks price moves down, price of ETF will also go down.

Generally speaking, iNAV of ETFs are recalculated every 15 seconds.

Means one can find a new price of ETF every 15 seconds.

Conclusion

ETFs also trade like stocks in stock market.

But share of ETFs do not trade as frequently as shares of stocks.

So does it means that, on a day for an ETF, there will be no buyers and sellers?

No this will never happen.

To meet the deficit between demand and supply of ETF, Authorised Participants (APs) comes into its role.

Authorised Participants has the authority to do the following:

- They can create shares of ETFs, and sell to buyers.

- They can buy shares of ETFs from sellers.

So this way, we can say that the demand-supply phenomenon does not influence price of ETFs.

What influence price of ETF is the individual value of the constituents of ETF.

When the average price of constituents moves up, ETFs price will also go up and vice versa.

Nice article.!!👍🏻

For buying any stock etf, suppose nifty etf. There are many so trading volume will be good criteria or not? Nippon and SBI have the high volume so should investors prefer those over the other alternative?

I was confused and worried about volume… but your article help me a lot and increase my confidence. Tons of thanks. keep writing such wonder articles.

Very well written.. keep up the good work !!

ETFs seemed to be very confusing at first but after reading your articles on the site, they have become easy to understand.

Thanks again

Thanks for reading and posting your feedback

1)How can I know the iNAV of an etf? Is it published anywhere?

2) The trading in etf seems to take place according to the bid and offer prices. Where does NAV figure in this?

3) If there is no supply demand mismatch,why is there a large spread in some etfs?

Thanks in advance.

WOW….. Very nicely written. Thank you so very much

Thanks

Thanks, very informative.

Please answer the below question

What happens if the AP does not fill the gap?

The are obliged to do it…

Thanks for your giving good knowledge about etf and AP WORK.

Thanks for the article,

Very Insightful

Thanks.

Wow! explained in such a simple language like reading a kids story book.

Thank you so much