Why I’m blogging about this topic? Recently I met a person who was inclined to explore stocks but wanted to practice only defensive investing. He was a regular investor in mutual funds. He would explore direct shares purchase, but only with safe stocks. I know, a lot of people have similar mindsets. How risk-averse people can approach direct stock investing? This article will discuss more of it. For quick answers, check the FAQs.

Introduction

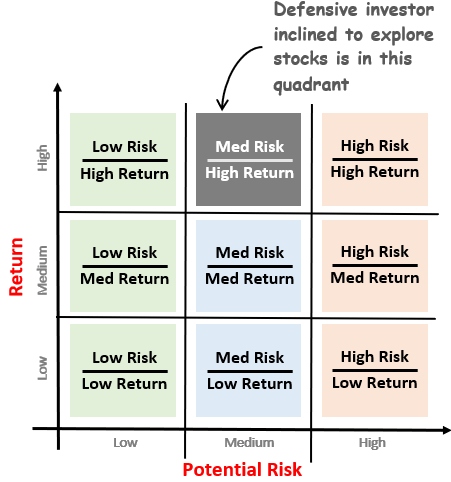

What is defensive investing? It is an approach to practice investment. The primary focus is on the protection of the principal amount. Earning a return is also a priority, but can compromise the return for the safety of the principal. To understand defensive investing from the perspective of the risk-return paradigm, this infographic will be helpful.

Defensive stock investors would take fewer risks to earn high returns. The portfolio of these investors would be equity-heavy. Such portfolios primarily include stable stocks with wider-moat from the large-cap space. The prices of these stocks are comparatively stable even in a volatile market.

Being a defensive investor, why they should care about stocks (equity) at all? Because only equity can prevent their money from the wrath of inflation. Investing in stocks can generate inflation beating returns.

To further reduce the volatility in the portfolio, debt instruments are included. The proportion between stocks and debt instruments can change. If the investor is feeling bullish, the weight of stocks will increase. If the priority is to reduce the volatility, the weight of debt instruments will increase. For a beginner, a 50-50 split between stocks and debt instruments will be a fair starting point.

Defensive Investing and Benjamin Graham

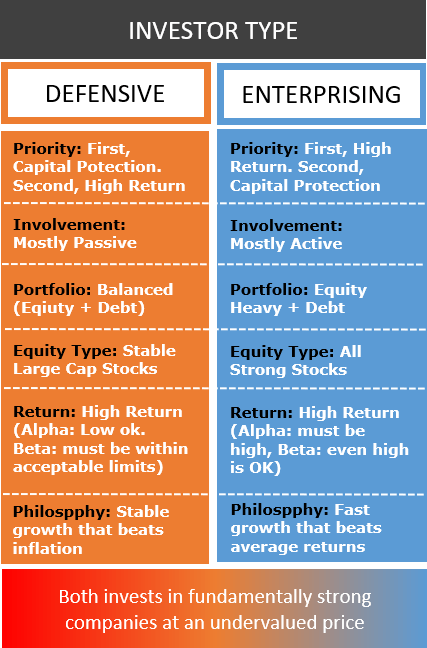

In his book, The Intelligent Investor, Benjamin Graham categorized stock investors into two types: Defensive and Enterprising. Graham also suggests a method defensive investors can use to screen suitable stocks. The method is particularly helpful for beginners who are starting their stock investing venture.

The points explained by Graham in his book are not only logical but also seem to satisfy the overall theme of value investing.

But before we look into the method, let’s know a bit about the difference between a defensive and an enterprising investor. It will help us build a perspective about defensive investing.

Suggested Reading: Estimating the risk profile of an individual.

Defensive vs Enterprising Investor

- Priority: Defensive investors’ first priority is protecting the invested capital. Though they also require higher returns, they can compromise returns for the safety of the principal amount. Enterprising investors’ first priority is above-average returns. They are also concerned about their principal and would pick stocks even more carefully.

- Involvement: Defensive investor mostly remains passive in tracking the performance of their investment portfolio. Their involvement is maximum while they are screening their stocks, But once the stocks get added to the portfolio, they become passive towards that stock. Enterprising investors remain mostly active as they also track their portfolios very closely. Their idea is to book profits at the first opportune instance.

- Portfolio: Defensive investors keep a balanced portfolio by including both equity and debt. Though their portfolio is mostly equity-heavy, the weight of debt is also significant. The proportion of equity and debt change depending on the market outlook and the investor’s mindset. Enterprising investors keep their portfolio equity heavy with only a little weight of debt instruments and cash.

- Equity Type: Defensive investors’ preference for the safety of principal makes their choice of stocks narrow. They pick stocks mainly from the large-cap space. To further reduce the volatility of their portfolio, they pick only wide-moat, large-cap stocks. Which are wide-moat, large-cap stocks? In general terms, we call them blue chip stocks. Enterprising investors will buy all stocks that are fundamentally strong. Both defensive and enterprising investors would pick only undervalued stocks. Read more: Screening safe stocks.

- Return: Defensive stock investors would like to earn at least average market returns (12% per annum). These investors do not focus on the alpha (overperformance). As long as their beta (volatility) is within acceptable limits, they are good even with low alpha. Enterprising investors’ priority is high alpha. To earn high alpha, they prefer high beta stocks with strong fundamentals.

- Philosophy: Both defensive and enterprising investors’ goal is to beat inflation. But in defensive investing, the goal must be achieved through stable growth. This is a challenge. For enterprising investors, as long as growth is beating inflation, in a specific time span, volatility is not a problem.

Method To Screen Safe Stocks

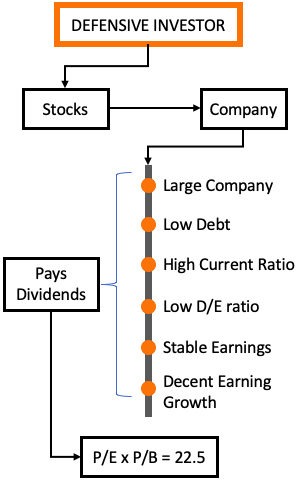

Stocks are included in the portfolio to generate inflation-beating returns. But here comes the word of caution. A defensive investor cannot add any random stock to the portfolio. Benjamin Graham has stated specific screening criteria in his book called The Intelligent Investor. These criteria filter stocks that are suitable for defensive investors.

Instead of going on buying all kinds of stocks, defensive investors should focus on a few stocks only. They do not need to diversify between many stocks. Their portfolio shall consist of between 10 to 30 number stocks. These stocks can be picked by applying the below screening rules.

Step #1: Focus On Large Cap Stocks

Ben Graham liked unpopular large companies.

What are large companies? Ben Graham limits the minimum size of the company to $100 million (Rs.20K Crore) in annual sales, and $50 million (Rs.10K Crore) in total assets. I’ve considered Inflation @6.6% and a USD-INR conversion rate of Rs.70.

Let’s understand the rationale behind Benjamin Graham’s preference for large companies.

- The market tend to reward stocks that are showing good growth rates. It also tends to punish them for not showing good results even if the reasons are temporary.

- Investors tend to continue focusing on large companies even when they are going through a phase of lower earnings. It makes the price of large-cap stocks less volatile, especially for the downside movement. Even if the underlying business performance is below par, they tend to hold their stock price better.

- The smaller companies are not as visible as large companies. Hence they can remain undervalued even if they are recent earnings are showing reasonable growth numbers.

It means, good large companies mostly remain in favor. Two benefits of investing in large-caps.

- Resistance to Punishment: Large companies have more capital and human resource. So even if there is a temporary problem, their chances of getting out are more solid. Hence investors tend to show more faith in large companies. As a result, the price of shares of such companies can resist downside movement more surely.

- Fast Reward: Large companies have shown another advantage. The possibility of seeing a quick price uptrend is more certain. How? As the focus of investors is primarily on large companies hence a relative improvement in their profits/EPS is applauded by the market rather quickly.

Unfortunately smaller companies do not enjoy these dual advantages of larger companies.

Take Away

What defensive investors can do? Find and buy companies that are large but are presently unpopular. Once the stock is purchased, continue to hold them for the next 4-5 years.

What investors cannot do? They should not get lured into buying stocks of smaller companies that look undervalued. Even if the smaller companies are doing good business but may continue to remain unpopular in the market. Waiting time will be longer. Furthermore, smaller companies are punished harder if their performance is below par.

Step#2: Financially Strong Companies

Graham suggests that defensive investors should buy stocks of a certain type of company.

- Low Debt: The companies must be “conservatively financed”. In simple words, they should be debt-free or low-debt companies. The ratio between debt and equity shall not be more than 2 (for industrial companies).

- High Liquidity: The ratio between current assets and current liability, the current ratio, shall not be less than two.

- Stable Earnings: The company should have reported some profits in all of the past 10 years. Any negative earnings will disqualify them.

- Decent Earnings Growth: The company must post at least 33% growth in EPS in the last 10 years. How to calculate the growth rate? Record the last 10 years’ EPS. Take the average of the first 3 years, then take the average of the last 3 years. Last 3 years average earnings shall be at least 1.33 times the first 3 years’ average earnings.

Step#3: Less Volatile Stocks

The focus of the defensive investors should be on dividend income rather than price appreciation. Hence, they should target buying stocks of dividend-paying companies.

How to identify such companies? They should have paid dividends continuously for the last 10 years. I’ve also written an article on dividend stocks. More detailed screening criteria are mentioned there. Please follow the link to know more.

Step#4: Undervalued Stocks

There should always be an upper limit on the price that a defensive investor shall pay for a stock. How to decide on the price limit?

- P/E Rule: By fixing a P/E multiple. These multiple screeners shall be applied in three folds: (a) 20 times the average EPS of the last 7 years, (b) 20 times the average EPS of the last 12 months, (c) 15 times the average EPS in the last 3 years.

- P/B Rule: In addition to the P/E rule, the price must also follow the price-to-book value rule. The price-to-book value ratio shall not be more than 1.5.

- PExPB Rule: The product of P/E and P/B shall not exceed 22.5. Example: P/E = 18 and P/B = 1.2. In this case, the PE multiplied by PB is 21.6.

What are undervalued stocks? These are those stocks that are trading at a price level below their fair price. How to establish a fair price? The fair price can be established upon prudent fundamental analysis of its underlying business.

As the situation of undervaluation, especially for quality stocks, rarely exists for large companies – hence Graham refers to it as a discrepancy.

What is the discrepancy? The difference between the stock’s fair price and its market price. Defensive investors should be on the lookout for such stocks displaying wide discrepancies.

One must also explore the reasons for the discrepancy. The question that needs an answer is, why such a quality stock is trading at a discount? Once a satisfactory answer is known, the investor can take the final buy call.

Conclusion

Why do some people avoid the stock market? Because here the returns are volatile. In the short term, the chances of negative return is also possible even from good companies. Furthermore, it is not easy to separate good companies from others. Why? Because to do it one needs to know the basics of fundamental analysis of businesses. So, for an untrained person, the stock market can be risky.

This article can work as one’s yardstick to practice defensive investing in stocks. It is a strategy that can be learned comparatively quickly. People who do not want to undergo detailed stock analysis can follow the method stated in this article. It will help people to screen quality stocks that could be safer for even risk-averse investors.

In this article, I’ve highlighted a screening criterion that filters safe stocks. These are such stocks whose prices remain comparatively stable even when the market is very volatile. Adding these stocks to a stock portfolio reduces its overall volatility. But on the downside, in a bull market, the price appreciation of these stocks is comparatively subdued.

Generally speaking, stocks of some industries are more suitable for defensive investors. Which are these sectors? Quality stocks of FMCG, Banking, Oil & Gas, Power Sector, Healthcare, REITs, etc are safer.

FAQs

These are those safe stocks whose price volatility is minimum within the stock’s universe. We can also remember them as low beta shares. But what makes them unique is their ability to grow steadily over time. Primarily, we can remember blue chip stocks as defensive stocks. Quality stocks from the large-cap space are safe stocks.

Yes. These are primarily blue-chip stocks. They are wide moat companies that enjoy a competitive advantage. Hence, they are able to grow their revenue and profits steadily over time. For risk-averse investors who want to explore direct stock investing, these stocks are the safest bet.

Wide moat blue chip stocks are one type of defensive asset. Other defensive assets can be like gold. real estate property, large-cap mutual funds, index funds, exchange-traded funds, etc.

A defensive equity strategy is to maintain a balanced portfolio so that the volatility is minimum. The first, step is to add only quality large-cap stocks to the portfolio. Second, the debt instruments shall also be included in the investment portfolio. The weight of debt instruments must not fall below 20%. In case one is not comfortable with the direct stock purchase, equity funds or ETFs are the next best alternative.

Large-cap stocks with a wide moat are the best defensive stocks. The concept of the wide moat was made famous by Warren Buffett. Check here for a list of Warren Buffett-type Indian stocks.

In India, the best defensive ETFs, that show minimum price volatility, will be those ETFs whose benchmark is the top Indian Indices like Nifty50 or Sensex. For slightly higher returns, Bank ETFs and Gold ETFs can also give relatively stable returns.

Excellent & very helpful article.Best content.

Thank you