The purpose of the article “Why You Should Avoid Investing in Gold During a Gold Rush” is to warn readers about the potential risks and downsides of investing in gold during a gold rush. I’ll emphasize that, although gold may seem like a safe investment, investing during a gold rush can be risky. This is due to high demand, inflated prices, and increased speculation. You’ll find here useful insights that can help one avoid falling into the trap of the gold rush hype. For quick answers, read the FAQs.

Introduction

What is a gold rush? From the point of view of gold investing, a gold rush is a period of time when there is a sudden surge in the demand for gold (cause). During a gold rush, investors are tempted to invest more in gold due to the perceived scarcity and potential capital gains over time.

However, investing in gold during a gold rush can be risky. The increased demand for gold can cause prices to become inflated and can lead to a bubble. Eventually, when the bubble bursts, it may lead to losses for investors. Therefore, it’s important for investors to carefully evaluate the risks and benefits of investing in gold during a gold rush before making any investment decisions.

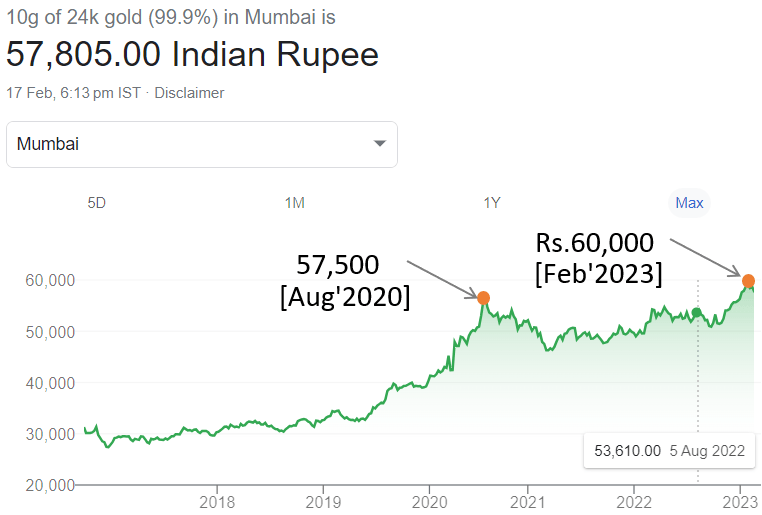

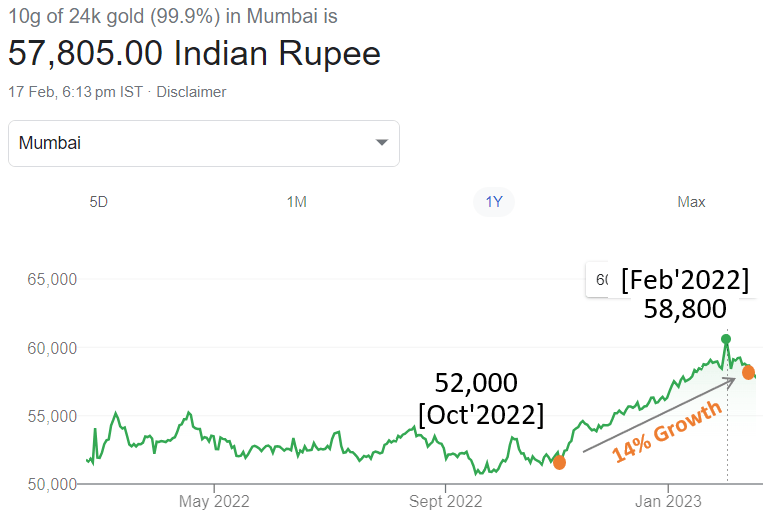

During the COVID times, the price of 24-carat gold surged to Rs.57,500 levels. Now, in Feb’2023, it even touched Rs.60,000 levels for a day. Is this a gold bubble? It sure looks like that. Hence, I thought to share my views on the gold bubble with my readers.

In the last four months, Nov’2022 to Feb’2023, there has been a gold price appreciation of about 14%. Price appreciation in such a narrow time frame is certainly indicating a bubble.

Video

What can cause the sudden surge in the demand for gold?

- Economic uncertainty: When there is economic uncertainty, investors often flock to gold. Historically it has been the investor’s safe haven asset. Investing money carefully in gold can be a reliable wealth protector in times of turmoil.

- Inflation: Gold is often seen as a hedge against inflation. Why? Because the value of gold tends to rise during times of high inflation.

- Geopolitical tensions: Geopolitical tensions, such as wars or conflicts, can cause investors to seek refuge in gold as a safe and stable asset. This is especially true for those regions that are more war affected. Like presently, Russian and Ukranian investors would prefer investment in gold to other asset types.

- Currency Depreciation: When the value of a country’s currency falls, the price of gold tends to rise. This happens because gold is priced in US dollars, and when a currency devalues, gold becomes more expensive in that country.

- Supply Constraints: A sudden decrease in the supply of gold due to mine closure or other factors can drive up the demand for gold, which can lead to price increases.

It’s important to note that a sudden surge in the demand for gold can also be driven by speculation or hype, which can cause prices to become artificially inflated and can lead to investment bubbles.

How to identify a gold bubble? To understand this, we’ll have to first establish a stable gold price growth rate. We’ll use the last 58 years of gold price data to do this analysis.

Gold Price Data (General Observation)

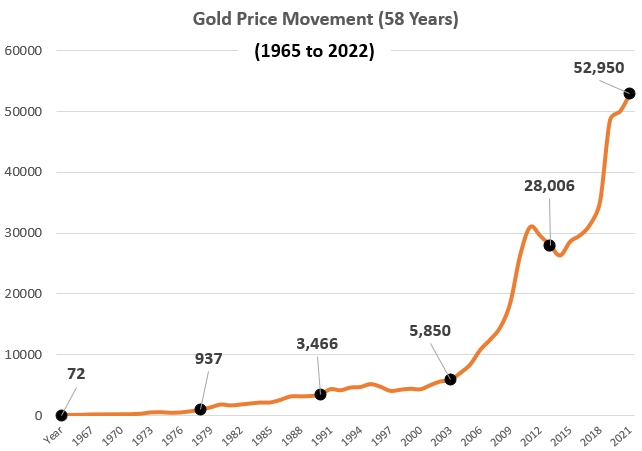

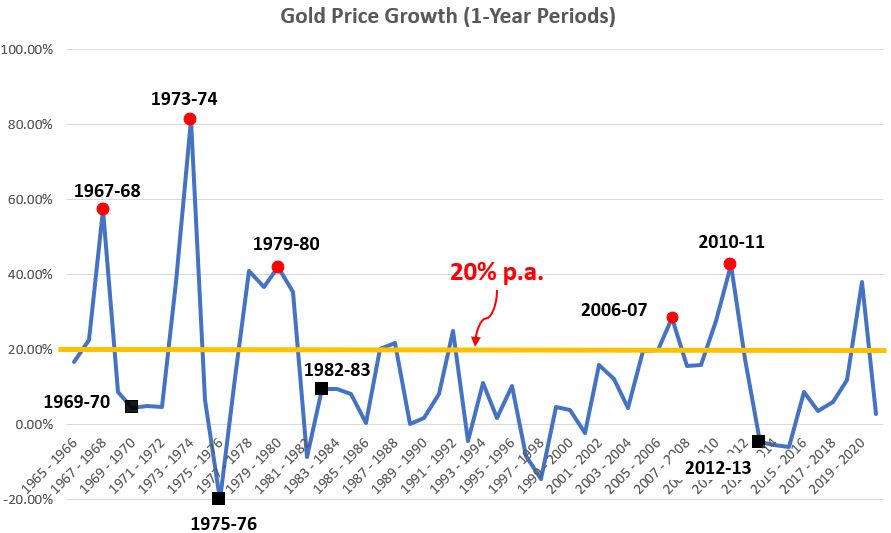

The above chart is based on the historical price of gold over the last 58 years. Here are some observations:

- Price Trend: The price of gold has generally been on the rise over the past five decades. There have been a few periods of decline, such as in the years 1976, 1982, 1993, 1997, 1998, 2001, 2013, 2014, and 2015. But overall the trend has been upward.

- Price Fluctuations: The data also shows that the price of gold can be highly volatile, with large fluctuations occurring over short periods of time. For example, there was a sharp increase in the price of gold in 2011, followed by a significant decline in 2013. Between 2016 and 2022, the gold price increased relatively fast.

End to End Growth (1965 to 2022)

Above is the last 58 years’ data analysis of the gold price in India. On the face of it, this price data will look like “ever-increasing.”

In 1965, the gold price was Rs.72 and in 2022 it was Rs.52,950 per 10 grams. This is a spectacular price growth rate of 12.05% per annum.

At this rate, Rs.5,000 worth of gold in 1965 will value about Rs.36.5 Lakhs in 2022. it’s spectacular, right? This is what pulls people towards gold.

Growth Rates (10-Year Holding)

In India, people buy gold to hold it forever. It is often bought to transfer it as an inheritance to the next generation. So, unless the need is special, gold is never sold. So it will be safe to assume that, on average, the purchased gold stays with the investor for at least a 10-year period.

Let’s calculate the return given by gold for every 10-year holding period, starting from the year 1965 to 2022.

| SL | Holding Periods | Start Price | End Price | CAGR | SL | Holding Periods | Start Price | End Price | CAGR |

| 1 | 1965 – 1974 | 72 | 506 | 21.53% | 26 | 1990 – 1999 | 3200 | 4234 | 2.84% |

| 2 | 1966 – 1975 | 84 | 540 | 20.45% | 27 | 1991 – 2000 | 3466 | 4400 | 2.41% |

| 3 | 1967 – 1976 | 103 | 432 | 15.42% | 28 | 1992 – 2001 | 4334 | 4300 | -0.08% |

| 4 | 1968 – 1977 | 162 | 486 | 11.61% | 29 | 1993 – 2002 | 4140 | 4990 | 1.88% |

| 5 | 1969 – 1978 | 176 | 685 | 14.56% | 30 | 1994 – 2003 | 4598 | 5600 | 1.99% |

| 6 | 1970 – 1979 | 184 | 937 | 17.68% | 31 | 1995 – 2004 | 4680 | 5850 | 2.26% |

| 7 | 1971 – 1980 | 193 | 1330 | 21.29% | 32 | 1996 – 2005 | 5160 | 7000 | 3.10% |

| 8 | 1972 – 1981 | 202 | 1800 | 24.45% | 33 | 1997 – 2006 | 4725 | 8400 | 5.92% |

| 9 | 1973 – 1982 | 279 | 1645 | 19.41% | 34 | 1998 – 2007 | 4045 | 10800 | 10.32% |

| 10 | 1974 – 1983 | 506 | 1800 | 13.53% | 35 | 1999 – 2008 | 4234 | 12500 | 11.43% |

| 11 | 1975 – 1984 | 540 | 1970 | 13.82% | 36 | 2000 – 2009 | 4400 | 14500 | 12.67% |

| 12 | 1976 – 1985 | 432 | 2130 | 17.30% | 37 | 2001 – 2010 | 4300 | 18500 | 15.71% |

| 13 | 1977 – 1986 | 486 | 2140 | 15.98% | 38 | 2002 – 2011 | 4990 | 26400 | 18.13% |

| 14 | 1978 – 1987 | 685 | 2570 | 14.14% | 39 | 2003 – 2012 | 5600 | 31050 | 18.68% |

| 15 | 1979 – 1988 | 937 | 3130 | 12.82% | 40 | 2004 – 2013 | 5850 | 29600 | 17.60% |

| 16 | 1980 – 1989 | 1330 | 3140 | 8.97% | 41 | 2005 – 2014 | 7000 | 28006 | 14.87% |

| 17 | 1981 – 1990 | 1800 | 3200 | 5.92% | 42 | 2006 – 2015 | 8400 | 26343 | 12.11% |

| 18 | 1982 – 1991 | 1645 | 3466 | 7.74% | 43 | 2007 – 2016 | 10800 | 28623 | 10.24% |

| 19 | 1983 – 1992 | 1800 | 4334 | 9.18% | 44 | 2008 – 2017 | 12500 | 29667 | 9.03% |

| 20 | 1984 – 1993 | 1970 | 4140 | 7.71% | 45 | 2009 – 2018 | 14500 | 31438 | 8.05% |

| 21 | 1985 – 1994 | 2130 | 4598 | 8.00% | 46 | 2010 – 2019 | 18500 | 35220 | 6.65% |

| 22 | 1986 – 1995 | 2140 | 4680 | 8.14% | 47 | 2011 – 2020 | 26400 | 48651 | 6.30% |

| 23 | 1987 – 1996 | 2570 | 5160 | 7.22% | 48 | 2012 – 2021 | 31050 | 50045 | 4.89% |

| 24 | 1988 – 1997 | 3130 | 4725 | 4.20% | 49 | 2013 – 2022 | 29600 | 52950 | 5.99% |

| 25 | 1989 – 1998 | 3140 | 4045 | 2.56% | – | – | – | – |

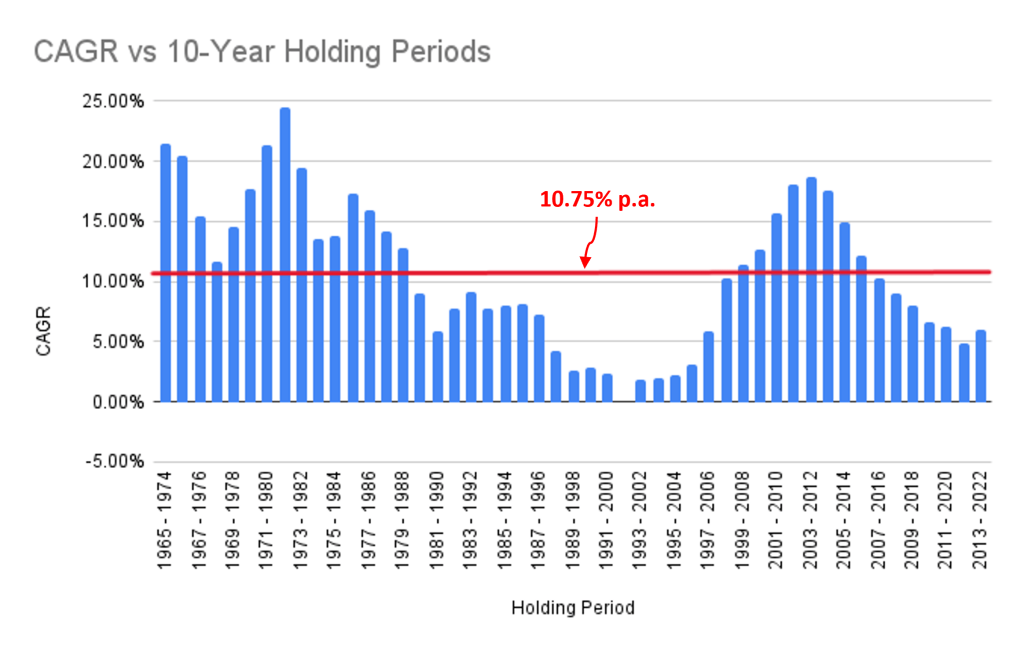

To simplify the above dataset, allow me to present the same numbers in a chart form. The chart presents to you 49 numbers instances of a holding period was 10 years. It starts with 1965-1974, 1966-1975, till 2013-2022. In the holding period of 1965-1974, the gold price grew at 21.52% per annum. Similarly, between 2013-2022, the growth rate was 5.99% per annum.

Here are my few observations:

- Average Growth: In the last 58 years, for 10-year holding periods, the average return generated by gold was 10.75% per annum. In some years, the returns were -0.08% per annum (1992-2001) and in some years it was as high as 24.45% per annum (1972-1981).

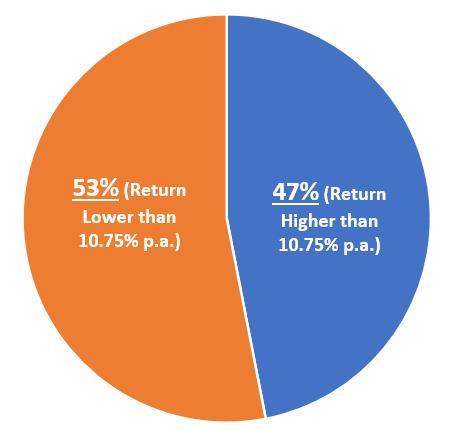

- Return Probability: In the last 58 years, there were 49 numbers instances of a holding period of 10 years. In these 49 instances, 26 times the returns were lower than the average (10.75% per annum), and 23 times it was higher than 10.75% per annum. It means, there is more than a 50% chance that the gold investment will fetch a return lower than 10.75% per annum.

In all those years when gold price grew at less than 10.75% per annum (53% times), the average growth rate was about 5.82%. Likewise, in years when gold prices grew at faster rates (47% times), the average growth was 16.31%.

Why Investing in Gold During A Gold Rush is a Bad Idea

As an investor, we must be mindful of the data presented above (53% vs 47%).

It explains why investing in gold during a gold rush is a bad idea. Investing during a gold rush will put the investor in the 53% probability matrix. On average, such investors earn only 5.82% returns. This kind of return we can get from a bank’s fixed deposit, right? Why put our money at risk by investing in a physical asset like gold?

The flip side is, if one can avoid investing in a gold rush, it puts the investor in the 47% probability matrix. Here, the chances of gold price growth rate are about 16.31% on average.

So, an investor must learn how to identify a gold rush (Bubble) so that investing during such times can be avoided.

How we can identify a bubble building in gold prices?

Gold price is affected by a wide range of factors, including economic conditions, geopolitical events, currency strength, inflation, etc. Hence, identifying a bubble in gold prices is not easy. But careful observation can give hints about the bubble.

- #1. Rapid price increases: When gold prices rise sharply over a short period of time, it can be a warning sign of a bubble forming. We’ve already seen that on average, the gold price grew at a rate of about 12% per annum over a 58 years time horizon. If the holding period is reduced to 10 years, the average growth rate is about 10.75% per annum. So, whenever the gold price (in short term) is growing at a rate higher than these two numbers (about 20% per annum), it is a sign that it is heading toward a bubble. Check the below chart, every price growth of beyond 20% is followed by mediocre growth rates.

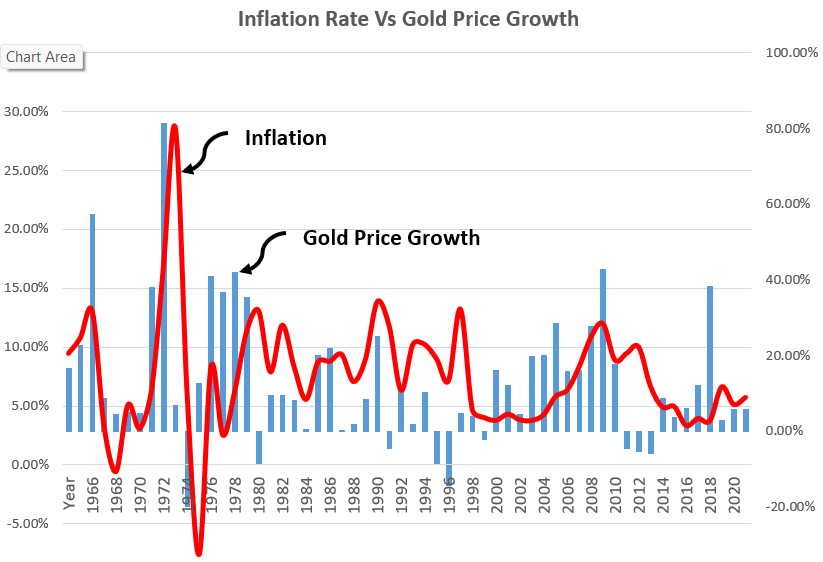

- #2. Inflation: Check the below chart where gold’s growth rate is compared with the inflation rate prevailing in the same period. The chart is establishing a pattern very clearly. Every time the inflation rate is hitting its peak, gold price growth is also at its peak. So, to identify a gold bubble, we must look at the inflation rate. If the inflation rate is on the rise, it is a sign that gold price is also heading towards a bubble (peak).

#3. Weak Currency: News about the country’s currency becoming weaker compared to USD will lead people towards gold investing. Since the start of the Russia-Ukraine war, the strength of USD has increased. It has created a weakening effect on the other currencies of the world. A gold price surge when paper currency is weaker may not create a big bubble in gold pricing. In fact, it creates very strong support for its long-term pricing. But yes, excess speculation in such times may lead to a bubble.

When the media starts reporting extensively on the price of gold, it is an indicator that a bubble is forming. During this time one can also look at the news reports about inflation. If the news channels are talking about high inflation rates, it is again an indicator that a gold bubble is forming on the sides.

Conclusion

Investing in gold during a gold rush may seem like a good idea due to the hype and excitement surrounding the price rise. However, it is important to keep in mind that bubbles often burst, and the gold price can correct as fast as it rose. In gold’s case may be the correction is not as steep as equity, but investing during peaks can certainly dampen future yields.

Gold prices can be influenced by many factors, including inflation, economic conditions, global events, currency valuation, etc. Hence, it is difficult to predict when a bubble will burst. Investors who are heavily invested in gold during a gold rush may suffer significant losses if prices fall.

Moreover, for me, gold is not a perfect investment. I often consider it more as a savings option than an investment. While it can be a good hedge against inflation and market volatility, it is not a great wealth builder (like equity). It also does not generate any income, hence it is almost impossible to estimate its intrinsic value. Read here about how we can value a fixed deposit.

In conclusion, investing in gold during a gold rush can be a bad idea. While it may seem like a good opportunity to make quick profits, it is important to consider the risks and potential downsides of investing heavily in a single asset that may be subject to volatile price swings. A better strategy for investing in gold may be to hold a small portion of one’s portfolio in the metal as a long-term hedge against inflation and market volatility while diversifying one’s portfolio with other assets to manage risk.

FAQs

In this article, the phrase “gold rush” is used to point toward that point in time when there is a sudden increase in the demand for gold resulting in a steep price surge.

A sudden surge in the price of gold is an indicator that the bubble is forming. One can also look at the inflation data. Generally, at inflation peaks, the price of gold is also at its peak.

Alternatives to gold investing are investing in other precious metals such as silver, platinum, and palladium. They can also work as an inflation hedge. Other investment alternatives are real estate, stocks, and cryptocurrency.

Here are two most recent examples. 2008-2012: Sub-prime mortgage crisis. During this time, investors flocked to gold as a safe-haven asset, causing the price of gold to rise sharply. The price of gold continued to rise until 2012. Between 2007 and 2012, the price of gold rose from Rs.10,000 to Rs.31,000 levels. 2020 – COVID-19 Pandemic: It was a period of widespread uncertainty and economic disruption, leading to a surge in demand for gold. The price of gold is touching new highs post the COVID pandemic (Rs.52,000 levels).

Have a happy investing.

Hi Mani, I love the way you analyze things and combine theory and practical knowledge. On this specific article, I read 2 different opinions (thou views are personal). Rich Dad Mr. Kiyosaki always insists we rely on Gold rather than other investments. Even 2 days back he is saying the same. What is your thoughts.

What surprises me is that people don’t understand that gold is not supposed to generate any cash flow

It is not an investment it is real money

Investment has cash flow money doesn’t

Simple as that

And there is a cycle where precious metals perform as it is undervalued against currency in that period gold revalues itself

And what you told about doomsday that if everything collapses gold won’t survive ask this to people of Zimbabwe, Venezuela, Turkey, Argentina and many more

In Turkey currently people are selling their houses and cars to buy gold

Why because they do not trust their currency nor the Dollar

Again I am not saying go and buy 100% of your network in precious metals

To generate cash flow and beat inflation stock market is the only place a person should be but you need to have an exposure in precious metals up to 20-30% of your portfolio

Gold is not an investment it is an insurance (which always beats inflation and is currently way undervalued it is just revaluing itself)

Well said. Thanks

Hello Mani,

I have always been an avid fan of your articles, but in regard to this article I have contrasting opinion, I believe holding as part of the portfolio should be must, but at what composition is the question to be answered, The numbers you have mentioned above clearly specifies that gold has been a safe bet in long term. Gold may not have an intrinsic value but a common man with limited knowledge of investing has used as tool in bad times and we can see the reflection in stocks like Muthoot Finance & Manappuram Finance, where there is drastic increase in their revenue, it explains the gold as very resourceful to monetize cash to support family or business.

It should have been very accurate if gold growth rate and equity growth rate compared with the same timelines.

You have a point.

Please check this article on “gold vs stock market.”

http://ourwealthinsights.com/price-of-gold-and-stock-market-correlation/