Car Affordability Calculator

Just enter your monthly income & loan in the data entry fields, the calculator will do the affordability calculations on its own.

Car Affordability Calculator

Financial Details

Average monthly salary credited in the last 12 months (not CTC).

Cumulative EMI for all home loans.

Cumulative EMI for all other loans.

Your Results

Maintenance Cost (₹/year)

Maximum you can spend on car maintenance annually.

Insurance Premium (₹/year)

Maximum you can spend on car insurance annually.

Car Value (₹ Lakhs)

Maximum you can spend to buy a car, considering your salary and loans.

Suggested Cars

Cars within your budget based on the calculated car value.

Based on ones monthly income & existing loan burden, the calculator computes what is the maximum one must spend on a car. There are two types of cost associated with a car: (1) Recurring cost & (2) Purchase Price (one time cost).

Accordingly the result of the calculator is spread into two parts as shown below:

- Recurring Cost: Here the calculator try to estimate how much one must spend on recurring basis on a car. Here the types of recurring costs assumed are "maintenance cost" and "insurance premium". Both are assumed as annual expenses. Cost of fuel is not assumed to keep the concept simple.

- Purchase Price (One Time Cost): This is the cost of purchase (On road price) of a new car. The calculator try to estimate the maximum on-road-price of the car that your current financial position can afford for you.

Once you are done with the mathematics of car purchase (income vs purchase price etc), now we are ready to enter the mind-set arena. So let's begin were everything begins - the thought process...

People who are car fans, and also remain aware of their spending habits will like my calculator. Take it as a fun calculator. When I use this calculator for myself, I've seen that it's car-value predictions generally matches my actual affordability.

Introduction

Car affordability calculation is one of those necessary preparatory work that must be done before a new car purchase. Generally when we buy a car, we do not care about affordability calculation. But this is a mistake.

Car is a financial liability, but it is also a very convenient way of transportation. Moreover for many, owning a car is a huge psychological booster. Hence, people tend to overspend on their car purchase.

How to control this overspending urge? By first performing ones car affordability calculation, and then buying a car in accordance with it. I've also provided a simple calculator which can ease ones affordability calculation.

Purchase Philosophy

I'm writing for people who are likeminded as me. These are people who observe and analyse their spending habits. They like to be called as wise-spenders. But it does not mean that they spend less, they just tend to buy things after little bit of more pondering. :)

Their purchases always exhibit the following three philosophies:

- Value for Money: Their purchased items often strikes a balance between quality, usefulness and price. This is what makes them a value for money.

- Taste & Personality: No matter if they are buying grocery, stocks or a car, the bought items are a reflection of their taste and personality.

- Blend: Their priority is to buy the best that the market can offer. But the item must also blend perfectly with their social status. I personally give lot of emphasis to this point in my life.

In this article, we will see how we can pick a great car which is in accordance with the above three philosophies.

So lets start with my car affordability calculator...(use here)

How to think About Car Purchase?

Whatever good or bad we do in our lives, it has roots in our brains. So, whether we bought a "value car" or "overspent" on it, it's origin happened in our mind.

As car purchase is a capital intensive activity, hence its accompanied with lot of money being spent. So before spending it, better is to plan this purchase. And a car being a CAR - it's has a special place in our hearts, right? :)

For many, possession of a nice car is a passion. But when a passion is about a capital intensive thing, it must be handled carefully. Because if not done properly, it often leads to overspending.

What it means by doing properly? What our calculator gives us is only the right price of purchase. But there are several other variable which must complement this price.

One cannot pick cars only on basis of "Brand Name" and "Price". There are other important parameters that must be considered alongside to complement the price target given by the calculator. Here is a list of these 9 parameters:

- #1. Pick the right car size.

- #2. Option: New vs used car.

- #3. Luxury or affordable brand.

- #4. Technical specification.

- #5. Pick optimum accessories.

- #6. Resale value.

- #7. Think Maintenance (affordability)

- #8. Buying car on Discount, and

- #9. Car Financing Rule.

- Conclusion.

In this article we will see all the above 9 parameters in a bit of detail.

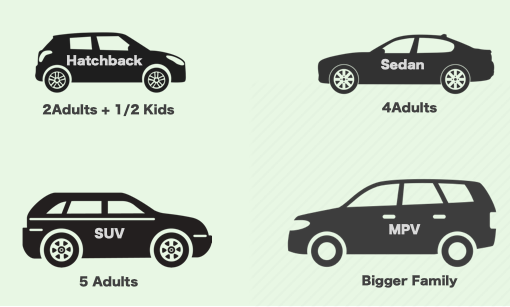

#1 Pick the Right Car Size

I am sure, people do consider car size before their purchases. But generally the “cost of car” dominates this decisions. People low on budget, go for small cars. A decent budget, will attract bigger cars. But this is not the right way to decide on car size.

A better approach will be to take this decision based on car usage. Pricing should come next. Few key questions can be like this:

- How many people will ride the car? Size of family.

- What will be the use of car? Personal or commercial use.

A nuclear family with 3/4 members, hatchback will do. For a nuclear family with 3/4 members, but with teenagers or adults, sedan is more suitable.

A joint family may need a MUV. People who also like off-roading may opt for SUV. These days, people who like sporty look also go for SUV-like built cars.

The bigger idea is, one must not spend extra on car purchase by picking a larger car than actually required.

#2 New vs Used Cars

This is one screening parameter that must be applied before finalising a car. Generally when it comes to car purchase, people think only “New”. But these days, the used car market has become more organised.

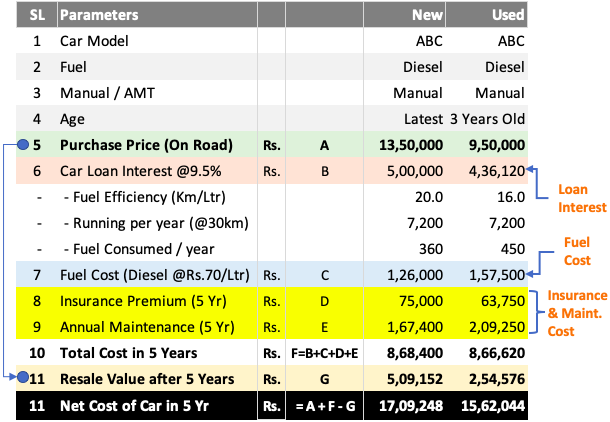

Good cars are amply available in the used car market. One just needs to have an eye for it. Moreover, a used car is a more “value for money”. How we can say that? See this comparison [P.Note: The car is held in possession for 5 years]

What does this table suggest?

- For a new car: On the date of purchase one will spend Rs.13,50,000. Henceforth, one must cumulatively spend Rs.8,68,400 in next 5 years. After 5 years when the car is sold, it fetches a resale value of Rs.5,09,152. This way the net cost of the new car will be Rs.17.09 Lakhs.

- For a used car: On the date of purchase one will spend Rs.9,50,000. Henceforth, one must cumulatively spend Rs.8,66,620 in next 5 years. [Assumed: 25% hike in annual maintenance cost of the car. Loan interest on used car loan is costlier]. After 5 years when the car is sold, it fetches a resale value of Rs.2,54,576. This way the net cost of the used car will be Rs.15.62 Lakhs.

Even though the monthly cost of operation of used car is higher, but over a period of 5 years, it is economical than a new car.

So if a person is ready to make a small compromise on “newness” of a car, used car will be a better value for money than a new car. By opting to purchase a used car, one can reduce the cost by at least 10-15%.

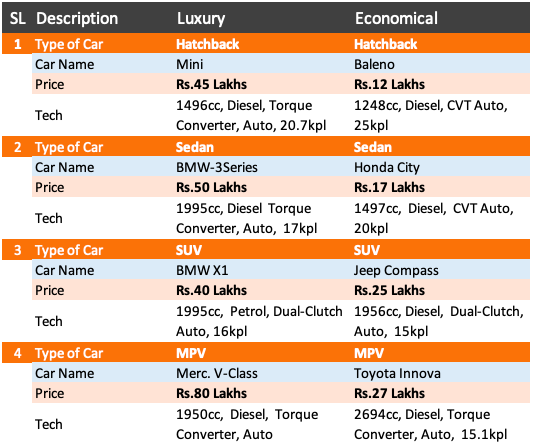

#3 Luxury vs Affordable Brand

I would like to touch upon this topic of car purchase. Why?Because I have seen people comparing cars like BMW/Merc/Audi with Toyota/Honda/Hyundai/Renault/ etc.

I personally think that they should not. If One can afford the price tag, they can straight away go for BMW/Merc/Audi/Volvo, No need to compare them with economical segment cars.

These are premium cars, and people who can afford to drive these, should not bother about “value for money” etc. Comparing technical specification of BMW with Renault, is not worth an effort.

Luxury cars compliments the social status of rich. Safety, performance and comfort of premium cars is far better. It is only a matter of how much extra one can pay for the extra-tech given by the luxury cars w.r.t the following features:

- Brand name.

- Safety.

- Performance.

- Comfort.

If one can pay, luxury cars will always outclass other brands. Overall experience of driving a luxury car is incomparable.

But the point that must not be forgotten is one’s “social status”. A decent SUV like XUV500 will cost Rs.20lakhs. A similar sized SUV by BMWX1 will cost Rs.40 lakhs. The cost difference is too high.

If one can afford BMW X1, there is no point comparing XUV500 with it. Similarly, if ones affordability calculation highlights XUV500 as the right pick, buying BMWX1 will be a mistake.

By opting to purchase a non-premium car, one can reduce the cost by almost 40-50%.

[P.Note: In selecting a model from non-premium brands, it is always better to pick the established model. One must avoid the models which has been launched for the first time in market.]

#4 Technical Specification: Do car research

If you are one who can afford premium cars, this itself is a big screener (Step #3). After this step, just decide your price bracket and brand & Model. Balance deliverables will be ensured by the car manufacturer.

But if you are like me, a lot of further research needs to be done. The requirement is to buy a right car. What is a right car? One which satisfies our purchase philosophy.

How to do it? By doing a simple car research. This also builds our taste for the "perfect car" which also stays within our affordability limits.

Where to start car research? Car portals (Carwale etc) will help you to screen cars of your choice. Use the following screening criteria:

- Size of car (#1).

- New or used (#2).

- Brand Names (#3).

- Fuel Type.

- Type of Transmission (Manual or Automatic).

- Minimum Engine power etc.

Once you have applied these screening parameters, note down names of all cars appearing in the list. The next step will be to watch what experts say about these cars. You can access reports of experts in youtube channels, Magazines like:

- Car & Bike.

- Autocar India.

- Overdrive.

- AutoX.

- CarWow etc.

Another effective way of car research is to ask a friend who is driving the same model you want to buy. It is also important to take test rides of as many cars as possible. This helps the buyer to get a better understanding of the look and feel of the car.

Try to take the test ride on roads you drive more frequently (like home to office), or on your favourite expressway.

If idea is to spend on a car, one can make the purchasing memorable by doing a detailed car research. But more importantly, an effective research will let you buy a perfect car, which you'll love each day.

#5 Pick Optimum Car Accessories

Every additional items purchased with the car comes at an extra cost. In most cases, these accessories prove expensive for the buyer. These accessories are never value for money till their use is justified. What type of accessories are generally offered with the car?

- Seat cover.

- Infotainment & Navigation system.

- Parking assistance.

- Safety lock.

- ABS

- Baby safety gear.

- Corrosion treatment.

- Auto anti glare mirrors.

- Additional airbags.

- Head support etc.

Generally, it is better to buy the “basic model” of your preferred car. These days, even the basic model of car is equipped with many features. Buying accessories which comes factory-fitted, are more economical.

One must try to avoid spending extra on accessories (which is not required) as they will make the car overpriced. Even the logic says, when focus is on car purchase, why to spill extra money on accessories, right?

#6 Think Future- Resale Value

All cars age with time. Their market price depreciates. In Financial Term, the aging of car is called “depreciation”.

As a rule of thumb, as soon as the car moves out of the showroom, its market value depreciates by 15-20%. Henceforth, with each passing year, the value of car will fall by 15%. Means, by end of fifth year, the market price of car is reduced to almost 40% or lower.

But not all cars depreciate so fast. Indian brands like Tata Motors, Maruti, Mahindra depreciates faster. It means, less people like to buy a used Tata or Maruti cars. Japanese, Korean, European, American etc brands find more number of buyers in used cars market.

European cars are most preferred brands in used car market. Hence they depreciates slowly. The color of car also plays a small role in value depreciation. White and black cars gets more buyers. Hence they fetch better price in used car market.

#7 Think Car Maintenance & Calculate Car Affordability

In India, people spend about 1.5% of their annual income on car maintenance (each year). Also, on an average, annual insurance premium is about 2.25% of depreciated value of the car.

This parameter also works as an affordability check. How? We will see here...

Suppose one want to buy a Audi Q3. It's cost is Rs.40 lakhs. On an average, annual maintenance cost of Audi Q3 will be around Rs.95,000. Annual insurance premium of the car will be about Rs.85,000. Hence we can say the total maintenance/up-keep cost of the car is Rs.1,80,000 per year. You can use the calculator to find the values.

Suppose, salary is Rs.2,50,000* each month. How much this person will spend on annual maintenance, compared to his annual salary, had he bought Audi Q3 ? Let's do the maths:

[* This is the average amount deposited in the savings account in last 12 months. This amount shall not be calculated based on ones CTC]

= Rs.1,80,000/30,00,000 = 6% (this must be around 4.5%)

This ratio proves that, the person will overspend by buying a Audi. So which is the right car for him? To find this, let’s do a back calculation for this person:

- Annual Cash in hand: Rs.30 Lakhs (=Rs.250,000x12)

- Preferred Car Up-keep Cost (@4.5%): Rs.1,35,000 (=30L x 4.5%).

- Car Value (@4.7%): Rs.28,00,000 (=1,35,000 / 4.7%).

What does it mean? A person who earns around Rs.2.5 lakhs per month, shall buy a car that costs not more than Rs.28 lakhs.

#8 Buy New Car On Discount

It is always better to buy cars on discounted rates. One way to do it, is discussed in #2 (used vs new car). But if one has decided to buy a brand new car, what can be done to get some discounts?

In this case the question to be asked is, when to buy car? Which part of the year is suitable for buying a car?

To boost sales, car dealers offer discounts. Best time to buy cars in India is between December/January or March/April. Dealers try to get rid of last year models in these months. Hence these months could be a best time to buy new cars.

One can also compare price of same car offered by different dealers. Due to competition one dealer may give better on road pricing than the other. Always remember, car is not an asset, it is a liability. Every penny saved in buying a new car is worth the effort. Read more about building assets.

#9 Car Financing Rule...

Not everyone can buy car from savings. Some outside financing may be required. Banks can provide upto 85% of car value as loan. Balance 15% must be self contribution. But a better value for money will be: (a) 50% Bank Loan and (b) balance 50% Self contribution.

If one does not have 50% savings to buy the car, it means it is not the time to buy. First accumulate savings (50%), and then buy the car. Read more about how to save money.

Conclusion

It is necessary to note two things about cars:

- People love to have a nice car.

- But car is a liability.

Hence it is only prudent to buy a car which is efficient for our pocket, and also match our bare minimum requirements. If the question is - how much to spend on car purchase? A right answer will be, depending on ones affordability. But this does not mean that one must buy only Tata Nano.

To do one’s affordability calculation, please look at #7 or you can also use my car affordability calculator.

Buying a right car is an important part of one’s personal finance management. Why? Because car doesn't come cheap. Moreover, cars also has a recurring operating cost. This is why it is called a liability.

I hope after reading this article, you will get some idea about how much to spend on car purchase.

Please add for EV vehicle now as this will be next in coming days

I really like the effort you put into explaining each aspect. Thank you soo much !!

Keep up the amazing work

Thank you.

Thank you for sharing this information about how much to spend on car purchase. It was useful and interesting. You indeed have written it in a layman way so that anyone can understand and work accordingly. You have done a great job… Great post!!

This is great. My take home is 80,000 PM and I was about to buy a car worth 13 Lakhs, then I saw this.

Thank you so much for the article.

But I wonder, people who are buying cars worth 16, 20L with moderate homes (like I see in my neighborhood), do they overspend or is India’s average household income increased so much?

Great analysis. This really has helped me decide how much should I spend on purchase of a car.

Thank you

Nice analysis dear Mani, perfect for the one like me who thinks on same line as you.

Thanks

Very Nice , Precise & Informative article.

Requesting you to keep it up the good work , if possible try to put some article on other key buying decision as well e.g. Home

Thanks

A very good analysis. I would be interested in a cost analysis for an EV (for example Kona). Will it be a better option than a diesel / petrol car, given the high initial cost for sn EV?

Truelly, Perfact your advices are really commondable

Thanks