Senior Citizen Saving Scheme (SCSS) is a “Government Initiative” in line with Government Savings Banks Act, 1873. It comes under “small savings scheme” which became live for public from 2-Aug-2004.

Considering that SCSS is a “central government” initiative, the investment made here is highly secure. This is one of the reason which makes it a suitable investment vehicle for retired people.

It must be noted that not everybody can invest in Senior Citizens Saving Scheme. It is specifically meant to benefit the retired people (senior citizens of India).

Topics

- Age criteria to invest in SCSS.

- Where to open SCSS account?

- How to open SCSS account?

- Limitation on deposits in SCSS account.

- Limitation on withdrawals from SCSS account.

- Interest payable on deposits.

- TDS applicable on SCSS interest.

- Maturity of SCSS Account Maturity.

- Income Tax Treatment.

- Conclusion.

Age criteria to invest in SCSS

- 60 Years: An individual who has attained the age of 60 years or above can invest in SCSS. It means, the money deposited in SCSS account must be done by the said individual, or the deposit mush be done on behalf of a senior Citizen.

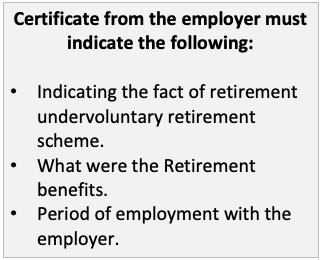

- 55 Years (1): An individual who has attained the age of 55 years can also invest in SCSS. But such an individual must have taken voluntary retirement. It is also mandatory for him/her to open SCSS account within 3 months from the date of retirement. The individual must also submit a certificate from the employer (along with FORM-A). The content of the certificate must include the following:

- 55 Years (2): The SCSS rule came into effect only in Aug’2004. What happens to people who retired before Aug’2004? Such people can also invest in SCSS if they meet a minimum age condition. “If they have achieved at least the age of 55 years within a month of this date – 27.Nov.2004, they can invest in SCSS“.

- Defence Employees: Retired defence employees are also eligible to open SCSS account. They can open the account and avail the benefits upon achieving the age of 50 years.

Where to Open Senior Citizens Savings Account (SCSS)?

SCSS account can be opened in two places:

- Post Offices: Any Indian post office branch which also provides banking services (like savings a/c etc) can open a Senior Citizens Savings Account (SCSS) for people.

- Banks: There are few banks which has been authorized by Central Government to service SCSS accounts for public. These banks work as an agency which accepts subscription on behalf of Central Government for SCSS.

| Allahabad Bank | Dena Bank | State Bank of India |

| Andhra Bank | ICICI Bank | State Bank of Mysore |

| Bank of Baroda | IDBI Bank | Syndicate Bank |

| Bank of India | Indian Bank | UCO Bank |

| Bank of Maharashtra | Indian Overseas Bank | Union Bank of India |

| Canara Bank | Punjab National Bank | Vijaya Bank |

| Central Bank of India | South Indian Bank | – |

| Corporation Bank | State Bank of Hyderabad | – |

How to Open a SCSS Account?

Opening a SCSS account is simple. But before opening the account this understanding should be clear that the depositor is going to open a “new” account under Senior Citizens Savings Scheme, 2004.

Even if one already has a “Savings Account” in a bank or post office, it cannot work as a SCSS account. A new account under SCSS,2004 has to be opened.

Following are the steps necessary to open the account:

- Step #1: Age Eligibility: SCSS account is not for everyone. Only people of a specific age group can open this account. So just to save time, best will be to double check ones age eligibility criteria before initiation (Check here).

- Step #2: Post office or Bank: This is an important decision to make. SCSS account can be opened in a Post Office or in a Bank. Which will be better for you? Choose post office only if its location is at a strategic advantage for you. Otherwise banks will always provide a better banking facility. Choosing a bank in which one already has a savings account is also essential. Why? Read this…

- Step #3: Fill Form A: The first form that needs to be filled is FORM-A. This is an account opening form. Here the depositor needs to declare if it will be joint account, or an individual account. Nominee declaration shall also be done here. If one already has other SCSS account(s), then they must be declared here. Along with this form, FORM-D also needs to be enclosed.

- Step #4 Fill Form D: This is just a pay-in slip. FORM-D highlights the details of the deposit done like check, cheque, Demand Draft or electronic mode. Cheque/DD should be made in favour of the “depositor’s SCSS account number”.

- Step #5 Fill KYC Form: These days all banking related account opening needs to be backed by a KYC form. It is a one page mandatory form filling that needs to be done.

- Step #6 Enclose Documents: Along with FORM-A and FORM-D self attested copies of few documents also needs to be enclosed. The documents are for:

- (a) Age proof,

- (b) PAN card,

- (c) Certificate from the employer as applicable (See here),

- (d) Address Proof,

- (e) Passport size photograph of account holders.

Opening Multiple Accounts

P.Note: It is possible to open more than one SCSS account. The depositor can choose to open multiple accounts in the same bank or post office. The depositor can also open segregated accounts in multiple banks and post offices. But there is a limitation / cap on the total amount that an account holder can carry under a single PAN number (Cap is Rs.15 Lakhs).

Limitation on Deposits in SCSS Account

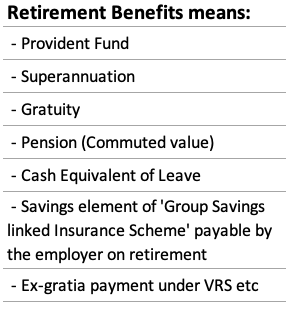

There are few rules related to SCSS deposits. These rules are designed to regulate the money that goes into SCSS account. One rule is, only retirement proceeds can be parked in SCSS account. Lets’ read more about few key rules:

- Deposit Amount: The maximum amount that a PAN number can carry in a SCSS account is Rs.15 Lakhs. Suppose one has multiple SCSS accounts. Cumulative value of all such accounts should be Rs.15 lakhs (Fifteen lakhs) or less.

- Number of Deposits: In a single SCSS account only one deposit is allowed. It means, the depositor must be clear about the quantum of the deposit before account opening. If the depositor wants to increase the corpus after account opening, it will not be allowed. (Note: Deposit should be in multiple of Rs.1,000 only).

- Period of Deposit: The deposit is locked for a period of 5 years. Though there is also a provision for premature withdrawals from SCSS account. Upon maturity, the deposit period can be further extended by another 3 years. To extend the period, a FORM-B must be filled. But request for period extension must be placed within one year of maturity.

- Source of Fund: The amount of money that goes into the SCSS account cannot be greater than the retirement benefit received from the employer. Hence it is mandatory for all account holders to submit their employer’s certificate. In the certificate the money received as a part of retirement benefit must be clearly indicated.

Limitation on Withdrawals from SCSS Account (Premature)

- Five Years: Full duration for SCSS account is 5 years. By default, the deposits made in the SCSS account are locked for a period of five years from the date of account opening. Though premature closure (after 1 & 2 years) is also permitted.

- After One Year: Account can be prematurely closed by filling an application FORM-E. But there is a penalty. A total sum of “1.5% of the value of deposit” will be deducted from the total account balance. The remaining amount will be paid to the depositor.

- After Two Years: Withdrawal after 2 year is possible but after paying a penalty. The penalty amount is 1% of the value of deposit. This value will be deducted from the total account balance. The balance will be paid to the depositor.

Interest Payable on Deposit

Interest rates paid on new SCSS account is updated every quarter. The revised interest rates offered on all central government backed “Small Saving Schemes” can be accessed from the website of Department of Economic Affairs.

SCSS interest rate applicable for Q1 of FY’2020-21 is shown below (Apr’20 to May’20).

| Instrument | Rate of Interest | Compounding Frequency |

| Senior Citizens Savings Scheme (SCSS) | 7.40% | Quarterly & Paid |

Though SCSS interest rate can change every quarter, but the rate is locked, for a depositor, once the account is opened. This interest rate will remain valid till maturity period (full 5 years).

The interest accumulated on the deposit in SCSS account is paid at the end of every quarter. Following are the schedule on which the accrued interest is credited into the savings account. A depositor can get the interest paid out each quarter as a part of regular income.

| Quarters | Period of Deposit | Interest Payable |

| 1st | Till 31-March | April (1st working Day) |

| 2nd | Till 30-June | July (1st working Day) |

| 3rd | Till 30-Sep | October (1st working Day) |

| 4th | Till 31-Dec | January (1st working Day) |

Where quarterly interest is paid?

The interest can be credited into any savings account (post office or bank account). If SCSS a/c is opened in a post office, interest will be credited into the linked PO savings account. If SCSS a/c is opened in a bank, interest will be credited into the linked bank account (of the same core bank).

TDS is applicable on SCSS Interest

TDS is deducted on the interest paid to savings account.

But if the total payable interest on SCSS deposit is less than Rs.50,000 p.a. TDS will not be deducted.

It means, @8.6% interest p.a., a deposit greater than Rs.5,81,000 will fetch an interest of more than Rs.50,000. Hence on such a deposit, TDS will be deducted. But there is a way to prevent TDS. How? see here…

Maturity of SCSS Account Maturity

After expiry of 5 years, the SCSS account is said to be matured. It is possible to extend the period by another 3 years.

A new interest rate will be provided on the extended account. The interest rate which is offered to new SCSS account (as on the date of extension) will be applicable on the extended account.

The extended account (for 3 years) can be closed at any time after one year from the date of account extension. There will be no penalty applicable on the premature closure.

If the depositor does not want to extend the account upon maturity (after 5 years), the same can also be closed. Account closure can be done upon a written application enclosing FORM-E (withdrawal form). On presentation of application, FORM-E, and the passbook the bank will proceed and close the SCSS account.

If the matured account is neither closed not expended upon maturity (after 5 years), such an account will continue to earn interest till one month from maturity. The interest payable will be the interest applicable for a typical savings account.

After this period, the bank/post-office will formally notify the depositor about the account maturity. The depository will also be asked to complete the account closure/extension formality at the earliest.

Income Tax Treatment

The investment made to SCSS is applicable for deduction under section 80C.

The interest paid on SCSS is fully taxable. Moreover, if the annual interest payable is more than Rs.50,000 p.a. TDS will be deducted on the quarterly interest payable.

But for those people whose total income is less than the taxable limit, they can submit a FORM-15H or 15G to prevent TDS deduction.

Conclusion

Senior Citizen Savings Scheme is a great risk-free investment option for retired people (specially senior citizens). Why?

A very close rival of SCSS is tax saver fixed deposits. These FD’s also have a lock-in period of 5 years. Interest rates offered on these fixed deposits are much lower than yield of SCSS deposits.

| Description | SCSS | Tax Saver FD |

| Interest Rate | 8.60% | 6.5% – 7% |

| Income tax | Applicable | Applicable |

| Lock-in Period | 5 Years | 5 Years |

| Premature Withdrawal | Allowed with penalty | Not allowed |

| Regular Income | Quarterly | Not Applicable |

| Investment Limit | Rs.15 lakhs | No Limit |

Read More: Where to invest retirement money in India?

Suggested Article:

Can I deposit my money under my mother’s account who is a senior citizen? She gets a pension of about 35k per month, how can we stop TDS deduction if we invest 15lakhs in SCSS?

Who will issue form-16A for the TDS on intereest paid on SCSS-2204

The details will be available in Form 26AS. To download Form 26AS please check these steps.

Kindly inform me the IT Section number for which TDS will be deducted from the interest of SCSS’04 Account.