Tool To Compare Indian Stocks

Compare Stocks

Click stock names to select up to 4 stocks.

Click a sector to filter stocks.

Why Invest in Indian Stocks?

India’s economy is projected to grow at 7% annually, driven by sectors like IT, renewable energy, and banking. Long-term investments in fundamentally strong companies can yield high returns due to increasing domestic consumption and government reforms.

| Stock Name | Sector | Price (₹) | P/E Ratio | Dividend Yield (%) | Market Cap (₹ Cr) | 5-Year CAGR (%) |

|---|

A Simple Guide to Comparing Stocks in India with Our Stock Comparison Tool

Like me, you too must have spent hours trying to figure out which stocks to invest in.

The Indian stock market is full of opportunities, but it can feel overwhelming to find the right stock.

How do you know which company is worth your hard-earned money?

That’s where a good stock comparison tool comes in handy.

Today in this post, I want to walk you through why comparing stocks matters and how our tool can make your life easier.

Let’s read the details.

Why Compare Stocks in the First Place?

Investing in stocks isn’t just about picking a name you’ve heard on TV. You need to dig deeper.

Comparing stocks helps you understand which companies are strong, which ones fit your goals, and which might be risky.

For example, when I first started investing, I was torn between DLF and Wipro. Both are big names, but their financials tell different stories.

That’s when I realized comparing key metrics like price, sector, or growth rate is crucial.

In India, our economy is growing fast, at around 7% annually, according to recent reports. Sectors like Industrials, banking, and energy are booming. But not every stock in these sectors is a winner.

A comparison tool lets you see the numbers side by side, so you can make smarter choices. Isn’t that something we all want?

What Makes Our Stock Comparison Tool Special?

I’ve tried a bunch of stock comparison tools online, and many are either too complicated or are junked with bad quality stocks.

That’s why we built our own tool, designed with Indian investors in mind. It’s simple, fast, and packed with features. Whether you’re a beginner or a seasoned trader, this tool is for you.

In my tool, I have included only quality stocks which maintain a balance between risk and return.

The tools works with a data base of hundreds of stocks like Reliance, HDFC Bank, Sun Pharma, and more.

The best part is, I’ve coded it in a way that it will loan only five stocks at first, so your on-page experience will be good.

How Does the Tool Work?

Using the tool is easy.

As you land on the page, you must have observed a clean table with five stocks. Each row shows the stock’s name, sector, price, P/E ratio, dividend yield, market cap, and 5-year CAGR (that’s the price growth rate over five years).

Want to see more stocks?

Just click the “Next” button to flip through pages, five stocks at a time.

- If you have specific stocks in mind, type their names in the search box. As you type, a dropdown suggests matching stocks. For example, type “Rel” and you’ll see “Reliance Industries” pop up.

- You can pick up to four stocks to compare.

- Want to focus on one sector, like IT or banking? Use the sector search box. Type “IT,” select it, and the table shows only IT stocks.

Filtering your preferred stocks or sectors using this tool is simple.

Features That Save You Time

Let’s talk about what makes this tool useful.

- First, the search feature is super quick. Whether you’re looking for stocks or sectors, the autocomplete dropdown saves you from scrolling endlessly. I once spent 10 minutes on another site just finding a stock—never again.

- The table is clear and easy to read. Each column gives you a key piece of info. The sector column is especially helpful. It tells you if a stock is in IT, pharma, or something else, so you can spot trends. For instance, I noticed banking stocks like HDFC Bank often have lower P/E ratios than IT stocks like TCS. That kind of insight helps you plan better.

- Another cool feature is pagination. Instead of dumping 100 stocks on you at once, the tool shows five at a time. This keeps the page fast, even if you’re on a slow connection. Plus, I’ve also added a the dark mode option. It is great for late-night research sessions. I personally love a sleek, eye-friendly design.

Why These Metrics Matter

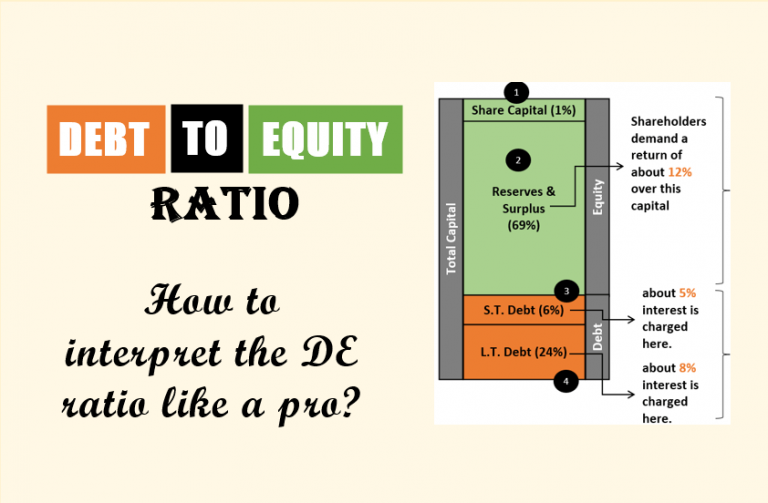

You might be wondering, “Why should I care about P/E ratio or CAGR?”

Let me explain it quickly.

- The price tells you how much a stock costs right now.

- The P/E ratio shows if it’s overpriced compared to its earnings. A high P/E, like 60 for HUL, might mean investors expect big growth. A low P/E, like 18 for HDFC Bank, could mean it’s undervalued.

- Dividend yield is how much a company pays you just for holding its stock. ITC, for example, has a 3.2% yield, nice for steady income.

- Market cap shows the company’s size. Reliance’s Rs.19 lakh crore cap makes it a giant.

- CAGR tells you how the stock price has grown over five years. TCS’s 15.3% CAGR is impressive, but is it enough for your goals?

Comparing these metrics helps you answer that.

The Stock Comparison Tool is Tailored for Indian Investors

As Indians, we know our market is unique.

Government reforms, growing consumer demand, and tech advancements are driving growth.

Our tool reflects this. It focuses on Indian stocks, with insights about why they’re worth considering.

For example, the tool highlights how sectors like renewable energy are gaining traction. Ever thought about investing in Adani Green? The tool can show you how it stacks up as compared to its closest peers (look for “Renewable Electricity Generation” in the sector search).

Whether you’re in Mumbai or a small town, you can use this tool to research stocks from home.

No need for fancy software or paid subscriptions. It’s free, simple, and built for us.

A Few Tips for Using the Tool

When you use the tool, start by exploring sectors you’re curious about.

- Step#1: Maybe you’ve heard IT stocks are hot right now. Type “IT” or “Software & Services” in the sector search and check out TCS or Infosys.

- Step#2: Now, compare their P/E ratios and CAGRs. If you’re new to investing, pick two stocks you know, like Reliance and ITC, and see how they differ.

- Step#3: Don’t just focus too much on the price. A cheap stock isn’t always a good deal.

- Step#4: Look at the dividend yield if you want regular income.

- Step#5: Check the market cap to understand the company’s stability and size.

My suggestion? Always think long-term, India’s growth story is just getting started.

What’s Next for the Tool?

it is not a static tool.

We’ll add more quality stocks to it, removing old ones and adding newgen companies. Idea is to give you even more choices of quality stocks.

We’re also working on ways to make the tool faster, especially for users with slow internet.

Maybe we’ll add charts to visualize stock performance over time. What do you think, would you like that?

For now, the tool is perfect for anyone who wants to compare stocks without the hassle. It’s like having a financial advisor in your browser, minus the hefty fees.

So, why not give it a try? Head to the page, play around, and let us know what you think.

Conclusion

Investing in stocks can feel like a big leap, but tools like this make it easier.

Whether you’re comparing Tata Motors to M&M or exploring new sectors, our Stock Comparison Tool gives you the data you need.

It’s simple, fast, and built for Indian investors like you and me.

So, what are you waiting for? Start comparing stocks today and take control of your financial future.

Happy investing.

Is there any installation required to work with this excel files?

It is a simple excel file. Read more about it here: https://bit.ly/385JEPO

Got your Stock analysis tool, in stock comparison sheet it prompts that the sheet is locked, and requires password…..

I don’t have a password…….

The sheet is protected. Please use it as directed. The password prompt will not bother you.

Hi Mani,

I purchased version V3.01 on 28th Dec 2020, Now you have changed algorithm of intrinsic value in version V3.1 on 31st Dec 2020, which means you will send this updated link to my Email ID or it will automatically updated in the files you already sent me from instamojo. Please advise.

Hi Mani,

I had purchased V3 of the stock analysis sheet last year, but I didn’t get the stock comparison tool along with it. Looks like I can’t purchase it separately. In order to get it, do I still have to purchase the new version of V3.1 stock analysis sheet, because currently I am happy with the older version of V3 sheet and I also want to use stock comparison tool?

I had bought xls v3.01,can you share v3.1?

Hello sir,

How can I update stock comparison tool. the data showing in comparison tool are very prior,about 2-3 months. How can I access the latest data for comparison atleast 1 one prior data.

Two updates has been emailed to you post purchase. They have an updated database. Thanks