If idea is to manage our finances seriously, we’ll resort to experts to handle it for us. But is it correct to be dependent on the external agency for this activity?

It is not wrong, but it has its own limitations. The success is dependent on the skill of the allocated personal finance manager.

More often than not, we blindly trust the finance manager. Why? Because we assume that in this role, he/she is somebody who is both qualified and reliable for the job. But this assumption is risky. Why?

Because not all personal finance managers are as skillful. Hence if we will trust them blindly, we may be making a mistake.

A better alternative is to start doing it by yourself. But how to manage our finances by ourselves? Is it practically possible? Yes, sure it is possible. We only need to become aware of all the ingredients that constitute good financial health.

So, how to go about it? Take a soft start…

Soft start…

A kind of soft start will be to start reading about the basics of personal finance. The idea should be to read enough so that you are able to connect the dots. What are the dots? This is what I call “the ingredients that constitute good financial health“.

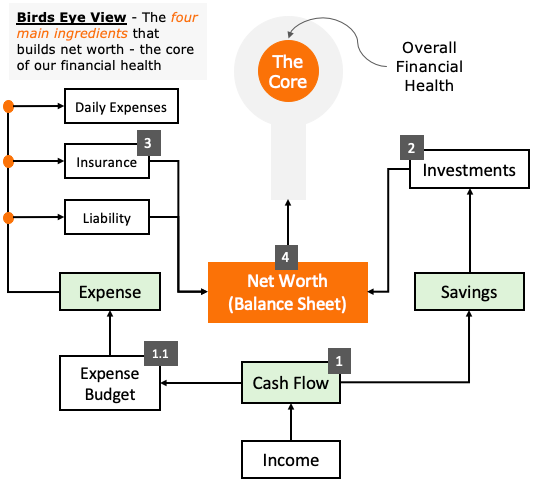

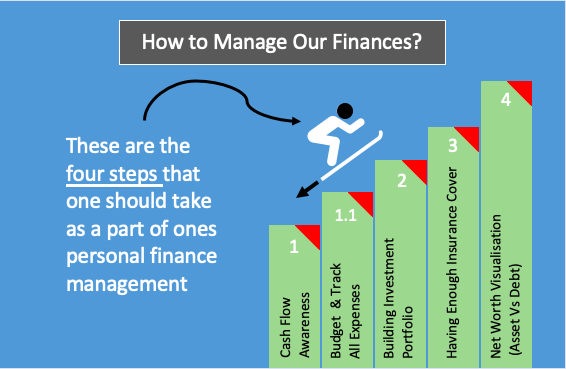

There is no one thing, handling which, your finances will start falling in order. One needs to control at least four ingredients. This control can eventually shape ones financial health.

What are these four ingredients? How to manage our finances by controlling these four ingredients? What are the associated activities that also needs to be controlled?

These are the questions, which makes self-management of personal finance a challenge for common men. How to meet this challenge? This is the objective of this article. I’ll try to declutter the process of personal finance management. How?

We’ll look at the four ingredients from the birds eye view. It will give a lot of clarity about how to manage our finances by self.

Once the image of birds eye view is shot in the mind, executing the balance activities becomes more systematic.

The Four ingredients – From Birds Eye View

- Cash Flow: The most important ingredient of building a strong financial health is cash flow management. We can manage our finances best if our cash flow is in control. How to control it? By making it more visible. This can be done by preparing a cash-flow statement. This statement should also be complemented by an expense budget. Read more about cash flow planning.

- Investments: This is another ingredient which is the biggest contributor to net worth. But to invest money, savings are required. A combination of cash-flow statement and expense budget highlights the potential savings. This saving in turn shall be invested in assets. Read more about investment portfolio building.

- Insurance: This is the third ingredient which provides protection to the already built savings, investments, and net worth. Without proper insurance planning, there is high chance that we might dig into our savings and investments in times of need. Hence, insurance cover is essential. Read more about insurance cover.

- Net Worth: The above three ingredients together builds the asset side of our personal balance sheet. But this is not net worth. It is calculated by subtracting our liabilities (debt load) from the accumulated assets. Mathematically, net worth = Total Assets – Total Debt. In our endeavour to build an ever increasing net worth, we need to maximise our assets and minimise debt. Read more about net worth building.

Let’s know more about the four ingredients so that we have at least a decent know how of how to manage our finances:

#1. Cash Flow – How to plan?

All financial planning should start with a preparation of cash flow report. What is a cash flow report? It lists all our incomes, all expense, and net savings. What is the utility of cash flow report? It helps us to compute and visualise, how much maximum we can save each month/year. A typical cash flow report can look like this:

Why it is important to know about savings? Because savings will render investments, which in turn will build our net worth.

Remember: Net worth = Total Assets – Total Debt. When we invest, we are actually accumulating assets. So we can say, the higher will be the savings, faster and bigger will be the asset base – and hence our net worth.

Savings is an important after-product of building a nice cash flow report. But to build a cash flow report we must first list down all income sources and expense heads.

Out of all expenses, household expenses are the real killer. Why? Because it is here that we tend to overspend money. What is the solution? Prepare an expense budget, and start tracking all expenses.

#1.1 Expense budget & Expense Tracking

The root of all financial planning has its foundation in the expense budget. How? Because it is the expense budget that has potential to prevent us from overspending. People who overspend, can never afford to enjoy the luxury of “high net worth”. To enjoy it, one must start controlling expenses. How to do it? Following two ways are the key:

- Prepare Expense Budget: There is a rule called 50-30-20 rule to prepare an expense budget. I’ve written an article on it. Go ahead and read it please. It will give you a fair idea of what rules to follow in preparation of an expense budget. More accurate will be the budgeting, more apt will be its outcome. What outcome? Budgeting will help us to cut our expenses and maximise savings.

- Record All Expenses: Budgeting alone can become meaningless. It must be complemented with a good habit of expense tracking. It is one of those habits which I’ve been following since last 10+ years. I can vouch for it that it has powers to change lives. My ultimate goal of life is financial independence, and I can say that I’ve achieved like 40% of it. But even 10% was not possible had I’ve not developed the habit of expense recording and tracking.

So if the bigger idea is to know about how to manage our finances, then first step is to prepared the following three: (a) expense budget, (b) expense tracking template, and (c) cash flow report.

Once you are done with this, take the next step of investment portfolio building.

#2. Investment Portfolio

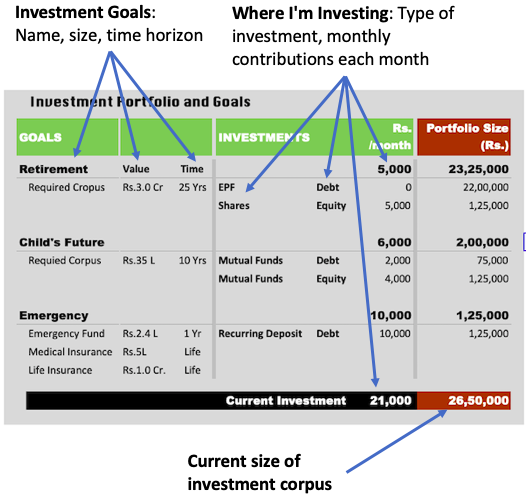

What is investment portfolio? It is a document which maintains our list of current investments. For me it also works like an investment plan. How? Let’s first check my investment portfolio format. It looks like this:

What shall be visible in an investment portfolio? It must have a structure which gives a clear display of the following three elemens:

- Financial Goals: It must list all the goals, its quantum and the time horizon available for its attainment. Why we need this? Because having this in our investment portfolio itself will keep reminding us, why we are investing.

- Investment Options: This will display where we are investing. If we are investing in shares, mutual funds, fixed deposits, etc it must appear right beside its corresponding goal. The type of investment shall also be displayed. It can give a first-impression of where we are going equity or debt heavy. Monthly contributions that is required to be invested each month shall also appear here.

- Portfolio Size: This is what gives us Planned-vs-actual comparison. Planned is what is visible as a goals. Actual is what we have already accomplished by adding assets (stocks, mutual funds, gold etc) in our investment portfolio. Read: Ideal investment portfolio mix.

For me the main utility of investment portfolio is to keep the data handy, for feeding in the numbers in balance sheet. Remember, our ultimate goal is net worth building, and it becomes visible only in the balance sheet.

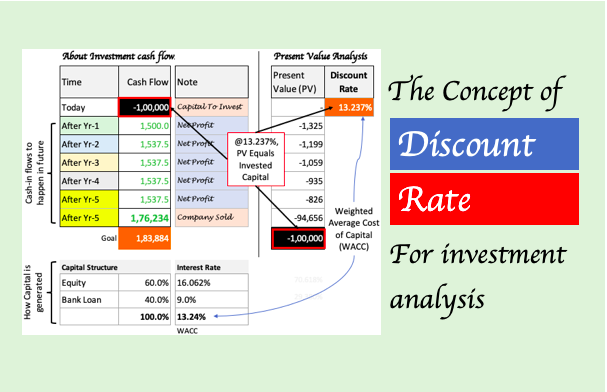

Example of Investment Planning

Suppose you have an investment goal of building a retirement corpus of Rs.3.0 Crore in 25 years. How to build an investment plan for this goal? The objective of investment planning should be to know the following (a) How much to invest each month?, and (b) Where to invest? How to do it? We can use my wealth building calculator. Read: All about wealth building.

| Data Input | |

|---|---|

| Wealth to be Built (Rs.Crore) | Expected Return p.a. (%) |

| Time (in years) | |

| Result | |

|---|---|

| To build the corpus within time you must invest | Rs. every month |

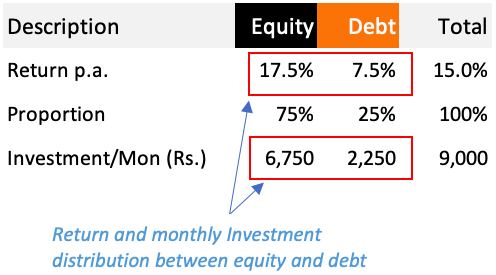

After few permutations and combinations it will be clear that, to build a corpus of Rs.3 Crore in 25 years, monthly investment of about Rs.9,000 will be necessary. So this calculator is giving you the quantum of regular investments that must be done each month.

Also, the calculator will highlight the need of 15% p.a ROI. Which investment plan can yield this kind of return? A combination of 75% Equity and 25% debt will yield the said returns. Check the calculation shown in the below table:

So what is the plan for retirement corpus building? Investing Rs.6,750 per month in equity (mutual fund), and Rs.2,250 per month in debt (mutual fund). This distribution will yield an average return of 15% per annum in next 25 years.

Suggested Reading: Rupee Cost Averaging – An Investment Strategy For Beginners To Invest With Discipline & Less Risk.

Investment Portfolio & Balance Sheet

It is from here-on that ones net worth begins to take a shape. Where net worth is visible? In our personal balance sheet. Everything that we do in investment portfolio changes net worth. How?

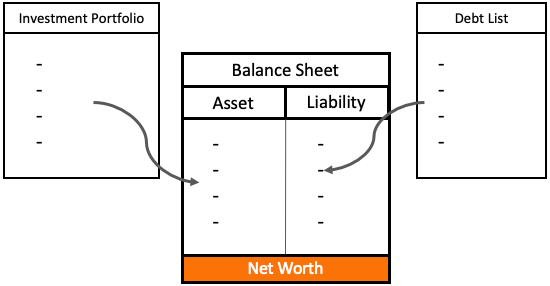

The asset column of the balance sheet takes data which appears in ‘investment portfolio’. Below is a typical representation of a balance sheet showing various investments listed on the asset side.

#3. Insurance Cover

Like investment is essential, insurance is also as important. But you will notice that “insurance” has a rather small weight in the overall net worth building (see balance sheet above).

So why to spend time and money on it? Because insurance deals with emergency management. If we will not plan for it, it is the emergencies which can eat into our investment portfolio the most.

Why I say so? Suppose there is a major accident in a family, and you had no medical insurance. How the hospital bills will be paid? Probably by liquidating the investments. Such action can also reoccur in absence of motor insurance and life insurance.

But such digging into the portfolio can be prevented by buying sufficient insurance covers. This may look like an unnecessary cost in normal times, but they prove to be the best saviours in need.

A typical insurance portfolio should look like this:

#4. Net Worth Building

What is the ultimate objective of the three ingredients discussed above? Together they should help us to meet our financial goals when we need it. This objective can be reached by building a big enough net worth. Why? Because net worth will ultimately finance our goals.

So in a way we can say that, as a part of managing our finances, we must know what builds our net worth. In order to carefully craft a decent net worth, we must start building our personal balance sheet.

In other words we can also say that planning finances also means “a plan to keep feeding ones balance sheet so that the net worth keeps growing with time”.What is balance sheet? It’s a record of ones list of assets and liabilities accumulated over time.

#1. Balance Sheet & Net Worth

Here I would like to make a distinct point. Net worth building is essential, but it is also important to have a clear visualisation of ‘net worth’. What I mean?

Buying investments is one thing, but keeping a record of it, to give it more visibility is also essential. How to keep the record? By maintaining a balance sheet.

This type of record keeping can have dramatic impact on ones size of wealth accumulated over time. Why? Because it gives one the necessary visibility of assets and liabilities. Remember, target is to accumulate more assets and less of liabilities.

Goals

In the balance sheet itself I prefer to add the column of Goal. It is not a standard practice, but I prefer it this way. Why? Because it helps to focus on individual goals, and then also see how each of them are being served (by assets and liabilities).

Just by looking at such a balance sheet, it can help to time the purchase of assets and liability. How? Let’s see an example.

Example:

Suppose, today my child is 17 years of age, and I am required to pay Rs.35 Lakhs as college fees. If you will see the balance sheet, it has only Rs.2.0 Lakhs worth of assets under the head “child’s future”. There is shortfall of Rs.33 lakhs.

How to make-up for this shortfall. By taking an education loan (Liability) of Rs.33 Lakhs. The balance sheet exactly shows how much education loan needs to be taken. Had this balance sheet not been in place, I might have dug into assets of other goals to finance this need. In terms of personal finance management, this would have been a terrible mistake.

For people who have more time for education fee payment, they must strengthen the asset column allotted to “child’s future”. For such capital intensive and uncompromising goals, a time horizon like 10+ years is a must. So, one must plan for them early.

Conclusion

We cannot expect to lead a safe and secure life without managing personal finance. This is something we all know, right? But a more specific question will be, what needs to be managed? The four ingredients – and these four parameters in unison will build the net worth. What we are ultimately bothered about is our net worth. The bigger will be the net worth the better.

How to know the present net worth? By building the personal balance sheet. How to know the ‘required level’ of net worth? This can be done by quantifying our financial goals.

Ones the financial goals are known, the next step is to prepare an investment plan. It is here that we will know how much shall be invested each month to reach the goal.

But to make the investment plan a success, it is essential to save sufficiently each month. How to estimate ones savings? By preparing ones cash flow report.

All this said and done, if we will not do one thing, no financial plan will ever succeed. What is it? Prevent overspending. How keep a check on overspending? By spending as per ones expense budget.

So in conclusion, here are the important take away’s from this article:

- Build your expense budget and spend accordingly.

- Have a cash flow report to visualise savings.

- Use investment plan to invest money.

- Always invest with the financial goals in mind.

- Keep feeding your balance sheet.

- The ultimate objective is to build a sufficiently big net worth.

Have a happy investing.

The article is very useful.Can u share the excel template used in this article?

Could you please share the template used in this article to my mail:-vamsi.4a6@gmail.com