Value investors are always prepared to invest in a bear market. Why? Because it is in the bear market that they make maximum profits.

Generally, there is a fear of bear market because majority lose money during this time. But value investors considers falling market as an opportunity to make big money. People like Warren Buffett treat bear market as a time to grab quality stocks at undervalued price.

It is also true that investing during bear market phase is daunting. In times when all prices are only falling, convincing self to invest in stocks is not east. But this article will talk about “how to invest in a bear market“.

First things first, the focus should be to buy only fundamentally strong stocks in bear market phase. This is a time to accumulate blue chip stocks of the market.

What is bear market?

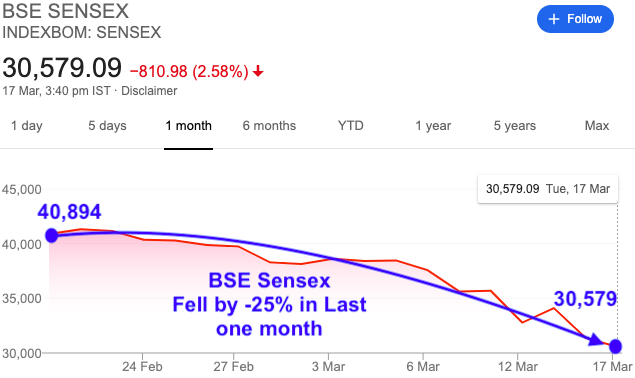

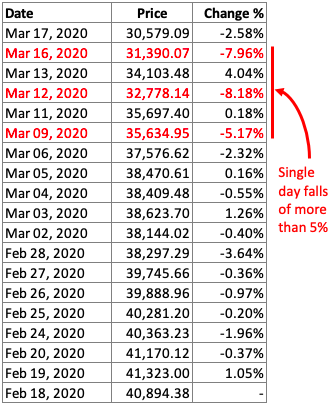

As a general rule, when index falls in a short span of time by -20% or more, it can be termed as a bear market. In fact, due to the prevailing pessimism around, the index continues to crash incrementally every passing day.

In last 30 days (between 18-Feb’20 & 17-Mar’20), there has already been three times when Sensex fell by more than -5% in one trading day. Talking about index fall, these single-day-falls are huge. Cumulative effect of such negative corrections in index builds a bear market. Read: High weight stocks in Sensex.

Opportunity in a Bear Market

In a bear market, fundamentals of good stocks generally remains unchanged. But its stock price falls drastically. This brings them to undervalued levels. But why price of even best of stocks fall?

In bear market the environment is of pessimism. There are more seller of stocks than its buyers. Majority prefers to sell their holdings whenever index starts to fall. This gradually build a panic situation in the market. Read: About stock market correction.

It will not be wrong to say that stock-selling is a reflex action triggered by the bear market. People are drawn to selling to prevent further losses. This is understandable. Why? Because when market crash, the numbers are daunting. In year 2008, SENSEX fell from 20,000 to 8,500 levels (down -57%).

Such massive and often irrational price falls makes prices undervalued and offers an opportunity for investors. Read: Investment basics for beginners.

Forward Thinking In A Bear Market

It is important to remember that bear market phase will not stay forever. It will eventually pass and market will recover. Important is to not panic as on date.

What you should do in a bear market? The most important is not to overthink. Because it is often this behaviour which leads us into panic.

So, if we are NOT overthinking what we are doing? We are asking few “logical” questions to ourselves.

- First: Sensex, Nifty, Prices are falling, but does it means that the fundamentals of the company is also deteriorating? Has the company done anything wrong during such times? In most cases, the answer will be a NO. The prices are falling because of a global crisis (like COVID-19 in 2020 and subprime mortgage crisis of USA in 2008-09). it means, stock’s fundamentals are still strong.

- Second: How long does it take for the stock market to recover from a bear market? Generally, a big bear market/crash phase – like that of 2008-09 and 2000-01 extend for a year. After that, the market slowly recovers and touches newer heights. Read: Stock market corrections.

- Third: What is the time to invest in a bear market? This is an important understanding. Ideally, one should start investing when the market has already bottomed. But practically it is not possible to catch the market bottom. In a situation like today (when index is already -25% down), starting to gradually build a portfolio will not be bad. What should be considered for investing? Dividend stocks, Equity mutual funds, & Exchange Traded Funds (ETF’s).

What I do?

Stock investing is all about calculation, estimations and nerve control. I like to accumulate savings in normal days. Keeping it simple is my way of doing it. I just opt for recurring deposit in bank when nothing else is available.

I try to stay away from stock market during normal times. Why? Because I want to just save money. I wait for the bear market (like we are seeing now). When bear market actually arrives, I break my deposits and invest in quality stocks mutual funds, indices etc.

How To Identify a Bear Market?

How to know if the bear market is arriving so that one can be prepared for investing? There is no formula to forecast the arrival of a bear market. Moreover, unless it starts to happen, no body can for sure tell that it is arriving. Why?

Because even in normal days, index correction of +/- 2% is common. But what should raise an eyebrow is a steadily falling index week after week. This is one of the more assured signals of a crash.

How I do it?

For me it is a three step process:

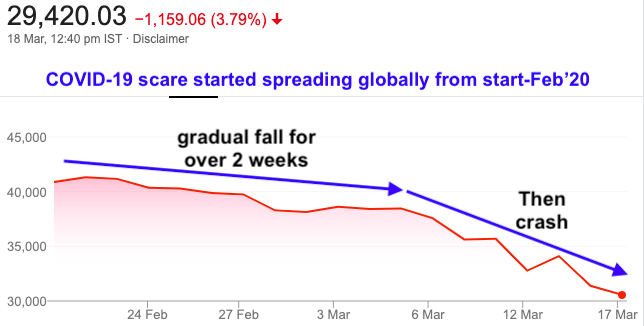

- Step #1 [By tracking BSE 500 index on weekly basis]: If index falls by 5%-6% in a matter of few weeks, it hints at the arrival of the next bear market. Example: On 01st Feb’20 S&P BSE 500 was at 15,248 points. Yesterday on 17th Mar’20 S&P BSE 500 is at 11,700 levels. This is a fall of -23% (3,492 points) in just 45 days. This is a clear sign of an active bear market. See Nifty 50 & Sensex Stocks.

- Step #2 [Performance of Top Market Cap Stocks]: After concluding the step one, I like looking at my list of top market stocks. Generally they trade at expensive price levels. If price of these stocks has also fell by 15%-20% then it means that the next bear market is around the corner. Here is a quick look at correction seen among big stocks in last 45 days:

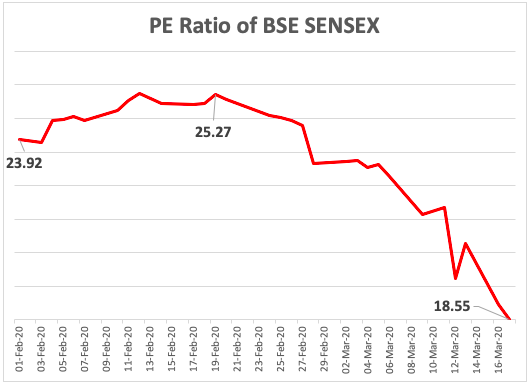

- Step #3 [P/E of Index]: One can also look at the Price Earnings Ratio (P/E) of the Index (like Sensex). Example: on 01/Feb/2020 average PE ratio of BSE was 23.92. In next 45 days the P/E ratio of Sensex has fallen to 18.55 (fall > -22%). In terms of P/E of an index like Sensex, this is a massive fall. This further confirms the presence of bear market.

It is not easy to know when is the next bear market. But when bear market is arriving and is also closer, it starts giving hints. But it must also be kept in mind that bear market does not happen very often. They are likely to happen every 8-10 years.

Sell or Buy Stocks in a Bear Market?

Generally, people buy and sell stocks based on others advice. They know very less about the companies fundamentals – but still they buy its stocks. As a result, when index falls stock-selling happens in sheer panic.

During such times of crisis, an informed investor does the opposite. For him/her the moment is not of panic, it is of euphoria. If a company is fundamentally strong, and its market price is falling, its time to grab more of its stocks.

Being Price & Quality Sensitive

Buying gold at Rs 30,000/10gm is better or at Rs 25,000/10gm? The answer is simple, because we have a feeling about the fair value of gold. A person who has not tracked gold movements in past, for him both Rs.25,000 & Rs.30,000 price levels are same. Why? Because he does not aware of gold’s price levels.

Stock investing is similar but it asks for more than just price sensitivity.

It is important for investors to know which stocks are better and which can be avoided. In stock investing, simply tracking historical price levels will not help. Knowledge about companies fundamentals is also necessary.

Price of all stocks fall in a bear market. But if one has a knowledge of which stocks are fundamentally strong, one must go ahead and buy them. Why? Because price fall during bear market makes them undervalued.

How to make money in bear market?

We (retail investors) can make more money in bear market than in bull market. If bull market is for day trading, then bear market is for investing. For retail investors, advisable is investing – not trading.

Everyone loves bull market because investing is easy in those times. Skill is required to invest during bear phases. What skill is necessary? The investors must have the ability to identify fundamentally strong stocks.

If one can develop this, then he/she can invest in bear market and make phenomenal amounts of money. If one wants to be a long term investor, then the best time to start is during a bearish market scenario.

How money is made in a bearish market? Suppose there is a stock which generally trades at Rs.100 levels. In a bearish market, its price can fall upto to Rs 65 levels. In this condition a knowledgable investor will buy this stock.

When market condition improves, investor might see a price growth of at least 10-15% in next few months. In stock investing, a price appreciation of 10-15% in such a short span can be considered excellent. A longer holding time can given even higher returns.

If one is holding a dividend paying stock, the benefit will be two folds. In a falling market dividend yield becomes high. Moreover, such stocks (after market crash) also show faster price appreciation.

Conclusion

Bearish market may sound scary but it is a moment to make money.

If your money is already invested in stock market (before crash), let it idle. Do not think of selling them in panic. Let the market recover and then decide if you still want to sell or hold.

For people who want to buy new stock during a bearish phase, look for blue chips and dividend stocks. These are stocks of companies which has very strong fundamentals. When market recovers, these are the stocks which will recover the fastest.

If one does want to take the risk of investing in direct stocks, then one can opt for the mutual fund route. Use my mutual fund calculator to estimate your potential returns.

If you want to explore more, try investing in a good small cap or mid cap mutual funds. Starting a SIP in such funds, till the market is tumbling down can be a great investment strategy.

As usual one more informative and instructive article from you.Congrats.Since Crude price is low one can buy in small lots in a staggered manner, IOC,HPCL,BPCL,MRPL,Chennai Petro,Gas-based Cos,like Fertilizers [Chambal].ONGC is expected to fall due to the reduction in Gas prices from 1.4.20.To Hedge one can by ONGC when it falls.Prez Trump is trying for a higher Crude to protect his shale oil Industry.

When analyzing stocks one should also look for PLEDGED Shares.

Very good articles. Best stocks to buy are CDSL, ICICI Bank, Nippon India AMC, HCL Technologies, Muthoot Finance

Superb article…!!!

Thanks Mani, a great analysis as usual!

Thank you

Brilliant..!! Thank you reinforcing the idea at this juncture when it’s time to act. Hopefully, but definitely scary in terms of what lies ahead..!!

Thanks for posting your comment.

Great Article and very timely, especially whats been happening over the past two weeks.

I had been synchronising my thoughts over the past 2 weeks carnage in the market and had written this article

I would appreciate your thoughts on this