In India we have an investment option called “Post Office Monthly Income Scheme (MIS)”. Among other investment options, PO-MIS can also be considered suitable for investment by retired people.

But PO-MIS is not limited for retired people alone. Anyone with age above 18 years can open a PO-MIS account. An account can be open even on behalf of minors with age above 10 years.

So if you are one who is interested in alternative income generation, then PO-MIS can be your choice. It is one of those super-safe investment options where the invested capital is fully protected. Moreover, it can also earn some interest.

Though the offered interest rate is not high, but considering that it is a monthly income plan, and is almost risk-free, it is a good compromise.

Like banks, Post Office’s are spread all over India. They are even located in such places which may not have banks. That is why, banking facility offered by Indian Post Offices are so welcomed.

Let’s know more about this monthly income scheme (MIS) offered by our post offices.

PO-MIS is suitable for whom?

First of all this is a monthly income scheme. Hence anybody who wants to invest for monthly income generation can consider PO-MIS. But there is more to PO-MIS than income. They are super safe.

This is the reason why PO-MIS is recommended for retired people. The money invested in PO-MIS is almost risk free. Why? Because Indian post offices are controlled by Government of India.

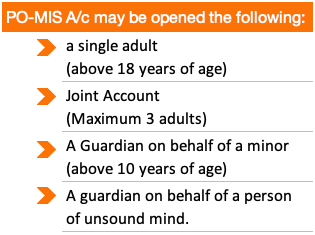

PO-MIS is generally talked about as if it is scheme meant for retired people only. But it is not the case. Any Indian citizen can open a PO-MIS account. The age criteria required to open PO-MIS a/c is shown below:

Post Office Monthly Income Scheme (PO-MIS)

Bank fixed deposits can make payout each month. Similarly post office monthly income scheme (PO-MIS) can also render monthly payouts. The payout is made from the interest earnings. Check this comparison between bank FD and PO-MIS.

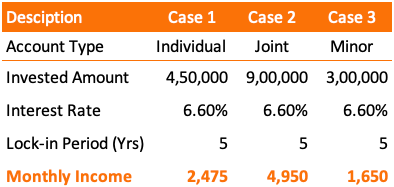

Depositors can invest a lump-sum amount in Indian post office. Under MIS scheme, the depositors savings account will be monthly credited with the predefined amount. The calculation for the monthly payouts is shown below:

Example: Suppose Raj & Ravi invests Rs.4.5 lakhs and Rs.9.0 lakhs respectively in PO-MIS. They have invested with an idea of generating a fixed income for next 5 years. Their deposit will yield an interest of @6.6% per annum. This way Raj will earn an income of Rs.2,475 and Rs.4,950 per month. [P.Note: Deposits made on behalf of minor is capped at Rs.3.0 lakhs]

How The Payments Are Made?

When it comes to PO-MIS plan, there are two types of payments:

- Payment of Monthly Interests: The interest payable will be credited in the account holder’s SB account in the post office. ECS transaction are allowed in all SB accounts. Hence, one can activate ECS in ones SB account. This way, the MIS interest credited each month can be automatically transferred to ones preferred bank a/c (say ICICI, HDFC etc) on every due date. Else, ECS of interest directly to other bank account from MIS account is also possible. Read: How to save money.

- Payment of Principal On Maturity: Once the PO-MIS account gets matured, the investor can do two things. They can go to the post office and withdraw the principal amount in cash. Else, the maturity amount will be credited into ones SB account. One can then use ECS to transfer the amount to ones other bank account. Read: A guide on emergency fund building.

How to open a PO-MIS account?

Account opening is easy. We will see the procedure. But before that we must understand a point about PO with CBS.

What is CBS? These are those post office branches which has Core Banking Solution (CBS) enabled. In one of the tweets posted by the Law Minister in year 2016, it was said that 20,106 number post offices had CBS activated.

By today number of Core Banking Branches of @IndiaPostOffice touched 20,106. It had only about 230 such branches in May 2014.

— Ravi Shankar Prasad (@rsprasad) March 14, 2016

PO-MIS accounts can be opened by an individual at “HO” (Head Post Office) or “SO” (Departmental Sub Post Office) of the region. These days, almost all HO branches has CBS facility. This has made the account opening procedure simpler. [P.Note: NRI’s & HUF’s are not permitted to open MIS account.]

Steps to open MIS account:

- 1. SB A/C: If one does not already have a savings account (SB) in the post office, it must be opened first. Once the SB account is in place, one must approach for MIS account opening.

- 2. FORM & DOCUMENTS: To open MIS account, first fill the account opening forma and submit it with proper document. The photo copies of the documents required here will be ID proof, address proof, and passport photographs.

- 3. VERIFICATION: Original documents must be carried while submitting the photo-copy of the documents. The photo-copies will verified alongside the original documents.

- 4. WITNESS: You will need the signature of a witness on the MIS account opening form. Better is to accompany the nominee with you. He/she can also work as a witness.

- 5. DEPOSIT: To open the MIS account, the final step of making a deposit shall be completed. The minimum deposit amount in MIS account is Rs.1,000. Deposits must be made in multiples of Rs.1,000 only.

Salient Features of PO-MIS account

Post offices which handles “monthly income scheme” (PO-MIS) comes under DoP (Department of Posts). DoP is a central government run department coming directly under the Ministry of Communications.

As the deposits made in Indian Post Offices comes under the purview of G.O.I, hence the capital protection is guaranteed. Moreover, the interest rate promised under PO-MIS is also non-varying.

These two factors makes PO-MIS most suitable for all risk-averse investors.

Accounts & Deposits

Deposit Limit: An individual can open multiple accounts. But the sum of deposits in all accounts must not be more than Rs.4.5 lakhs. In case of joint account, the maximum limit is Rs.9.0 lakhs.

Joint Account: A maximum of 3 individuals can open a join MIS account. Suppose the joint account has a deposit of Rs.9.0 Lakhs. In this case, the share of deposit for each person will be one third of Rs.9 Lakhs (Rs.3 lakhs each) . It means that each depositor is still eligible for another MIS account of Rs.1.5 lakhs (Max Limit is 4.5 Lakhs = 3.0 + 1.5).

Account Conversion: MIS account opened by an individual can be converted into a joint account at a later date. A person can add the spouse to convert the single account to a joint account. Similarly, a joint account can be converted to a single account.

Number of Deposits: Only one deposit is allowed in a MIS account in multiples of Rs.1,000. What does it mean? It means that the depositor must be clear about the quantum of deposit at the account opening stage itself. No further deposit is allowed once the MIS account is active.

Account Transfer: If the account holder changes the city of residence from say Delhi to Ajmer. In this case the PO-MIS account can also be shifted from Delhi’s HO post office to Ajmer HO post office. Such account transfers are allowed.

Maturity & Premature Withdrawals

Lock-in Period: Once the MIS account is active, the deposit amount gets locked for at least next 5 years from the date of account opening.

Premature Closure: MIS account can be closed prematurely with a penalty. But the clause of premature closure will become active only after 1 year from the date of account opening. Means, the deposited amount gets compulsorily locked for at least 1 year. Request for premature closure can be applied only at a post office where the account stands.

Penalty: There is a penalty clause. If the deposit is withdrawn within 3 years of account opening, the principal amount will be returned after deducting 2% of the deposit. If the deposit amount is prematurely withdrawn after 3 years, 1% of the deposit will be deducted.

Reinvestment: The money parked in post office monthly income scheme can be reinvested bak into a new PO-MIS plan for another 5 years period. The reinvested money will be treated as a new account, and new/revised interest rates will be applicable.

Rate of Return

High Returns: Presently (on 21st May’20), the interest rate offered by PO-MIS is 6.6% per annum. Do not get me wrong, I’m not saying that 6.6% qualifies for high returns tag. But we have to compare apple-to-apple to know better.

Here I will provide a list of banks and the interest rate offered by them today on a five year term-deposit.

| SL | Name of Bank | FD Interest (%) |

| 1 | State Bank of India | 5.70% |

| 2 | Punjab National Bank | 5.75% |

| 3 | Bank of Baroda | 5.70% |

| 4 | Canara Bank | 5.70% |

| 5 | HDFC Bank | 5.75% |

| 6 | ICICI Bank | 5.75% |

| 7 | Axis Bank | 5.10% |

| 8 | Kotak Mahindra Bank | 5.00% |

Tax Liability

The interest earning from post office MIS is taxable under the hands of the depositor. The income so generated will be taxed as per ones marginal tax rate. There are no income tax benefits from PO-MIS plan. Read: About the new tax slabs (2020).

But to make it slightly more convenient for the depositors, under PO-MIS plan no Tax is deducted at source (no TDS). This increases the monthly take home income. As this scheme is also used by senior citizens, no TDS deduction helps their cause. Read: Where to invest money after retirement.

Death Benefit

In the event of death of the account holder, the nominee will be eligible for the death benefit. Post the death of the account holder, the due interest amount and the principal amount will be paid to the registered nominee. Read: Buying health insurance in 40.

FAQ’s about “Post Office Monthly Income Scheme”

Q: What happens to the interest rate of existing PO-MIS accounts after revision of interest rates?

- A: About only few years back, the interest rates offered on PO-MIS account was 7.3% per annum. Today this number is down to 6.6% per annum. But lowering of the interest rates does not impact the existing accounts. Their interest rates remains unchanged. The lower interest rates will be applicable for the newly opened account only.

Q: What happens to the minority account when the minor attains the age of 18 years?

- A: The account holder (previously minor) must apply for the change of account. The applicant must ask to convert the account to his name. Before attaining majority, the account was in the name of the minor, but it is managed by a guardian.

Q: Nomination modification or cancellation of current nomination is allowed in PO-MIS?

- A: Yes. There is a procedure laid down for it. The account holder must visit the post office to get this procedure done.

Q: Maturity bonus is applicable on all PO-MIS accounts?

- A: No. No maturity bonus is paid on accounts opened after 30.11.2011. Earlier a 5% bonus was payable on the principal amount post maturity.

Q: What happens to a join MIS account on death of one of the members?

- A: If the account is held by two person, upon death of one, the joint account becomes a single account. The account will continue to operate under the name of the surviving depositor. But as single account can have a maximum of Rs.4.5 lakhs as deposit, the excess amount will have to be withdrawn by the surviving depositor.

Comparison of PO-MIS With Other Similar Income Plans

| Description | PO-MIS | SCSS | PMVVY | FD | MF MIP |

| Investment Limit | 9 Lakhs | 15 Lakhs | 15 Lakhs | 5 Crore | NIL |

| Interest Rate | 6.60% | 7.40% | 7.40% | 5.70% | Variable |

| Lock-in Period | 5 Years | 5 Years | 10 Years | 10 Years | Variable |

| Tax Benefit | NIL | 80C | NIL | NIL | NIL |

| TDS | N/A | Yes | N/A | Yes | Yes |

| Premature Withdrawal | Allowed with penalty | Allowed with penalty | Difficult but possible | Allowed with penalty | Exit Load |

| Regular Income | Monthly (M) | Quarterly (Q) | M/Q/HY/Y | M/Q/HY/Y | Monthly |

Suggested Reading:

![Swagbucks India: A Way to Earn Money Online [Now]](https://ourwealthinsights.com/wp-content/uploads/2018/06/Swagbucks-image.png)

PLS CALL ME

HI MANISH JI,

ARE FD’S OF DCB AND HDFC TYPE PVT BANKS ARE SAFE UNDER Deposit Insurance and Credit Guarantee Corporation (DICGC) scheme??

Is it advisable to buy tax free bonds from the secondary market.

Good article. Mostly such articles (Post Office based) are neglected calculation for the monthly payouts is shown for POMIS can u give for the SCSS also

Sir, fantastic article at the correct time. One question from me… Are the fixed deposits in our psu for eg. Bank of India are safe in the current times

FD in a public sector banks should be safe. But question we can ask is why BOI? What other options we have?

Very good article at times when investors are looking safe avenues to invest their hard earned money and get a reasonable returns.Article is very well detailed to understand the Pros & Cons of the PO-MIS investment plan/strategy.

I always read your articles and get convinced about your noble thoughts to guide your readers to make their investments with better information and be well informed.

Thanks once again & Be Safe.

Thanks for the super feedback.

Good article. Most often such instruments (Post Office based) are neglected or less written about. Refreshing change !

Thanks