Retirement planning is important. Why? Because this is what is going to give us financial independence after we’ve retired from our jobs/work.

The planning will ensure the availability of the required funds when it’s time to retire. In India, the majority of service-class retired people depend on annuities to take care of their cash flow needs post-retirement. But often, this is not enough to lead a decent life.

It means people need a bigger retirement fund. How to do it? By building some externally.

Internally our retirement fund is built through EPF, NPS, PPF, etc. In addition to these, external contribution to the retirement corpus is also necessary. This makes the requirement of retirement planning even more essential.

The planning for retirement needs to be done when we are still earning (is in a job). How to do it? By diverting sufficient savings to a good retirement-linked investment plan. Which is a good plan? That is what we will see in this article.

Topics:

- What is retirement planning?

- How to plan for retirement?

- Retirement planning calculator.

- Why to do retirement planning?

- Accumulation & distribution.

- How to calculate the size of the corpus?

- How to build the retirement corpus?

- Conclusion.

What is retirement planning?

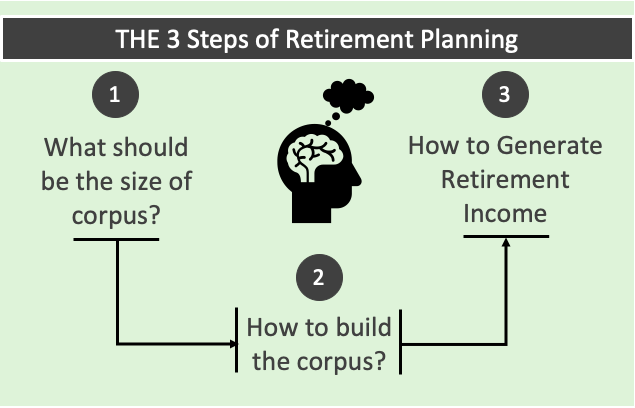

When we say retirement planning, it consists of three main steps:

- First Step: This is the most essential step. It starts with the estimation of how much retirement corpus will be necessary for an individual to lead a decent retired life. In simple words, we must decide the size of the retirement corpus here.

- Second Step: Once the size is established, the second step is knowing how much monthly savings will be necessary to build the estimated retirement corpus. Often, savings alone will not be enough, investment must be practised along with it.

- Third Step: This is the final step. It is about investing wisely the built retirement corpus. There is a difference between investments practised in second and third step. In 2nd step it is done to build the corpus. In the 3rd step it is done to generate fixed income.

To successfully execute these steps, it is essential to first judge one’s present financial heath. If ones current health is strong, smaller savings will be necessary to build the required retirement corpus.

But if ones financial health is not strong, larger savings will be needed. Why? Because the size of corpus to be built will he larger. Financial health analysis of self gives us a target of how much to save and invest each month. Once the target is set, it is also necessary to know where to invest the money.

How to Plan for Retirement?

The above flow chart summarises how one can plan for retirement. This flow chart is more useful for people who wants to know the thought-process that must go behind retirement planning.

We can also read few Q&A’s about the above flow chart which will further clarify its utility. Let’s see how this flow chart answers few important questions about retirement planning. It is the answering of these questions which will eventually helps us to plan well for retirement:

Hers are the Q&A’s:

- Q1. When you want to retire: It’s the first question of retirement planning. Answering this is important because the further away is the retirement date, easier will be to build the corpus. When goal is far, even smaller monthly investments can build a given corpus. Read more about how to retire early from job.

- Q2. How long the retirement corpus must last: This question is related to life expectancy. People who are expected to live longer after retirement, will need a bigger retirement corpus. In order to build a bigger corpus, more money needs to be invested each month. Read: How to invest retirement money.

- Q3. What will be my expenses after retirement: People often overestimate or underestimate this requirement. My calculator estimates the minimum future expense requirement based on a rule of thumb. It assumes, a person’s expenses post-retirement will be approximately 35-45% of current expense. Read more about how to calculate daily expense for self.

- Q4. What is size of current retirement portfolio: Check the current balance in accounts like EPF/PPF/NPS etc. Enter the value in the calculator. As per current trends, we can estimate that our savings parked in EPF, PPF etc will fetch close to 7-8% returns in times to come. Read about the how to withdraw money from EPF.

- Q5. How fast the expense grows with time: Over long period of time, ones expense growth will match the rate of inflation @6% p.a. Understand inflation using Dosa Economics of Raghuram Rajan.

- Q6. Where to invest to build the corpus: This is a goal which is very far away in future. Hence can take the liberty of ‘equity based investing’. Personally I would like to use SIP in multi cap funds to build my retirement corpus. Read about use of step-up SIP to build wealth.

- Q7. Where to invest retirement corpus: Here the money cannot be invested too conservatively or too aggressively. Here one must focus on ‘regular income generation‘. Once the focus is right, the next attention-point must be on ‘yield’ and ‘diversification’. Read more about where to invest retirement money.

- Q8. What shall be the size of retirement corpus (TRF): This is the most critical question. One can use my retirement planning calculator to have a rough estimate of the size the total retirement fund (TRF). Read about Money needed to retire from job.

- Q9. What is the Monthly Investment Required (MIR): This is that monthly investment which is necessary build the total retirement corpus. Read about how to invest risk free and earn high returns.

Based on the above flow chart and the Q&A’s, here is my retirement planning calculator:

Retirement Planning Calculator

Allow me to break the monotone a bit. I’ll suggest you to use the below retirement calculator. This calculator will highlight how much you must invest, more, each month to build a decent retirement corpus.

| – | Current Age | Years | |

| – | Retirement Age | Years | |

| – | Life Expectancy | Years | |

| – | Current Monthly Expense | Rs. | |

| CRF | Current Retirement Fund | Rs. | |

| – | Expected Growth of CRF | % | |

| – | Average Inflation Till Life Time | % | |

| – | Expected ROI Till Retirement | % | |

| – | Expected ROI After Retirement | % |

| TRF | Total Retirement Fund Required | Rs.Lakhs | |

| ARF | Additional Retirement Fund | Rs.Lakhs | |

| MIR | Monthly Investment Required | Rs. |

This retirement planning calculator gives three critical answers:

- Total Retirement Fund Required (TRF): Based on the present expenses, the calculator will forecast future expense (after retirement). Based on this forecast and ROI levels, the calculator will estimate the total retirement fund required. The size of this retirement fund will be enough to manage retirement expenses. Know more about manual estimation of retirement corpus.

- Addition Retirement Fund to Build (ARF): Suppose ones needs to build a retirement corpus of say Rs.2.0 Crore (TRF). Based on his current retirement portfolio, Rs.80 Lakhs will be built automatically. It means, the person needs to build only an additional Rs.1.2 Crore (ARF). Read more about NPS vs EPF for retirement corpus building.

- Monthly Investment Required (MIR): This is the main To-Do for the user of this calculator. This is the amount which one must invest each month to build a corpus as big as ARF. Read more about types of mutual funds and their potential returns to understand where to invest – to build ARF.

The logic based on which the above retirement planning calculator works will be explained below. Why it is essential to know? Because it will build a thought process which eventually benefits the planner.

P.Note: An informed planner can build a substantially bigger retirement corpus than a casual investor.

Why to do retirement planning?

Because it is necessary. Retirement is a phase of life where one has left the job and is no longer working. This eventually leads to stoppage of regular income in form of paycheck etc.

People generally retire from job at 60 years of age. This is an age where the person may not be physically as able as before. Hence at this phase of life if a person can rest, and still generate regular income, it will be ideal.

How this will happen? Generation of regular income without working for it, is the goal of retirement planning.

The first step of retirement planning is to access a reliable retirement planning calculator. This calculator will not only ask important questions, but will also give critical answers.

A good retirement calculator guides one to the right set of answers related to retirement corpus building.

Accumulation and Distribution Phase…

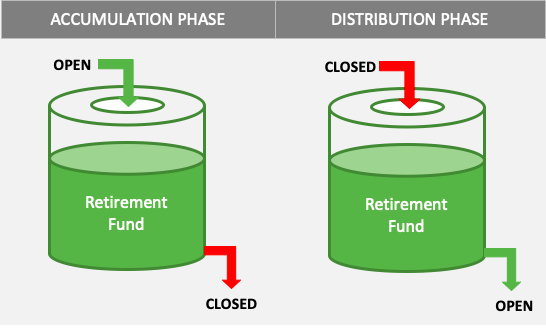

To understand retirement planning completely, one must know these two stages of retirement planning.

- Accumulation stage: In this stage people save and invest money to build their retirement corpus. The longer will be the accumulation stage, easier it will be to build a sufficiently big retirement corpus. Hence experts recommend to start early. Required corpus for retirement is always a big amount. Hence, starting early will make the life easier for the investor.

- Distribution stage: In this stage people withdraw money from their retirement corpus. As important it is to build the corpus, it is equally important to utilize the funds even more wisely. How to use it wisely? By investing the built corpus in such a way that it generates consistent income. Read more about how to use retirement fund.

Longer accumulation period is good

Longer is the accumulation stage the better, why? Because in such a situation, even smaller SIP’s can eventually build a large retirement corpus. We will use an example to understand this fact.

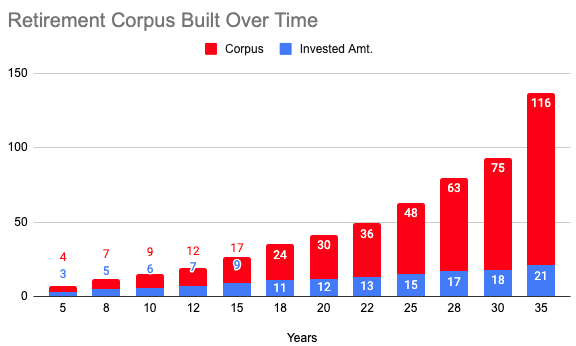

- Example: Investing Rs.5,000 per month for 35 years yielding a return of 8.5% per annum

The above chart is a graphical representation of this example. The blue portion indicates the total amount invested as on date. Example, the number 3 indicated in blue is Rs.3 lakhs is invested till the 5th year. Similarly, the number 11 indicate in blue is Rs.11 lakhs is invested till the 18th year.

The red portion indicates size of retirement corpus as on date. Example, the number 4 indicated in red is the size of corpus as Rs.4 lakhs till the 5th year. Similarly, the number 24 indicate in red is the size of corpus as Rs.24 lakhs till the 18th year.

You will note that in the initial years (till 10th year), out of the total retirement corpus built, the principal amount (amount invested) dominates the total size of corpus. Example: 5th Year: When total retirement corpus is 4 lakhs, out of it 3 lakhs is the principal amount.

But after the 10th year, compounding effect starts to take its toll. Example: 18th Year: When total retirement corpus is 24 lakhs, out of it only 11 lakhs is the principal amount. Similarly, In 35th year: When total retirement corpus is 116 lakhs, out of it only 21 lakhs is the principal amount.

What does it mean? The red portion gets bigger in later years. It means, the invested money grows more rapidly in the later years. Hence the longer the money stays invested, bigger is the benefit.

#2. Why to Start Early?

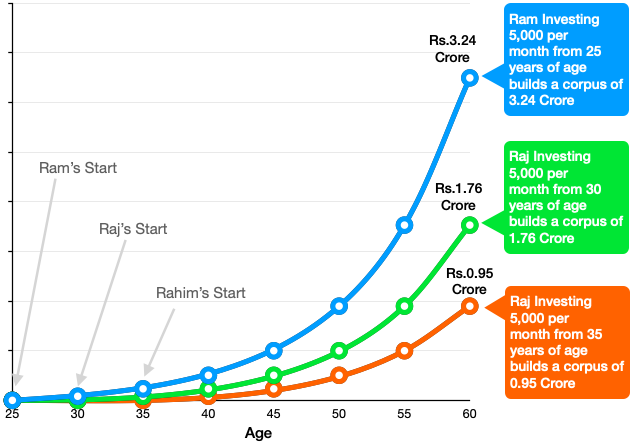

Suppose there are three friends Ram, Raj and Rahim. Each of them are 25 years of age. These three friends decided that they would like to retire at the age of 60 with a healthy retirement corpus.

- Ram Starts: a SIP of Rs.5000 per month in an equity mutual fund immediately after making this decision. His mutual funds yielded a return of 12% p.a. over next 35 years. By the time Ram was 60 years of age, his SIP built a retirement corpus of Rs.3.24 Crore for him.

- Raj Starts: a SIP of Rs.5000 per month in an equity fund when he reached 30 years of age (5 years after Ram). By the time Raj was 60 years of age, his SIP built a retirement corpus of Rs.1.76 Crore for him. Because of 5 years delayed start, Raj’s corpus is only 50% of Ram’s.

- Rahim Starts: a SIP of Rs.5000 per month when he reached 35 years of age (10 years after Ram). By the time Rahim was 60 years of age, the size of his corpus was only 95 lakhs. Though Rahim has also stayed invested for as long as 25 years, but because his start was 10 years delayed than Ram, Rahim’s corpus is only 20% of Ram’s.

The lesson to learn from this example is that, as soon as one realised the need of investing, one must start. Idea shall be to give our money a long-time to stay invested. The longer will it say invested, bigger it will become eventually.

Initial Years are Tough

When one first starts to set-aside money for retirement, it will feel like a burden. This is natural. Including a new activity in life is mostly not smooth. What is the reason? Current priorities overshadows the future requirement of retirement.

Allow me clarify this point more because it will help in overcoming the obstacles of starting. Suppose, one’s current priorities are like Child’s education, parent care, home purchase, entertainment, dinning-out etc. These are immediate needs of life. Among such needs, retirement planning becomes hard to execute.

It is true that our mind sees immediate financial goals as important. But it is also true that retirement also needs a fair treatment. But how to plan for retirement linked savings when immediate ones look far more important?The idea is simple.

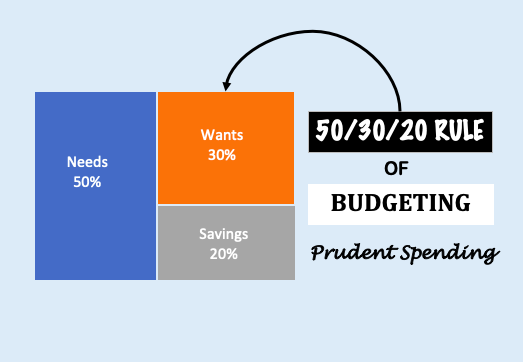

- Start Low: Start diverting only small sums of money each month into retirement linked plans. If allocating funds is a problem, you can start with as small a denomination as Rs.500 per month. More important at this stage is to start investing for retirement.

- Increase Gradually: Once you have started and contributed at least 12 SIP’s to your mutual fund, you are ready to take the next step. Increase the contributions gradually (every year). How much to increase? Match the percentage pay-hike you got that year.

How to Calculate Size of The Required Retirement Corpus?

How big should be ones retirement corpus? The corpus should be big enough so that it generates enough income to support retired life. There are two essential questions that need answering at this step:

- a) How much income is required after retirement?

- b)What shall be the size of retirement corpus necessary to generate the required income (in a).

(a) Income Required After Retirement

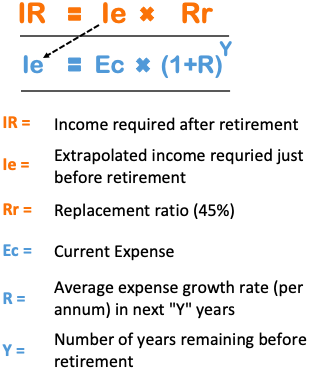

I’ll present to you my formula using which we can quantify the required-income after retirement. But before we see this formula, allow me to explain a term that I’ve used in this formula:

- Replacement Ratio (Rr): The concept of income replacement ratio is simple. Suppose a person’s present average monthly expenses is Rs.100,000. He has planned well his retirement. In this case, after retirement, his income-need will be Rs.45,000 (45% of present average expense). The value of 45% is what I call as “replacement ratio”. [Note: People tend to spend much less after retirement. If you need, you can select a different replacement ratio for yourself. ]

Now let’s see the formula:

Let’s understand the use of this formula with an example:

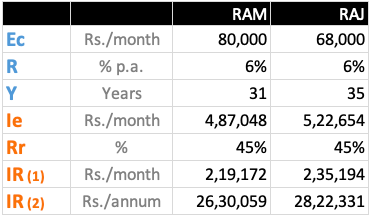

- Ram and Raj are two friends. They want to estimate their retirement income. Their current monthly expense is Rs.80,000 (Ram) and Rs. 68,000 (Raj). Ram is 29 years of age and Raj is 25 years of age. It means, Ram has 31 years before retirement and Raj has 35 years. Also we are assuming that the rate of inflation for next 30-35 years will be average 6% p.a.

Let’s put these values in the above formula and see what numbers these two friends get as an estimate for their “required income” post retirement.

What we can deduce from this example? A person, 25 years of age, who spends Rs.68,000 per month today, will need an income of Rs.2,35,194 per month at the time of retirement (Age: 60 years – 35 years from today).

So in this case, from where will the income come from? It will be generated as returns from the invested “retirement corpus”. What shall be the size of the corpus? This is what we will see next…

(b) Size of Retirement Corpus

Let’s try to estimate the size of retirement corpus by continuing with the above example (for Ram & Raj). We have already estimated that Ram’s retirement-income requirement is Rs.2.19 Lakhs per month (or 26.30 Lakhs per annum). Raj’s income requirement is Rs.2.35 Lakhs per month (or 28.22 Lakhs per annum).

Before proceeding, we must also factor-in an important assumption. It is related to life-expectancy. Suppose, both Ram and Raj expects to survive till 85 years of age. It means, the retirement corpus should generate income for next 25 years after their retirement.

In this case what should be the size of retirement corpus? To calculate the size, we can use the “Present Value” formula of Excel.

What is assumed here in this formula are the following:

- rate: expected return on investment is 4.5% per annum. I’ve assumed that a typical monthly income plan (MIP), after 30-35 years from today, will yield this much return.

- [fv]: I’ve assumed that the future value of the retirement corpus as zero. Why? Because after the lapse of 25 years, I’ve assumed that the full retirement corpus will get consumed. Hence the balance becomes zero.

- [type]: I’ve assumed that the monthly payments will start yielding at the end of each month. It means, if the money is invested in a MIP on 1st-Jan, then the first income will start flowing-in from 31st-Jan.

Using this formula, the size of retirement corpus for Ram is Rs.3.95 Crore, and for Raj is Rs.4.23 Crore. Check the calculation down in the above screenshot.

How to build the retirement corpus?

Ram and Raj now has a number. They know that Ram must build a retirement corpus of Rs.3.95 Crore and Raj Rs.4.23 Crore. But how to build this corpus? There are two things that must be clarified first to answer this question:

- #1. How much to invest: Ram and Raj must invest a certain amount of money each month to build a corpus of Rs.3.95 and Rs.4.23 crore respectively. We must note that Ram & Raj has 31 & 35 years respectively for corpus accumulation. To know the quantum of investment, we can use the “PMT” formula of excel (shown below). Using this formula, we know Ram will need to invest Rs.15,582 and Raj 11,053 per month to build the corpus.

- #2. Where to invest: The clue must be taken from #1 above. The expected return on investment is 10% per annum for both Ram and Raj. It means, return generated by the investment portfolio must be 10%. What shall constitute an investment portfolio in the accumulation stage? To meet the target of 10% p.a. returns – the portfolio composition must be equity dominant. Read: About basics of mutual fund investment.

Where to invest money in accumulation stage?

In the accumulation phase, the target of the planner should be on corpus building. The faster and easier the corpus is build the better. In my opinion, here the person should concentrate on growth investing. Generally people try to play safe here too.

But considering that one has such a long time horizon available for investing, going all guns blazing should not be a big worry. People who are farthest away from retirement (like people in their 20’s and early 30’s) should definitely consider growth investing over any other options.

Here I will try to list down all “traditional” investment options which a person can use to invest their money in accumulation stage of retirement planning:

A. Traditional Retirement Plans

- Employee Provident Fund (EPF): Most salaried class people already contributes to EPF/PF. In this scheme, the employees mandatorily contributes 12% of their basic salary and allowances. Employee’s can also voluntarily contribute more than 12%. Employer’s contribution is limited at 12%. The interest rate provided by EPF is close to 8.6% per annum. Read: How to withdraw money from EPF.

- Employee Pension Scheme (EPS): This comes as a package with the EPF. In EPF, 12% is contributed by the employer. Out of this 12%, 8.33% is diverted to EPS. Moreover, the GOI of India also contributes to EPS. In addition to the employer’s contribution of 8.33% to EPS, GOI (Central) also contributes 1.16% of employee’s basic salary towards EPS. Interest rate offered on EPS is same as EPF.

- Gratuity: An employers should mandatorily pay a gratuity to the employee. If an employee has completed 5 years continuous services, he/she becomes eligible for gratuity. The employee can claim gratuity while leaving job. Insurance companies like: LIC, ICICPRULIFE, KOTAK etc provide group gratuity scheme.

- VPF: This is an acronym for Voluntary Provident Fund scheme. When we have options like EPF, why VPF is required? In EPF, the percentage contribution is limited to 12%. But in VPF, one can contribute even 100% of their paycheck. One has to just ask the HR to raise a request for a VPF account. VPF offers same interest as EPF.

- PPF: In Public Provident Fund scheme (PPF), like VPF, one can start contributing from as low as Rs.500 per month. But in PPF, there is a upper limit to contribution. The upper limit is Rs,1,50,000 per annum (Rs.12,500 per month) with a 15 year lock-in period. At present the interest offered by PPF is close to 8.7% per annum. Suggested reading: About annuity.

#B Non-Traditional Retirement Plans

- National Pension System (NPS): NPS is also a retirement linked investment scheme that all individuals above 18 years of age can utilize to build their retirement corpus. NPS is comparatively a new retirement plan made available by government of India in year 2009. I personally consider it as an effective tool for building a large retirement corpus with ease. Read more about it: NPS scheme.

- Mutual Fund’s Pension Plans: When we already have great traditional retirement plans and NPS, why to consider mutual funds?Because in case of NPS, people are obliged to use 40% fund to buy an annuity. The annuity in turn generates regular income. But in case of pension plan of mutual funds, buying annuity is not compulsory. One can also decide to opt for a systematic withdrawal plan post retirement – which may yield better returns.

- Hybrid Mutual Fund: I personally would go full throttle when it comes to building a retirement corpus. Traditionally people opt for safer options like PEF, VPF, NPS etc. But when time horizon in hand is so huge, why to play safe? But this is also a fact that one cannot afford to play reckless when it comes to retirement planning. There must be a clever balance between aggression and playing safe. I think, hybrids funds offer such a balance. These funds can offer 10%-12% returns in long term. Read: Basic guide on mutual funds.

Where to invest money in the distribution stage?

In the distribution stage, the funds of the retirement corpus must be invested conservatively. This is necessary because in this stage the family is dependent on income generated by the accumulated retirement corpus.

Over and above this, the priority is also to keep the corpus amount intact as as much as possible. Distribution stage can further be subdivided into sub-stages:

- Stage 1: This represents the first 10 years of retirement. Here the retired person is expected to be more active. Hence, risk profile is higher. In this stage the person can maintain partial exposure to equity.

- Stage 2: This represents a stage where the person has already lived first 10 years of retired life. In this stage the person is expected to becomes less active. The risk profile of the person is low in this stage. I feel, in this stage equity exposure shall be almost zero.

Investment diversification must also be maintained in the distribution stage. The retirement corpus must be spread evenly in multiple income generating source. Ideally, income should flow-in from multiple sources instead of one or two options. Here we will see a list of few proven investment options suitable for post-retirement phase:

- #1. Annuity: Retired person can buy an annuity. This is a very safe investment option. It’ll generate regular income. Schedule of income generation can be monthly, quarterly, half-yearly and yearly. Read this comprehensive guide on annuity.

- #2. SCSS: People of only 60+ years of age can invest in SCSS. One can open a SCSS account with Indian Post Office. The money invested in SCSS has a lock-in period of 5 years. The maximum amount one can invest in SCSS is Rs.15 Lakhs per account. Presently SCSS offers a reasonable interest rate of 7.4% per annum. Read this elaborate guide on SCSS.

- #3. POMIS: This is a savings scheme offered by Post Offices. POMIS stands for “Post Office Monthly Income Scheme”. It can be used to generate monthly income. Its lock-in period is 5 years. Here the minimum investment amount is Rs.1,500. The maximum limit that can be invested in POMIS is Rs.9 lakhs (joint account). Presently POMIS offers interest rate of 7.7% per annum. Read more about POMIS here.

Suggested Reading: I’ve written a detailed blog post on how one can use retirement savings for income generation. I’ll suggest my senior citizen friends to give a glance to this blog post. I’m sure you will find it useful.

Conclusion

Retirement planning is an essential priority of personal finance management. In fact it will not be wrong to say that retirement planning should be the number one priority of all. Why? Because financial stability at old age is a necessity.

How to plan for retirement? I use my retirement planning calculator to figure out ‘how big should be my corpus‘, and ‘how much should I be investing‘ as on date to reach the goal.

This is a simple tool, but a very effective related to retirement planning.

If you like, I will request you to share your opinion in the comment section below.

Have a happy investing.

Hi Mani, thanks for this informative and educational post! One question I have is: what is the difference between “Expected Growth of CRF” and “Expected ROI Till Retirement”? They seem the same to me.

Thanks,

Meghna

Expected Growth of CRF:

This is rate of growth of current retirement fund (say growth of your current PF/EPF balance)

Expected ROI Till Retirement:

This is the expected ROI of investment made in addition to PF/EPF (say SIP in a mutual fund)

At the end you will see a value “Monthly Investment Required”

This is the total investment required = PF/EPF + SIP In Mutual FUnd

Thanks for asking and the feedback.

Annuities can be used for income flooring during retirement. Once you know, that you will be receiving a certain fixed income every month, then it does take out some tension of you.

Excellent article. The only drawback is the effect of inflation in th emonthly expenses post retirement is not accounted for. As a result, the proposed corpus may force the retiree to become extremely frugal towards the latter part of his life.

Hi,

Could you please discuss about a situation where a person is going to retire within six months. Assume that he has a fixed income of 50,000 per month from LIC pension scheme. Now he will have 1 crore liquid cash at hand when he will retire after six month from today. Assume that his current expenditure is 70,000 per month.

So what exactly he will do to adjust the inflation in future?

Mani,

I m electronic enggr. Retired frn Air India in the year 31-10-2015.at the Age 58yrs. Got corpus 95 L

Investment(as per yr suggestion( GET MONEY RICH)

4.5 L MIS post

15L SCSS post

70 L UTI MASTERSHARE DIRECT GROWTH SWP 8%crisil *****(Five star Large cap Mutual fund)This script fetch fantastic result and my primcipal jumps from 70L to 96L in worst corona period

Now i cancell SWP 8% & WIthdraw amotnt above 91L. Now I m getting (saving) amt. Which i m investing in family members name.

Mani sir Thank u verymuch for yr Idea (safe Investment)

sir any sujjestion ,for Investment philosophy please guide me.

I’ve been investing and saving up for retirement. What I’ve been considering recently is doing a partial retirement, where I still work part time. I figure I’ll be pretty bored once I retire. Do you have any advice on budgeting for a partial retirement, or should I just focus on saving for a full retirement and then just enjoy the extra cash from work?

Thanks for pointing out that growth investing is an important thing to focus on when it comes to retirement planning. One of my dreams is to be able to travel a lot later in life. As such, securing my financial stability even through retirement would be a sound way to make that dream come true.

In section “(b) Size of Retirement Corpus”, I get a feeling that you have not considered inflation in monthly expenses post retirement in the “PV” formula. To assume a RoI of 4.5% post inflation is quite high, I think.

Hey! I have read your blog and I must sat the content you have shared is really useful. Thank you for hsaring

Excellent set of articles and online calculator. Very comprehensive and elaborate explanation.

Really helpfull and quite fantastic! Good work on this article. It’s worth reading.

Hi Mani.

Not very sure as to how i got your to your blog,but ever since i got it,which is about a month or so back,i have been investing time almost every day since then in going through your articles.The reasons why your articles have got my attention is because you explain things very well and you are covering almost every thing which is one needs to know as far as managing money is concerned also the very down to earth,practical way some of the generally complex points are explained.

Though it could be said that i a bit a late(58 now,but will go and plan to go on for many many years!) in getting to read such detailed stuff,i still think it is better to be late than never.However,besides,trying to apply what could be applicable to me,i also reading this stuff so that i could pass on this learning to our son.

Thanks Mani( nice name in the sense it rhymeswith money!!)

Thanks for the feedback. It means a lot.

Hi Mani,

Since sometime I was looking for a practical guide to retirement planning and found one on this blog. I also liked the other blog posts on Financial Planning.

Do you also consult on Financial/Retirement Planning. I’d suggest you can do so for a fee if not doing it already. I am looking for some help on this and will appreciate if you can revert on my e-mail.

Best regards,

Santosh

Thanks for posting your comment.

Dear Sir,

I am a learner and your topics related to Financial Plannings are more elaborate , logical , practically proven too…

I really enjoyed all the contents you have written and hope to read more which helps me a lot…

Thank you so much…

Thank you for posting your comment.