There can be a formula for wealth building. If you are interested to know about how to build wealth then you just need to follow this formula.

Who can use this formula? Anyone can use it. But people who are in 30s can benefit most out of it. Why? Because they are ones who have both, the resources and time, which can make this formula work most effectively.

Wealth building is a big thing, right? So how can a small blogger like me can speak about it? It is like speaking about “time travel” without understanding the “theory of relativity”.

Though this analogy between time travel and wealth building may echo, but in reality building wealth is not as daunting. Why? Because no body has done time travel till date, but we have billionaires living within us.

What we can learn from these billionaires? We can learn their formula of wealth creation. How they did it? How they create wealth for themselves? What process & principles they follow?

So this article is about those principles…that basic wealth formula….which can actually increase your wealth.

Topic

- Wealth building calculator.

- About mediocrity.

- Paycheck dependency.

- Asset liability & wealth creation.

- The concept of ROI.

- A formula to build wealth.

- Conclusion.

Wealth Building Calculator

| Data Input | |

|---|---|

| Wealth to be Built (Rs.Crore) | Expected Return p.a. (%) |

| Time (in years) | |

| Result | |

|---|---|

| To build the corpus within time you must invest | Rs. every month |

How to start the journey of wealth building?

Remember, it is a tough task to achieve. One must work regularly on it for years together to achieve it. The requirement of “regularity” and “long time period” is what makes becoming wealthy a tough ask.

But it can be achieved. How? By giving oneself that “kick”. This kick will make us aware of the quantum of the task in hand. How to get that kick? Use the above calculator.

How to use it? Ask the following questions and get it’s from above:

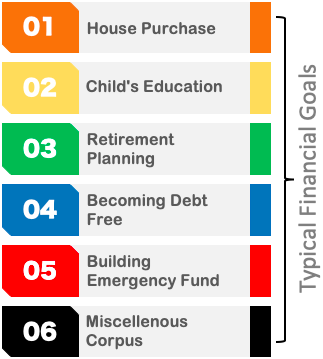

- Home Purchase: How much downpayment (20% of loan amount) I’ll need to get my home loan sanctioned? Say it is Rs.10 Lakhs. How much time I’ve in hand to accumulate Rs.10 Lakhs? How much I’must invest each month from today to accumulate Rs.10 lakhs. Read: Rent vs buy house decision explained.

- Retirement: How much retirement corpus I’ll need to lead a decent retired life? How much time I’ve in hand before retirement? How much I must start investing from today to accumulate the retirement fund? Read: How much money do I need to retire.

Use the above calculator and try to get the answer for the above questions. For majority, they will be surprised with the amount of work that still needs to be done to reach the goal.

This is the kick that is required. The pressure of achieving the goals on time will push us and motivate us to start the process of wealth creation. No matter how hard or difficult is may sound earlier, but we will start.

It is also worth knowing the once the initial days are over, and we get into the habit of wealth building, the process becomes easier in latter years. Why? Because we can see a part of our wealth already created. This will be a big confidence booster.

Mediocrity

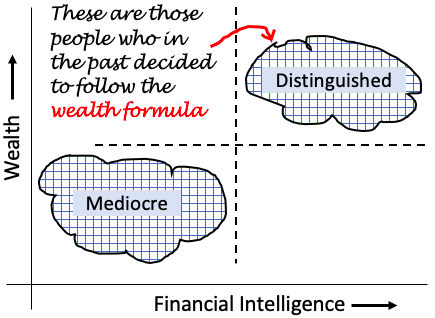

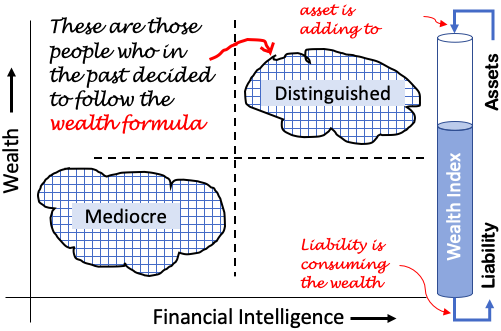

Majority of us feel satisfied to lead a mediocre life. Really? Yes it is true, but the reason for this mediocrity is ignorance. Actually when people gives up on their dream of wealth creation, they resort to mediocrity.

But such people must realised that the process of wealth creation can start any time. Anyways it is going to take its time. Probably, with grey hairs on the head, one can accumulate wealth in a slightly better way.

So no point in procrastination, just start following the wealth formula. Yes there is a formula for wealth creation. This formula completely adheres to the principal of wealth building. We will see this wealth formula in this article.

So we can push ourselves out of mediocrity any time. What we need to do is to follow the basic principles of wealth building.

Paycheck Dependency

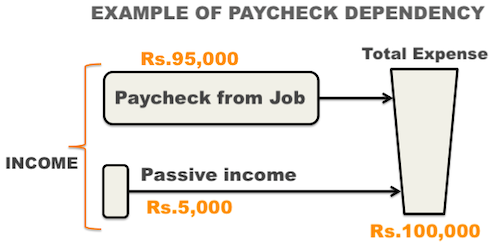

How to realise that we are heading towards mediocrity? When we start becoming comfortable with paycheck dependency, those are the early days of agreeing to a mediocre life.

Building wealth should be on everyone’s priority. But not everyone is seen following this priority. People follow their 9-5 job and keep themselves busy.

At the end of month they get their paycheck & are happy. Some are paid more, and some are paid less. This way people get used to their mediocrity.

For these same people, a proper knowledge about the wealth formula can change everything. A mere 5% realisation of the formula can like overhaul ones financial position.

We do the same job day after day. Even if we do not like it, we still need to do it for paycheck. Over time, we get totally dependent on our paycheck. By the time we realise their dependency, its late.

The ease with which people get their paycheck has made it an evil-like-dependency. One must do everything to reduce this dependency. What is the opposite of paycheck dependency? It is a life of financial independence.

Complete financial independence can only be achieved gradually. It cannot happen in few months or few years.

That is why the foundation of financial independence must start early in life (like in 20s or 30s).

How to realize ones dependency on paycheck

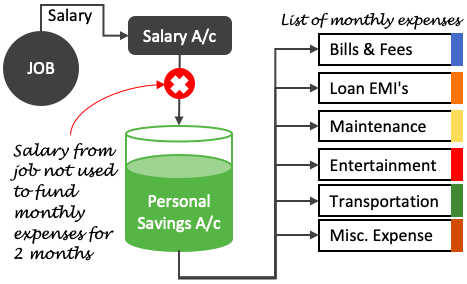

The realization can be achieved by doing a small experiment. If this experiment is sounding too tough to execute, give yourself that kick – use the calculator and become aware of the financial load you have on your back.

Take a conscious decision of not using one months salary. That month, use only savings to pay for all expenses. Repeat this experiment for at least another month. The experiment must continue for two months is a row.

The longer one can survive without using paycheck, the better. A completely financially independent person will survive all his life without a paycheque.

But for us, we will have to experiment it for only 60 days. The closer one gets to 60 days, it is an indication that the person’s brain-mapping is more suitable for wealth creation. They will follow the wealth formula more effortlessly. For others, the effort will be more. Suggested reading: The concept of passive income.

People who has a habit of saving and investing money, will find it easier to implement the formula, and ‘ll find the process of wealth building easier.

Please note that majority cannot pass the first 10 days of the month. But this is okay. It’s true that this experiment will make you uncomfortable. But once you come out of it, you will be a changed person.

You will start asking difficult questions to yourself.

- What happens if I loose my job?

- How will my child continue education?

- How will I pay my EMI’s?

This realisation about how dependent we are on salary, is one big step towards building wealth. Everything after that will start happening like automatically.

Asset/Liability and Their Contribution on Wealth Creation

Asset creates wealth, liability consumes wealth. This is the general principle that must be remembered in our endeavour of wealth creation. If the bigger goal is to create wealth, spend money to buy assets, and limit spending on liabilities.

But in real world we actually do the opposite. We use our money to accumulate more liabilities. In fact, asset purchases are bare minimum. This is the reason why our wealth-pool is so dilapidated.

So what is the solution?

Identify financial goal and start accumulating wealth for it. If goals are like child’s education, parents care, retirement, health care etc, it is less likely that the fund get spend elsewhere. Generally speaking, we can say that our goals align us to buy more asset and less liability.

There is one more hurdle….

People often gets confused between what is an asset and which is a liability. We must establish a clear distinction in our mind between assets and liabilities.

Asset/Liability Distinction

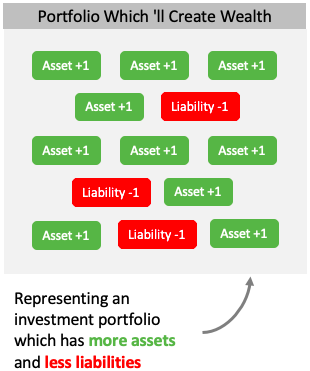

To know the difference between asset and liability, we can take help of a simple mathematical concept. Let’s assume the following for an example sake:

Asset is +1 and Liability is -1.

The above is a symbolic of what an unit of asset or of liability, if purchased, will do to our wealth. Buying an unit of asset will make our wealth go one-up (+1). Similarly, buying an unit of liability will make our wealth go one-down (-1)

Hence, it means, if we want to build wealth, then our effort shall be towards accumulating more assets (+1’s) in our portfolio. In parallel, we must also try to minimize the concentration of liabilities in our portfolio (-1’s).

So what we can understand here?

Assets are those entities which compliments our existing wealth with a +1 and liability censures it with a -1.

Example of Few Assets:

- Bank Deposits: Both saving and fixed deposit are an asset. How? Because they have a +1 effect when they yield interest on deposit. A deposit of Rs.10,000 with become Rs.10,600 after one year @6% p.a. interest.

- Debt Funds: Units of debt funds is also an asset. When we’ll hold on to a liquid fund for at least a year, it can easily yield a return of 5% per annum. Rs.10,000 parked in liquid fund can become Rs.10,500 in one year.

- Equity Funds: Units of equity fund is also an asset. They have potential to yield much higher returns than debt based plans. But we have to make sure to buy its units at a fair price (avoid peaks).

- Dividend stocks: These are those stocks which consistently pays dividends to its shareholders. Compared to other stocks, their average dividend yield is also higher. Such stocks are excellent example of asset. But again, we must take care to buy then at undervalued price.

- Value Stocks: These are quality stocks which are currently trading at undervalued price levels. Picking these stocks at these price levels, and holding for long term can surely yield positive returns. This ability of them makes it a great asset to buy. Suggested Reading: How Warren Buffet thinks and buys his stocks.

- Gold: Accumulating gold with intentions of holding them for long durations (like 15 /20 years), can yield decent returns in tune of 8-10% per annum. I personally consider gold as a saving option, which I’ll buy to lock my savings (from getting spent needlessly). Hence, I treat gold as an okay asset.

- Rental property: This is one investment which we all understand. Buy a property, put it on rent, and earn rental income. Suppose the property was worth Rs.1.0 crore. You bought it with no loan, and is earning a monthly rent of Rs.30K. This is a return of 3.65 per annum. Hence it is an asset. Read: Property investment guide.

Example of Few Liabilities:

- Self Occupied Property: Suppose you bought a home for self occupation. As it is self occupied, this house will yield no income. Instead you will have to pay for maintenance, utility, tax etc. As this property is costing you increased-expenses, hence it is a liability (till it is occupied). Once you sell it, it’ll stop being a liability. Read: Rent vs buy house decision.

- Personal Car: Purchasing a car will increase our expenses in terms of fuel, maintenance, insurance etc. Hence, till you do not sell your car, it is a liability to you. Read: Car affordability calculator.

- Furnitures: Though our furnitures do not create new expenses on its own, but they also do not yield any income. Hence it is a liability (till we sell it off in a second hand market).

- Bad Investments: Those investments which is showing negative yield, and you sell it at loss, these become a liability.

The concept of Return on Investment (ROI)

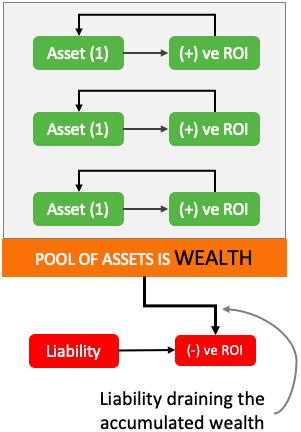

In wealth building, we must save and invest money. In the process of investing, we must buy only assets. Fix a financial goal which says for example, “In next 10 years I shall buy as much bank deposits (assets) that will earn me an interest income of at least Rs 15,000 per month“. Here the ‘bank deposit’ is the asset and ‘interest income’ is the return on investment (ROI).

It is the combination of the asset and its ROI capability is what that builds wealth for us.

ROI is a litmus test for any asset. It helps to differentiate asset from liabilities. We may mistakenly assume some item as asset. How to prevent this mistake? Remember: if an item is not generating ROI, it cannot be an asset.

Biggest Hurdle in Wealth Building

What we have learnt till now about wealth building? Accumulating assets and minimising liabilities will build wealth. The faster we will accumulate assets, the bigger will be the wealth. It is this simple.

But if building wealth is so simple then why everybody is not wealthy? Because to accumulate assets one need to overcome a psychological limitation. To buy an asset one needs to compromise a liability purchase.

To understand why it is difficult pick asset over liability, allow me to establish an analogy.

Liability is like a ‘Cheese Burger’ which is very tempting, hard to resist, and tastes like heaven. But asset is like a plain ‘vegetable soup’. We all know the benefits of vegetable soups, but which sells more? Cheese burger sells more. Why? Because avoiding a tasty food when you are hungry is one of the hardest thing to do in life.

Similarly, in the hustle and bustles of life, a common man anyways feels dull and tired. When he/she gets back home, he would like to pamper himself with a nice home, nice car, gadgets, food, entertainment etc.

Are you able to see the pattern? All these names which gives us immediate gratification are inherently liabilities. On one hand where assets ask us to sacrifice, liabilities gives us quick pleasure.

This distinction between asset and liability forges a huge psychological limitation in our mind. Most of the time, if we are not trained, our psychology will drive our decisions.

We are not trained to pick assets over liabilities. We are not trained to ride over our temptations and buy assets. This is what makes people poor.

Our education system has also not taught us the difference between asset and liability. Instead, we’ve got wrong examples of assets.

Wealth Formula [A Process]

This is a magic formula that can guide anybody to build wealth. This formula is based on the theory that we’ve read till now. I’ve tried to convert this theory into a process flow. This formula can work as a yardstick for wealth building.

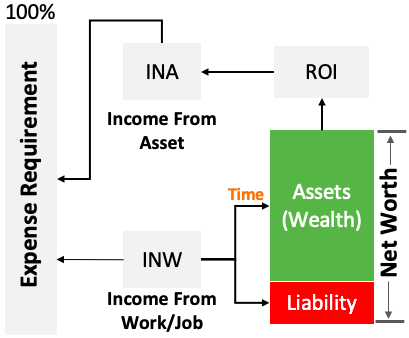

How does this formula hels us in wealth building? Allow me to explain the process:

- Income From Work: Leave a frugal life and use the majority portion of this income to buy assets. In this process make sure to keep the liability to zero or minimum. Net of all assets and liabilities is your net worth. The cumulative net worth will generate an ROI.

- Income From Asset: ROI yielding out of net worth will become the main income source. Idea is to continue building assets month after month for years to come. Over time, this income source will become so big that you will not need income from work/job. That is the stage of financial independence.

Conclusion

To become wealthy, one must first start diverting majority portion of income towards asset purchase. This is the most difficult part. The way to do it is by budgeting and expense tracking.

The initial days will be particularly tough. But remember, it is all psychology. Just train your mind to survive with less expenses. Also, keeping track of the growing net worth is key. This is what will keep one motivated.

Found your article very interesting and convincing to create wealth. thanks for sharing

Thank you of posting your feedback.

Great Article ! Your writing always has ‘Financial Wisdom’ and are diligently written. Your sincerity is very evident in your writing. Good Financial Education for all

Thank you.

Thank you for your article Manish! What you wrote there makes so much sense.

I think that we are consumers rather than savers. It is human nature. One thing that is also crucial, I believe, is patience. One needs patience to see his/her capital grow and the returns on his/her investments. In our societies, we are increasingly lacking it, and this is influencing our savings.

Adding to what you said about liabilities, we also know from Economic Growth theories that social status is playing a role in increasing our liabilities. The more concerned we are about our status, the more we need to spend to feel like we are having a comparatively higher status than the people around us. Status consumption is an unnecessary form of consumption and is preventing wealth accumulation. So, I guess, remembering that it is not about the brand we wear or the car we drive is a key factor in successful wealth building.

Your articles are good references. Useful for financial education which is lacking on our youngsters. I forward these to my friends and acquaintances.

Good Job Mani… Go on…

Very Nice article and an eye opener! Please do continue the same and i am following this blog for more than an yea.

Thank you

Very Informative article…thanks for sharing

Thanks

Great article.. Mani, I have been following you for last 2 years… You got the stuff right..

Thanks for spreading the word.

Thanks