Recently I was reading a book written by Peter Lynch (One Up on Wall Street). It talked about a concept called “multibagger stocks“. We all know what are multibagger stocks, right? Most of us have even use this as a phrase casually to refer to “quick return stocks”. But multibaggers are far for it. [Check the calculator here.]

When I started reading this book, time and again Peter lynch has used the term of multibagger. So I began to realise that a big investor like Peter Lynch might not be using this phrase (multibagger) only to make his book catchy. There must be something of true value for his readers.

Being a defensive investor myself, I really do not prefer catchy terms like hot stocks, multibaggers – this kind of phrases. But this book of peter lynch has changed my perception towards the term “multibagger”.

While reading this book I started to wonder, what actually he is trying to say by using this catchy phrase? It did not took long to realise that what Peter lynch was indirectly pointing towards was value investing. How? We will see this in this article.

Multibagger Stocks & Value Investing

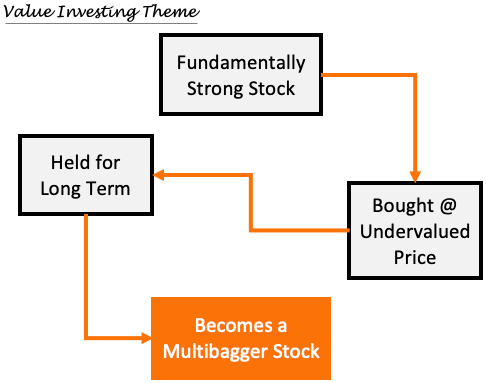

Contrary to what we might think, Multibagger stocks are not symbolic of day trading. In fact they are a perfect synonym for value investing. To understand this, we just need to dig deeper into the concept of multibagger stocks.

Let me give you a direct explanation first. What peter Lynch might be saying is this – “We can benefit from stock investing and make them a multibagger only if we buy stock of good companies at right price, and stay invested in them for long-term“.

So the theme that Peter Lynch is propagating in his book was not about multibagger stocks, but he is marketing the theory of long term investment, undervalued stocks, and fundamentally strong business.

These three concepts are explained under the bigger umbrella of ‘value investing’. But he intends to use a more colloquial tone, hence the use of catchy phrase like “multibagger stocks”.

In this article we will see how the concept of “multibaggers” can be used by retail investors like us for long-term investing in stocks.

What Means by a Multibagger Stock?

These are those stocks which has grown multiple times in a specific period of time. When we say a multibagger, we are actually referring to a stock’s cumulative returns.

Generally when we use return numbers (in %), we are talking about annualised returns. A more flashy name for it is ‘compound annual growth rate’ (CAGR). This is different from cumulative returns. Read: About high return stocks.

To define multibagger stocks for a layman, let’s take an easy example.

- Two Bagger Stock: Suppose you bought a stock and held it for 3 years. Within this 3 year holding period, suppose the price of this stock doubled. In this case we can say that this was a 2 bagger stock.

- Four Bagger Stock: Suppose you bought a stock and held it for 8 years. Within this 8 year holding period, suppose the price of this stock went up by four times. In this case we can say that this was a 4 bagger stock.

What we can learn from these example is that, along with the term multibagger (2 bagger, 4 bagger etc), there is always a hidden element. That hidden element is the holding period. In the above two examples, the holding period was 3 years and 8 years respectively.

So as an informed investor, when somebody points you towards a multibagger stock, a pertinent question should be “what should be the holding time?”. Because a ‘2 bagger in 10 years holding time’ might not interest you a lot. Why? We will see in here – please keep reading.

In the book, Peter lynch also refers some stocks being a 15 bagger. But these were those stocks which became 15 times in a time horizon of 10 to 15 years. So long term holding is an essential ingredient of multibagger stocks.

Three Pertinent Questions Related To Multibagger Stocks

Suppose your stock broker or financial advisor suggested you a multibagger stock to you. You should ask the following three questions to make more meaning out of the multibagger term:

- First Question: You should ask him/her to define the the term multibagger. Ask him about what I call as the multibagger number. Ask, what is the multibagger number of this stock? Is it two, three, six etc bagger. The bigger is the bagger number the better.

- Second Question: The second question is obvious. Ask him/her, what should be the minimum holding time. In equity investing, holding time of multibagger stocks shall be 3 years plus.

- Third Question: This is the most relevant question. This is what is going to unearth and quantify the multibaggers in true sense. Ask, what is the annualised return expected from this stock? If you have the above 2 numbers, you too can self calculate the annualised returns (use my calculator).

Multibagger Number Calculator (Lump Sum Investing)

We will use this simple calculator to understand the meaning of multibagger more clearly. What we will do? We will unearth two very important numbers associated with a multibagger stock – holding time and annualised returns.

Suppose your broker has given you a stock name saying that this stock has a potential of yielding 15% p.a. annual returns with a minimum holding time of 5 years. Now you want to know if this stock will prove to be a multibagger or not? How to do it? Use my calculator:

Calculator #1 (Lump Sum Investing)

| Data Input | |

|---|---|

| Initial Investment (Rs.) | |

| Expected Return p.a. (%) | |

| Time (years) |

| Report | |

|---|---|

| Final Amount (Rs.) | |

| Multibagger Number |

Put any number as initial investment (say Rs.5,000). At 15% per annum annual returns, in 5 years your investment size will become Rs.10,011 (double). This means that this stocks has a multibagger number of two (2.01) – it is a two bagger stock.

Calculator #2 (SIP Investing)

Similarly, suppose you have invested in a mutual fund SIP for last 7 years. This mutual fund scheme has yielded an annualised return of 18% per annum. You are interested to find the multibagger number for this SIP. What you can do? Use my calculator:

| Data Input | |

|---|---|

| Monthly Contribution (Rs.) | |

| Expected Return p.a. (%) | |

| Time (in years) |

| Report | |

|---|---|

| Final Amount (Rs.) | |

| Total Investment over Time (Rs.) | |

| Bagger Number |

Put any number as monthly contributions (say Rs.1,000). At 18% per annum annual returns, in 10 years your investment corpus will grow to become Rs.3,36,258. In these 10 years, you have already invested Rs.1,20,000. This means that this SIP scheme can earn a multibagger number of nearly three (2.8 to be accurate) – it is a three bagger mutual fund.

What makes a stock Multibagger?

Not all stocks become multibagger simply by holding on to them for long term. It is essential to keep a check on few things which will make stocks of a company multibagger in times to come. Here are few points that I can recall offhand: [Read: How to make money in stock market]

- #1 Institutional Investing: The effect on stock price is huge when institutional investors starts buying stocks of a company. When this happens, even normal stock transforms itself into a multibagger. But this is also worth remembering that, those stock where institutional investing is at its peak, anything can co wrong soon. Why? Because when these people starts to sell, there is a price collapse.

- #2. Product is key: What drives a company more than its cash flows and managers? It is its products. If a company is offering unique product, and people are liking it, it’s bound to reflect in the company’s financial reports. If you like any company’s products or services, ask yourself if I can buy its stocks. But do not forget to check point #1.

- #3. Consistent Earning Growth: At the end of the day, nothing is more important that earnings (net profit and EPS). A company posting consistent earning, at a decent growth rate is what you would like to see in your stock. Read: About EPS of stocks.

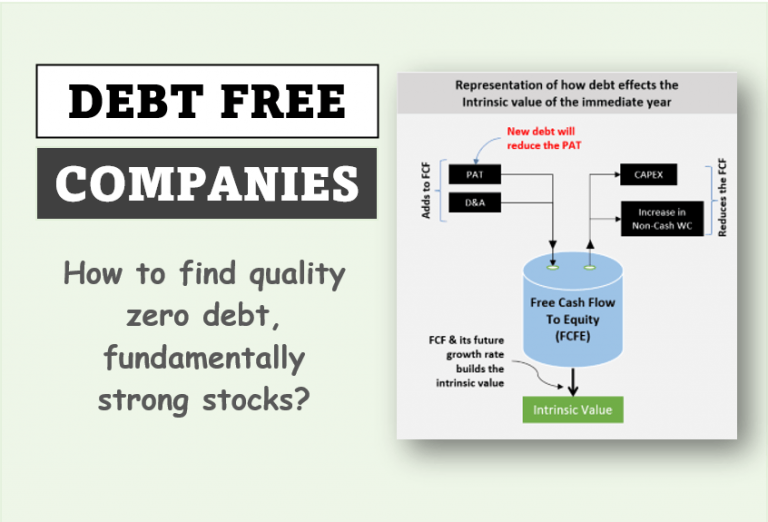

- #4. Low PE Ratio: Ultimately, everything boils down to price valuation. A multibagger investor may not like to buy stocks of even Hindustan Unilever just because is P/E multiple is insanely high (70 times earnings). These can be good stocks, but they can only give average returns. Read: Significance of low P/E in stocks.

Conclusion

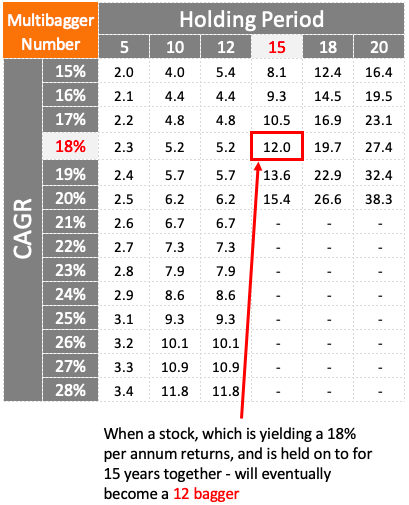

Theoretically, now we can say that multibagger is a term which is real. It is not a marketing gimmick to sell a book. Above is a matrix of annualised return vs holding time. It is just a symbolic representation of a multibagger number.

Suppose there is a stock which is expected to yield a return of 18% per annum in next 15 years. If an investor manages to hold on to this stock for 15 years, his investment will become a 12 bagger by that time.

You can check the matrix and identify what combinations might work for you to get a 10 bagger for yourself. Do this exercise, it will be a fun. If you need a better range of values, try the multibagger calculator.

Important note:

No stock can promise consistent price appreciation year after year. There will be a patch of years, where returns may run in negative. Then, there will be years which will be only bullish.

Idea is not to get scared when prices are falling, and not to become greedy when price is rising.

Focus on the business fundamentals of the company. If the fundamentals are strong, continue holding on to them no matter how good or bad the stock price is behaving. This is the only way to convert a quality, low price stock into a multibagger.

Have a happy investing.

Any screener to get info about companies in all sectors with consistent growth for 5..10 years ?

I mean this would mostly be multibagger.

Thanks

Hiten Mehta

9769760002

mehta.hiten @

gmail.com

Good

Hey Dear

As you mention a chart ” Value investing theme”.This is the best part of the Article. It is very easy to find out multibagger stock using this chart with very low risk and less effort.

Today in corona virus situation,Many high quality business are traded at low valution.if we use this theory we have many high quality business like Bajaj finance,hdfc bank and many more in our portfolio.

Nice and very informative post.

Yes indeed.

Yes,once Warren Baffet was asked about the holding period of stocks.His reply was -forever. To reap the benefits and to draw value from investments the holding period must be very long.Then one should choose the right stocks and leave them to grow as a tree. The power of compounding would help one see them mushroom into huge corpus over several years. Patience and study are the key elements towards success