Long term investment is not an investment option in itself. It is a strategy which we can follow to practice investment. Let’s understand it using an analogy.

One can improve ones physical health by jogging or by practicing yoga, right? Both these exercise has the same goal – of making the person fitter.

Jogging and yoga are two separate disciplines of achieving the same goal (physical fitness).

Similarly, when we are investing money, we are doing it to build and improve our financial health. “Long term investment” is one of the strategies to do it.

An alternate investment strategy could be to practice short term investing (like day trading). Here the investor does profit-booking more often. Unlike day trading, long term investors book profits once in say 7-10 years. Read: How to make money in stock market.

Topics

- The Concept.

- About long term holding.

- What is long term investment?

- Investment Calculator.

- Which is better – Equity or Debt Plans for long term investing?

- Advantages of Long Term Investment.

- How long is long-term in investment [Equity].

- Where to invest for long term?

- Tips on long term investing.

- Conclusion.

The Concept

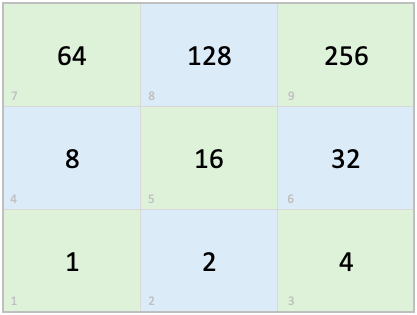

The image shown above resembles a chess board, right?. But what are the numbers? See the pattern of the numbers – it is doubling every time it reaches the next square. The longer the number travels, the bigger it becomes.

Rupee one, after travelling through the ninth square, become Rupee two-fifty-six. In other words we can say that Rupee one has grown by 256 times as it travelled through the chequered boxes.

Had the travelling stopped earlier (say in the fourth box), the Rupee one would have grown by only 8 times. So, the longer the Rupee travels, the bigger it becomes.

The concept of long term investment is as simple as the above example. Letting our money stay invested for longer periods of time, gives it a power of compounding. It becomes bigger and bigger.

About Long Term Holding

What is a typical characteristic of long term investment? Long holding time. People buy investments, and then hold them for longer periods. Just because they have held the investment for long-term, they see their corpus grow bigger.

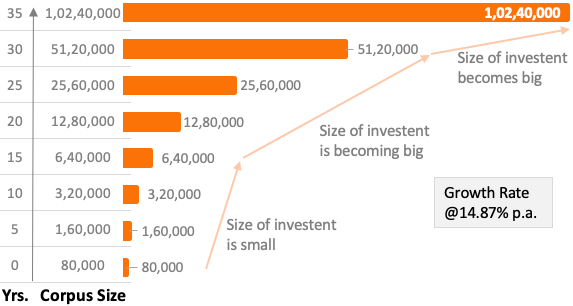

Let’s understand this with help of an example. Suppose you invested Rs.80,000 in an investment option. This option doubles your money every five years (@14.87% p.a.). How your money will grow with time?

The patter of growth is shown in the above chart. There are three segments to this chart:

- Segment #1: In this segment the size of corpus is small. Investors see Rs.80,000 growing and becoming Rs.6,40,000 in 15 years. For many, this growth pattern will not be so attractive. The same is also visible graphically (See the growth pattern above).

- Segment #2: In this segment the size of corpus grows to a reasonable size. Here Rs.80,00 becomes Rs.51,00,000 in 30 years. It looks impressive. But at this stage, the investor also realises that if he can hold for another 5 years, the corpus will become a Crore. Read: The process to become rich.

- Segment #3: In this segment, the corpus actually becomes a crore. Imagine the effect it has on the investors mind. Just five years back, the size of corpus was Rs.50 lakhs. Just by holding it for 5 more years, it became a crore. Read: Building 10 Crore from stocks.

What is the point? No matter whatever is the segment (1,2 or 3), the money is growing at a same rate of 14.87% per annum. But in later stages, the size of corpus is bigger. As the number become bigger, the benefits of long term investment also gets glorified.

Hence, to really FEEL the benefits of long term investing, hold your investments for long term. Enjoy seeing your money grow bigger in later years.

What is long term investment?

Long term investment is a strategy of buying such assets which grows faster, and are also safer, when held for longer periods of time.

To practice long term investing, care must be taken about the following two points:

- Which assets to buy: How to pick assets for long term investing? Suppose you bought a bank’s fixed deposit which gives 7% p.a. return. If you’ll hold the FD for a year it will give 7%, and it you hold it longer (say 5 years), it will again give only 7%. But if you invest in an equity mutual fund conditions will be different. Here the chances of earning returns like 15%+ p.a. becomes high when held for longer term. So which asset to buy? One which gives higher returns when held for long term, right?

- How long to hold: There are no fixed rules. The only rule which is valid is, “the longer you’ll hold, bigger will be the corpus“. When dealing with debt, long term holding is an option. But while dealing with equity, long term holding is mandatory. On an average, equity must be held for 5-7 years (minimum) to avoid the risk of loss, and earn high returns. High return in turn will make the corpus bigger in long term. Read: How long is long-term?

Suggested Reading: How to invest in share market?

Now allow me to present to you a more interactive part of my article. Here you will get a calculator and a useful infographics that you can use to plan your long term investment (like retirement).

Investment Calculator

| Amount Invested (Rs.) | |

| Expected Return p.a. (%) | |

| Holding Time (in years) |

| Size of Investment Corpus (Rs.) |

How to use this calculator & infographics? Check the following examples:

- Example #1: Suppose you have Rs.1 Lakhs available for investing. Your goal is to accumulate Rs.4 Lakhs (4 times). You are comfortable investing in a hybrid mutual fund which can yield return of 11% per annum. Using the infographics, you can see that at 11% return, you’ll have to hold your investment for about 13.5 years to make it grow by 4 times. You can cross-check the number using the calculator.

- Example #2: Suppose you have a goal to build a corpus of Rs.1.0 Crore in next 15 years. You are planning to invest Rs.12 lakhs today in lump-sum. It means, capital growth of 8.33 times is required. You’ll invest in an equity fund, which will yield 15% p.a. return. Infographics says, when holding time is 10 years, @15% p.a. return, the money will be multiplied by 8.14 times. Hence, you will just miss the target of 1.0 core. You can double-check the numbers using the calculator.

People often think that when it comes to long term investing, the default choice should be equity. This understanding is not wrong. But is there a way we can prove that equity is better for long term investment? Yes – please read further.

Which is better – Equity or Debt Plans for long term investing?

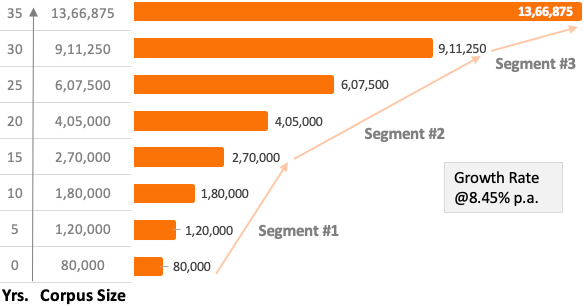

What is shown above is a growth profile of a debt based investment plan (return @8.45% p.a.). Compare this with the growth profile an equity plan (return @14.87% p.a.) shown above. You will see that their profile are almost similar.

But as equity plans yield higher returns, the size of the end-corpus is substantially more in equity. Example: Rs.80,000 invested in an equity plan (at 14.87% p.a.) becomes Rs.1 Crore in 35 years. Similarly, Rs.80,000 invested in a debt plan (at 8.47% p.a.) becomes just Rs.13.66 lakhs in 35 years.

What does it mean?

In both equity and debt plans, the power of compounding takes it effect in later years. The size of corpus becomes bigger when holding time is longer.

But in equity based plans, the final numbers are more impressive. Moreover, when equity is held for long term, the ‘risk of loss’ associated with it is substantially reduced. Hence, while practicing long term investing, it makes more sense to go with equity plans.

[P.Note: In equity investing, it is necessary to buy them at undervalued price levels. Because buying an overvalued equity, and holding them for long term might not work in most cases.]

Advantages of Long Term Investment

There are several advantages of following the strategy of long term investing. This is specially true for equity based investments like equity mutual funds, stocks, ETF’s etc. What are the benefits? The main benefit is related to high potential returns.

Other benefits are listed below:

- Short-term volatility can be ignored: Invest for long term, and you can ignore the short term volatility of the market. How? Because price movements becomes more predictable when held for long term. Example: Consider TCS. Its stock price goes up and down every second. This is volatility. If one will focus on this price movement, TCS will look scary. But look at TCS’s long-term price trend. The growth pattern is so clear.

- More tax effective: Short term investment options are taxed heavily by way of STCG. Long term investment is encouraged, hence are taxed lightly by way of LTCG. While investing, considering the tax liability that may be applicable on the gains, is a good idea.

- It is more cost effective: Frequent buying and selling of securities (like stocks, mutual fund units, ETF’s) is costly. How? Because every time we transact, we end up paying brokerage, commissions, taxes etc. Hence buying and holding for long term seems to be the better alternative. It lowers the cost-per-rupee of our investment.

- Benefits of compounding: Long term investment advantages is felt best with the power of compounding. Example: Suppose you want to accumulate Rs 1.0 crore by the time you are 60 years of age. Your present age is say 30 years. Rupees 1,427/month, at 15% p.a. return, will build the corpus in 30 years. Suppose you started just 3 years earlier. Only Rupees 910/month, will be required to build the same corpus. By staying invested longer, less money is required to build the same corpus. Check this on my mutual fund calculator.

- Earn higher returns: Equity based investment options can yield maximum returns. But equity can be explored only if one is investing for long term. Why? Because in short term the risk of loss in equity can be very high. So if you want to enjoy the luxury of high returns, go for equity – but with a longer holding time in mind. Read: How to invest money?

How long is long-term in investment [Equity]

Experts advice us to invest and stay invested for long term. But how long is long term investment? In long term investment how many years can be considered as long?

As per Government of India rules, following is true:

- Short Term: When holding period is less than 12 months, it is considered as short term holding. Hence, short term capital gain (STCG) tax is applicable. People are taxed more when they resort to short term profit booking.

- Long Term: When holding period is more than 12 months, it is considered as long term holding. Hence, long term capital gain (STCG) tax is applicable. People are taxed less when they hold their investment longer.

Does this mean that long term investment means holding period of more than 12 months? No. Why? Because this understanding is too general. Let’s try to quantify ‘long-term holding time’ in a more calculated way.

Generally Speaking, long-term holding should be long enough to convert uncertainty into surety. What is uncertain? Return on investment is uncertain, right? How to get surety about it? Follow this principle: “Equity is volatile in short term, but more predictable in long term“.

Holding Time

In equity investing, how many years of holding time is enough? To answer this question, I’ve prepared a small report. We will try to figure-out how, “long term investing’ increases the ‘certainty of returns’ (in equity).

In our study we’ve assumed a well diversified portfolio. A good example of a well diversified equity portfolio is an index fund.

Holding Time of 1 Year

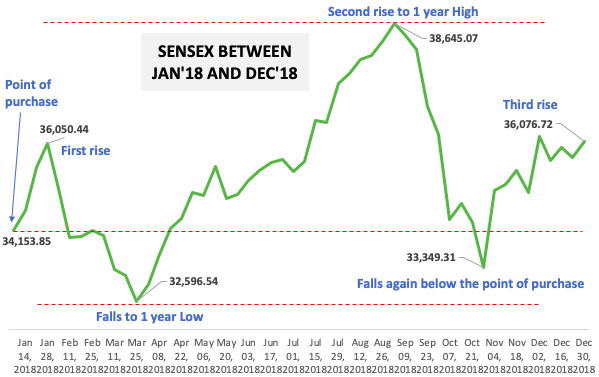

In equity investing, holding time of 1 year is considered too short, why? Look at the above chart and you will know why. The price remains very volatile. Hence, the chance of making a loss is high.

Please see the Sensex chart shown above. From the point of purchase (Jan’18), see how many times Sensex rises and then falls within a span of 12 months. For normal investors, this price fluctuation would have given them jitters.

Moreover, within the period of Jan’18 and Dec’18, Sensex moved up by only 5.63%. Compare this with risk-free investment option where average return is 7% per annum, and risk of loss is almost zero. Why anybody will care to invest in equity for holding time of 1 year or less.

An interesting data: Between Jan’18 and Dec’18, there were 246 nos trading days. Out of them, there was 116 nos trading days, where the Sensex was trading below the price at the point of purchase (see chart). It means, for investors there was 47% chance of making a loss, within a span of 12 months.

So the question is, to earn a return of 5.63%, is it worth taking the risk? It is not. Hence, we can conclude that holding time of 1 year is not sufficient.

Holding Time of 3 Years

Equity holding time of about 3 year is reasonable. In this period, the effect of short term volatility begins to fade away. In a stock market like that of India (growing economy), a 3 year holding time is decent.

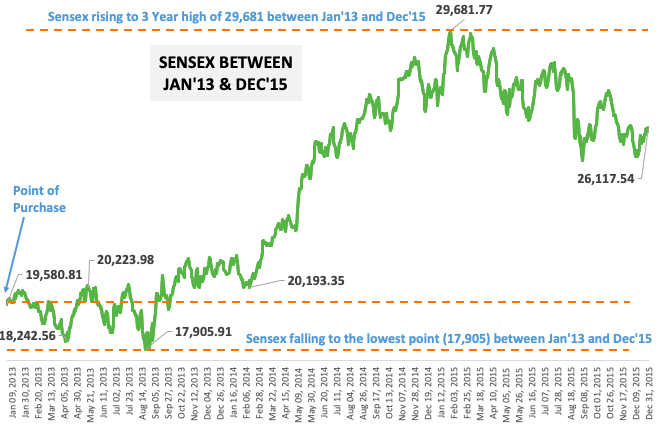

Please see the Sensex chart shown above. From the point of purchase (Jan’13), see how many times Sensex falls below the point of purchase – within a span of 36 months? Let’s quantify it using some real numbers.

Between Jan’13 and Dec’15, there were total 742 nos trading days. Out of them, there were 107 nos trading days when the Sensex was trading below the point of purchase (see chart). It means, for an investor there was 14.4% chance of making a loss, within a span of 36 months.

Moreover, within the period of Jan’13 and Dec’15, Sensex moved up from 19,580 levels to 26,117 levels. This is a decent growth rate of 10.08% per annum.

Compare this risk-return matrix with performance of a hybrid mutual fund (Example: Canara Robeco Conservative Hybrid Fund). This mutual fund has a portfolio composition of Equity: 22% and Debt: 78%. It means, it is a safe mutual fund (compared to Senses which is 100% equity). In the period Jan’13 & Dec’15, this hybrid fund gave a return of 10.36% p.a.

So the question that we must ask is, if a conservative hybrid fund can give the same return like Sensex, why to invest in equity for holding time of 3 year or less. But nevertheless, holding period of 3 year looks much safer than 1 year.

Holding Time of 5 Years

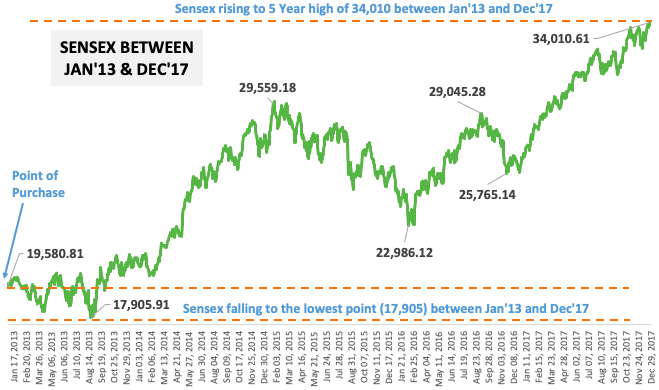

When equity is held for a period about 5 year, it is considered safe. Why? This is what is visible from the above Sensex chart. Look at the number of times Sensex dipped below the “point of purchase” in a span of 5 years. It is not very often, right? Let me give you some numbers.

Between Jan’13 and Dec’17, there were total 1237 nos trading days. Out of them, there were only 107 nos trading days when the Sensex was trading below the point of purchase (see chart). It means, for an investor there was only 8.65% chance of making loss, within a span of 5 years.

Moreover, within the period of Jan’13 and Dec’17, Sensex moved up from 19,580 levels to 34,101 levels. This is a growth rate of 11.71% per annum.

Considering the risk-return balance, I think this trade-off is reasonable. Hence we can conclude that, for a diversified equity based investment option, a five year holding time is good.

[Caution: When we are investing directly in stocks, our portfolio is not as well diversified (as that of Sensex). Hence a longer holding time may be required. My guess is, for blue chip stocks, long term holding of 7+ years should be considered]

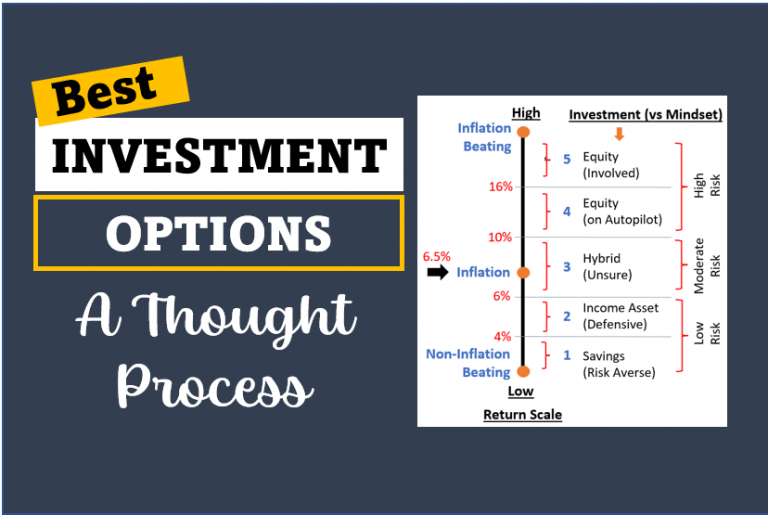

Where To Invest for Long Term?

What should be the thought process while practicing long term investment? The focus should be on building a healthy portfolio. How to build it? By including quality assets at reasonable price levels.

How to make-out if the current price is reasonable? For this the investor must see long-term. One must try to guess how the current price of the asset will trend in next 5-7 years. [Tip: If you are dealing with stocks, better option will be to use this tool which help you gauge its intrinsic value’].

Which assets we can consider for long term holding? Here is a list of 6 such assets:

- Stocks: Buying value stocks is best for long term investing. If you are not so conversant with value investing then focus on other stocks. Three types of stocks which you can be considered for long term holding are (a) dividend stocks, (b) blue chip stocks, & (c) growth stocks.

- Equity Mutual Funds: If one is not comfortable investing in stocks directly, then a good alternative is mutual funds. These funds are managed by expert fund managers. Generally, these are actively managed funds and they try to beat the performance of the index. Read: Basics of mutual fund.

- Exchange Traded Funds: These are also known as ETF’s. These are basically a hybrid-product of stocks and mutual funds. People who wants to get the benefit of both stocks and mutual funds can consider investing in ETF’s. Read: Know about exchange traded funds.

- National Pension System: These are also known as NPS. This is a product launched by Government of India. People who are not already included in the government pension scheme, or EPF scheme can plan their retirement using NPS. Note: One can invest in equity through NPS. Read: About Nation Pension System.

- Real Estate: To diversify beyond the ambit of equity, one can also consider real estate for long term investment. If practiced properly, real estate investing can yield returns like equity. There are rules of real estate which is slightly different from equity, but it is worth trying. Read: A property investment guide.

- Retirement Plans: There are people who may neither want to risk their money in equity or real estate, where they can invest? They can park their money in safer debt linked plans. Investing in annuity can be a great alternative. Read more about retirement planning.

Suggested Reading: How to build an alternative income source.

Tips on Long Term Investing

When Warren Buffett invests in companies, he buys its stocks with idea of holding them forever. For Buffett, long-term is forever. His point is, he will buy only those stocks which he thinks, at the point of purchase, will be good even if held forever. These are such stocks which you will never like to sell.

Here are few principles which we common people can follow to practice long term investment:

- Diversified Portfolio: Never stuff your portfolio with only one type of asset. Having a mix of securities/assets in ones portfolio is advisable. How to diversify? By having a range of items like value stock, ETF’s, equity funds, read estate, gold, cash etc. Read more about investment diversification as an investment strategy.

- Retirement Fund: People often complicate their investment theory by thinking about too many things. If you too are getting confused about where to invest money, go for retirement linked investment. A salaried employee, can maximise his/her EPF/Pension contribution. If you are self employed, consider increasing the contributions to NPS. Read: How much money is required for retirement?

- Manage You Risks: You must always invest money. But while doing it, you must know how to manage your risks. How to do it? Simple rule is, if you do not know about stocks, avoid it. If you still want to explore equity, do it through mutual funds. How to buy mutual fund units? Always buy it gradually through SIP’s. Continuing SIP contributions for at least 5-7 years at stretch can yield best returns. Read: The best investment strategy.

Conclusion

In the world of investments, everyone loves high returns. But high return must not come at the cost of high ‘risk of loss’.

But if investor will give too much emphasis on “minimising risk”, then they will end up investing in debt based plans. Debt plans are ok, but they yield only low returns.

“Long term investment” is a strategy which one can use to earn high returns without taking too much risk. How? Because while practising long term investing, one can deal with equity.

Though equity is a risky option, but when it is held for long term, their returns become predictable.

Have a happy investing.

Suggested Reading: Effect of Bonus Shares and Stock Splits on Long Term Returns.

Next: Stock Market Distractions >>

Thanks for sharing

I wanted to invest for longer period from 2-4 years or may be more time so suggest some stocks which gives higher growth

Recently goverment has announced 2 packages and may still continue with more. What type of Debt mutual funds will get advantage out of this?